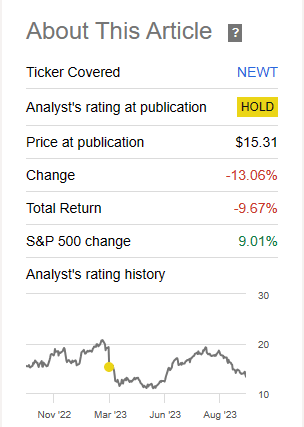

On our last coverage of NewtekOne (NASDAQ:NEWT) we suggested that the stock while beaten down to $15.31, still did not offer compelling return prospects. We also could not rate it a “Sell” as the valuation was not as poor as it was when it traded at $30.00 (see, A Good Point To Exit). We took the middle of the road approach and offered a range where it could be bought.

Hence, we think the stock has some downside bias, and we would look for $11.50-$14.50 as a range where to consider buying. While we see solid downside risks, the stock is not a compelling short as it was when we assigned a sell rating at a $30.00 price. We currently rate NEWT as a Hold and think investors should be cautious in making the assumption that it’s all priced in.

Source: This Is Not The Dividend Policy You’re Looking For

The stock had an extremely interesting journey dropping a stunning 30% from there and then moving up 80% from that point. The air came out of that vertical ascent eventually and the stock is firmly within our suggested buy-zone.

Seeking Alpha

We examine the recent results, the newly issued baby bonds and update our thesis.

Q2-2023

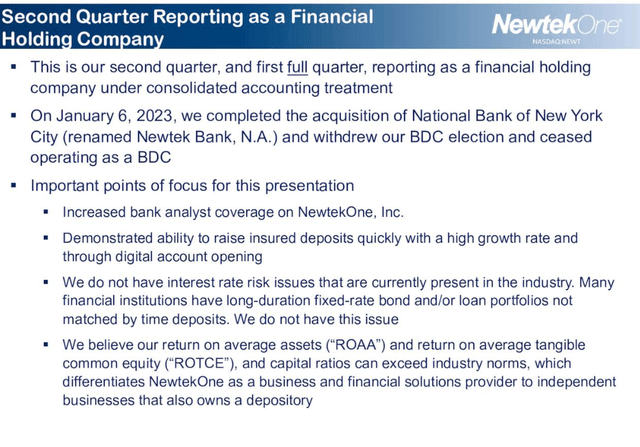

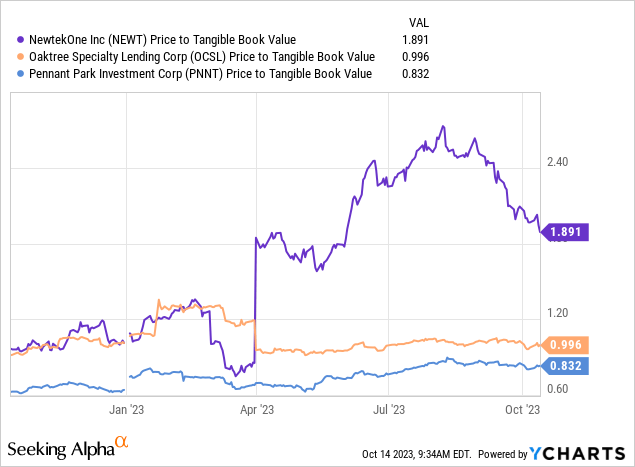

This was the first full quarter as a financial holding company for NEWT and it was quick to point out that it did not have any of the legacy issues that plagued the regional banks.

NEWT Q2-2023 Presentation

The revenues and earnings were hard to predict for NEWT as it had just transitioned into this model.

NEWT Q2-2023 Presentation

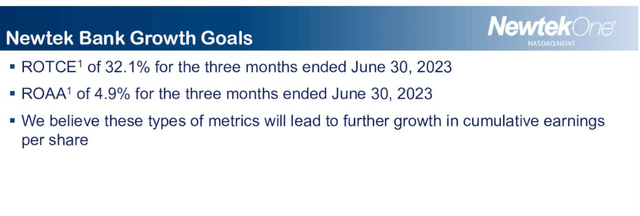

We will note here that its total risk-based capital ratio and Tier-1 Leverage ratios are both excellent for a bank. Of course NEWT is not a bank, nor does it want to be thought of as a bank. At the same time, it appears that it has only those metrics (return on tangible common equity and return on average assets) to present which paint it like a bank.

NEWT Q2-2023 Presentation

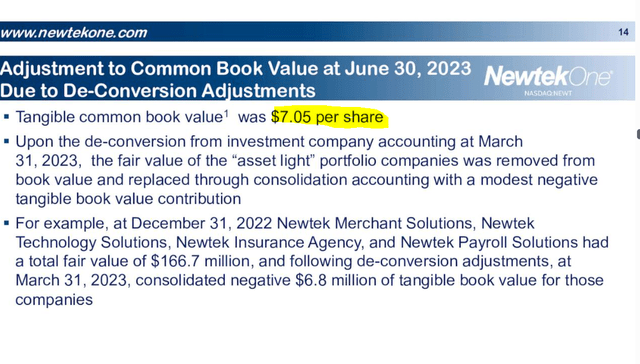

One reason these look incredibly high is that NEWT is really a hybrid and the move from BDC to bank holding company required its book value to be marked down.

