Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Nvidia investors are bracing for a roughly $300bn swing in market value following quarterly results on Wednesday, amid rising unease over Silicon Valley’s vast spending on artificial intelligence.

Options markets imply traders are expecting the AI chipmaker’s share price to move by an average of 6.4 per cent in either direction when markets open on Thursday, equivalent to a gain or loss of about $280bn in value.

Nvidia became the world’s first $5tn company at the end of October but since then has been caught up in a sharp stock market sell-off led by big AI players that has dragged the chipmaker’s shares down 11 per cent.

Julian Emanuel, Evercore ISI’s chief equities strategist, said: “The angst around ‘peak AI’ has been palpable.”

The California-based company’s critical role in the AI boom means its results have in recent years heavily influenced the direction and mood of the broader tech-dominated US stock market.

Wednesday’s results arrive as investors’ enthusiasm for the AI boom appears to be on the wane, with the tech-heavy Nasdaq Composite down more than 4 per cent over the past five sessions.

Silicon Valley’s biggest companies have been among those hardest hit by the recent bout of selling, with Meta down 19 per cent and Oracle down 20 per cent over the past month.

Mike Zigmont, co-head of trading at Visdom Investment Group, said: “In the run-up to Nvidia’s earnings announcement, we’re experiencing cold feet and worry that prices went too high to justify.”

“If Nvidia delivers disappointing guidance Wednesday, the [market] is going to sink significantly,” he added.

Wall Street is expecting Nvidia to report revenue of about $55.5bn on Wednesday, according to Visible Alpha data, above the company’s prior guidance in August of roughly $54bn.

The company is also expected to forecast its revenue for the current quarter, which analysts estimate will be about $62bn, up roughly 58 per cent year-on-year.

Nvidia has consistently beaten predictions over recent quarters, ratcheting up expectations that it will outperform again.

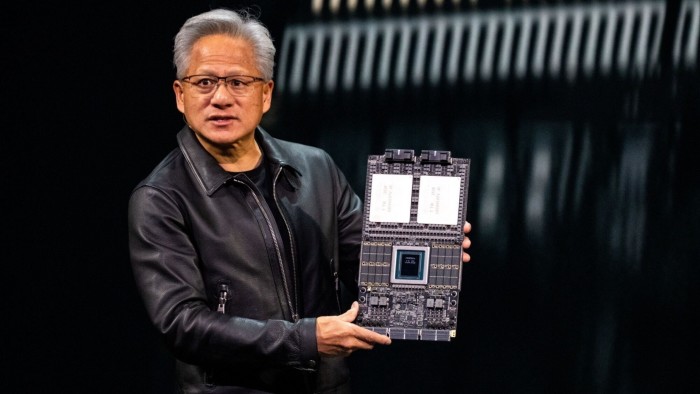

Chief executive Jensen Huang in October announced the company had secured $500bn in revenue for the next five quarters, at the high end of Wall Street estimates, helping the company temporarily surpass a record $5tn market valuation.

Nvidia has been buffeted by volatile trade relations between China and the US this year. A rally in its shares last month was boosted by hopes of a diplomatic breakthrough. But the future of its AI chip sales in China remains uncertain, caught between US export controls and a push from Beijing to build more chips at home.

Nvidia has in recent months signed multibillion-dollar deals with ChatGPT maker OpenAI, outside investors and rival tech groups to build data centres that use its chips to run AI models.

Analysts have drawn attention to the circularity of some of these agreements, which often involve suppliers, investors and customers of the same handful of companies. Big Tech groups have also recently made greater use of public and private debt markets to fund their spending on AI infrastructure, which they had previously largely paid for with cash.

Nvidia and Microsoft on Tuesday agreed to invest up to $15bn in Anthropic, whose chatbot Claude is a major competitor to OpenAI.

Read the full article here