With one astronomical forecast, Nvidia has gone from a company best known for gaming chips to one whose role in artificial intelligence could make it into the world’s first trillion-dollar semiconductor stock.

The reality of the US chip designer’s last quarter was unimpressive. What is powering the share price is the current quarter. Revenues are expected to double at a critical unit. This sells graphics processing units used to train large-language models needed for generative AI.

That could bring company-wide revenues to $11bn, up more than 60 per cent on last year. The jump in demand does not appear to be a one-off. In the earnings call, Nvidia mentioned that it had procured “substantial” supply for the second half of the year.

It was already clear that Nvidia was a smart way for investors to capture the mania for generative AI. Companies have not pinned down exactly how much money they can make by applying AI to services. But they need to buy products to train it if they are going to find out. Feedback from bosses combines bewilderment, fear and awe at the possibilities.

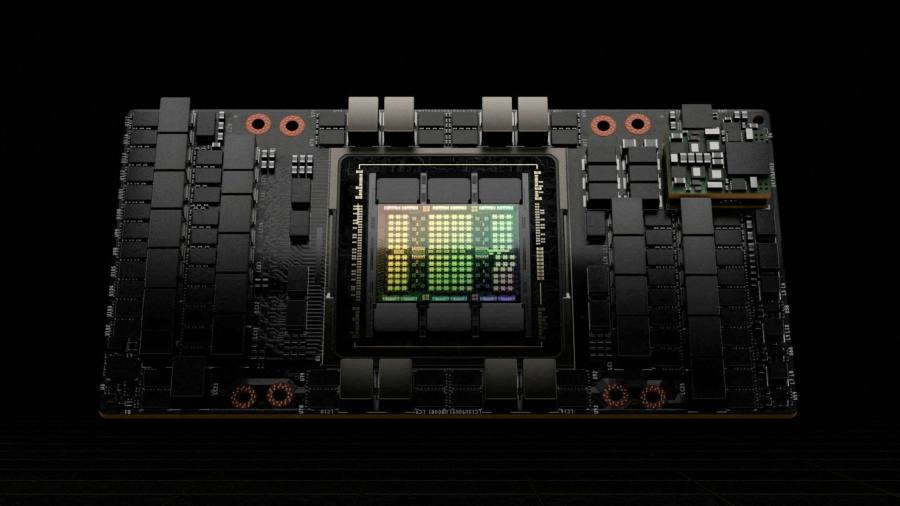

It must be bruising to the competition that Nvidia’s market cap rise on Thursday was so vast that it is being measured in Intels (a $193bn increase = roughly 1.7 Intels). Then again, Intel’s attempt to compete in AI chips has been hobbled by its failure to launch anything that can match Nvidia’s H100 chips.

The latest share price jump means that Nvidia now trades on 59 times forecast earnings, almost double that of rival Intel. Buying into this requires belief that experiments in AI will herald the start of what one analyst called the fourth Industrial Revolution.

Chief executive Jensen Huang has warned that US-China tensions could seriously damage the US tech sector. Nvidia cannot sell its highest- performing chips to China. But domestic demand makes up for this.

Keeping pace with that demand is one near-term challenge to watch. That includes ensuring smooth supply. The US may be trying to bring chip manufacturing home, but Nvidia relies on Asian manufacturers Samsung and TSMC.

Keep in mind that global competitors are racing to make their own chips fit for AI workloads. But for now, Nvidia is not just in the business of selling shovels to gold miners, it is the only shovel seller in town.

The Lex team is interested in hearing more from readers. Please tell us what you think of the outlook for AI chips in the comments section below.

Read the full article here