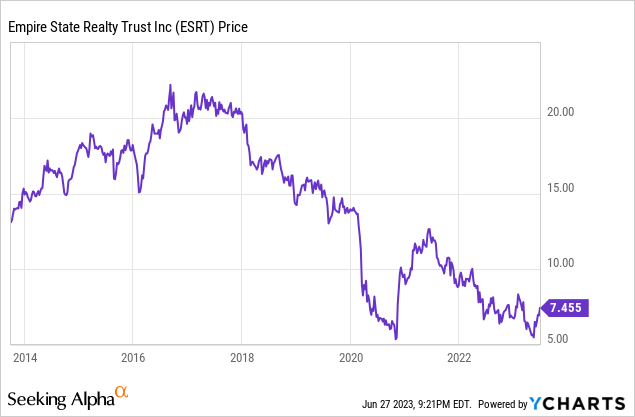

Manhattan office building REIT Empire State Realty Trust (NYSE:ESRT) stock price got a boost this week because of a transaction that valued 245 Park Avenue at $2.0 billion. The reality is that New York has not turned around and is actually continuing to decline. While ESRT is not facing an immediate financial crisis, they are not immune to the city imploding because of social-economic reasons and its lost star quality. I rate ESRT stock a sell.

245 Park Avenue Transaction

SL Green Realty (SLG) announced on June 26 that it sold 49.9% of 245 Park Avenue to Mori Trust Co., Ltd, a Japanese trust, that valued the building at $2.0 billion. This announcement lifted the stock prices of most office building REITs, including ESRT. It is between 46th and 47th Street and years ago this was Bear Stearns’ headquarters. I have been in this building many times over the years.

Many investors seem to think that this transaction represents a turnaround in the office building real estate market. I take a reverse point of view. I think this represents a “flight to safety” similar to those buying U.S. treasuries when some dramatic event happens. 245 Park Avenue is in a very special Manhattan location. Park Avenue between 46 Street to 56 Street is extremely clean. Most people walking in this area are up-scale office workers. There are almost no retail stores. It is very safe, by New York standards, 24/7, except on the east side of the corner of 51 Street. While almost all of the rest of the city is severely impacted by perceived higher crime, this small area of the city has not been impacted except perhaps the Lexington Avenue back entrance to 245 Park. Those who feel they “must’ be in New York most likely will be willing to pay a premium price to be in this very safe building, which is why it was valued at $2 billion. It was not, in my opinion, valued at $2 billion because New York has turned around – just the opposite.

The $2 billion valuation might seem positive given the current real estate market, relative to a prior sale it is actually a negative. In 2017 before S.L. Green was involved in 245 Park, the building was valued at $2.2 billion for a transaction. Adjusting for inflation using the CPI, that $2.2 billion is $2.74 billion. From that perspective, this is a very significant decline in value.

Properties in Their Portfolio

Empire State Realty Trust is a pure New York trade. This REIT owns 9 Manhattan office buildings totaling 7,572,475 SF. They also own some retail properties and 3 apartment buildings in Manhattan. Their crown jewel is the Empire State Building, including the usual cash cow observation deck.

A key problem for them is that they are not diversified. Most of their office buildings are located within the same area of the city just below Time Square in the traditional Garment Center. Not only are they not diversified geographically they are not diversified in their type of tenant. They don’t have top-tier trophy tenants who lease much of the building for their corporate headquarters. Many of their tenants are small to modest sized privately owned companies. In addition, there is no diversification in the age of the buildings. They are all old – very old. Their “newest” building was built in 1954. Most were built in the 1920’s and 1930’s.

The area where most of their office buildings are located enjoyed sort of a renaissance a few years ago under Mayor Bloomberg. Parts of Broadway were blocked from traffic and replaced with outdoor seating and large flowerpots. Private security was added to the area. It was actually fairly nice. Now, the area is disgusting. Absolutely terrible, in my opinion. Garbage all over. People sleeping on the seats. Open drug use. Constant crime. Homeless and new immigrants are being housed in formerly tourist hotels. There is a very legitimate safety concern for workers in their office buildings. This is NOT like 245 Park Avenue.

1333 Broadway

I want to focus on a few of their properties. First is 1333 Broadway which is right across 35th Street from Macy’s. For years there has been talk about constructing some super-high office building above Macy’s. Some have asserted that 1333 Broadway could make “millions” by selling needed air rights to build this office tower. (In New York there are zoning density caps based on the land size and these “air rights” can be transferred/sold to adjacent properties.) Since 1333 Broadway is “only 12 stories it must have massive air rights” it can sell to Macy’s for millions. Wrong. 1333 Broadway is zoned M1-6. Yes, it is zoned “manufacturing” – not commercial. This area was actually garment manufacturing decades ago. The “floor area ratio” – FAR for M1-6 is 10. Since 1333 Broadway lot area is 28,500 SF it has a density cap of 285,000 SF. The building, however, has 313,294 SF. (These zoning laws were passed after it was built.) 1333 Broadway, therefore, has no air rights that can be sold to Macy’s for “millions”. (Note: this is a very useful website that can be used to get data and zoning information on each building in Manhattan.)

