NIO (NYSE:NIO) submitted its earnings sheet for the second fiscal quarter yesterday and the electric vehicle company not only saw an expansion of losses and decelerating revenue growth, but also a fundamental decline in vehicle margins. Vehicle margins have been fundamentally under pressure after Tesla’s (TSLA) announcement to drop prices in a bid to spur demand. This price war, which escalated in the first six months of FY 2023, resulted in a sharply deteriorating margin profile for NIO, but also for other EV manufacturers. Considering, however, that NIO has seen a huge price plunge in August and that the share price has fallen back to approximately $10, I continue to see a favorable risk profile!

Rating change

I am changing my rating from strong buy to buy to take into account the sharp drop in vehicle margins in NIO’s Q2 which could result in a delayed profitability date for the EV company.

Biggest take-away from NIO’s Q2 earnings report

The biggest take-away from NIO’s second-quarter earnings sheet was not that the company saw declining revenues or expanding losses, but that the Chinese EV sector as a whole is seeing broad pressure on vehicle margins due to increasing price competition… which has the potential to push out break- even years not only for NIO, but for other electric vehicle manufacturers as well.

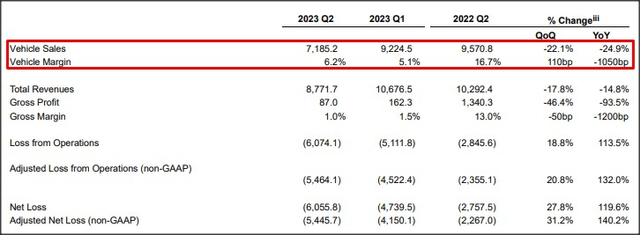

NIO’s revenues in the second-quarter amounted to 8.8B Chinese Yuan ($1.2B), showing a decline of 14.8% year over year. Revenue growth is decelerating chiefly due to slower than expected delivery growth as well as the factors mentioned in the introduction. Tesla’s price decreases for popular models such as the Model Y, which is a best-selling electric vehicle in China, forced other companies in the sector to also lower their prices. Among them was NIO which cut prices by 30,000 Chinese Yuan ($4,200). The decline in prices led to a massive decline in vehicle margins in the second-quarter. NIO’s vehicle margins increased slightly, quarter over quarter, to 6.2%, but they are still down 10.5 PP since the second-quarter of the year-earlier period. XPeng (XPEV) has saw a deteriorating margin trend in the second-quarter due to pressure on EV prices.

Source: NIO

As a result of the steep cut in vehicle margins, NIO also reported massively expanding net losses in Q2’23: NIO lost 6.1B Chinese Yuan ($835.1M) on its electric vehicle operations in the second-quarter which compares against a loss of 2.8B ($411.7M) Chinese Yuan in Q2’22. Losses therefore more than doubled and the culprit, as indicated, is lower selling prices as well as weaker deliveries in Q2’22.

This massive decline in margins and profits obviously is a huge concern for investors, especially as profitability targets may be pushed out further into the future. NIO is expected to achieve its first break-even year in FY 2026 and a deteriorating margin trend is a key concern and a potential headwind for NIO’s break-even goals.

Abu Dhabi investment

What I believe supports an investment in NIO despite margin headwinds is that the Chinese EV sector sees interest from strategic investors. NIO secured a $738.5M investment from Abu Dhabi in June while XPeng agreed to collaborate on EV development with Volkswagen… and gained a $700M investment from the German car brand.

NIO’s Q3 delivery outlook

As is customary for NIO, the company gave a prediction for its delivery volume in Q3’23. For the third-quarter, NIO expects a total delivery volume in the range of 55,000 to 57,000, which represents a year over year increase of 74.0 to 80.3%. In the second-quarter, NIO delivered just 23,520 electric vehicles to its customers, so the company expects a solid 138% rebound in its delivery volume in Q3’23. The delivery forecast which indicates a strong re-acceleration of delivery growth in the third-quarter was definitely one piece of good news in NIO’s Q2’23 earnings report on Tuesday.

NIO’s valuation has become more attractive again

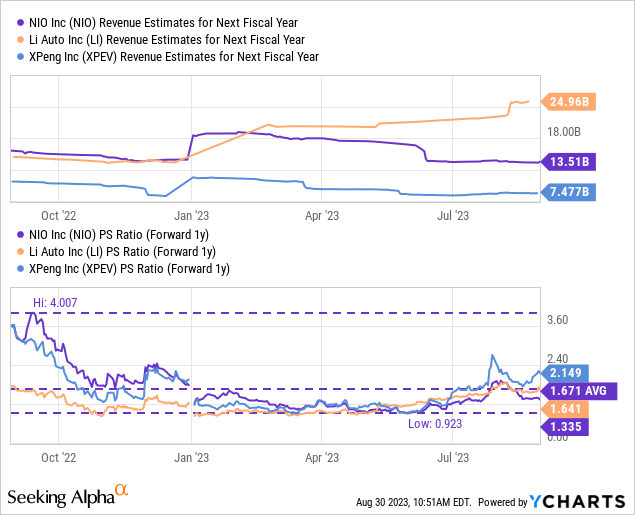

NIO’s shares soared in July on improving investor sentiment towards electric vehicle companies and improving delivery prospects, in part due to new product launches such as the ET5T. However, NIO’s valuation has pulled back lately and is now at about the same level at which I last recommended the EV company. Therefore, I issue a buy recommendation for shares of NIO, but not a strong buy recommendation, due to the company’s declining vehicle margins.

From a valuation perspective, NIO is an attractive buy again, in my opinion. NIO currently trades at a P/S ratio of 1.34X, showing a 20% discount to the 1-year average P/S ratio. Both XPeng and Li Auto (LI) trade at significantly higher valuations. Li Auto, in my opinion, still offers investors the best package deal consisting of superior delivery growth, faster top line growth and higher vehicle margins.

Risks with NIO

From a risk perspective, NIO’s deteriorating margin trend is a red flag and it indicates a deteriorating risk profile. XPeng also saw serious margin pressure in the second-quarter and even reported negative vehicle margins. The best bet in terms of delivery margins as well as delivery prospects, in my opinion, remains Li Auto, which continues to crush the competition on multiple fronts. The recent correction has also taken some risk out of the NIO trade, in my opinion. What would change my mind about NIO is if the EV company saw its vehicle margins drop into negative territory.

Final thoughts

There were a number of take-aways from NIO’s second quarter earnings report and the biggest one was that price decreases in the EV sector have started to make a considerable impact on NIO’s electric vehicle margins. Just like XPeng, NIO saw material pressure on prices and vehicle margins in the second-quarter which has resulted in an expansion of losses as well as decelerating top line growth. Going forward, NIO needs to prove that it can mass-produce its electric vehicles profitably or risk losing investor interest.

What I liked about NIO’s Q2’23 earnings report was that the company expects a rebound in delivery growth in the third-quarter… which could ultimately drive a recovery of NIO’s valuation. While I am lowering my recommendation from strong buy to buy, given the deteriorating margin trend, I continue to see NIO’s valuation as attractive after the firm’s valuation plunge in August. With a P/S ratio of 1.3X, NIO is the cheapest of the top three Chinese EV makers and a buy for investors despite margin headwinds in the business!

Read the full article here