Challenges Galore

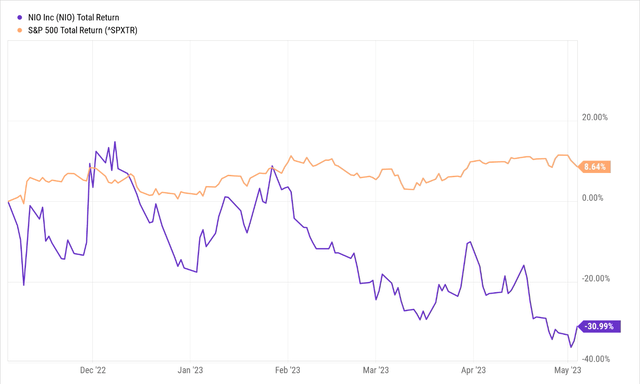

Over the past six months, the stock of the China-based EV specialist- NIO, Inc. (NYSE:NIO) has proven to be very inimical for those pursuing alpha-generation; whilst the broader markets have delivered positive returns of high-single-digits, NIO has slumped by over -30%!

YCharts

Meanwhile, the influential institutional investor segment, which is typically instrumental in facilitating big moves in certain counters, continues to shun the stock. On a YTD basis, the number of institutions that owned the NIO stock is down by 12%, while the net shares owned by them are down by 7%.

YCharts

A lot of things have turned topsy-turvy with the NIO story over the past 12 months, and whilst one can always question if things will get any worse than it already is, it’s also difficult to imagine a smooth comeback of sorts. Broadly, I think it would be reasonable to expect some choppy progress in the foreseeable future.

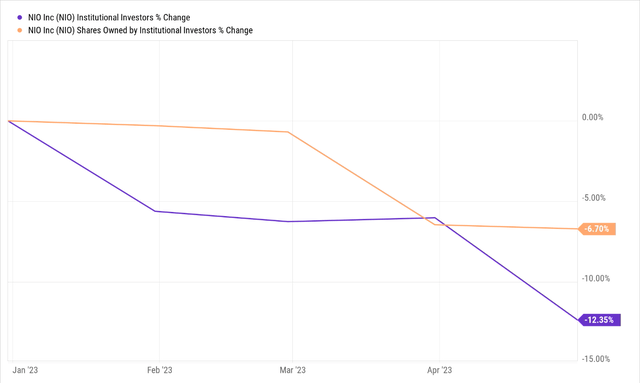

On the topline front, NIO is paying the price for being an elitist pariah of sorts; whilst most competing entities in the Chinese EV market are dexterous enough to adapt to the prevailing market realities and engage in some form of discounting, NIO has chosen to remain steadfast in its premium positioning, shunning discounting tactics. This puts it in an unfavorable position on the volume charts; for context, note that NIO’s top-selling model-the mid-size electric sedan- ET5, doesn’t even make the top 10 charts in China!

Clean Technica

NIO believes it is better positioned to offer a better experiential user effect for potential consumers by way of the new NT2.0 platform, which offers superior digitization, functionalities, and computing power relative to its peers. This sense of bravado may have worked well if the Chinese economy was at full tilt, but that is hardly true. In an environment of this sort, it is questionable if prospective clients would be prepared to pay a premium.

In effect, NIO’s monthly deliveries which had slumped by 14% sequentially in March (at over 10,300 vehicles), have fallen yet again by a far greater margin of 36% m-o-m in April (6,658 units). All in all, considering the recent run rate, it is asking a lot to expect NIO to double its sales volumes by the end of this year!

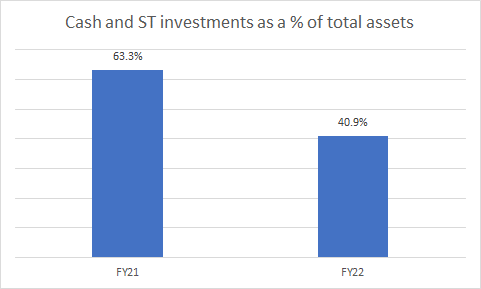

It also doesn’t help that NIO’s balance sheet is looking a lot less sturdy when you consider that over a year ago, the company’s cash and short-term investments accounted for a sizeable 63% of the total asset base. These days it is only around the 41% mark.

