Intro

National Beverage Corp. (NASDAQ:FIZZ), a leading non-alcoholic beverage company in the U.S., boasts a portfolio centered around functional drinks that emphasize health benefits. Key among its offerings is the widely popular LaCroix sparkling water brand. Complementing this are Rip It energy drinks, Everfresh juices, and classic soda brands like Shasta and Faygo.

A distinctive feature is the company’s firm control over both production and distribution processes, with minimal outsourcing. Its market approach entails warehouse distribution for larger retailers, direct-store delivery for convenience stores and smaller outlets, and food-service distributors catering to schools, hospitals, and restaurants.

Within this evaluation, we will offer thorough exploration of FIZZ’s financial performance and its horizon for potential growth. Our assessment will delve into the company’s earnings trajectory, profitability landscape, and its aptitude to utilize cash flow. By gaining a deeper understanding of these facets, investors will be able to make a more informed judgment regarding investing in FIZZ, and understand why we recommend selling the stock.

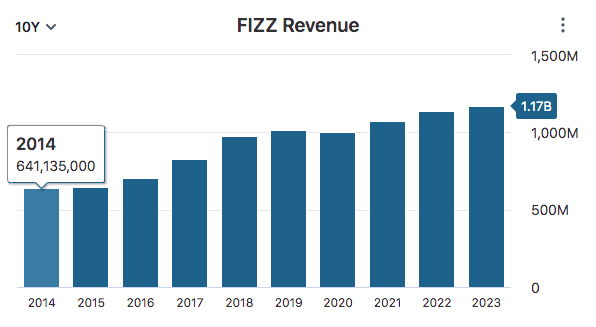

A History of Growth

When you’re pondering where to put your money, it’s crucial to take a look back at how a company has performed in the past. By checking out important things like how their revenue and free cash flow have grown over time, you can get a feel for how well they can handle ups and downs in the market. This kind of analysis also lets you see how skilled the company’s leaders are at coming up with smart plans and tackling challenges. In the end, knowing how a company has done before gives you the info you need to make wise investment choices. And talking about FIZZ, well, this company has actually built a pretty solid track record of doing well financially over the years.

Over the past decade, FIZZ has demonstrated consistent growth in both revenue and free cash flow. From 2014 to 2023, the company’s revenue increased from $641 million to $1.17 billion, showcasing a substantial 82.96% growth. This growth trajectory translates to a Compound Annual Growth Rate (CAGR) of 6.23%.

Data by Stock Analysis

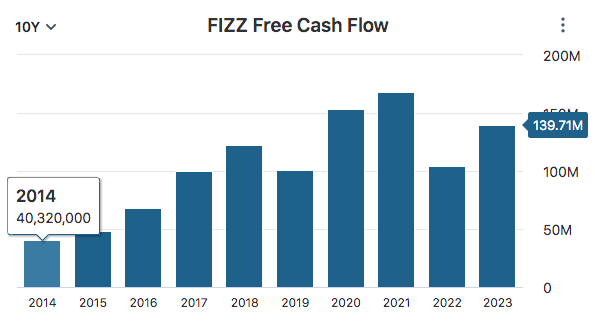

Similarly, the company’s free cash flow witnessed remarkable expansion, climbing from $40.32 million in 2014 to $139.71 million in 2023. This impressive growth of 246.50% is reflected in a CAGR of 13.23%.

Data by Stock Analysis

The impressive surge in FIZZ’s revenue and free cash flow over the past decade can be attributed to the strength of its diverse and captivating brand lineup. The likes of LaCroix sparkling water, Rip It energy drinks, and Everfresh juices serve as cornerstones within this portfolio, capitalizing on their allure to cultivate consumer engagement and loyalty.

The widespread appeal of LaCroix, the revitalizing essence of Rip It, and the invigorating Everfresh juices have collectively played an instrumental role in sustaining a consistent expansion of revenue. This resonates particularly well with consumers who are on the lookout for a spectrum of flavorful and health-conscious beverage choices. This carefully crafted brand strategy has not only cemented FIZZ’s market position but has also been a driving force behind its commendable growth in free cash flow. This underscores the efficacy of its approach in translating consumer inclinations into tangible financial triumphs.

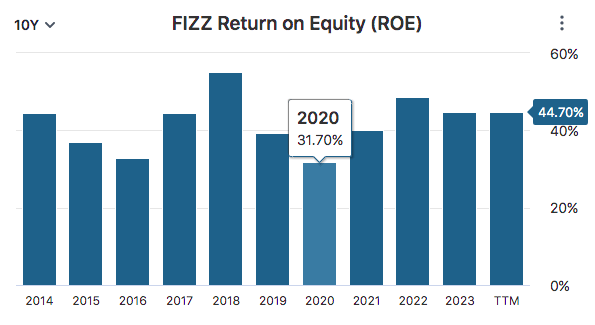

In addition, driven by the robustness of its brand portfolio, FIZZ has consistently demonstrated a remarkable track record of profitability. With an average 10-year Return on Equity soaring at an impressive 41.87%, the company significantly outpaces the sector median ROE of 11.28%. This disparity underscores the company’s exceptional knack for delivering substantial returns to its shareholders.

