Investment thesis

Our current investment thesis is:

- OMC is a well-regarded advertising business, with a range of highly regarded global agencies and a roster of multinational clients. The company has a strong track record for quality output and a diversified revenue profile.

- The industry has faced significant competition in the last decade due to the rise of social media and digital marketing, with OMC unable to respond well, contributing to growth stagnation.

- The business has good margins and a lucrative capital allocation strategy, but we are concerned that sufficient improvement will not be made in the coming years.

Company description

Omnicom Group Inc. (NYSE:OMC) is a global marketing and corporate communications company that provides a wide range of advertising, marketing, and communication services to clients worldwide. The company operates through various agencies specializing in advertising, media planning, public relations, branding, and digital marketing.

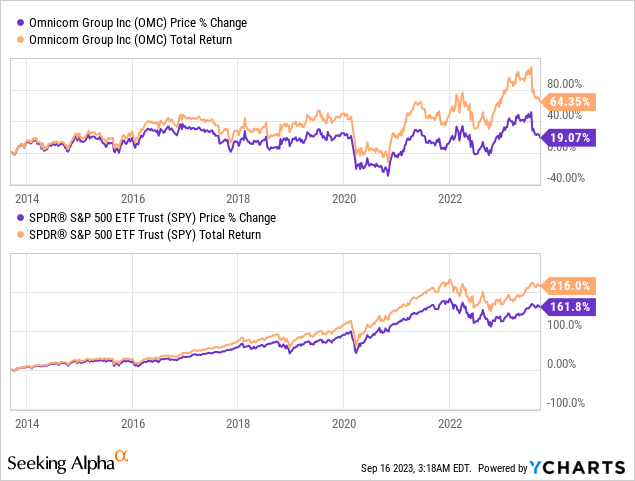

Share price

OMC’s share price has underperformed in the last decade, with returns enhanced by consistent dividends, but still lagging behind the wider market. This is due to a lack of multiple expansions, owing to poor financial results and development.

Financial analysis

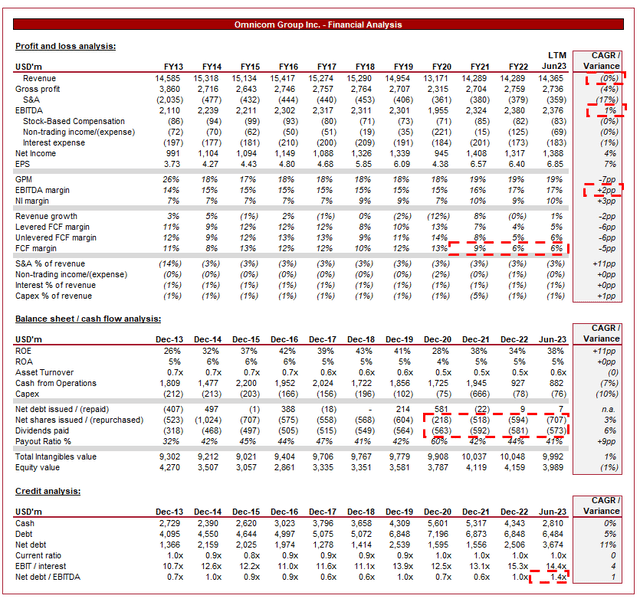

Omnicom financial analysis (Capital IQ)

Presented above is OMC’s financial performance in the last decade.

Revenue & Commercial Factors

OMC’s revenue has remained flat in the last 10 years, with various periods of low and negative growth offsetting each other. Further, the business remains below its pre-pandemic level. This is a concerning outcome considering many advertising businesses supplement organic growth with acquisitions, with OMC spending over $1bn of cash during this period.

Business Model

OMC operates through a network of agencies that specialize in various aspects of advertising and marketing, including advertising, public relations, digital marketing, branding, media planning, and more. Within this industry, a proven track record (past projects delivered) and expertise are fundamental for winning new projects, and so the development of successful agencies in various segments is key. Further, this diverse service offering is critical to achieving scale, as it allows the company to cater to a wide range of client needs.

Omnicom operates over 1500 agencies, sitting below its 6 “major networks”. Each of these is highly regarded within the industry, receiving numerous awards (3 within the Cannes Lions top 10) and boasting multinationals as clients. Many of its agencies have a strong global presence. This enables the company to serve clients with diverse cultural and market-specific requirements while maintaining an integrated solution for its global clients.

