NMI Holdings (NASDAQ:NMIH) is the parent company of National Mortgage Insurance Corporation. NMIH reported its Q2 EPS yesterday, and for a dinosaur – a plain old insurance company with a low tech component – I think it did OK. The Wall Street brainiacs pegged NMIH’s EPS at $0.85 for Q2. The company came in $0.10 better. That’s $0.95, or a $3.80 annualized rate for a stock at $26.97 prior to the earnings report. The resulting 7.1 P/E is one-third the market multiple.

Let that soak in for minute. One third of the market’s valuation. That says investors see really rough times ahead for NMIH relative to other companies. I disagree. I think that NMIH is a 5-8% EPS grower for the foreseeable future. This article will focus on three key reasons why I disagree:

- NMIH’s credit protections are outstanding

- Revenue growth is perking up

- Management is starting to use its growing excess capital.

Let’s get to it, shall we?

NMIH’s credit protections are outstanding

NMIH insures $193 billion of mortgages against default. These mortgages have average down payments of only 8%. Crazy, right? Not as crazy as the fact that annualized Q2 claims payments were $4.5 million. That’s two-tenths of 1 basis point! That’s $0.04 a share! Barely 1% of earnings.

How is this happening? Here’s the very short story:

- NMIH insures very few low-credit borrowers. Only 9% of its insureds have credit scores below 700. Nearly half have credit scores above 760. Its average FICO score is over 750.

- Most of its borrowers have low mortgage rates. NMIH doesn’t provide this data, but Redfin reported that 62% of mortgage borrowers have mortgage rates of 4% or less. Those borrowers will fight hard to keep those loans.

- Home price appreciation. About half of NMIH’s insurance in force was written when home prices were at least 10% below where they are today.

- The housing shortage. I estimate that the U.S. is short about 1.5 million homes, compared to its normal vacancy rate based on Census Bureau data.

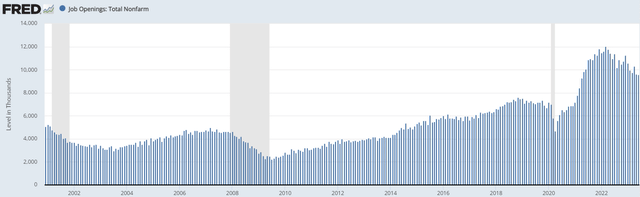

- The worker shortage. This history of job openings shows that a near-term surge in the unemployment rate – a key risk factor for mortgage defaults – is highly unlikely:

FRED

Source: FRED from Bureau of Labor Statistics data

This terrific performance, or something close to it, will probably last for many years, for three reasons.

- NMIH reinsures a material part of its risk, protecting itself against recession-level losses.

- NMIH is not alone in maintaining conservative underwriting standards. The whole industry has done so since the ’08 financial crisis when massively stupid home mortgage lending blew up.

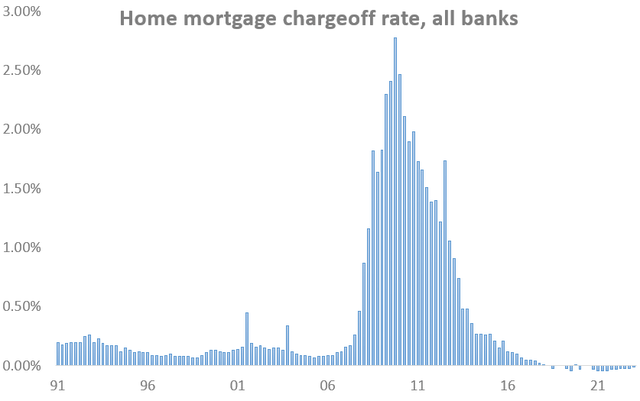

- Large mortgage defaults are the exception, not the rule, as this history of bank home mortgage charge-offs attests:

Federal Reserve

Source: Federal Reserve

Revenue growth is perking up

A big knock on NMIH and its peer mortgage insurers over the past few years has been disappointing revenue growth. Versus four years ago, NMIH’s Q2 revenues were up only 56%. I say “only” because its insurance in force was up 144%. The problem has been that over that time period NMIH’s revenues per loans insured dropped from 47 bp to 30 bp. While a bad reason – price competition – caused some of that margin compression, most was due to NMIH’s (and its peers) risk reduction efforts. It charges higher quality customers lower insurance premiums. And it has to give more premium dollars to reinsurers the more coverage it gets. Further, lower interest rates reduced the yield that NMIH earned on its capital.

But the tide may be turning. NMIH’s Q2 revenue yield of 30.2 compares to the Q1 yield of 29.5. One quarter a trend doesn’t make, but there is logic to the idea that its revenue margin is bottoming. For one, at some point NMIH will no longer be reducing its credit risk. Its net premium yield has been 26/27 bp for the past year. Second, yields on new investments are clearly rising. NMIH’s investment yield rose from 2.1% a year ago to 3.0% this Q2. That increase added $0.05 to EPS from a year ago.

NMIH’s insurance in force grew by 13% from a year ago and by 10% annualized during the quarter. It will almost certainly slow to 5-7% for the next few years. But that is now likely to drive at least 5-7% revenue and earnings growth.

Management is starting to use its growing excess capital

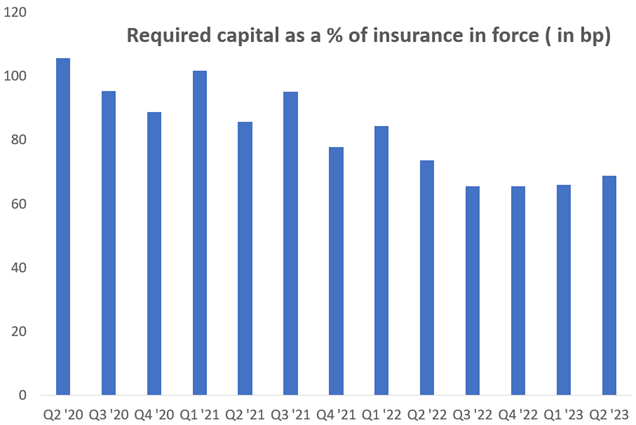

As of the end of Q2, NMIH’s main regulator required it to hold $1.3 billion of capital against its $191 billion of insurance in force. But NMIH has $2.5 billion of capital, for an excess of $1.2 billion. And despite that 144% growth in insurance in force over the past four years, its excess capital has been increasing, for the same reason that NMIH’s revenue margin has been decreasing – reduced risk. Here is a recent history of NMIH’s required capital as a percent of insurance in force:

National Mortgage financial reports

Source: National Mortgage financial reports

And by the way, NMIH is generating over $300 million a year in new capital through earnings.

Until a year ago, NMIH retained all its capital to support its growth. Nothing for us shareholders. That changed last year when management started a stock buyback program. To date it bought back 5% of its shares. That’s a 5% permanent bump to EPS. The company just added $200 million to its buyback program, bringing its war chest to $228 million. Management expects to spend that by 2025. That means another 9% reduction in shares outstanding at today’s stock price over the next year and a half. Another 9% permanent bump to EPS.

What about a dividend? With a stock still selling at only an 8 P/E after a post-earnings rally, share repurchases remain the best use of capital – a 13% yield. But as NMIH’s insurance growth slows, it will generate even more excess capital and initiation of a dividend gets more likely.

Wrapping up

With the stock up to $29 as I write this, the stock is still below an 8 P/E. The three stories I reviewed above suggest EPS growth of about 10% a year for the next few years. NMIH stock should be somewhere north of $40. I’m waiting around for that number.

Read the full article here