Published on the Value Lab 06/18/23

Considered on the basis of buying on the domestic Japanese exchange under the (5943) ticker. Documents machine translated by Google Translate.

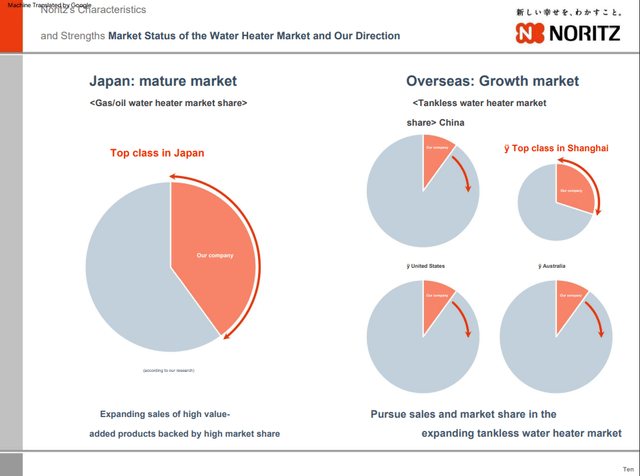

Noritz Corporation (OTCPK:NRTZF) makes water heaters and climate control implements as well as gas stoves and other kitchen equipment that benefit from a decent degree of recurring economics and a rebound from the loosening of supply chain bottlenecks. They are dominant in market share in Japan and are relevant in major Chinese metropolitan areas.

Market Shares (Q1 2023 Pres)

Secularly, Noritz benefits from the higher energy prices persuading end-markets to consider upgrading to more modern equipment that is more efficient and also more environmentally friendly. Longer term, they benefit from periodic replacement (usually every 10 years), and more frequent maintenance and repair activity which we estimate is around 15% of revenue and a greater margin contributor. Rising volumes for a comparatively prosperous Japanese economy that is poised to benefit food service and hospitality markets due to a weak Yen, important ones for Noritz, as well as generally stronger consumer trends, are in opposition to a very compressed valuation for a business whose economics, regardless of macroeconomic trends, are generally strong. Noritz is also engaging in a profit improvement plan that is likely to generate modest results, and they are focusing on winning maintenance contracts now in non-residential markets as part of the management plan. Finally, Japan is going through a corporate governance shift, which is why it has been the best performing market in the developed world YTD in 2023. The TSE is requiring minimum P/B and ROE ratios in order to remain listed on the TSE, which can be solved by companies like Noritz, lying below these thresholds, paying out dividends to reduce its book equity from its obscene balance of cash that is compressing their EV. A hard deadline isn’t in place yet but it could be March 2024-2025. Noritz is a clear and screaming buy at 1.6x EV/EBITDA with catalysts to come for Japanese mid-cap and small-cap issues, as the large-cap rally around governance factors trickles down.

Noritz Products and Markets

Noritz makes the majority (~80%) of its money selling water heaters and related climate control products in Japan, but also has a relevant overseas exposure at around 1:2 ratio. Their domestic business which is much more scaled is about 1.2% higher in operating margin at 4% compared to the foreign businesses.

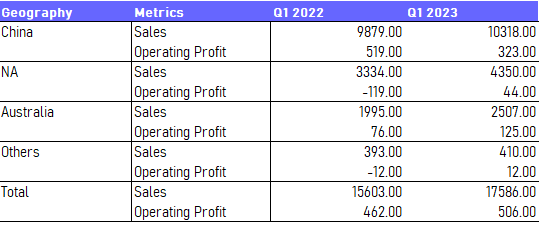

Overseas Sales Split (Q1 2023 Pres)

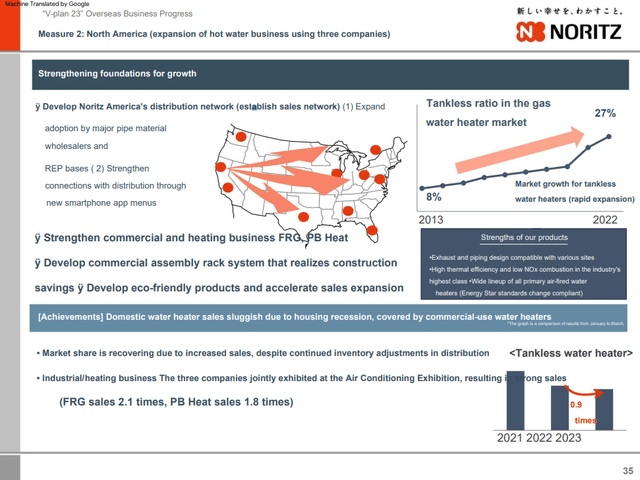

The major push that Noritz is making is increasing the prevalence of tankless water heaters in their business mix. They are more expensive, are higher margin, but are lower cost of ownership (probably around 70% less energy intensive than tank boilers) for the consumer and that appeal is driving replacements and upgrades towards tankless heaters as energy prices remain structurally higher. MRO revenues are pretty relevant across its products, and it gets a lot of maintenance calls a year that likely amount to about a 15% revenue contribution from recurring MRO activity, likely at a margin higher than the comprehensive business’s, as is often the case with aftermarket and service activities in industry.

