Occidental Petroleum (NYSE:OXY) took full advantage of financial leverage through the acquisition of Anadarko. At first, this looked like an unmitigated disaster in fiscal year 2020 as oil prices went negative. Then it looked absolutely brilliant as oil prices careened past $100 a barrel. Now it is time to look at the long-term knowing that the industry is very volatile, and the visibility is poor. That long-term outlook is darn good as the industry continues to make amazing technology strides to drop costs and bring more acreage into Tier 1 territory. That makes the acquisition more valuable over time because more oil (and other products) will be extracted for each new well drilled than was anticipated at the time of the acquisition.

Admittedly there is a race of technology advances and operational improvements (as well as cost declines) against the time value of money. Large companies often face that issue because many larger acquisitions take time to show the benefits of the acquisition. But the last fiscal year aided the cause immensely when commodity prices soared so that the company made several years of progress all at one time.

Now, the company does not need quite as much in the future for that acquisition to come out ahead. Technology appears to be on track to provide a considerable profitability boost in the future. Management just announced the purchase of Carbon Engineering Ltd. Occidental already has one of the largest secondary recovering operations in the United States in the Permian Basin. As unconventional wells age, a lot of carbon dioxide is going to be needed to produce more oil through secondary recovery. Management is obviously already thinking about that (and that acquisition should increase the value of the Anadarko acquisition even more because more oil will be recovered).

Favorable commodity prices always help though. Right now, it would appear that prices, as usual, are not acting as predicted. Instead, they are acting better. The more this happens during the early deleveraging process, the more likely the company will be able to demonstrate to shareholders the advantages of the acquisition.

A large acquisition often needs five to seven years for the full benefits to become apparent. That can be disheartening to shareholders that want to see all the results yesterday. But it could also mean a very competitive company in the future with competitive benefits that were not available before the merger.

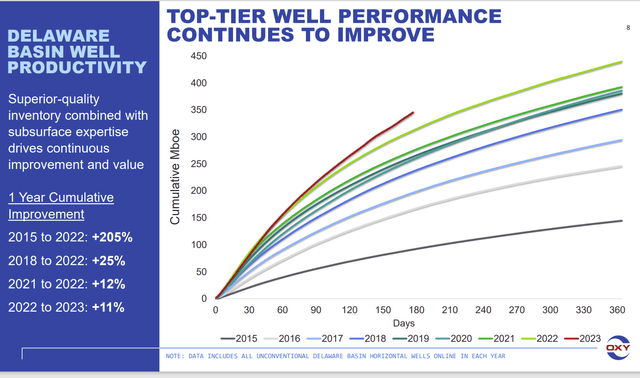

Wells Drilled

The most obvious place of improvement is the well results.

Occidental Petroleum Well Improvement Results (Occidental Petroleum Second Quarter 2023, Earnings Conference Call Slides)

The new well performance continues to at least (and probably exceed) escalating costs elsewhere in the upstream system. This is the kind of progress that brings more acreage into Tier 1 territory than was initially assumed at the time of the merger. It also makes the acquisition more valuable over time.

Investors often wonder why company results do not reflect this progress where they can see it. The reason is that the established production still has the costs at the time of the well drilling. Those costs do not disappear simply because the latest well is so much better.

That means that the reported results are a mixture of new and established production. It takes time for enough wells drilled the “new way” so that there are enough of them to report lower costs (and hence better profitability) corporate wide.

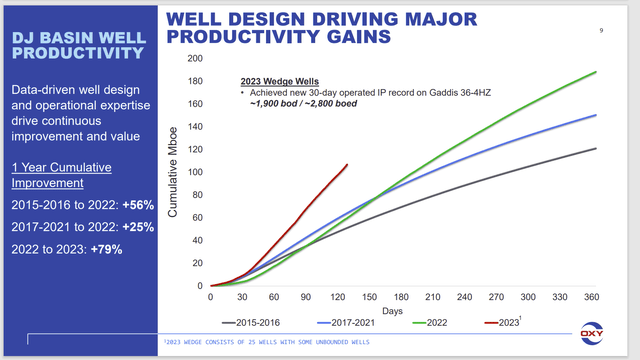

Occidental Petroleum DJ Basin Well Improvement Performance (Occidental Petroleum Second Quarter 2023, Earnings Conference Call Slides)

Here is yet another basin where well performance is improving. Elsewhere, management mentions (for example) that wells are getting longer (where that is needed or desirable). There are some things going on that improve profitability and raise costs.

