Potential has a shelf life.”― Margaret Atwood.

Today, we take a look at a small developmental biotech concern that has had somewhat of a rough go of it in its time as a public company. However, its vast pipeline and potential seem to be “under the radar.” An analysis follows below.

Seeking Alpha

Company Overview

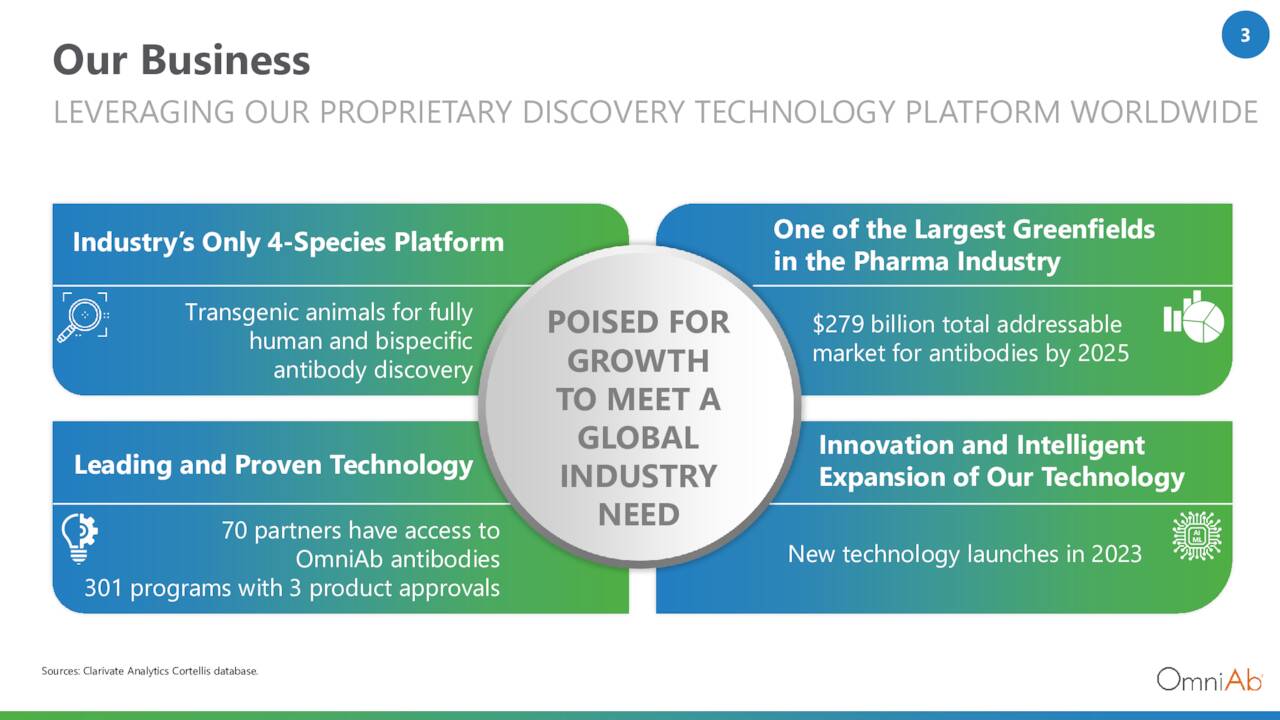

OmniAb (NASDAQ:OABI) is an Emeryville, California-based commercial stage biotechnology concern focused on the discovery of antibodies. As of March 31, 2023, the company had 70 active partners with 301 active programs employing its technologies, of which three are approved therapies with another 24 in clinical development. Two of its clinical assets are undergoing evaluation in Phase 3 trials and two in Phase 2 studies; the balance are in Phase 1.

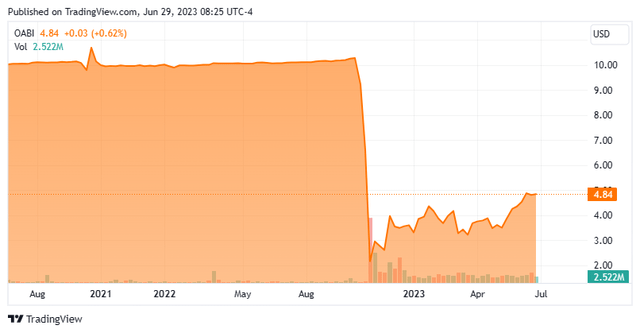

OmniAb was founded as OMT (Open Monoclonal Technology) in 2008, was acquired by Ligand Pharmaceuticals in 2016 for a total consideration of $178 million, spun out and concurrently merged into special purpose acquisition company (SPAC) Avista Public Acquisition Corp. in November 2022, with its first “when-issue” trade transacted at $9.24 a share (October 25, 2022). After plummeting to $2.41 a share to close their first day of “regular-way” trading (November 2, 2022), shares of OABI trade just above $4.75 a share, translating to an approximate market cap of $560 million.

