By Seema Shah, Chief Global Strategist

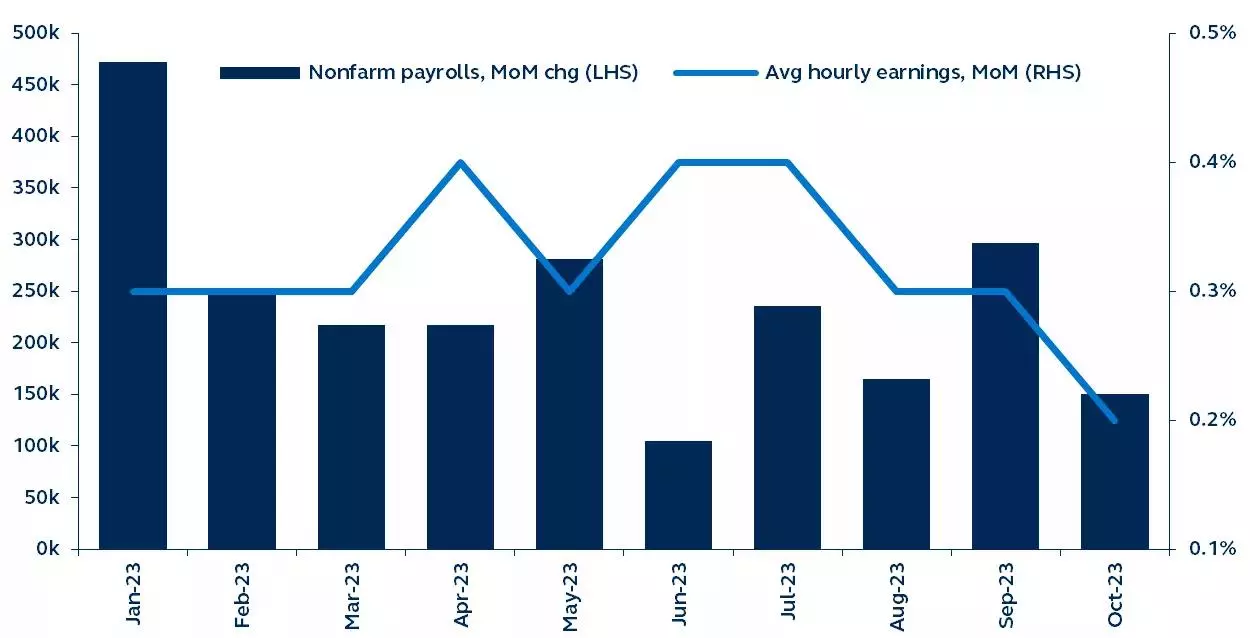

After a very strong September number, payroll gains almost halved in October, tentatively confirming a softening labor market.

The economy added 150,000 jobs last month, bringing payroll gains back in line with their previous downward trend.

The unemployment rate rose to 3.9%, slightly below the threshold that would trigger the Sahm Rule – a historically reliable predictor of past recessions.

After a somewhat dovish FOMC meeting earlier in the week, today’s jobs report further reduces the chances of a December hike.

Report details:

- Total non-farm payrolls rose 150,000, sharply down from the 297,000 gain in September. Downward revisions to August and September mean that total employment is 101,000 lower than previously reported. The three-month moving average has fallen back to around 200,000 (from nearly 250,000 in September), but it is worth noting that while the labor market is slowing, payroll gains are still at fairly healthy levels from a historical perspective.

- The unemployment rate rose from 3.8% to 3.9% in October, the highest since January 2022. It is now on the verge of triggering the Sahm Rule, which stipulates that recession occurs when the 3-month moving average unemployment rate rises by at least 0.5% in a 12-month period.

- The labor force participation rate ticked down from 62.8% to 62.7%, the first decline since October 2022. Prime age participation fell from 83.5% to 83.3% – a slight surprise after Fed Chair Powell’s remarks earlier this week, where he noted that labor supply was increasing and supporting a rebalancing of the labor market.

- Job gains were limited to very few sectors this month. Leisure and hospitality, government, education, and health care led the gains, while more categories saw declines than in prior months. Manufacturing payrolls dropped 35,000 in October, although the autoworkers strike accounted for around 33,000 of those losses. As the autoworker labor disputes are now broadly resolved, this downward impact on the total payroll number should be reversed in November.

- Wage growth continues to slow. Average hourly earnings rose by just 0.2% month-on-month and 4.1% year-on-year. While it is still above pre-pandemic levels, annual earnings growth is now at the lowest level since mid-2021.

Non-farm payrolls and average hourly earnings

January 2023–present

Source: Bureau of Labor Statistics, Bloomberg, Principal Asset Management. Data as of November 3, 2023.

Outlook

Today’s report suggests the jobs market is a little softer than the data had indicated in September. With wage growth continuing to cool and labor demand softening, the Fed will have been encouraged by today’s report.

However, it will likely require further evidence from the inflation reports to convince the Fed to fully abandon its tightening bias.

The jobs market is typically one of the last areas of the economy to weaken – and it is also the foundation that holds up the consumer and, as a result, the overall economy.

It is still early days, but if the recent softening in labor demand extends, consumers will likely come under pressure over the coming months, potentially inviting a meaningfully more dovish tone from the Fed in 2024.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here