Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Any anxiety that Nvidia’s earnings would trigger a traumatic tech-sector correction was misplaced. True, shares of the world’s biggest listed company slid a little after US markets had closed on Wednesday. But if there is a correction to come — and there may be — it will take more to precipitate it.

The dominant maker of chips for artificial intelligence beat estimates for both revenue and profit in its most recent financial quarter. But as Nvidia gets bigger, overachievement gets harder. Revenue of $47bn grew smartly, but at the slowest sequential rate since late 2022, when the launch of ChatGPT sparked AI mania.

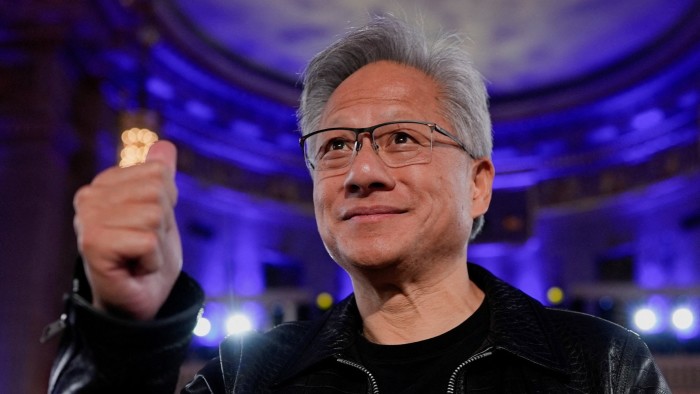

Fortunately, the company’s $4.4tn valuation has little to do with its recent past. Investors are instead mostly focused on three unresolved questions. One is whether an ongoing trade war will ruin Nvidia’s hopes of selling chips to China. That’s a market chief executive Jensen Huang sizes at $50bn, growing at 50 per cent a year, if politicians can keep their mitts off it.

The other unknowns, somewhat interrelated, are demand for Nvidia’s fanciest chips, and spending on data centres by big customers such as Meta Platforms and Alphabet in coming years. Huang is optimistic. He believes, for example, that companies could earmark $4tn for AI infrastructure by 2030, much of it to buy servers incorporating Nvidia’s Blackwell, Rubin and Vera chips.

Do investors share his faith? Viewed through the conventional price-to-forward-earnings lens, Nvidia stock isn’t expensive: it trades at a multiple of 33, a little more than tech giants Microsoft and Oracle, but with profit growing faster than theirs. Based on what’s known as the PEG ratio — price to earnings, adjusted for growth, Nvidia looks positively cheap.

The snag is that those crude measures don’t capture what happens in the more distant future, which matters greatly to Nvidia’s worth. Add up analysts’ estimates of the next five years’ worth of free cash flows, discount them back at a 10 per cent rate, and they total just $650bn. In other words, the remaining $3.8bn of enterprise value represents cash arriving from 2030 onwards.

That “terminal value”, in analyst-speak, would be justified if Nvidia’s free cash flow were to grow at a 6 per cent annual rate for the rest of time, Lex calculates. But that’s a punchy assumption. Some of Nvidia’s customers are already designing chips of their own. Its 72 per cent gross margin, far ahead of anything ever reported by Apple, is an open invitation to competitors.

Perhaps surprisingly, Nvidia bears are hard to find. Out of the analysts that cover the stock, almost 90 per cent rank it a “buy”, according to Bloomberg. About half think the company is worth $5tn or more. Meanwhile, the number of shares sold short by investors betting on a share-price drop is close to its lowest level in five years, LSEG data shows.

That alone might be a worrying sign that groupthink has set in. Huang tells a compelling story about the world AI will create, and his company’s central role in it. But for now it really is just a story. As Nvidia’s market capitalisation edges towards the next big round number, investors are leaving almost nothing to chance.

[email protected]

Read the full article here