NEWT Q2-2023 Presentation

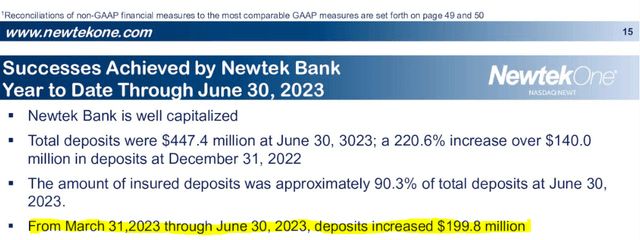

So if you crush the denominator, you inflate the end result. NEWT has shown though that it can attract deposits at a breathtaking rate.

NEWT Q2-2023 Presentation

We sometimes lose track of the relevance of numbers when we hear “billions” and “trillions” mentioned daily on the news. But that $200 million increase is really large considering that NEWT only has a market capitalization of $328 million. A lot of these were also lower cost deposits in savings accounts (vs CDs).

NEWT Q2-2023 Presentation

The vast majority of these deposits are from small customers and over 90% remain with FDIC limits.

Outlook

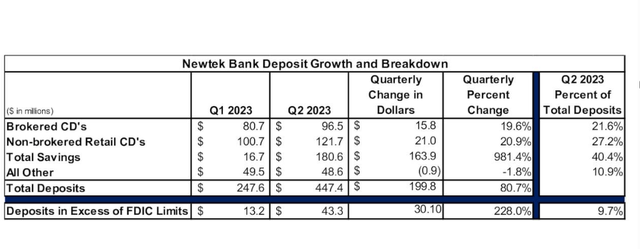

NEWT’s biggest issue is that it does not have a good target investor base. Nobody looking for regional banks is going to buy NEWT. There are some great quality choices available like New York Community Bancorp, Inc. (NYCB) and M&T Bank Corporation (MTB) to name just two. Both are cheaper than NEWT on forward earnings and they also offer better dividend yields as well.

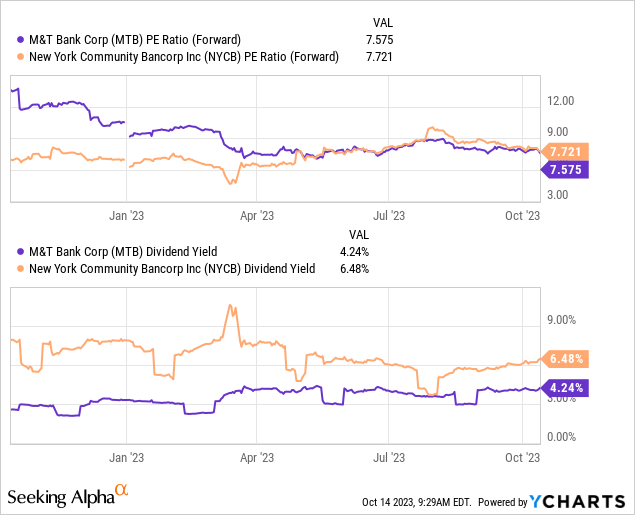

On the abandoned BDC side the comparatives look completely broken. BDCs offer double to triple the dividend yields of NEWT and are far ahead in terms of tangible assets backing the current price.

So you will need a very compelling return profile for investors to get interested here. This is especially true in an era of 5.5% risk-free rates. NEWT, in our opinion badly miscalculated in jumping into this new model. It has made matters worse by offering a very small percentage of its earnings back to investors. Unless it dramatically changes how it offers to reward investors, it will be stuck in no-man’s land. While the price is in our previously suggested “buy-range”, there are just too many great choices available (far more than when we wrote the last article) to even consider a “buy” rating. We rate the shares a “hold” for now.

Baby Bonds

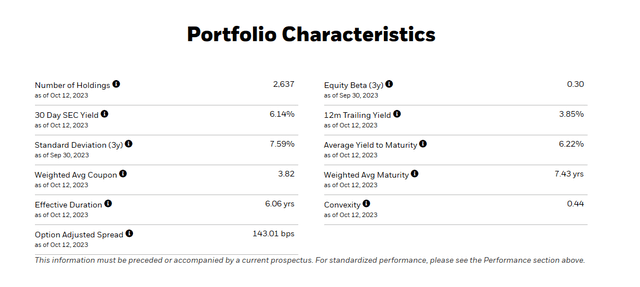

NEWT priced an offering $40 million of 8% fixed rate senior notes due 2028. NewtekOne, Inc. CAL NEWT 28 (NASDAQ:NEWTI). While the quick pricing and placement were a testament to the relatively familiarity of the capital markets with the company, the interest rate points to the real problem with the move away from the BDC model. The idea was to get low-cost funds and at least these funds are not remotely cheap for 5 year notes. The notes received a rating of BBB+ from Egan Jones, though one has to wonder whether that remotely is carrying any weight here. The average yields for BBB+ rated securities is about 6% for 5 years. iShares 5-10 Year Investment Grade Corporate Bond ETF (IGIB) which has a blend of credit quality, has a 6.22% yield to maturity.

IGIB

At $24.50 (par value $25.00), the baby bonds offer a nice 8.12% plus yield to maturity. This is not a bad yield all things considered. With no long duration bonds in the portfolio (unlike many of the regional banks) and an extremely high FDIC insured deposit base, NEWT is not even close to the risk of a bank run. So in that context, the bonds look extremely safe. The yield while good is not extremely compelling as actual top BDCs like Main Street Capital (MAIN) have three year bonds with 7.7% yields to maturity. We cannot speculate as to where NEWT shares land over the next five years, but in the medium term, we believe NEWTI could outperform NEWT with far less risk.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Read the full article here