Networks (Omnicom)

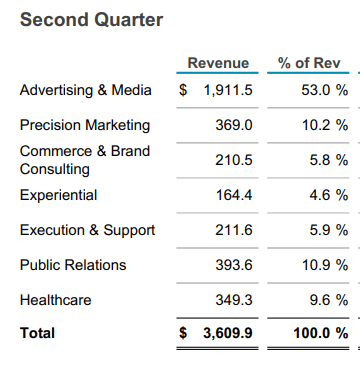

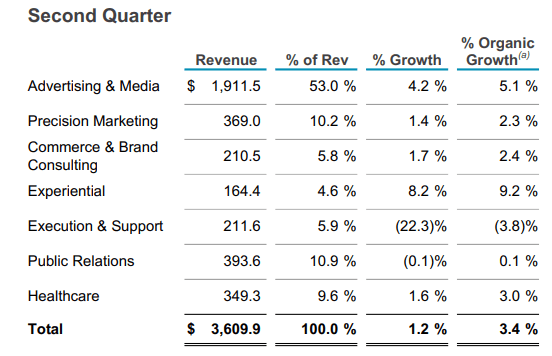

As the following illustrates, the vast majority of OMC’s revenue is from Advertising and Media (53% in Q2), with the remaining between other communications-related services. This does provide the business with the benefits of diversification but leaves a heavy reliance on advertising.

Q2 revenue split (Omnicom)

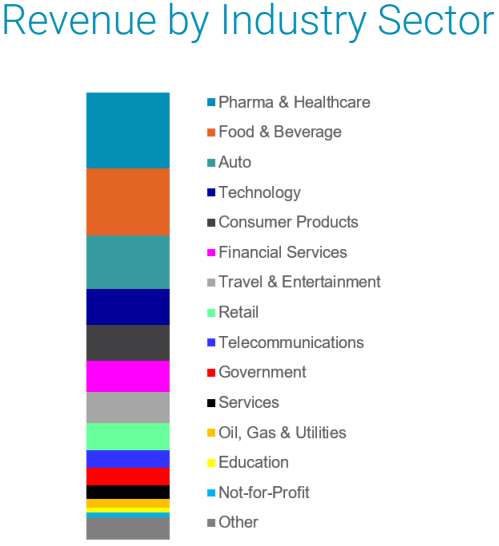

Omnicom serves a global client base across industries, working closely with clients to achieve specific business objectives. As the following illustrates, the business is highly diversified among industries, with Healthcare (17%) and Food and Beverages (15%) the largest. This is incredibly important diversification as some industries (such as Auto or Retail) can be highly cyclical based on economic conditions and so spending can decline heavily during downturns. Healthcare and Financial services by contrast are far more robust.

Revenue by industry (Omnicom)

Competitive Positioning

The advertising and marketing industry has undergone significant changes in the past decade due to the rise of digital media, social media, and changing consumer behavior. No longer are advertising businesses the gatekeepers to consumers, with the likes of Google (GOOG), Meta (META), and others now providing businesses with a cost-effective way to advertise to the masses.

Digital advertising often requires different skills and approaches, with agencies struggling to attract clients and achieve growth due to their declining value proposition. Why would a mid-sized business spend a large amount with an advertising agency when it can get an affordable cost-per-click ratio with Google, alongside operating a small in-house/outsourced marketing team that runs its social media and wider marketing approach?

The primary reason for this is a change in Consumers’ behaviors and preferences. Examples include ad-blocking, shorter attention spans, increased streaming (less TV), more social media usage, the rise of shock/hype marketing, and a preference for personalized content.

Clients are increasingly demanding measurable results and a clear return on investment (ROI) for their marketing spend, particularly compared to digital spending. Agencies are struggling to demonstrate their impact on clients’ bottom lines, particularly through traditional outlets that are seeing reduced traffic.

Those who are performing well have developed an agile and creative approach, with a strong digital presence, collaborations with influencers, and seeking unique approaches. We believe this is a primary reason for OMC’s weakness, as it has been unable to improve its value proposition.

OMC competes with various marketing and communication companies, including WPP (WPP), Publicis Groupe (OTCQX:PUBGY), and Interpublic Group (IPG). OMC has faced similar issues to WPP with a lack of “modernization” (although WPP’s growth has been better) but to its credit is attempting to catch up. Publicis has progressed far better, investing in its technological capabilities and expanding its tech consulting services. We believe OMC has fallen behind the pack during this period.

Economic & External Consideration

Current economic conditions represent near-term risks to the business. With high inflation and elevated rates, discretionary consumer spending is softening, negatively impacting consumer-facing businesses (such as retail). Compounding this are struggles faced by businesses, with reduced demand (due to the above), as well as margin pressures due to inflation.

These factors will encourage reduced marketing spending, as businesses attempt to protect margins and also adapt to the potential for reduced spending yield if demand is lower.

In the most recent quarter, revenue growth has been mild, with an organic rate of 3.4% across the whole business, lifted healthily by Advertising and Experiential. This is likely a reflection of resilience in the market (which is why the West remains marginally above recessionary levels).

Q2 (Omnicom)

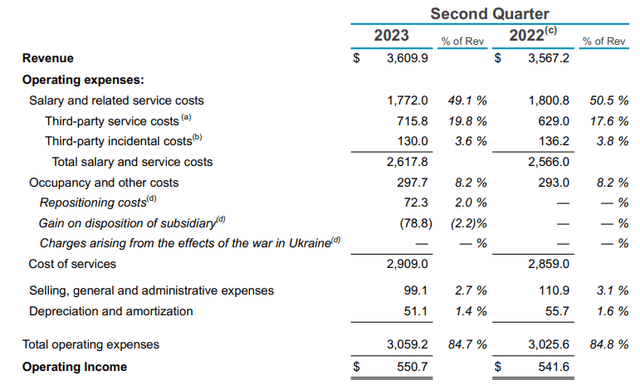

Margins have also improved relative to Q1, although are slightly below the Q2-22 levels. This suggests continued struggles with the achievability of margin improvement and continued cost pressures.

