Tonight (10/18/23) after the closing bell, Netflix (NASDAQ:NFLX) will report their Q3 ’23 financial results, and it goes without saying that the bullish optimism has worn off the last 3 months, with the writers and actors strike, as well as some less than bullish commentary NFLX has made about their ad tier venture and password sharing.

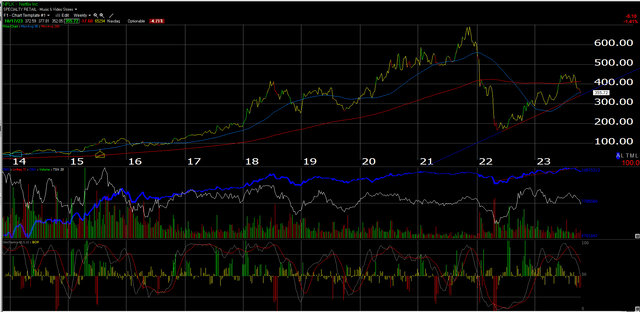

The above weekly chart of Netflix, cut and pasted from Worden’s technical analysis software, shows the stock sitting right on top of its uptrend line from the 2022 lows near $160-165.

Tonight, Wall Street consensus is looking for $3.49 in earnings per share on $8.54 billion in revenue, along with $1.88 billion in operating income for year-over-year (YoY) growth of 13%, 8% and 23% respectively.

While I’d like to see growth stocks with better revenue growth expectations, the double-digit expected operating income and EPS growth aren’t too shabby.

However, revenue growth has slowed to “mid-single digits” the last 4 quarters (probably see 5 quarters in a row tonight) as ARPU has been stagnant and total subscriber growth has also slowed to mid-single digits, the last 8 quarters.

One of my file notes on NFLX last quarter (didn’t note the source), noted that US and Canada, NFLX’s most profitable region, might be getting saturated. Almost all of NFLX’s growth seems to be coming from Europe and non-US/Canada.

Cash Flow: One bright spot for NFLX has been cash flow and free cash flow generation, even though the stock has fallen from its all-time high near $700 in late 2021, to its $355-360 price today.

4-quarter trailing cash flow and free cash flow have improved to $4.6 and $4.3 billion respectively, eclipsing the late ’20, early ’21 peak that were driven by stay-at-home with the pandemic. NFLX even sports a 2.5% free cash flow yield today with a $360 stock price.

Valuation: Using 3-year, average, “expected” estimates, EPS growth of 23% is expected for ’23 through ’25, while expected revenue growth is expected to average 10% for the same time period. Can those estimates hold up?

Trading at 36x expected 2023 EPS and 24x expected ’24 EPS, NFLX is more attractive on a GARP (growth-at-a-reasonable price) than an absolute valuation.

Current cash flow valuation metrics still sport a 40x and 45X cash flow and free cash flow multiple on the streaming giant and the 5.3 price to sales isn’t attractive either.

With cash flow valuations not as attractive, the key questions are, “can growth hold up” or can growth re-accelerate for the US/Canada region ?

Morningstar’s fair value on NFLX is $330, and usually Morningstar has a margin of safety built into the valuation, so NFLX is probably fairly valued today, trading between $350-360.

Subscriber growth was the pleasant surprise last quarter, coming in much stronger than expected, but again it wasn’t from the US/Canada, which is what drives margins, apparently.

Summary/conclusion: It doesn’t seem like anyone is looking for a strong rally in Netflix after earnings are released tonight, which is indicative of the poor sentiment and low expectations around the stock, which in and of itself can be positive for forward returns, but the plan is to wait and see what the numbers actually look like, and more importantly, what if any commentary management makes about an early look at 2024 growth.

NFLX’s current 2024 estimates expect 24% EPS growth on 13% revenue growth. That’s a bit higher than ’23’s expected 19% EPS growth and 6% revenue growth, so expectations for 2024 might get tempered tonight.

Clients currently have a 1.6% position in NFLX, which has been slowly built since the mid-2022 lows, with plans to buy more on substantial pullbacks.

Disney (DIS) recently announced a price increase, and there is always a first-mover advantage to disruptive tech, which NFLX still holds, although the increase in streaming competition the last few years has been sizable.

As of the Tuesday night, 10/17/23 close, NFLX’s 2023 YTD trailing return was 20%, still ahead of the S&P 500, YTD.

Readers can be patient: it’s not really a market (yet) where chasing growth stocks can pay off.

Thanks for reading.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here