The Novavax’s COVID-19 Investment Thesis Is Old News

We previously covered Novavax, Inc (NASDAQ:NVAX) in January 2023, discussing the stock’s volatility, attributed to the ongoing dispute with GAVI, waning COVID-19 vaccine demand, and the bear market situation.

While the biotech company had a stellar flu vaccine candidate, NanoFlu, it remained to be seen when the product might be commercialized.

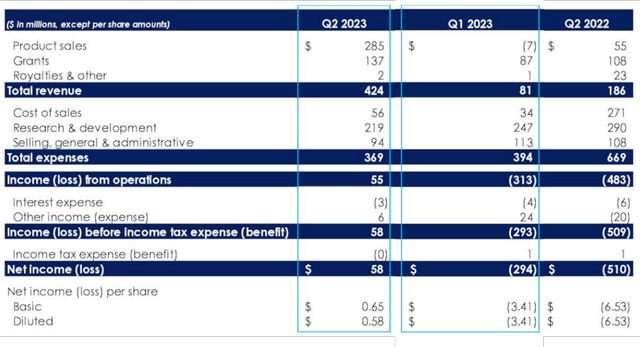

NVAX’s FQ2’23 Financial Results

Seeking Alpha

For now, NVAX’s FQ2’23 results remain spotty, with COVID-19 vaccine sales of $285M (+4,171.4% QoQ/ +418.1% YoY) and the rest attributed to grants/ royalties.

NVAX FY2023 Guidance

Seeking Alpha

While NVAX may have guided FY2023 revenues of $1.4B at the midpoint (-29.2% YoY), implying a heavier top-line weightage at approximately $895M in H2’23, we are not so certain if its COVID-19 vaccine may achieve a successful commercialization moving forward.

On the one hand, the management has projected a potential US market demand of up to 100M in COVID-19 vaccine doses for the 2023 fall season, potentially explaining its bullish H2’23 guidance.

On the other hand, these numbers appear to be overly optimistic, based on Pfizer’s (PFE) commentary in the recent JPMorgan US All Stars Conference. The PFE management has estimated that only 24% of the US population may choose to be vaccinated in 2023, or the equivalent of 82M doses.

Even then, we believe these numbers are still too lofty, since only 17% or the equivalent of 58M have opted for booster shots last year, with only 4M Americans receiving the updated shots in September 2023, triggering an estimated annualized sum of 48M.

As a result of the potentially reduced demand, we may see NVAX’s FY2023 revenue guidance further lowered in the upcoming FQ3’23 earnings call in November 2023, as it has in the previous FQ2’23 earnings call.

So, Is NVAX Stock A Buy, Sell, Or Hold?

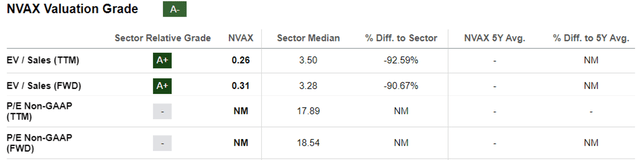

NVAX Valuations

Seeking Alpha

Since NVAX has yet to record a sustainable profitability over the past few quarters, the only metric that we may use to measure its performance is the FWD EV/ Sales of 0.31x, which is undervalued compared to the biotech sector median of 3.28x.

However, while the biotech company may record FQ2’23 GAAP EPS of $0.58, investors must also note that this event is extremely rare, with the only other GAAP profitability occurring in FQ1’22 at $2.56.

Therefore, while NVAX’s FQ2’23 annualized EPS of $2.32 and the sector median FWD P/E of 18.54x may suggest a fair NVAX stock value of $43, it seems that Mr. Market shares our pessimistic sentiments, based on the stock’s current retest at $7s.

It is also apparent that the biotech company will not record a profitable year in 2023, based on the management’s lowered revenue guidance of $1.4B and operating expenses at $1.35B at the midpoint, with COGS and interest expenses not even factored in yet.