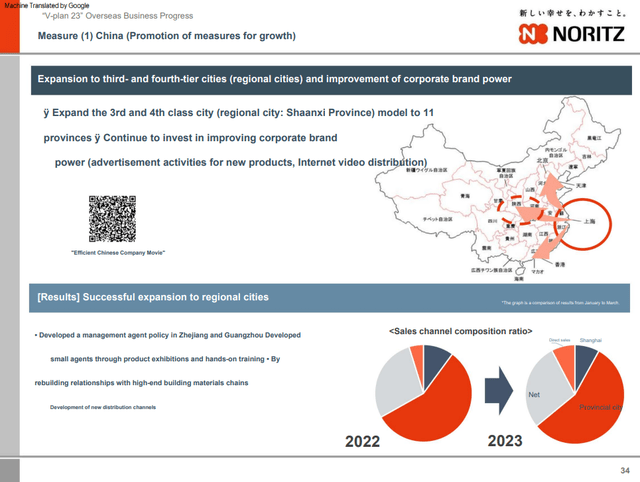

It manufactures many of these products in Japan, but growth CAPEX is being focused on expanding the current footprint in China with more distributors and manufacturing, where China is a growing market for their products despite relatively pronounced economic headwinds, and they already lead in cities like Shanghai in terms of market share. They plan to expand market share further into the provinces from their landing zone in Shanghai with their distributor push. They also have growing markets in the US, Australia and are launching in New Zealand now too.

New Zealand and Australia (Q1 2023 Pres)

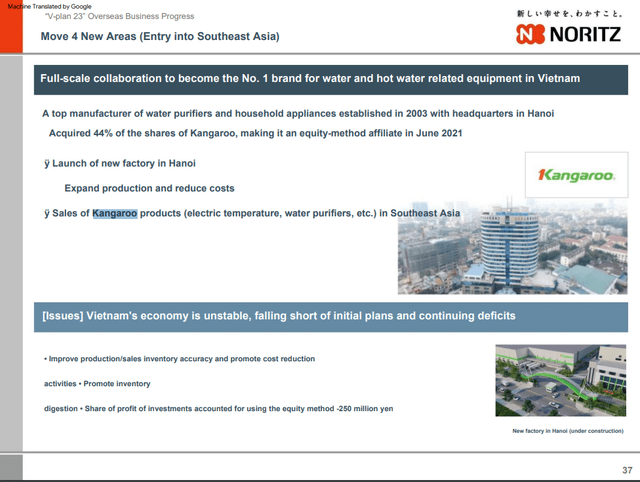

In Vietnam they manufacture water purifiers. This is an almost negligible part of revenue for now (around 3%), though they are expanding their manufacturing footprint for water purifiers in order to scale the business out of low profitability, where it is currently a 4% detractor from net income. They also sell gas stoves and range hoods, and these kitchen exposures are relevant at around 12% of sales.

Vietnam (Q1 2023 Pres)

Current Results and Modest But Effective Plans

Let’s have a look at the key charts that summarise the most recent performance figures and then give them some context.

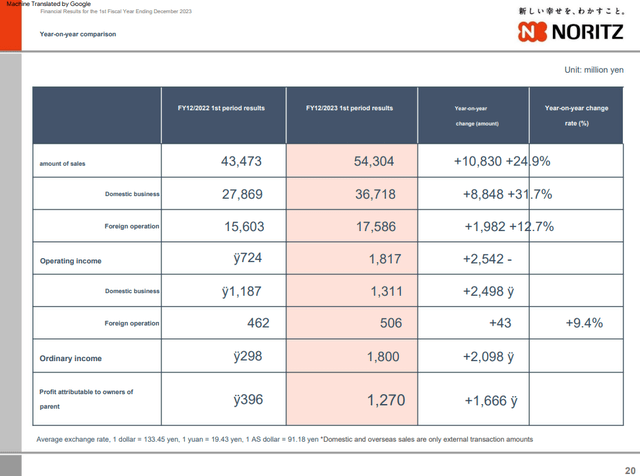

Domestic – Overseas Split (Q1 2023 Pres)

