Written by Nick Ackerman, co-produced by Stanford Chemist.

Tortoise Energy Independence Fund (NYSE:NDP) provides investors exposure to the producer and midstream energy space. The fund is trading at a discount, which can make it an appealing choice for investors.

However, a discount has been a fairly regular occurrence since around 2019, when they cut their distribution. That cut was before the Covid crash, which sent leveraged closed-end energy funds tumbling. NDP was one of those funds that was ravaged, and they had suspended their distribution for over a year post-Covid. So there are clearly some risks here, but with much milder amounts of leverage, a collapse of the same magnitude as Covid seems unlikely.

Additionally, Tortoise recently announced that the conditional tender offer triggers were hit. The tender offer is fairly small, at 5% of outstanding shares for 98% of NAV. This was the same tender offer that was conducted last year. They specifically state that “portfolio managers, officers and Board of Directors will not tender their shares.”

As was the case last year, the actual prorated amount for each shareholder was significantly more than the 5%, so it makes it a more enticing deal for investors to participate. Last year, the proration factor was nearly 9%. This happens because not all 100% of investors will participate.

The Basics

- 1-Year Z-score: 1.16

- Discount: -13.41%

- Distribution Yield: 7.85%

- Expense Ratio: 1.49%

- Leverage: 10.80%

- Managed Assets: $71.9 million

- Structure: Perpetual

NDP seeks “a high level of total return with an emphasis on current distributions paid to stockholders.” To achieve that objective, the fund “invests primarily in equity securities of upstream North American energy companies that engage in the exploration and production of crude oil, condensate, natural gas and natural gas liquids that generally have a significant presence in North American oil and gas fields, including shale reservoirs.”

This is a rather tiny fund, which can make buying and selling difficult for larger investors. At one point, they attempted to merge the fund with their sister fund, Tortoise Pipeline & Energy Fund (TTP). However, that wasn’t approved as they couldn’t get enough votes from shareholders. TTP isn’t that large of a fund either, but combined, the two could have been a more respectable size.

The fund is still leveraged, but it’s less than it was previously – though they appear to have added more leverage since our last update. Unfortunately, it would appear that they have been increasing leverage after a significant run in the energy space. Adding leverage heading into this year seems like it wasn’t a great idea. That being said, the energy sector has moved into positive territory more recently for 2023 and has been trending higher for a couple of months now.

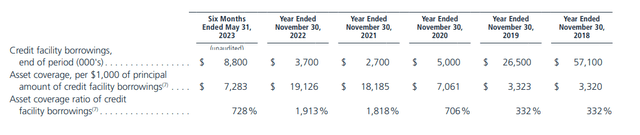

NDP Fund Borrowings (Tortoise)

Still, borrowing costs have also increased substantially, which brings up another reason why leverage is lacking appeal at this time. Combining the rising leverage costs and increasing leverage, the last semi-annual report shows a total expense ratio of 2.17%. That’s up from the 1.60% it was in the prior fiscal year. This is also after a fee waiver of 0.45%.

Performance – Highly Volatile Fund

It has been quite a while since we’ve taken a look at NDP, but the fund has performed essentially flat or provided some total returns if factoring in the distribution. During this time, which mostly includes 2023, the energy market has been quite weak after coming off of what was a strong rebound from Covid.

NDP Performance Since Prior Update (Seeking Alpha)

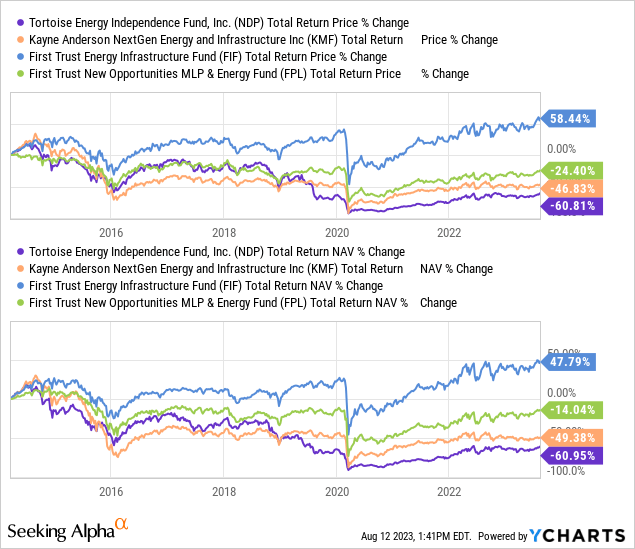

NDP is invested heavily in the energy market, and it even includes exposure to the producers. Being exposed to energy producers leaves the fund more volatile as producers are more exposed to the prices of oil and natural gas. That’s one of the reasons why NDP would have been the weaker performer in the last decade, as energy has overall been a weaker performer. In this case, First Trust Energy Infrastructure Fund (FIF) is the only fund with positive results. This is because they are allocated meaningfully to the utility sector, which protected the fund during this period.