Seeking Alpha

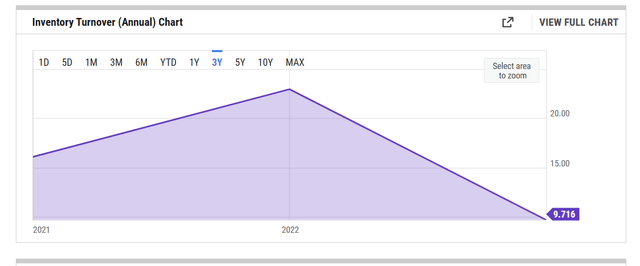

It is also quite troubling to note that the company has bloated its balance sheet with a lot of inventory, and may struggle to convert this to sales, given its inherent aversion to discounting. For context, the inventory turnover ratio of NIO has previously trended within a level of 16-23x; these days, it is closer to the single-digit terrain.

YCharts

A Few Silver Linings

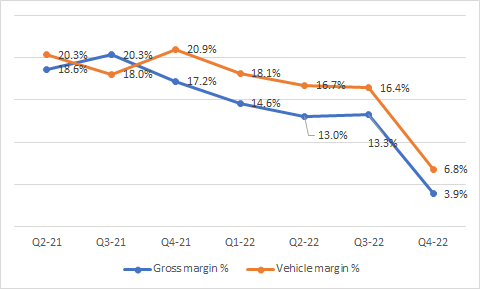

If one wants to look for silver linings, you could perhaps say that dynamics with NIO’s vehicle margins (sequential slump for four straight quarters), and gross margins could be close to bottoming out, and could actually start improving in H2, when the premium ES6 (five-seater SUV), and the ES8 (six-seater SUV) start taking up a higher share of the overall sales mix (currently the product mix is heavily tilted to the ET5). The ES6 will be launched this month, and the ES8 in June, although deliveries may lag by a month or two.

NIO Quarterly Report

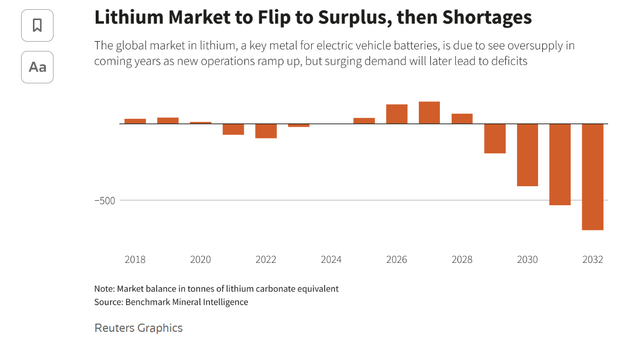

Another variable that could provide a fillip to gross margins is the drastic downward adjustments in lithium carbonate prices in China. Around six months ago, it was trading at CNY605k a tonne, now it has slumped to less than CNY190K a tonne. Whilst this may cross the 200K mark yet again, it will still be a lot more palatable than last year (the average price for FY23 is still expected to decline by 54% YoY). Going forward, considering the likely surplus position in the lithium market from FY24 to FY27, prices are not expected to be too prohibitive.

