Northwest Bio (OTCQB:NWBO) has some important news – just today, they provided a clear timeline for submitting an application for approval to the UK equivalent of the US FDA for DCVax-L, their glioblastoma multiforme (‘GBM) therapy.

NWBO investors are a long-suffering lot. For over two decades, DCVax-L has been in trials for GBM. NWBO investors still remember with horror the long wait for topline data, an event I covered for over a year. That data was finally released, and we saw that the data was flawless. This data, published in November 2022 in JAMA, is basically this:

A total of 331 patients were enrolled in the trial, with 232 randomized to the DCVax-L group and 99 to the placebo group. Median OS (MOS) for the 232 patients with nGBM receiving DCVax-L was 19.3 (95% CI, 17.5-21.3) months from randomization (22.4 months from surgery) vs 16.5 (95% CI, 16.0-17.5) months from randomization in control patients (HR = 0.80; 98% CI, 0.00-0.94; P = .002). Survival at 48 months from randomization was 15.7% vs 9.9%, and at 60 months, it was 13.0% vs 5.7%. For 64 patients with rGBM receiving DCVax-L, mOS was 13.2 (95% CI, 9.7-16.8) months from relapse vs 7.8 (95% CI, 7.2-8.2) months among control patients (HR, 0.58; 98% CI, 0.00-0.76; P < .001). Survival at 24 and 30 months after recurrence was 20.7% vs 9.6% and 11.1% vs 5.1%, respectively. Survival was improved in patients with nGBM with methylated MGMT receiving DCVax-L compared with external control patients (HR, 0.74; 98% CI, 0.55-1.00; P = .03).

Armed with this data, one would have expected NWBO to file away with the FDA quickly. However, they are now filing with the UK, and it has taken them over a year. Now, a year’s time for filing a regulatory approval application is not that long. However, what’s interesting is that they are filing with the UK first. The reason for this is probably their UK-based manufacturing facility and generally British associations of the company.

Here are the key points from their press release announcing the timeline for the UK filing:

MAA Progress: The company has reported significant progress in the preparation of a Marketing Authorization Application (MAA).

Completion of Key Sections: Almost all of the key sections of the MAA have been delivered to the publisher. The publisher is an independent party responsible for formatting and checking references in preparation for submission.

Finalizing Last Key Section: The company and its consultants are working intensively to finalize the last remaining key section of the MAA. There was an unexpected delay, but the company is committed to making this section strong, given the extensive work on the DCVax-L program.

Submission to Multiple Regulators: The company plans to submit applications to multiple regulatory authorities.

Consultant Availability: Some key expert consultants who are essential for finalizing the remaining section will be temporarily unavailable, but are expected to return the week of October 30.

Anticipated Timeline: The remaining section of the MAA package is expected to be delivered to the publisher about two weeks after the consultants’ return. The publisher will then need two to three weeks to complete their work on both the last section and the entire package.

Submission Date: Based on the provided timeline, the submission of the MAA to the MHRA (Medicines and Healthcare products Regulatory Agency) is anticipated to take place between mid and late November.

Planned Updates: The company intends to provide updates at key milestones, such as when the last section is delivered to the publisher and when the MAA is officially submitted.

Thus, what we see here is that the company has made significant progress in preparing the MAA for DCVax-L. They are working to finalize the remaining section, and they are taking some time because they want to produce a strong submission package.

Very interesting to note here is that they are planning to use the same material (or at least some of it) to file with multiple regulators, which one would like to assume means the FDA and the EU people. That is a very good thing.