Ycharts

However, the sensitivity to commodity pricing is exactly why NDP would have also been one of the stronger performers coming out of the Covid pandemic. Producers took the largest hit, so naturally, they rebounded the hardest too, when energy prices soared. That being said, Kayne Anderson NextGen Energy and Infrastructure (KMF) also performed relatively well, while the First Trust funds FIF and First Trust New Opportunities MLP & Energy Fund (FPL) were the laggards by a substantial amount.

Ycharts

Looking at NDP today, one would have to have still a positive outlook on the energy space and the expectation that oil and gas prices aren’t peaking at these levels. Should we hit a recession, we would expect to see weaker commodity prices, so it really depends on an investor’s outlook from here and what economic conditions are expected going forward. I don’t have a strong conviction personally, one way or another.

However, with the Fed raising rates, we generally end with a crash one way or another – a time when NDP would likely be much cheaper than it is today. If one is still convinced about owning NDP from here, its discount presents a fairly attractive time to consider the fund. Though even on the valuation basis, it isn’t a screaming deal.

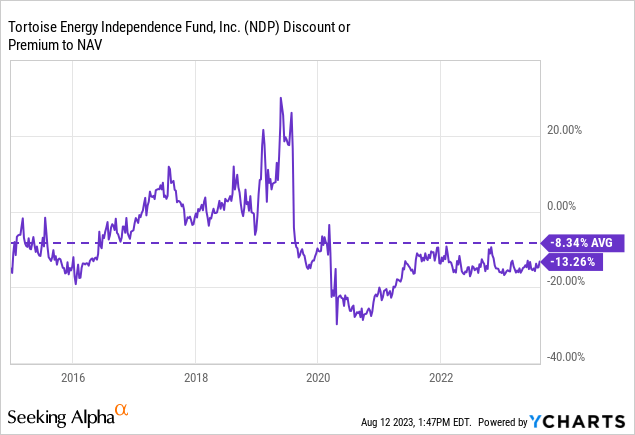

It’s trading below its historical average, but that is quite skewed during the 2018/2019 years when the fund was at an elevated premium.

Ycharts

The discount is probably better represented if we look at the average for the last year. In that case, the average was -14.64%, which is lower than where it is trading today, producing a 1-year z-score of 1.16. I wouldn’t anticipate large discount contractions to produce material returns, but significant widening – assuming no recession – also doesn’t seem likely. If we see volatility pick up, NDP could likely revisit a wider discount of 15 to 20%.

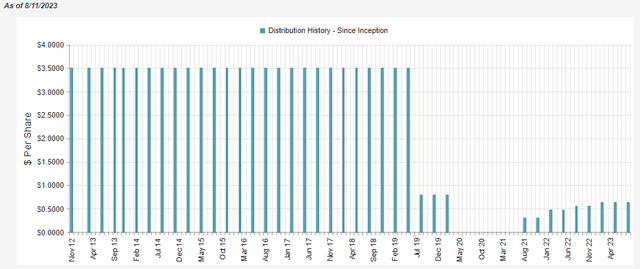

Distribution – Discount Offers Better Rate

As mentioned, this is one of the energy funds that suspended its distribution post-Covid after basically collapsing. It’s quite rare for a closed-end fund to suspend a distribution altogether. Also worth noting is that in 2020, NDP had a reverse split of 1 for 8, which really helps drive home the point that this fund was destroyed during that time.