Q2 Detailed (Omnicom)

Margins

OMC’s margins have improved well over the last decade, with EBITDA-M increasing to 17% and NIM rising to 10%. This is a very strong performance, as both Publicis and WPP have experienced a decline during this period.

With numerous agencies competing for clients’ budgets. Competition is leading to pricing pressure and difficulty in differentiating services. We are concerned the business could experience erosion in the coming years.

BS/CF

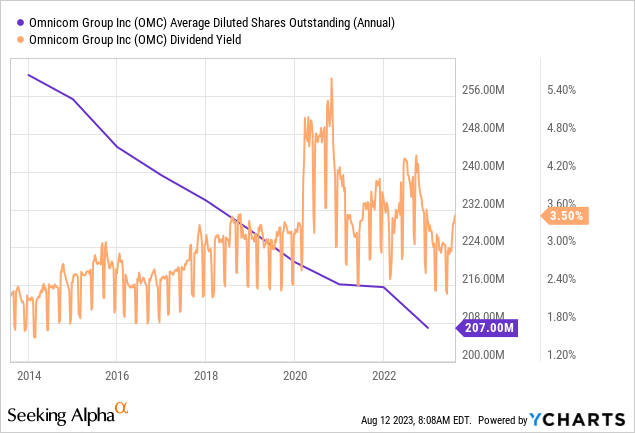

With a conservative financing approach, Management has been aggressive with distributions to shareholders, with both dividends and buybacks growing well.

OMC’s dividend yield is currently 3.5% and its share count has declined by just under 20%, an impressive achievement and the reason for the share price movement despite the lack of material multiple expansion.

Industry analysis

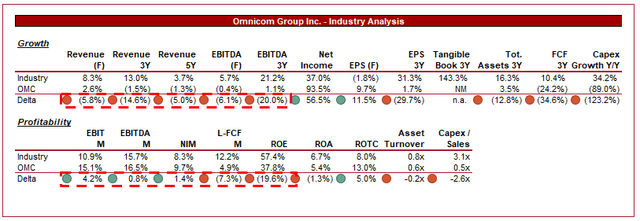

Advertising (Seeking Alpha)

Presented above is a comparison of OMC’s growth and profitability to the average of its industry, as defined by Seeking Alpha (16 companies).

As we have previously discussed, OMC’s main weakness is its lack of growth. The key message from this is that the industry as a whole is still able to generate healthy growth, implying an underperformance by OMC. A degree of this will be size, as OMC has less absolute growth potential than a smaller business (especially if tech-driven). When compared to WPP and Publicis, OMC is lagging.

Margins are the key area of strength of OMC, with a small outperformance relative to the peer group. Its cash flows are lagging, but we believe improvement should be made in the coming year. OMC is comparable to Publicis and outperforms WPP.

Valuation

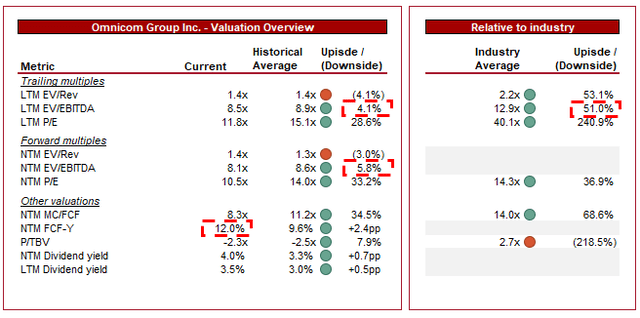

Valuation (Capital IQ)

OMC is currently trading at 8.5x LTM EBITDA and 8x NTM EBITDA. This is a discount to its historical average.

Our view is that a small discount to its historical average is reasonable, as this reflects the continued lack of growth, increased competition, and risk of margin deterioration.

Further, a discount to its peer group is also reasonable, as it reflects its lack of growth and similar margins, as well as peers within the cohort that is better positioned to grow long-term.

Given the size of the discount to its peer group, we believe the historical average is a better indicator of valuation. This said, it is worth highlighting that WPP is trading at 11x LTM EBITDA (13% NTM FCF yield) and Publicis is trading at 9x LTM EBITDA (10% NTM FCF yield).

Based on the historical average, there is no evidence of sufficient upside to offset the various risks the business is facing.

Final thoughts

OMC’s returns have been respectable, owing to its strong cash flow and capital allocation strategy. This said, the interest from investors beyond this has been low. The primary reason is the increased competition the industry has faced and the lack of sufficient response thus far, as evidenced by its lack of growth.

Although OMC could find itself as an attractive investment opportunity, if growth returns, we believe it is currently fairly valued with no clear upside.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here