May Company Presentation

Technology Platform

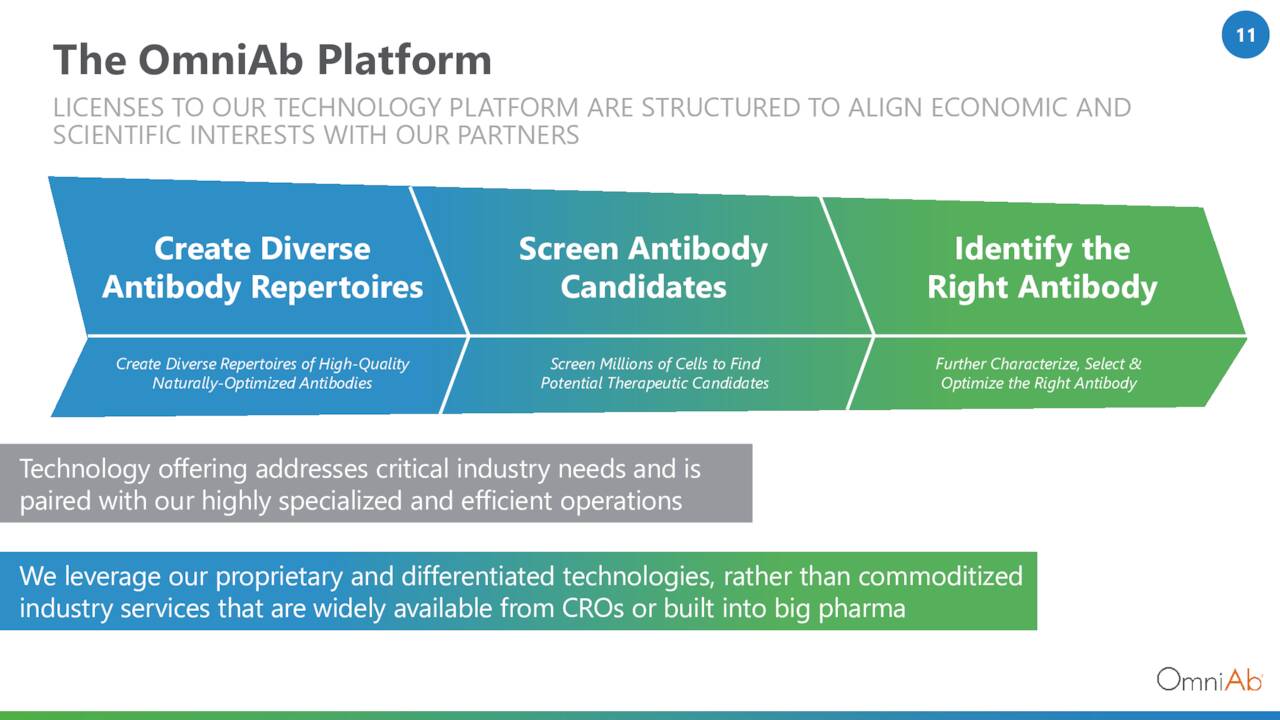

The company employs multiple transgenic animal platforms to “discover” monospecific, bispecific, and poly-specific human therapeutic antibodies, as well as antibody-drug conjugates and chimeric antigen receptor T cells. The term “transgenic” refers to organisms (in this instance rats, mice, chickens, and cows) that contain genetic material into which DNA from an unrelated organism (human) has been artificially introduced. In this instance, proprietary antigens are introduced into the host animal, which generate a human antibody idiotype (through natural selection pressures) in response. OmniAb believes this in vivo approach accelerates development timelines and generates an antigen with higher affinity, specificity, and expression levels.

This technology has been both developed in-house and acquired. OmniAb’s transgenic animal platforms include OmniRat, OmniMouse, and OmniChicken for monoclonal antibodies; OmniFlic (rats) and OmniClic (chickens) for bispecific antibodies; and OmniTaur [COWS] for unique structural characteristics and challenging targets.