NDP Distribution History (CEFConnect)

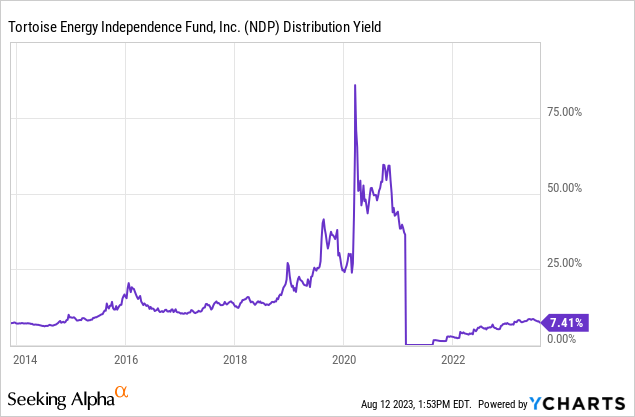

They’ve been able to raise a few times since, but it remains a more modest distribution yield than it had been at one point. Today, the NAV rate comes to 6.87%, but with the fund’s discount, the distribution rate for investors comes to 7.85%. The NAV rate is slightly below the 7 to 10% target distribution rate, which could indicate a raise in the next quarter if the NAV stays flat or increases from here.

Ycharts

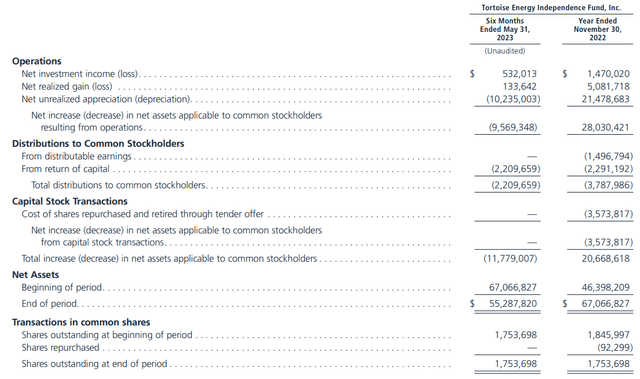

With an energy fund, we can take a look at net investment income to see how much of their distribution is being covered. However, there are also substantial distributions paid through return of capital, which is something we would add back in to find the net distributable income.

In the last semi-annual report, NII came to $0.30 (annualized $0.60.) That was a decline from the full year of $0.80. This has to do with the rising borrowing costs that they have been facing.

The fund produced a total investment income of $1.188 million in the last six months, which was actually an increase from $1.109 million in the same period a year ago. However, the interest expense went from $32k to $205k now. Another factor was the advisory fee rising from last year due to more assets being managed through recovery in the fund’s underlying portfolio and increased leverage.

NDP Semi-Annual Report (Tortoise)

We can see that overall, NII coverage of the fund’s distribution in the prior six months came to around 24%. When including the ROC distributions received from its underlying portfolio, NII would have been $1.031 million or NDI coverage of 46.7%. This is a decline from the 58.3% we saw last year.

With coverage like that, it becomes even more pertinent that an investor has a strong outlook on the economy and the energy market as it provides rather weak coverage.

Weak distribution coverage also indicates that the return of capital distributions we’ve seen are partially destructive, and not just because of the ROC distributions the fund receives itself.

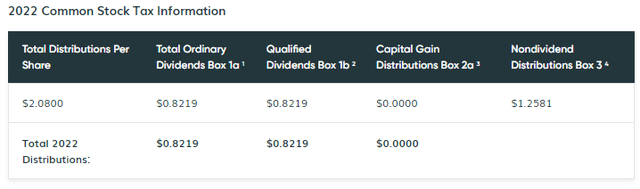

NDP Distribution Tax Classification (Tortoise)

NDP’s Portfolio

NDP had a very inactive portfolio in the last semi-annual report, with a turnover rate of only 0.36%. That pace was well below what came out to be 13.67% in the prior fiscal year. This is also down substantially from the years before that. In fiscal 2019, the fund hit a turnover rate of over 180%.

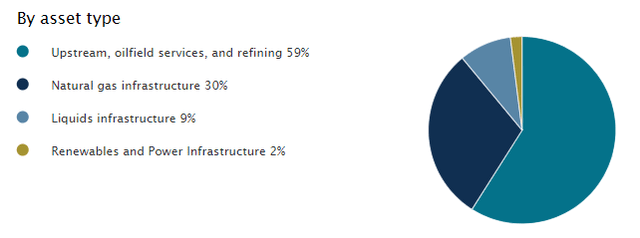

So there can be significant differences at times, but they’ve been more limited in their changes recently. As noted, producer exposures remain a significant allocation of this fund.

