Investment Thesis

I expect the stock to see modest performance from here, unless we see a significant rebound in growth for both net interest income and equity market performance.

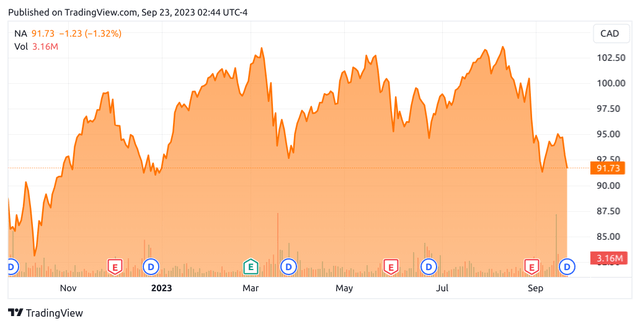

In a previous article back in April, I made the argument that National Bank of Canada (TSX:NA:CA) may see some short-term downside, owing to pressure on net interest income and global markets.

Since then, the stock has descended to a price of $91.73 at the time of writing:

TradingView.com

The purpose of this article is to assess whether National Bank of Canada has the ability to see a rebound in growth from here taking recent performance into consideration.

Performance

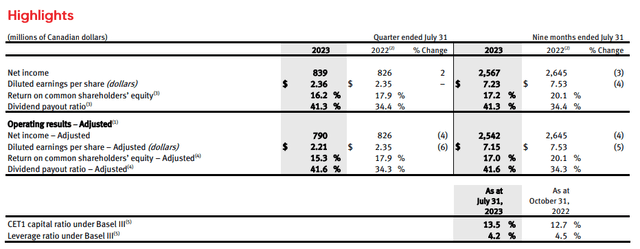

When looking at the most recent earnings results for National Bank of Canada, we can see that net income showed modest growth of 2% as compared to the same quarter last year.

National Bank of Canada: Press Release Third Quarter 2023

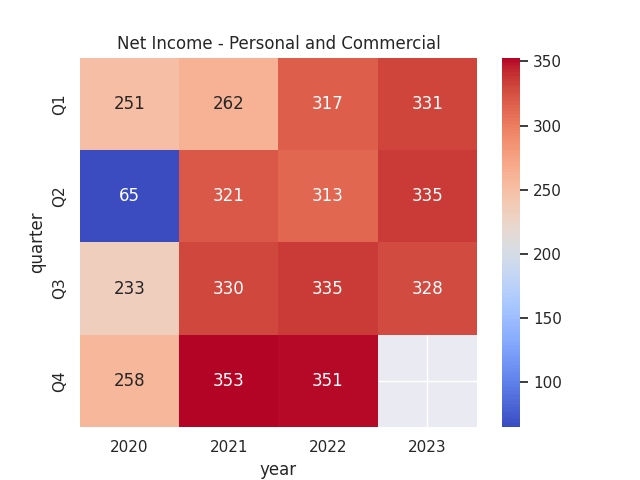

Here is a breakdown of net income by quarter across the Personal and Commercial segments (both net interest and non-interest income):

Figures (in millions of Canadian dollars) sourced from historical quarterly National Bank of Canada reports (Q1 2020 to Q3 2023). Heatmap generated by author using Python’s seaborn library.

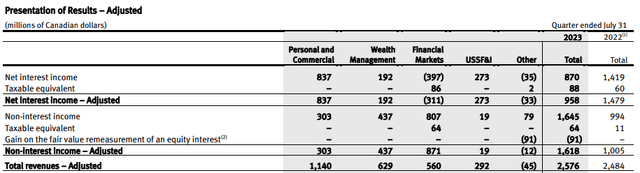

I had previously made the argument that non-interest income had been coming in as higher than net interest income across the company’s segments more broadly – and that lack of growth in the latter could place pressure on the stock.

We can see that this trend has continued into this quarter, with adjusted net interest income coming in at CAD 958 million for this quarter – down from that of CAD 1.479 billion for the quarter ended July 2022. A significant contributor to this has been a decline across the Financial Markets segment.

National Bank of Canada: Press Release Third Quarter 2023

With that being said, we did see net interest income grow across the Personal and Commercial segment – from CAD 741 million in Q3 2022 to CAD 837 million in Q3 2023.

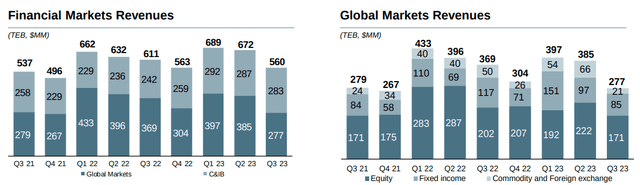

When analysing Financial Markets revenues in more detail, we can see that the biggest drop in revenues from that of the last quarter were down to a decline in the Global Markets segment – which saw a drop from CAD 385 million in Q2 2023 to CAD 277 million in Q3 2023.

National Bank of Canada: Investor Presentation Third Quarter 2023

Particularly, we saw that a decline in Equity and Commodity and Foreign exchange had led the drop across this segment.

My Perspective and Looking Forward

As regards my take on the above results and the implications for the growth trajectory of the stock going forward, I had previously stated in my last article that “the next two quarters will be significant indicators as to whether net interest income across the Personal and Commercial side can continue to rise under a higher-rate environment.”

Since Q1, net interest income for the Personal and Commercial segment has seen modest growth from CAD 825 million to CAD 837 million in Q3. This rate of growth is significantly less than that seen over the prior two quarters, with net interest income for the Personal and Commercial segment having grown from CAD 741 million in Q3 2022.

From this standpoint, growth has been modest in spite of rising rates – indicating that higher rates have been dampening loan demand. At the time of my last article, the benchmark interest rate in Canada was at 4.50% and has subsequently risen to 5%.

In addition, the capacity for National Bank of Canada to see an overall rebound in net interest income is significantly dependent on a recovery across the Financial Markets segment – which has been significantly equity-driven. In other words, in the absence of a significant bullish run across the equity markets going forward, then we are not likely to see significant growth across this segment.

Going forward, I take the view that the main risk for the National Bank of Canada at this time is largely related to macroeconomic factors. Namely, should we continue to see modest performance across the equity markets as well as modest loan demand as a result of higher rates – then I take the view that overall net income growth will continue to be modest.

Conclusion

To conclude, National Bank of Canada has seen modest growth in net interest income across the Personal and Commercial segment, as well as a decline across the Financial Markets segment – led by weak equity performance.

I continue to maintain the view that I expect the stock to see modest performance from here, unless we see a significant rebound in growth for both net interest income and equity market performance.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here