Data by Stock Analysis

Unfortunately for FIZZ’s shareholders, over the past 5 years, the company’s impressive track record for financial performance has resulted in a disappointing total return of 5%. In contrast, the S&P 500, has experienced a considerably higher 5-year total return of 66%. This indicates that the company’s performance, in terms of returns, has been a letdown compared to the broader market.

Data by Seeking Alpha

Outlook

Anticipating an exciting outlook for FIZZ, the earnings estimates for the fiscal period concluding in April 2024 are eye-catching. The projected EPS stands tall at $1.83, marking a surge of 20.56% in year-over-year growth. Additionally, the revenue estimate for the same period hits the stage at a $1.20 billion, showcasing a slight expansion of 2.04% compared to the preceding year.

Data by Seeking Alpha

FIZZ’s future growth trajectory gains strong momentum as it capitalizes on the surging demand for healthier beverage options. With an evolving consumer preference towards wellness, the company’s diverse portfolio of refreshing and health-conscious offerings, led by LaCroix sparkling water and Everfresh juices, is perfectly poised to cater to this emerging trend.

As health-conscious consumers increasingly seek flavorful and nourishing alternatives, FIZZ’s ability to provide a wide range of appealing options positions it at the forefront of meeting this demand. This strategic alignment with evolving preferences not only fuels the company’s revenue growth but also solidifies its market position as a forward-thinking player in the beverage industry.

Though FIZZ’s future seems bright, there is an inherent risk that could potentially impact FIZZ’s future performance which is the susceptibility to shifts in consumer preferences. As consumer tastes evolve and new trends emerge, there is a possibility that the demand for the company’s current portfolio of beverages could wane.

Consumer preferences in the beverage industry can change fast, if FIZZ’s offerings no longer align with prevailing consumer preferences or if competitors introduce more appealing alternatives, the company might face challenges in maintaining its current growth trajectory. Staying attuned to changing consumer dynamics and swiftly adapting its product lineup to cater to evolving preferences will be critical in mitigating this risk and ensuring sustained success in the dynamic beverage market.

To effectively mitigate this risk, FIZZ can draw upon its rich legacy of creative innovation, spanning over 130 years. This longstanding tradition positions the company to proactively anticipate and respond to market shifts, ensuring it remains at the forefront of evolving consumer preferences.

FIZZ’s stock holds an intriguing element for investors: the company’s chairman and CEO, Nick Caporella, possesses substantial influence, owning over 73% of the common stock. We love to see high insider ownership because high insider ownership aligns the interests of management and common shareholders. Additionally, high insider ownership shows confidence in the company’s future. This encourages decisions benefiting all shareholders, indicating commitment to growth and shareholder value, boosting investor confidence.

Valuation

In assessing FIZZ’s intrinsic value, a discounted cash flow analysis is employed, commencing with the initial free cash flow of $139.71 million recorded in 2023. An initial growth rate of 20.56% for 2024, followed by 7.67% for 2025 and 5.49% for 2026 aligns with robust earnings projections from earlier analyst insights.

Transitioning to the next phase of the DCF, we will use the average compounded annual growth rate of revenue and free cash flow over the past decade, which is a 9.73%. We will apply this growth rate to years 4 through 10.

With a discount rate of 10%, reflecting the market’s average return with reinvested dividends, and a perpetual growth rate of 2.5%, FIZZ’s projected intrinsic value stands at $35.89. This analysis estimates that FIZZ’s existing share price is substantially overvalued. The implied total return from this valuation is estimated to be approximately -30.39%.

Author’s Work

Takeaway

Wrapping up our analysis of FIZZ, it becomes evident that the company’s vibrant portfolio of brands and commendable financial progress over the years deserves due recognition. As we look ahead, the promising landscape of increasing consumer appetite for healthier beverage options is an undeniable tailwind for FIZZ, even though the possibility of changing preferences looms.

CEO Nick Caporella’s notable ownership stake and the confidence exhibited by insiders provide an encouraging underpinning. On the other hand, our discounted cash flow analysis suggests that the stock might be trading well above its intrinsic value and investors could see as much as a 30% decrease from its current share price.

With that said, our recommendation leans toward selling FIZZ. This stance reflects an acknowledgment of the potential growth trajectory while acknowledging the ever-present risks and over valuation of the company’s stock.

Read the full article here