Introduction

Novavax (NASDAQ:NVAX), a biotechnology company, specializes in creating innovative vaccines against serious infectious diseases globally. Their proprietary recombinant technology platform produces genetically engineered nanostructure vaccines that mimic proteins found on natural pathogens, stimulating robust immunity. They incorporate a unique saponin-based Matrix-M adjuvant to further boost the immune response. Novavax has commercialized a COVID-19 vaccine, NVX-CoV2373, which is approved globally for various populations and scenarios. They’re also developing influenza vaccines, a combined COVID-19-Influenza vaccine, and solutions for variant strains of COVID-19, alongside focusing on diseases like respiratory syncytial virus and malaria.

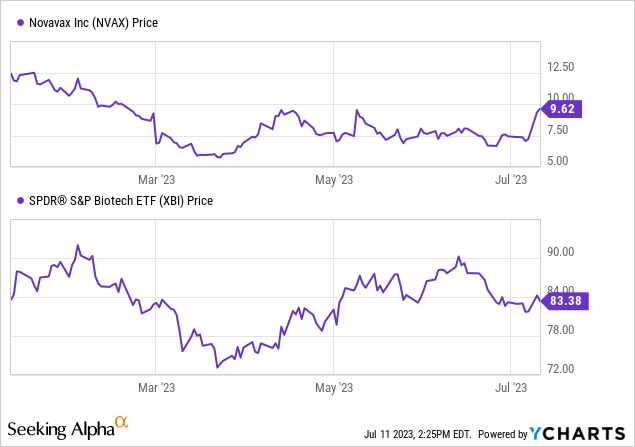

Recent updates reveal that Novavax’s COVID-19 vaccine, Nuvaxovid, achieved full marketing authorization in the EU for those 12 and older. The company also intends to pursue US approval. In the wake of modifying their vaccine supply agreement with Canada, resulting in a $349.6M payment, Novavax’s stock surged by ~28% in after-hours trading, despite an ongoing dispute with Gavi and decreasing demand for Nuvaxovid.

Q1 2023 Earnings

Let’s first review the company’s most recent financial report. In Q1 2023, Novavax’s revenue fell to $81 million from $704 million in Q1 2022 due to seasonal demand for COVID vaccines. The cost of sales and SG&A expenses rose, while R&D expenses decreased. A net loss of $294 million was reported, compared to a net income of $203 million in the same period last year. Cash reserves dropped to $637 million from $1.3 billion, with significant reductions in liabilities. Full year 2023 revenue is projected between $1.4 billion and $1.6 billion, with R&D and SG&A expenses between $1.3 billion and $1.4 billion. A $100 million payment, not included in sales guidance, is expected in Q2 2023.

At writing, Novavax has a market capitalization of $807.82 million, total debt of $246.57 million, and cash holdings amounting to $624.95 million. This results in an enterprise value of $429.43 million.

Novavax Modifies Agreement with Canada: Strategic Move to Alleviate Pressures and Secure Capital

On June 30, 2023, Novavax modified its Advanced Purchase Agreement with Canada. Key changes include a forfeiture of certain vaccine doses previously scheduled for delivery, a decrease in the amount of vaccine doses due, a revision of the delivery schedule, and a requirement to use the Biologics Manufacturing Centre to produce bulk antigen for 2024 and 2025. In exchange for forfeited vaccine doses, Canada agreed to pay Novavax $349.6 million in two equal installments in 2023. This payment arrangement is contingent on Novavax’s delivery of vaccines in the latter half of 2023. The amendment retains the total contract value of the original agreement.

This development could be seen as a strategic move by Novavax to alleviate financial and production pressures, securing substantial capital in the process. The revised agreement provides Novavax with guaranteed revenue and a more manageable delivery schedule, potentially contributing to stock stability. However, it’s important to note that the agreement’s long-term success hinges on Novavax achieving regulatory approval for vaccine production in the Biologics Manufacturing Centre by December 31, 2024. If this condition is not met, Canada may terminate the agreement, leading to significant implications for Novavax. The intention to create health, economic, and future pandemic preparedness benefits for Canada, as well as the commitment to an Invest In Canada MOU, further underscores the depth of this partnership.