Reuters

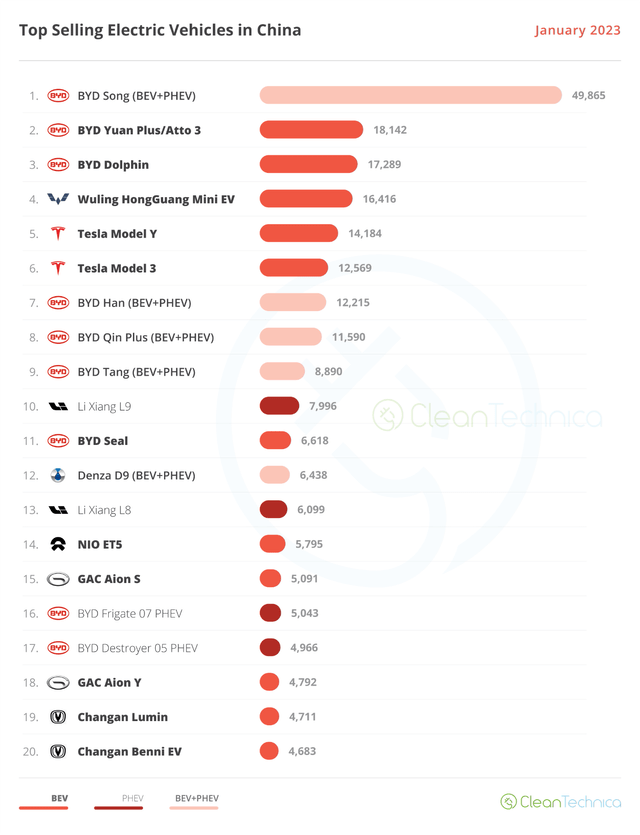

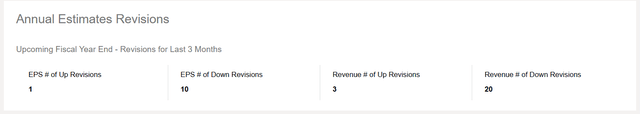

While NIO has been in a bad way, it’s not as though the sell-side community has been sitting still. Over the last three months, a whopping ~87% of the revenue revisions, and ~90% of the EPS revisions have been towards the downside.

Seeking Alpha

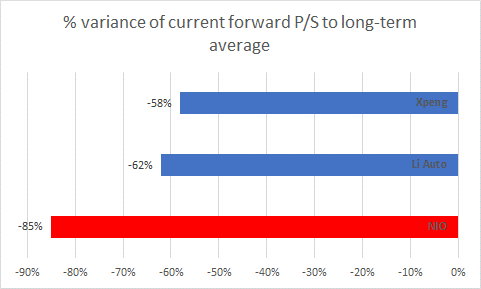

Ordinarily, this would have made forward valuations quite prohibitive, but such has been the ferocity of the decline witnessed WITH the NIO stock, that valuations look quite decent.

NIO looks set to incur losses through FY25, so we’re left with the forward price-to-sales metric. Despite all its flaws, in FY23, NIO looks poised to deliver revenue of $12.37bn, which would translate to relatively respectable revenue growth of ~75% YoY. Considering that cadence of revenue growth, a forward price-to-sales (based on the FY23 figure) multiple of just 1.1x feels like quite a steal, more so when you consider that NIO’s long-term forward P/S average has been over 7x.

YCharts

For context, note that NIO’s implied forward P/S discount of -85%, over its long-term average, is a lot wider than what one is currently seeing with Xpeng’s stock (-58% discount to the long-term average) or even Li Auto’s stock (-62% discount).

YCharts

Closing Thoughts- Technical Picture

If you’re a technically-minded investor, there are a few more green shoots worth considering.

Firstly, do consider that between late June 2020 and the first week of July 2020, one could spot a gap in the structure of NIO’s stock. As long as that gap remained unfilled, there was always the risk that the stock would come back at some stage to bridge it. Well, that risk now has passed, with the stock filling the gap in October 2022.

Investing

Secondly, if you watch NIO’s trading range since October 2022, we can see that it has broadly been chopping around within the range of $8-$14. If you’re contemplating a long position at this juncture, the risk-reward looks rather attractive as the stock is currently perched around the lower end of this range. Ideally, one also wants to buy a stock when there are signs of volatility contraction, and this is validated by a huge decline in the average true range indicator (ATR) which has almost halved from levels of over 3.2x in October to 1.65x currently.

Investing

Finally, if one switches over to a chart highlighting how NIO is positioned relative to other large-and mid-sized companies from China (as captured by the flagship iShares MSCI China ETF), it’s fair to say the risk-reward looks promising here as well.

Stockcharts

The relative strength (RS) ratio of these two options had looked quite overbought at the start of 2021 (irrational exuberance linked to NIO’s stock), but since then, there’s been a steep decline in the shape of a descending channel. As a mean-reversion candidate within the broad Chinese landscape, NIO offers good potential at this juncture as the RS ratio is trading around ~58% away from the mid-point of the long-term range, and this mid-point also almost coincides with the upper boundary of the descending channel (where the ratio could potentially revert to over time).

Read the full article here