Note:

I have covered Navios Maritime Holdings (NYSE:NM, NYSE:NM.PG, NYSE:NM.PH) previously, so investors should view this as an update to my earlier articles on the company.

Following the sale of its dry bulk carrier fleet to former subsidiary Navios Maritime Partners (NMM) or “Navios Partners” as part of a massive bailout package last year, Navios Maritime Holdings or “Navios Holdings” has been left with two major assets:

- A 10.3% equity stake in Navios Partners that is accounted for under the equity method with a current value of approximately $69 million.

- A 63.8% equity stake in consolidated entity Navios South American Logistics or “Navios Logistics”.

Company Presentation

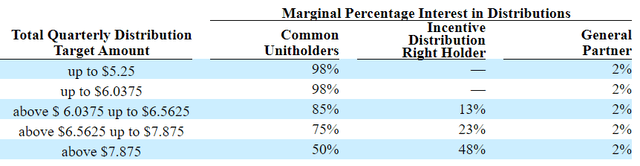

The company also holds some incentive distribution rights (“IDRs”) related to Navios Partners which remain far out of the money:

Navios Maritime Partners Annual Report

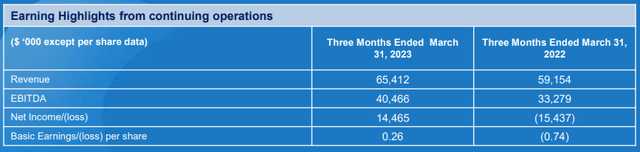

On Wednesday, Navios Holdings reported profitable Q1/2023 results which benefited from sequential top- and bottom line improvements at Navios Logistics and the contribution from Navios Partners:

Company Presentation

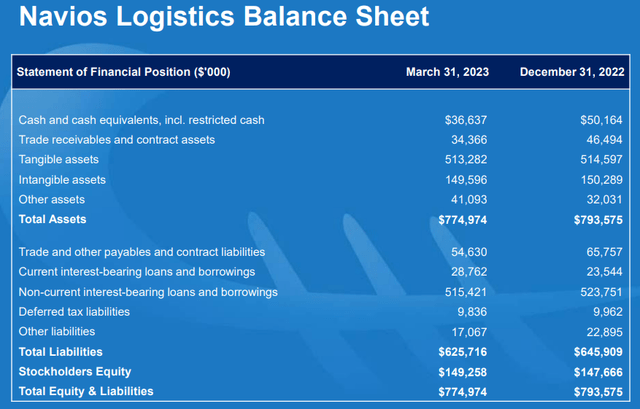

While Navios Logistics contributed $26.6 million in Adjusted EBITDA in Q1, the company has more than $550 million in debt principal outstanding with $500 million in 10.75% Senior Secured Notes scheduled to mature on July 1, 2025.

Company Presentation

Assuming Navios Logistics to achieve $110 million in Adjusted EBITDA this year and assigning an Adjusted EBITDA multiple of 5x to the business, this would be barely sufficient to cover the company’s debt obligations.

In addition, Navios Logistics might experience difficulties refinancing the notes should the current interest environment persist into 2025.

Given these issues, I am having a hard time assigning any meaningful value to Navios Holdings’ 63.8% stake in Navios Logistics at this point.

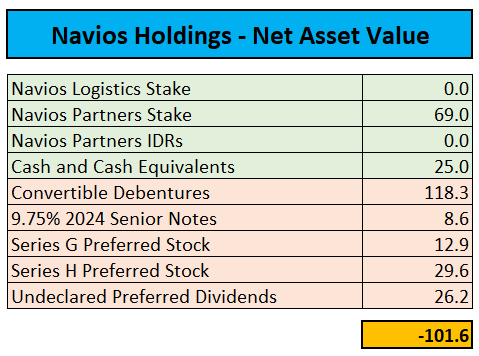

Unfortunately, there appears to be no common equity value in Navios Holdings either, even when considering the company’s stake in Navios Partners and approximately $25 million in cash on its balance sheet as the company’s debt and preferred stock obligations exceed assets by more than $100 million:

Annual Report on Form 20-F / First Quarter 2023 Report

Please note that the terms of last year’s bailout agreement have resulted in Navios Shipmanagement Holdings Corporation or “Navios Management”, a private entity controlled by the company’s CEO and Chairwoman Angeliki Frangou, having accumulated almost $120 million in convertible debentures which are convertible into common stock at a conversion price of $3.93 per common share.

At the date of company’s annual report on form 20-F filed with the SEC in late March, Ms. Frangou beneficially owned approximately 64.1% of Navios Holdings including shares issuable upon conversion of the above-discussed debentures.

As the maximum number of common shares issuable under the debenture is limited to 35.5 million, Ms. Frangou’s stake in Navios Holdings won’t exceed 67.3% without her taking further action.

Apparently, Navios Holdings’ common equity holders will have to hope for:

- The Navios Logistics business to improve quite meaningfully

- Major price appreciation for the company’s stake in Navios Partners

- Angeliki Frangou taking Navios Holdings private at a substantial premium

As I do not expect any of the required catalysts to come to fruition in the near- to medium-term, investors should consider selling their shares and moving on.

That said, there has been some major price appreciation in the company’s Series G and Series H Preferred Stock in recent months despite the dividend having been suspended since 2015 already with both issues now trading substantially above last year’s tender offer prices.

Apparently, some investors are speculating on Ms. Frangou making a near-term move for Navios Holdings but as discussed above already, I consider this a highly unlikely scenario as there’s not much to gain for her at this point, particularly given the fact that she is in full control of the company anyway.

Bottom Line:

While last year’s bailout deal has saved Navios Maritime Holdings from a near-term bankruptcy filing, it’s difficult to assign any tangible value to the company’s common shares at this point.

Effectively, both the common and preferred shares now represent options on major improvements at Navios South American Logistics, substantial price appreciation of Navios Maritime Partners’ publicly-traded common units and particularly a buyout at favorable terms by Angeliki Frangou going forward.

As I consider none of the above-listed scenarios as likely in the near- to medium term, investors should avoid both the common and preferred shares or even consider selling existing positions.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here