Novavax’s Late Entry and Competitive Challenges: Uphill Battle in Vaccine Market

Despite Novavax’s commendable advancements in the vaccine landscape, particularly with its COVID-19 vaccine Nuvaxovid, it’s challenging to overlook the fact that they entered the market significantly later than biopharma giants Pfizer and Moderna. This late entry has had considerable implications for Novavax’s market share and its ability to penetrate a space already dominated by these established vaccines.

The success of Pfizer and Moderna can be attributed to their utilization of mRNA technology, which allowed for rapid development and efficacy in the face of the pandemic. Novavax’s protein-based approach, while innovative and theoretically promising, has struggled to outpace these competitors in terms of production speed and market roll-out.

Furthermore, the drop in Novavax’s revenue in Q1 2023, compared to the same period in 2022, suggests a decline in demand for their COVID-19 vaccine. This trend is likely exacerbated by the company’s late market entry, with potential customers already vaccinated with competitor products. This leads to Novavax’s dependence on booster shots and potential new outbreaks, both factors that are inherently unpredictable.

Turning to the company’s other vaccine candidates, there is some concern over their potential success. Although Novavax’s influenza and COVID-19-Influenza combination vaccines, as well as their developments for RSV and malaria, represent significant contributions to global health, the question remains: Will Novavax face the same hurdles it has with its COVID-19 vaccine? In other words, will other biopharma companies outpace them in response to these global health threats, essentially repeating history?

Despite these challenges, Novavax’s unique Matrix-M adjuvant technology could prove to be a significant differentiator, potentially offering more robust immunity than other vaccines. Furthermore, their successful negotiation of the vaccine supply agreement with Canada demonstrates their ability to navigate complex business challenges and secure funding. The approval of Nuvaxovid in the EU also provides a glimmer of hope in the otherwise competitive market.

My Analysis & Recommendation

In conclusion, investors should monitor how Novavax navigates the difficult terrain of having entered the vaccine market late. Despite its promising technology, the company faces significant competition from biopharma giants Pfizer and Moderna, who have a firm hold on the global vaccine market. The decreasing demand for Novavax’s COVID-19 vaccine, Nuvaxovid, and the company’s financial performance, marked by a substantial drop in revenue, highlight this challenge.

However, the recent amended agreement with Canada, which has secured significant capital, along with the EU approval for Nuvaxovid, presents potential opportunities. These developments indicate Novavax’s ability to make strategic decisions under pressure and potentially secure market share in regions less dominated by their competitors.

To renew confidence from investors, Novavax needs to demonstrate its capacity to keep up with market leaders in the face of global health threats. That could mean accelerating its vaccine development and rollout strategies, showcasing the distinct advantages of its technology, or securing more strategic partnerships. Investors would benefit from seeing Novavax making strides not just in its COVID-19 efforts, but also in its developments for influenza, RSV, and malaria.

Given the considerable challenges Novavax is facing, the significant drop in its stock value, and the uncertainties surrounding its capacity to effectively compete with established biopharma giants, my recommendation, for the time being, would be to “Sell”. However, investors should keep a close eye on the company’s developments, as the biotech sector is known for its dynamic nature, and shifts in the market or advancements in Novavax’s technology could present future opportunities.

Risks to Thesis

When the facts change, I change my mind.

When the facts change, I change my mind.

The three primary risks to my “Sell” thesis for Novavax are:

-

Rapid Approval and Adoption: If Novavax is successful in rapidly obtaining full approval for its COVID-19 vaccine, Nuvaxovid, in the U.S. and other key markets, and manages to significantly increase its distribution and adoption, it could drive substantial revenue growth. This could potentially revitalize the company’s financial standing and trigger a positive revaluation of its shares.

-

Breakthrough in Vaccine Development: Novavax’s pipeline contains several promising vaccines, such as those for influenza, RSV, malaria, and especially the combined COVID-19-Influenza vaccine. If any of these vaccines make significant progress, it could improve the company’s prospects, invalidate my “Sell” thesis, and potentially provide a positive surprise to the market.

-

Resolution of Disputes: The resolution of Novavax’s ongoing disputes, notably with Gavi, could lift a significant weight from the company’s reputation and financial outlook. A positive outcome might result in renewed contracts and partnerships that can help Novavax’s overall performance. This could change the financial trajectory of the company, challenging my current recommendation.

Read the full article here