Currently all the growth is focused in the water heating and related businesses (35 –> 46 billion Yen a 31% growth), with kitchens being flat (6.2 –> 6.3 billion Yen). Moreover, domestic growth is more pronounced than overseas growth, owing primarily to the relative weakness in China on account of pressures on the credit markets, slowdowns in housing, but also general economic weakness. China even managed to be a growth region, but promotional activity at the costs of margins was one of the reasons for that. North America and Australia grew at a rate more similar to Japan despite being more marginal markets for Noritz thanks to relatively strong economic conditions where Japan was dealing with cost of living difficulties and a weak Yen, whereas the US economy was resilient these years and Australia has a highly pronounced housing shortage as well as lower rates to keep bubble-level mortgage-holders solvent. Noritz gained market share in the US with major competitors seeing much flatter sales evolutions thanks to a pivot to commercial markets which were stronger than residential. Commercial contracts usually come with maintenance contracts so there is promise of even more recurring economics as commercial end-markets grow in the mix.

The last couple of years have been difficult for Noritz primarily due to the initial freeze up from COVID-19, followed by pronounced supply chain shortages that were especially severe among Japanese companies, and in some markets like the US the issue of destocking deferral which continues to be a problem as well as weaker residential demand. Also, high steel, logistics and raw material prices hurt margins meaningfully across the water heating industry, so in addition to the sales shortfall and loss of scale, margin was highly impacted on the gross margin side. Profits went from negative to positive YoY thanks to volume rebounds focused in Japan but also the pass through of higher prices onto customers to wedge ahead of higher-costed inventory.

Steel prices are still pretty high relative to the average prices in 2022, but they were lower in the first quarter and this should mean inventory build-up in this quarter will liquidate at higher gross margins in the next quarters. Logistic prices have also started to come down after this reported Q1 so we expect multiple vectors for margin lift in the next quarters as the post-pandemic and post-supply-stop rebound, particularly in Japan, continues to fuel growth. The greater monetary accommodation in China following a real estate scare as well as poorer credit conditions should also give some downside protection to Noritz in China in the newbuild space. But in general, the end of the pandemic and the ability to replace equipment, where replacement revenues is a major proportion of results, is going to be the most important and recurring factor to grow revenues in a way that should buck the downward trend we’re seeing in new construction and residential demand.

Even when volume growth and pricing action decelerates in the next couple of quarters, the abating inflation situation will eventually start to show, starting a little now with the commodity and logistic come-downs, but later also from the domestic business when the Yen revalues more in line to previous levels as monetary policies converge over the next couple of years. Underlying economics based on MRO and replacement will mean resilient results, barring extraordinary lockdown events like COVID-19 or sudden stops in the supply chains which hit the last two year’s results.

While organically developments already look positive, there are intelligent actions that Noritz is taking in order to structurally improve their profitability. In addition to following the market and becoming ensconced in more modern and higher-value water heating products for favourable mix effects, Noritz is taking profitability action on the labour side in Japan as well, allowing for a period of voluntary retirement and carefully restructuring labour practices. The Japanese labour market is sensitive, it’s not easy to just fire people, and therefore it is not common to see a proper restructuring. These actions my Noritz are about as much as you can expect from a Japanese company.

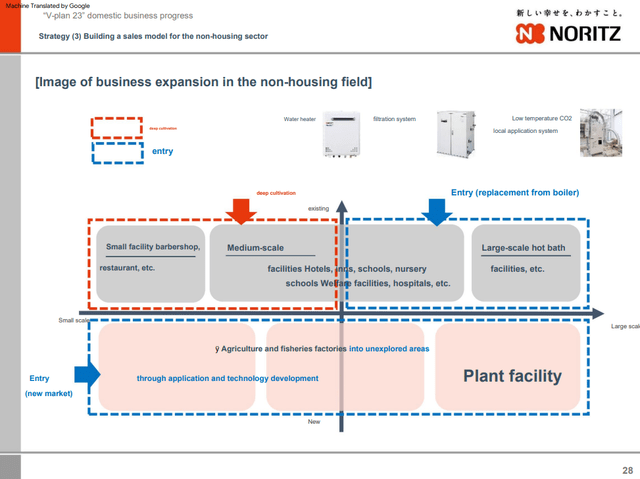

They are also trying to grow business in non-residential markets as well, because these commercial contracts also come with managed maintenance and service contracts that are great margin contributors, usually 2x the margins of selling heater units, and provide desirable contractually recurring economics. While residential markets were stagnant in the US according to competitors like A.O. Smith (AOS), commercial markets did well and the overall growth for Noritz by targeting these markets allowed that region to match the sales growth of Japan which was benefiting from a major rebound from supply availability. While commercial business was important for the US market, Noritz is also making clear strides in adapting their products for major domestic industries too, looking to get into large scale fisheries and agriculture with water heating products and water purification.