Commercial Antibodies

To date, OmniAb’s discoveries have spawned three commercial products. Gloria Biosciences obtained approval in China for its PD-1 monoclonal antibody zimberelimab for the treatment of recurrent or refractory classical Hodgkin’s lymphoma in 2021. Also in China that same year, CStone Pharmaceuticals (OTCPK:CSPHF) received approval for its anti-PD-L1 monoclonal antibody therapy Cejemly (sugemalimab) for the first-line treatment of metastatic non-small cell lung cancer (NSCLC) in combination with chemotherapy, as well as stage III NSCLC in cases where the disease has not progressed subsequent to platinum-based chemoradiotherapy.

OmniAb’s first and only FDA green light came when Johnson & Johnson (JNJ) received accelerated approval for its bispecific B-cell maturation antigen-directed CD3 T-cell engager Tecvayli (teclistamab) in a fifth-line or later setting for patients with relapsed or refractory multiple myeloma in October 2022. Tecvayli has also obtained conditional marketing authorization in Europe.

Business Model

May Company Presentation

In exchange for inducing its animals into producing specific human antibodies, OmniAb primarily receives three forms of payment: upfront access fees; clinical and regulatory milestones; and royalties. Each agreement is structured differently, but typically generates $100,000 to $2 million upfront, with eligibility for $5 million to $20 million in milestones, and low-to-mid-single digit royalties. That said, the business model has evolved over time and many active programs with no royalties were onboarded via acquisition. For example, Tecvayli generated $35 million in milestones for OmniAb ($25 million in the U.S. and $10 million in the EU) but no royalties, whereas its two commercial assets in China are generating royalty revenue. Management does not provide a breakdown on a program-by-program basis.

May Company Presentation

Marketplace

Either way, antibodies are big business, generating 2022 global sales of ~$238 billion with 51 different antibodies achieving blockbuster status. In 2022, there were more than 140 approved antibody therapeutics, with over 220 in Phase 3 clinical trials worldwide. That said, OmniAb is not the only outfit discovering antibodies on behalf of biopharmaceutical partners. Its business model is nearly identical to AbCellera Biologics (ABCL), which discovers antibodies via microfluidics and transgenic rats. It is currently engaged with 41 partners, covering 177 programs, of which nine are in the clinic.

Balance Sheet & Analyst Commentary

With the $35 million received from J&J, OmniAb held cash and investments of $113.6 million as of March 31, 2023, which management believes, when paired with future anticipated milestones and access fees in the intermediate term, is enough to obviate any future financing needs.

With its novel business model in a massive market, it is not surprising to see the Street unanimously bullish on OmniAb, featuring five buy and four outperform ratings and a median price objective of $10. Despite the optimism, they aren’t anticipating much from the company’s discovery engine over the next two years. On average, they expect OmniAb to lose $0.43 a share (GAAP) on revenue of $57.7 million in FY23, followed by a loss of $0.42 a share (GAAP) on revenue of $59.5 million in FY24.

CEO Matthew Foehr is also ensconced in the bullish camp, purchasing 440,000 shares at an average price of $3.40 on May 12, 2023, increasing his stake to 2.44 million shares. He then added another 115,000 shares to his holdings on June 9th.

Verdict

The cadence of access fees and milestones should provide OmniAb with enough funding to get it to the point where royalties are its chief revenue source. Net of cash, the market is currently assigning an average value of ~$1.5 million to each of its 301 programs – or looked at another way, all of its programs will generate lifetime total sales of ~$7.8 billion, assuming no access fees, no milestones, and 5% royalties. It would seem that by accident, one of the company’s discoveries will become a multi-block buster antibody, meaning one therapy could generate $7.8 billion in two or three years.

That said, the deal structures of its current clinical programs are unknown and if Tecvayli becomes a blockbuster, OmniAb will not reap any benefit. As such, it would behoove the company to be slightly more transparent regarding its deal structures (e.g., providing the number of deals in its clinical pipeline with potential royalty payments). That criticism notwithstanding, the investment thesis – at least for now – is not about the prospects for any particular program, but rather the math concerning all its programs. And with three receiving approval, OmniAb’s approach has been validated.

The absolute trainwreck of a public debut – with OmniAb, Inc. stock down 61% on its first day of regular-way trading – and aftermath have provided an opportunity for the patient investor. Look for shares of OABI to grind higher over the next 12 to 18 months as more programs enter and advance through the clinic, triggering milestones and additional positive attention on its platform and royalty model. A small “watch item” position within well diversified biotech portfolio seems warranted.

Every year, you lose a bit of potential.”― Moby.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here