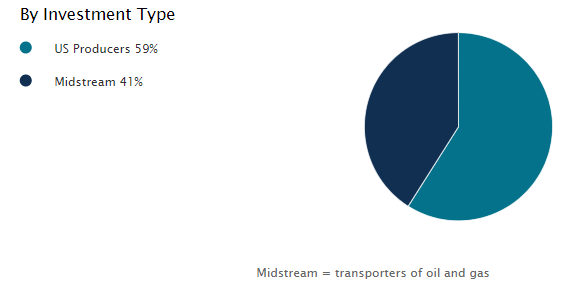

NDP Portfolio Investment Type (Tortoise)

This has remained fairly consistent since our previous update.

NDP Portfolio Asset Type (Tortoise)

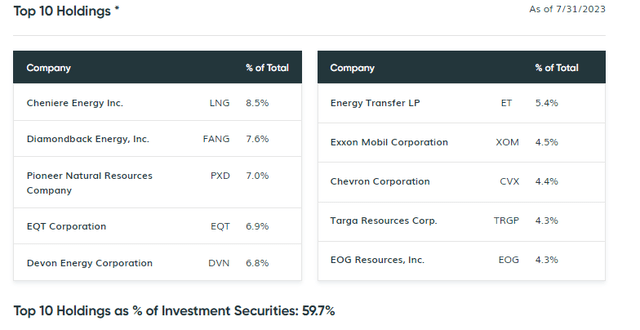

Energy funds tend to be fairly narrowly focused in terms of holding securities. NDP is no exception, with the top holdings accounting for nearly 60% of the fund. The fund holds a total of 35 positions.

Cheniere Energy (LNG) comes in as the largest holding, which it was previously as well. However, its allocation has come down from the even more weighty position of 11.1%.

NDP Top Ten Holdings (Tortoise)

LNG pays a modest but growing dividend at less than a 1% yield currently. This is a factor in why NDP’s own distribution coverage remains so low. Diamondback Energy (FANG) is another one of their top holdings that pays a low regular dividend, just 2.25%. Pioneer Natural Resources (PXD) is similarly quite low at around 3%. However, FANG and PXD had also been paying out significant specials when energy prices were significantly higher, and they’ve been growing their regular payouts too.

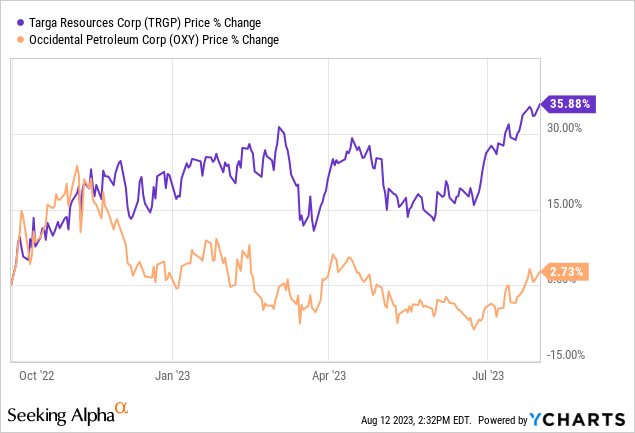

The only new name to make the list this time is Targa Resources (TRGP), which replaced Occidental Petroleum Corp (OXY) from a top ten spot. However, OXY remains a position in the fund and a key factor in this playing out would be that TRGP has performed so strongly during this period relative to OXY.

Ycharts

That being said, it also looks like the latest share counts played a role too. NDP holds 37,880 shares of TRGP, an increase from the 28,897 shares it had at the end of August 31st, 2022, listed in the N-PORT. For OXY, the fund showed a total share count of 43,302 with the latest full holdings list, but that was a decline from the 53,183 share count previously.

Conclusion

NDP is an appropriate fund for an energy bull that trades at a fairly attractive discount. However, it definitely isn’t for a conservative investor with its tilt towards energy producers that carry more exposure to commodity prices than their midstream counterparts. The fund has also added more leverage to invest further, though that seems like a strange move with higher interest rates after such a strong two years in the energy space. It still remains fairly modestly leveraged, but it’s something to consider regardless.

An additional factor for current shareholders to consider is the tender offer that should be kicked off in early October. Participating is a good idea given the discount and would remain so unless the fund’s discount narrowed to less than 2%. Even if you don’t want a smaller position for NDP, you can buy back after participating in the tender offer with the cash received.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here