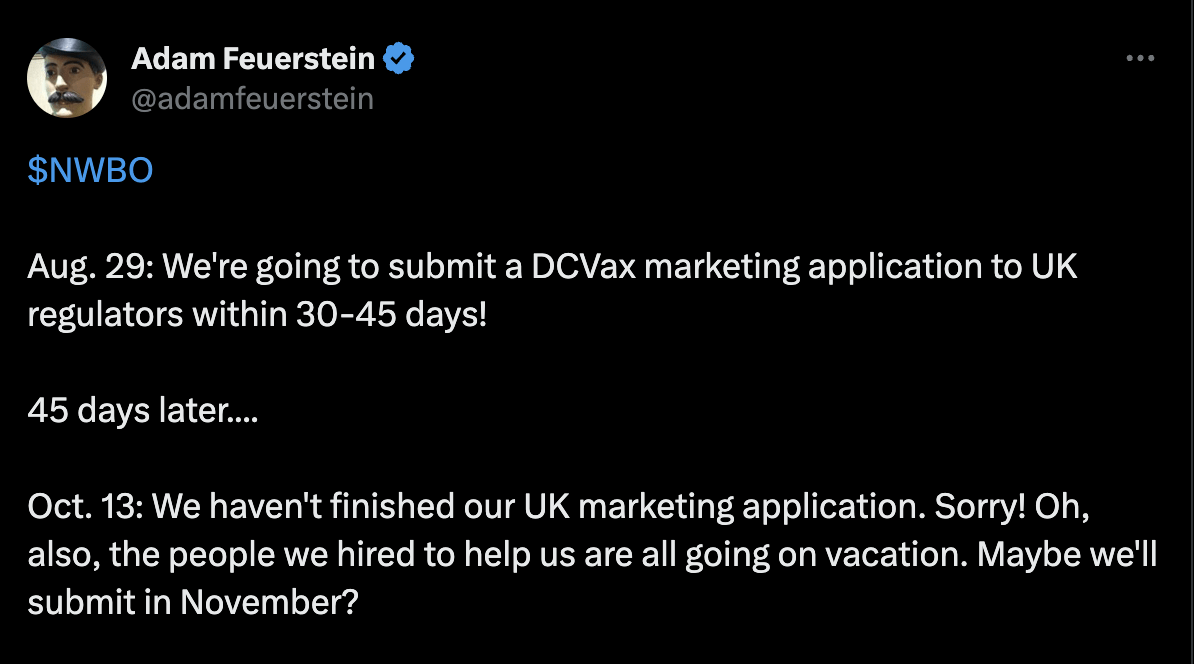

NWBO has had its detractors over the years. This latest announcement has given them necessary fodder for more bearishness. They cannot be blamed – NWBO has a habit of doing things in the worst possible way. This latest announcement of a 45-day timeline comes after another timeline was provided in August with an October date for submission. At that time, the company stated that it had…:

… now completed all of the remaining prerequisites for such an application

However, in today’s submission, it states that the…:

…Company and its consultants are working intensively to finalize this last key section of the MAA, after overcoming an unexpected delay in that regard.

No wonder, well-known biopharma analyst Adam Feuerstein tweeted:

Twitter (twitter)

Nobody can be blamed for doubting a company as procrastinating as NWBO. However, like I noted last year, their 67-author JAMA publication has decimated their detractors who had doubted their data. I am guessing that after the usual NWBO delay, Ms Linda Powers will produce a thorough application, and one day – some day – it will be approved by someone.

Financials

NWBO has a market cap of $900mn and a cash balance of $5mn (current assets) as of the June quarter. They spent around $6.5mn and $7.5mn in R&D and G&A. The company regularly issues debt and stock. In March, Streeterville Capital, LLC lent them $11mn. John M. Fife, who owns and managed Streeterville, has been in trouble with FINRA and the SEC before, and has been called “Wall Street’s toxic lender of last resort.” The same source has been tapped multiple times before. Ms Powers and another director own 153 million options, some of it against direct debt issued to them in return for loans. This is one strange company, and ordinary equations do not apply.

That is also true in another way; this is the only company I am aware of over 90% of which is in the hands of the retail public. No wonder, retail owners (especially on social media) get so excited at the slightest good or bad news at NWBO. For example, the stock is down 20% today on announcing a 45-day delay.

Another interesting little note: Dr. Linda Liau, MD, PhD, MBA has joined the Company’s Scientific Advisory Board (SAB). This happened in September. Dr Liau, as everyone knows, is the inventor of DCVax-L and its princpal investigator. Her joining the SAB of NWBO should be interesting news.

Risks

NWBO is an extremely risky stock. While I have suggested buying NWBO once or twice before, that was spurred mostly by that outstanding data. As they have continued with their inordinate delays and lack of information releases, including no conference call “in living memory,” I have shied away from calling it a buy. This time is no different.

Plus, their cash position makes no sense. Where are they getting survival money – and at what cost? NWBO is no ordinary company, and only the very enthusiastic retail investor will want to hold shares here.

Bottom line

I agree that my rating suggestions for NWBO may not make sense – but then, neither does NWBO ever make sense. I called it a buy last year, and the stock is down 30% from that price, with additional derisking from then in the form of a concrete announcement of application submission. Yet, this is a stock that runs on enthusiasm, and that enthusiasm wanes when such delays happen. I am very risk-averse, and while I will cover these risky stocks, I have no intention of suggesting that these are buys unless they are producing JAMA articles with 67 authors, each of whom is a who’s who in the GBM space.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here