As against that drilling is going faster than I ever thought possible and completion (both speed and design) advances also exceed my expectations.

The real unanswered question is if the company is gaining against the competition over time. Management clearly has some first-rate results. But then again, they had that before the acquisition. Now the question remains if management can translate these gains into superior profitability in the future (above what is currently being reported).

I personally think that they have a much better chance of demonstrating this in the D J Basin because Occidental is a far superior operator than Anadarko was. Therefore, the profitability improvement is likely to show itself in a place where Occidental really had no significant exposure before the merger.

Implied Progress Strategy

The whole second quarter message appears to be that the benefits of the merger and the leverage will be margin expansion at various commodity prices throughout the business cycle.

A side issue is the upside potential as North America increases the ability to export natural gas to the world. Management mentions in several places that oil is about 51% of total production. That would imply some upside potential as North American natural gas prices (and related liquids as well) join the considerably stronger world market prices.

Some other considerations would be that the Chemicals division supplies the raw materials for plastic that are extremely important to the green revolution. The future demand for raw materials like ethane and propane appears to be very good. That could mean better prices in the future than was the case in the past.

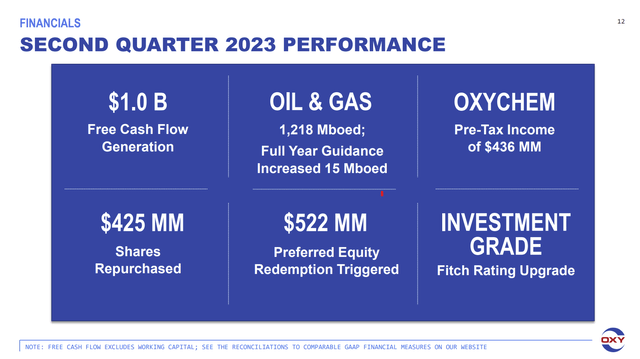

Occidental Summary Of Second Quarter Results (Occidental Petroleum Corporate Presentation Second Quarter 2023)

There will also be benefits from retiring debt and the preferred stock. Right now, the preferred stock retirement is the priority with debt being retired on an opportunistic basis.

Management appears to be on-track to retire about one-quarter of the preferred stock in the current fiscal year. That is nothing close to the pace of debt retirement in the previous fiscal year. But it is significant enough to reduce the costs of preferred stock in the next fiscal year.

Similarly, the ratings upgrade, if that continues (so that all the ratings are upgraded), has the potential to reduce future debt costs if refinancing is preferred to repaying debt.

Key Takeaways

Occidental still needs some decent pricing to make progress deleveraging. Right now, the current market appears to signal that commodity prices will aid in that deleveraging progress. Technology improvements will likewise take some pressure off the leverage ratio in the form of better company profitability.

There is always the danger of another cyclical downturn. But the longer it takes for that downturn to appear, the better financial shape this company will be in to make it through that downturn okay. Usually, the first few years are critical to the deleveraging process. That was why the pandemic challenges of fiscal year 2020 were a cause for concern.

Now, after the benefits of fiscal year 2022, things look a whole lot better. The company can still use some decent future commodity prices. But the issue is not as necessary as it once was (especially after 2020).

The proposed benefits of the merger with Anadarko appear to be on-track to be significant enough to become apparent to shareholders in the near future. But the overall question of the benefits of leverage compared to the risks (as to which dominated in this case) remains an open question.

Read the full article here