Commercial Ideas (Q1 2023 Pres)

As mentioned earlier, overseas businesses are less profitable than Noritz’s Japan business. For that reason as well Noritz’s management plan is focused on expanding overseas presence and sales in order to scale those businesses and bring operating margins up. Currently, the majority of the manufacturing footprint is in Japan, but they also have a relevant factory in China and a smaller one in Pennsylvania. They are expanding their manufacturing overseas as well as expanding their distribution net. In China it’s a clear land-and-expand from Shanghai where they are getting close to having dominant market share into the provinces and other cities. This will raise capital expenditure 20 billion Yen beyond depreciation as part of a growth CAPEX initiative. It will also help to make their supply chains better shored up, self-sufficient in their respective markets and less prone to bottlenecks and failures.

China – Land and Expand (Q1 2023 Pres)

US Expansion Plan (Q1 2023 Pres)

Valuation

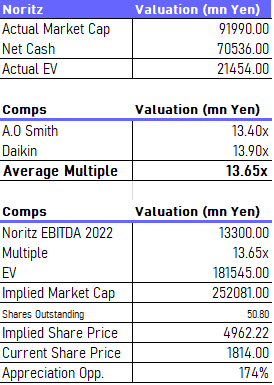

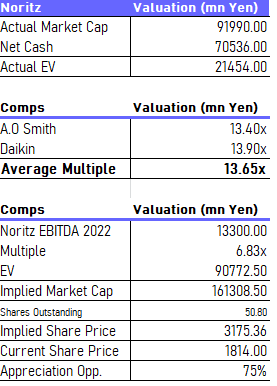

Noritz, like many Japanese companies, has a massive non-operating asset base of cash and investments, consistent with years of profits without commensurate payouts, accumulating equity and driving the P/B down to the very low level of 0.67x. This compresses the EV to the point where the cash and investments almost eclipse the market capitalisation.

Bull Case (VTS)

We use other water heater companies but also HVAC players to get an idea of what replacement and MRO-based economics get in terms of multiples on international markets. Admittedly, Noritz hasn’t managed its business to match the margins of a company like AOS which operates in a similar business. As such, we propose a bear case where we halve the proposed multiple. Still, the upside is very meaningful at 75%, although if the company becomes managed a bit better, with profit plans and eventually some discretionary costs coming down like R&D, then the 175% value case becomes more appropriate. Given that Noritz is actually accomplishing better profit growth right now, even demonstrating momentum, unlike AOS which is stagnating, something between the technical 75% and 175% upside would already make sense.

Bear Case (VTS)

Bottom Line

Variable costs are coming down and some fixed costs are coming down. Supply chain loosening means rebounding volumes at higher realised prices. On top of that the mix is shifting towards more valuable products and commercial business with maintenance contracts. The economics are improving, being decent to begin with thanks to substantial ongoing replacement activity and MRO, and the multiple is 1.6x EV/EBITDA, way below the average business let alone one with a good deal of recurring economics and industrial scale opportunities. With an overseas expansion, we expect positive mix effects from that as well, starting with a recovery of scale in China, one of Noritz’s most profitable markets even now, as the situation there slowly normalises.

Moreover, something that hasn’t yet been mentioned is the fact that depreciated Yen and opening up to tourism will lend a hand to the food and hospitality industries in Japan. We expect growth to come in the kitchen segment which has so far been stagnating to also add to the profits.

While there are general economic risks, the main dangers to the business are industrial threats to their scale, now in the rear-view with the worst of the supply chain issues behind companies like Noritz and the end to the pandemic concerns and lockdowns. Noritz apparently has more levers to pull in how they bucked weakness in US water heating markets by hunting for commercial contracts.

The market is clearly not valuing Noritz’s non-operating assets. For years this would have been the sensible thing to do as shareholders have not been able to access cash balances in Japanese companies in the past, with the companies not even particularly reinvesting the cash. With the resolutions by the TSE likely to put some fire under management teams and boards in Japan, who are generally not as financially literate as they are in the US where the business culture is more sophisticated, shareholders are likely to be able to access these funds by receiving enhanced dividends in the coming years, as has been speculated for Japan’s low P/B large cap players which has driven Japan to overperformance in global developed markets. With the downside protection of good earnings growth prospects, much like our monster idea Daiwa Industries (OTCPK:DAWIF), Noritz is a clear and obvious buy.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here