Oracle (NYSE:ORCL) reports their fiscal Q4 ’23 after the closing bell on Monday, June 12th, 2023.

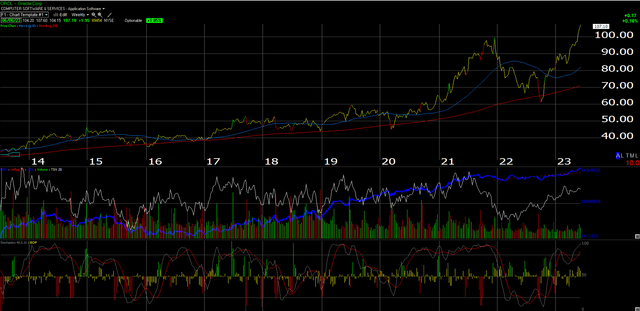

Analyst consensus is expecting $1.58 in earnings per share on $13.7 billion in revenue for y.y expected growth of 3% and 16% respectively.

The Cerner acquisition closed in November ’22, so all results are being influenced or distorted as the bowling ball passes through the proverbial snake and Oracle attempts to integrate Cerner into operations.

Last quarter, the Feb ’23 quarter, Oracle reported 7% y.y organic revenue growth but 20% (cc, thanks to Cerner and the dollar), as license revenue was just 4% y.y.

Cloud appeared to be the bright spot last quarter and is expected to continue into Q4 ’23 and into ’24.

The May quarter every year is typically Oracle’s strongest.

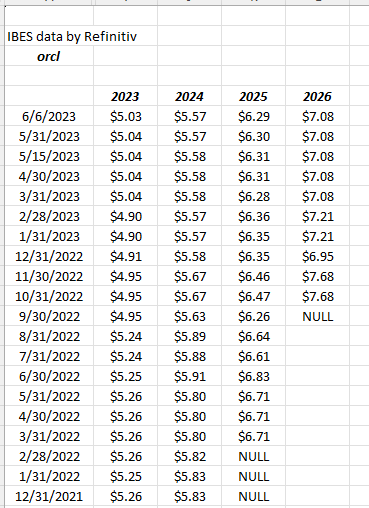

History of EPS and revenue revisions

Oracle EPS revision history (IBES data by Refinitiv ) Oracle revenue revision history (IBES data by Refinitiv )

These tables show the chronological progression of EPS and revenue estimates for Oracle over the last 18 months.

While the Cerner acquisition has boosted revenue estimates there is a lagging effect on EPS, as Oracle’s operating margin was cut to 39% following the closure of the deal – Oracle’s operating margin normally averages between 44% – 47% – and is now slowly making its way back to those levels.

One small problem

Here’s why Oracle was never a bigger position in client accounts:

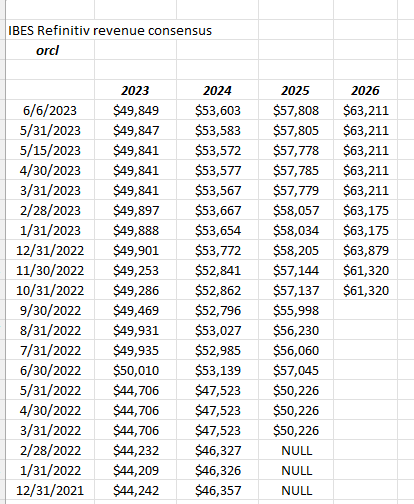

Oracle Cash-Flow vs Net income (internal valuation s/sheet)

Readers will find this the height of geekdom, but for every company that is owned (in size) and modeled, where EPS and revenue estimates are tracked and financials are examined every quarter, Oracle’s “quality of earnings” seemed to never stack up as an enterprise software giant.

The first two quarters on the above spreadsheet, are influenced by Cerner’s incorporation into Oracle’s “capex” but look at the cash-flow and free-cash-flow coverage of net income for Oracle over the last 3 – 4 years.

If Microsoft’s coverage were to be shown, it would be 4x – 5x that of Oracle’s.

It doesn’t sound like much but again – for a major software giant, and worldwide technology brand – the quality of Oracle’s cash-flow coverage is not nearly as healthy as you would think would be normally found in an enterprise software company.

Part of this – I think – is Oracle’s penchant for very large acquisitions, which are heavily dilutive to shareholders and result in big distortions for the financial statements.

Technical analysis

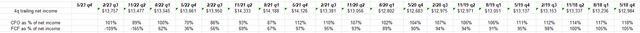

Oracle’s weekly chart (Worden )

The technicals on Oracle actually look pretty good, as Oracle has participated in this large-cap growth rally and has even traded above and closed above its late December ’21 all-time around $104, closing at $107.10 on Tuesday night, June 6th.

Not even Microsoft has traded above its late 2021 all-time-high of $349 and change yet.

Valuation

Oracle is expected to average 12% EPS growth from fiscal ’24 – ’26 thus with the stock trading at an average PE of 13x for the projected 3-year growth, Oracle does look cheaper on a PE-to-growth basis.

At 5x expected sales, Oracle is trading less rich than a lot of AI names too.

Summary/conclusion

In 2000, when the “dot-bomb” and the large-cap growth segment of the SP 500 imploded, Larry Ellison made what I thought was a genius move: he hired Chuck Phillips (hope I got the name right) the enterprise software analyst at Morgan Stanley, made him President and let Chuck make strategic acquisitions and pick through the bone-yard of what was left of the software and hardware businesses after 2001 and 2002.

Although Larry Ellison has appeared to move on from the day-to-day at Oracle and Safra Catz is now sole CEO (with the death of Mark Hurd), since they were co-CEO’s, Oracle is still in good hands, but the business model is the same.

Oracle, with NetSuite in ’17 and now Cerner closing in ’22, makes these gigantic acquisitions, which are heavily dilutive and takes a few years to integrate, and shareholders are left with watching a lot of cash get sopped up from having to repurchase (ISO’s) incentive stock options to offset even more dilution.

Oracle sets their dividend for 8 quarters at a time (not 4) which I guess is OK, but another thing that caught my eye was that when TCJA (Tax Cuts & Jobs Act) was passed by President Trump and the Republican Congress in December ’17, Oracle had nearly 36% or $71 billion of its market cap just in cash sitting in the US and overseas, and now as of last quarter, that cash is down to $8.7 billion or just 4% of its market cap.

Morningstar maintains a narrow moat on Oracle and has a fair value on the stock of $67 per share, making it overvalued by about 30% at its current price.

Morningstar is worried about Oracle for different reasons than I am; I just want the software giant to generate better cash-flow and free-cash-flow versus net income and start retaining some of it.

Another plus not mentioned is Oracle really gets hurt by a stronger dollar: with the dollar weakening since last October ’22, that’s a plus for the software giant, but the dollar can’t strengthen again or it isn’t good for Oracle.

Bottom-line: Oracle is preferred at a lower price – at least 20% lower – with the Cerner acquisition getting the bulk of the attention for fiscal 2024. It takes a while to integrate a company that size, and Oracle has a history of doing so, but I’d rather not chase the stock here.

Will Oracle talk about AI on the Monday night, call. Probably in some regard or context. If Larry Ellison is on the call, it would be interesting to hear his take.

Read the full article here