Many old buildings in Manhattan have very valuable air rights that can be sold to nearby properties to allow new large developments “as of right” without major zoning changes needed. I researched all of Empire State Realty’s buildings and none have any available air rights. All their buildings exceed the density cap for their specific zoning regulation.

561 Tenth Avenue

The next property is an apartment building at 561 10th Avenue (Victory Apartments) which was purchased along with 345 E. 94th Street in December 2021. This apartment building is located near the entrance/exit to the Lincoln Tunnel between 41st and 42nd Street. The noise from the traffic is horrible from the early morning until late at night. Constant horns. When it was constructed in 2021 there was the expectation that the #7 subway train extension would have a stop nearby on 42nd Street adding value to the property. Plans were changed. The #7 extension only went to 34th Street and the 42nd Street stop was cancelled because of the cost. Based on reviews and local chatter, the construction quality is only so-so. The real problem is elevators. There are only four for 46 stories, including the rooftop deck, and 417 units. Since there is no service elevator, effectively there are just three elevators or about 140 apartment units per elevator. (The wait times must be unbearable.) This is a problem that can’t just be dealt with by some modest construction improvement.

Their regular rents are currently about standard for Manhattan. A one-bedroom is listed for $4,690/month and a studio for $3,790. This is a 421a tax abatement program building – often called 80/20. 80% are regular rents and 20% are way below market rents. This means one tenant could be paying about $4,500/month for an apartment and those tenants in this program only pay about $600/month. This often creates serious friction between tenants whose social-economic backgrounds are so completely different. (There currently are no new 80/20 apartment buildings being developed in the city.) Collectively these issues, in my opinion, means ESRT purchased a “lemon”.

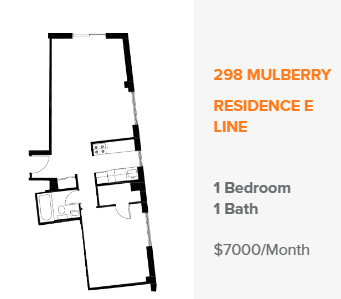

298 Mulberry

They purchased another apartment building for $115 million in December of 2022 with 96 units and a ground floor that is mostly leased to CVS. It is on very high traffic Houston St with the entrance on 298 Mulberry St. It is in NOHO, which was trendy a few years ago. It seems their target renters are mostly students at nearby NYU who have very wealthy parents to co-sign leases because the rent is jaw dropping even by Manhattan standards – $7,000/month for a very basic one-bedroom. A small studio is available for only $4,600/month.

www.fetner.com/properties/298-mulberry

Rents are high because there are very few nearby rentals in quality buildings. There are mostly very expensive lofts/condos/co-ops in the area or very old rental apartments of “questionable” livability. There are, however, many problems for this location. The noise level from the very busy Houston St is absolutely terrible. Right below this apartment building is the subway station that had the recent high-profile death of a person threatening passengers on the F subway train who died after passengers tried to subdue him waiting fifteen minutes for the police to arrive. Tenant safety has become a very serious concern as NOHO and SOHO have experienced soaring crime rates in the last few years. I am frequently in this area because I have friends who own lofts in SOHO, and I have seen this area go downhill over the last five years.

This is another apartment building that I have trouble understanding why management could consider it a rational purchase, especially since the purchase price was no bargain.

Empire State Building

Finally, their crown jewel – the Empire State Building. Besides revenue from office leases, they make a lot of money from the world-famous observation deck. It is a tourist magnet for those willing to pay the price of $79 per person. (There is a complex pricing structure.) This is just not some incidental side business for this REIT. About 25% of their annual NOI comes from the observation deck and exhibition area. There are two new competitors – the Edge located in the new Hudson Yards area and the Summit on top of One Vanderbilt, which is next to Grand Central. Both new competitors offer fantastic views of the city.

They have greatly improved the experience of this landmark deck and now also require reservations, which has greatly reduced the long lines around the building on the sidewalk. The building itself is disappointing inside the actual offices. Years ago, Donald Trump was involved in this building when it had a very complex ownership structure. Now it is 100% owned by ESRT, including the land.

Travel plans are often made well in advance, and I think it might be some time before the significant increase in negative press coverage of crime in the city impacts the number of tourists visiting the city. The terrible weather New York City has had lately will have a negative impact on revenue from the observation deck in 2Q because clouds block the view.