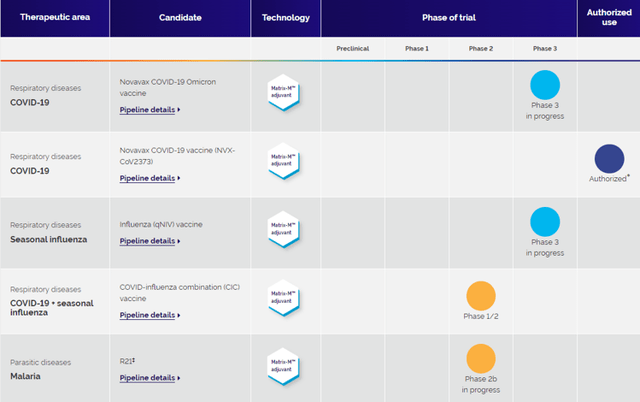

NVAX’s Pipeline Programs

NVAX

In addition, NanoFlu remains on a back burner, based on the NVAX management’s guidance of a “flu late-stage development in 2023 and 2024” in the recent FQ2’23 earnings call. This implies zero top-line contribution over the next few quarters indeed.

With only one other candidate in NVAX’s current pipeline, Malaria vaccine, it appears that the biotech company only has its COVID-19 vaccines to depend on in the intermediate term.

Even then we are not certain if the NVAX management may be able to bring both candidates to FDA authorization, which is an immense feat due to the numerous delays for NanoFlu since 2019 and the industry’s actual success rate from clinical trials to the eventual approval at only ~8%.

Even if FDA authorization is achieved, we do not expect an accretive impact similar to that of COVID-19 vaccines, since market analysts only project a global flu vaccine market growth from $7.28B in 2022 to $12.4B in 2030, expanding at a CAGR +6.83%.

The global market size for malaria vaccines is even smaller at $41.08M in 2022, with a projected growth at a CAGR of +29.6% to $328M by 2030.

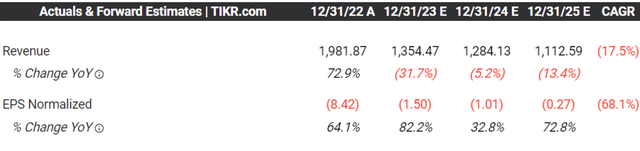

NVAX Consensus Forward Estimates

Tikr Terminal

These numbers coincides with the consensus pessimistic forward estimates for NVAX’s top and bottom lines through FY2025, with the stock’s investment thesis likely to underperform moving forward, barring any unforeseen developments.

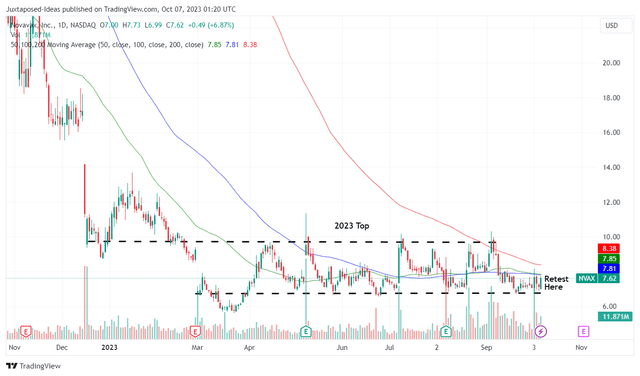

NVAX 1Y Stock Price

Trading View

On the one hand, the NVAX stock has displayed a consistent trading cadence over the past few quarters, with a robust support level at $6s and a resistance level at $9s, offering interested traders with a clear investment trend.

On the other hand, the stock’s eye watering short interest of 54.24% at the time of writing cannot be ignored, with any future rally potentially digested by volatile short trading.

Combined with the uncertain pipeline performance, NVAX is unlikely to outperform for the foreseeable future, resulting in our conclusion that the stock is not suitable for the impatient and risk averse investors.

As a result of the potential capital losses, we maintain our Hold (Neutral) rating for the NVAX stock.

Read the full article here