Recent New York City Developments

With the approval by the Federal Highway Administration earlier this week of congestion vehicle tolls to drive into Manhattan below 60th Street, there could be even less demand for their offices. These tolls could be up to $23 on weekdays. It might still be some time before this congestion fee becomes effective, but just the fact it seems more likely to eventually happen could have a negative impact on those considering leasing office space in Midtown Manhattan from ESRT.

Gov. Hochul announced on June 26 that the Penn megaproject with Vornado Realty Trust (VNO) is not going forward at this time. While this was expected it does confirm that the Manhattan office real estate market outlook is not bright.

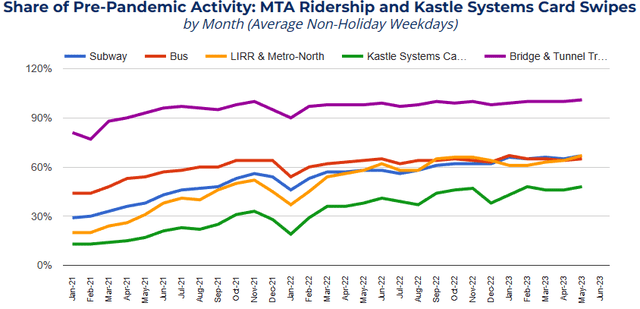

The New York City Comptroller on June 13 released a report that included a rather depressing outlook for the Manhattan office building market. He also released a report in June that shows that office entry swipes remain well below pre-Covid levels and seem to be leveling off as can be seen by the green line below. People continue to work from home which will have a long-tern negative impact on Manhattan office building owners.

comptroller.nyc.gov

Crime continues to soar or at least the perception that crime is increasing influences what people do. Why spend a small fortune to live in the city and also face the risk of getting stabbed on the subway? Now people don’t want to fight back because they are afraid of getting arrested. The streets in Midtown Manhattan are absolutely disgusting. All this has a very negative long-term impact of ESRT, in my opinion.

Financials and Valuation

Many investors buy REITs for dividend income and with the expectation of modest dividend increases over time. ESRT only pays $0.035 quarterly resulting in a current yield of only 1.9%. Instead of using cash to pay higher dividends or pay down debt, management used over $70 million cash up to April 25 of this year to repurchase 11.6 million shares at an average price of $6.11. I am strongly against repurchases of shares, especially given the very uncertain office outlook.

During their April conference call management lowered their FFO guidance by $0.02 because of the potential loss of the Signature Bank lease. With Firstar assuming the lease in May (at slightly lower lease terms), I am assuming their FFO guidance is back to about their original $0.82-$0.86 per share. Using the midpoint $0.84 and the latest ESRT price of $7.40, the price/FFO is 8.8x. That is not cheap, in my opinion, because I expect that operating cost will continue to increase and there will be difficulty rollover leases or getting new leases at favorable rates given that I expect a very weak office real estate market in Manhattan in the future, especially as people continue to work from home and crime gets worse in the city.

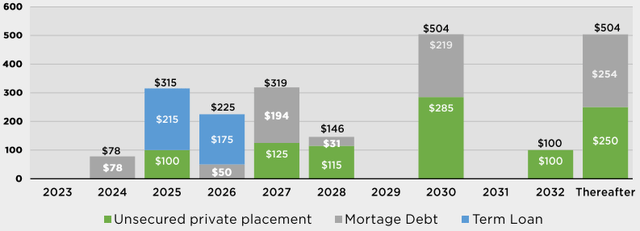

Unlike some other office REITs, such as Hudson Pacific Properties (HPP), Empire State Realty does not have maturing debt worries for a few more years.

Debt Maturities

investors.empirestaterealtytrust.com/presentations

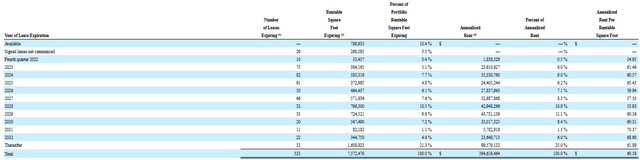

They also do not have a large number of leases expiring within the next two years. There is, however, always the risk that some of their tenants go into Ch.11 bankruptcy and reject the lease or at least try to get some type of abatement.

Manhattan Offices Leases Expirations

sec.gov

Conclusion

I started shorting ESRT and SLG as traders irrationally bid up the stock prices for these New York office REITs after the 245 Park Avenue news. New York is NOT back. Workers in New York have a very strong incentive not to return to their offices – crime. Some workers have been waiting for years to be able to work from home and avoid horrible commutes to their offices. The Manhattan Office building market is dead. There might be special exceptions, but the city and office buildings will never be back to “normal”. It is sad because I used to “love” New York.

Eventually the very negative press world-wide on the increased crime in New York will discourage tourists from coming. The observation deck will be hurt. I also think that many factors collectively will make it very difficult for Empire State Realty Trust to generate enough cash flow in the future to justify its current price. I rate ESRT a sell.

Read the full article here