OOIL logo (OOIL )

Investment Thesis

In our last article on Orient Overseas (International) Limited (OTCPK:OROVY) (OTCPK:OROVF) from the 1st of May this year, we concluded that our view of the container freight market was that it still had much more downside potential, which ultimately would depress earnings to companies such as OROVY.

The share price is down 24% since our previous article, which had a Hold stance. However, due to the monstrous dividend payment, the return for investors has been a positive 4%.

OROVY recent share price development (SA)

OROVY published its FH 2023 financial results at the end of August, so we want to revisit the thesis again.

FH 2023 Financial Results

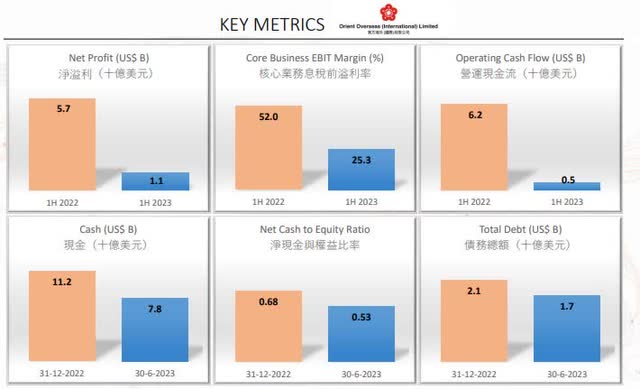

They say that a picture can tell a thousand words.

This graph from OROVY’s FH 2023 presentation shows how big a drop they had in profit on a Y-o-Y basis, and what it has done to their large pile of cash which they had in 2022.

OOIL – Key metrics from FH 2023 versus 2022 (Orient Overseas FH 2023 Financial Presentation)

It was not so much the volume that dropped, it was the freight.

The total number of containers shipped in FH of 2023 was only reduced by 1%, but the revenue from the operation dropped by 59% Y-o-Y. The operating costs only dropped by 26%.

The main reason for this large difference between the drop in revenue and cost lies in the fact that OROVY needs to pay charter hire on vessels chartered in, regardless of whether they sail or not.

Their lease commitments on vessels chartered in, as of 30th June 2023, stood at $382 million spread evenly over the next five years. OROVY should be able to trim their fleet even in the SH of 2023 as more than 30 vessels, totaling over 200,000 TEU capacity are coming off charter in SH of 2023.

That is good news.

Their Capex requirements as of 30th June 2023 were $3.75 billion, which is mostly payments to be made on their new-builds. Most of this will be financed, so it is not a total drain of cash.

On the topic of cash, it is quite large at $7.8 billion, but it is important to note that they did “burn” $3.4 billion over the last twelve months. Since it would be too optimistic to expect a quick recovery in the market, it will only take a couple of years, and that cash pile will have disappeared.

To get a better understanding of this cash drain, you may want to read SA’s excellent contributor Henrik Alex’s last article on Zim Integrated (ZIM) which is in the same predicament as they too will burn cash. We agree with his thoughts that the negative cash effect of having expensive vessels under charter and a falling freight rate environment will cause cash to be drained.

OROVY will be able to release a portion of these vessels throughout 2023 and early 2024. This will help their situation. On the other hand, they have new building payment installments to be made, which is also a negative impact on their cash flow.

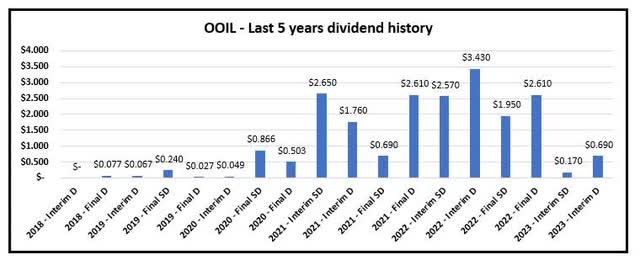

This leaves us with the topic of dividends. It surprised us that the company decided to pay a large dividend and even a special dividend for the interim period of FH 2023.

After all, the operating cash flow in FH was $548 million, a far cry from the $6.24 billion it was a year earlier. From this cash flow, they will pay out to shareholders a regular interim dividend amounting to $455.6 million plus a special dividend of $112.3 million.

Here is their dividend history over the last five years.

OOIL – Dividend history (Data from OOIL. Graph by author)

It is in our opinion not prudent to distribute more in dividends than what the free cash flow is. Especially, in view of the challenging market condition.

OROVY did not do any share buyback over the last six months.

Market Update

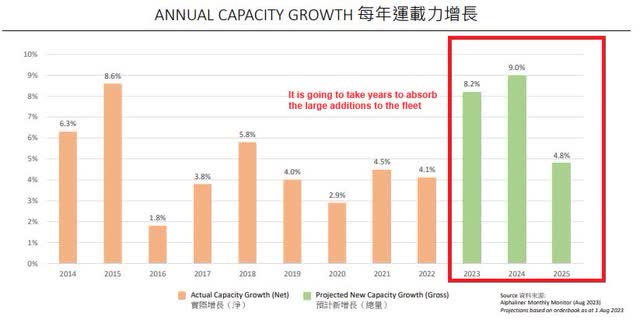

It is, as we just mentioned, a challenging market. One could say it is the perfect storm, with a reduction in demand and an increase in supply.

It is particularly the supply that is the most worrisome, and this author has pointed this out in several articles covering companies such as SFL Corporation (SFL) and Maersk (OTCPK:AMKBY).

Newbuilding of container vessels (Orient Oversea 2023 FH Financial Presentation)

A vast majority of the new ships coming out are large vessels plying the main routes.

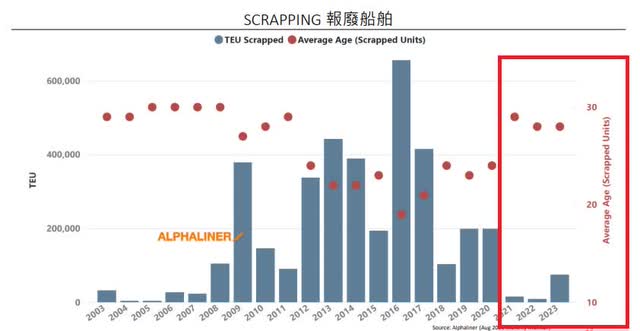

To make things worse, there is not enough scrapping of tonnage.

Not enough scrapping of vessels (Orient Oversea 2023 FH Financial Presentation)

Even the management of OROVY pointed out in their FH 2023 financial report, that demand is not coming back any time soon:

“The overall economic environment in the USA is still highly uncertain, in particular, dropping cargo demand and freight rates became more evident from the fourth quarter of 2022. It is expected that high inflation and interest rate environment would further slow down the USA economy growth and would adversely affect the demand/import of the USA for some time, it is expected the economy in the USA would take years to recover.”

These comments came in relation to a liability they have toward Long Beach Container Terminal, which is lasting for 20 years from October 2019. OROVY has guaranteed a certain minimum volume for each contract year. Failing to meet this, they will have to pay the terminal owners a compensation. It has been estimated they need to make a provision of $894 million to cover this.

Risks to Thesis and Conclusion

It is difficult to predict. Especially about the future, as the Danish physicist Niels Bohr is said to have proclaimed.

How will the economy look like a year from now?

We can only rely on past data of supply and demand and try to inject a “reasonable” estimate of what it is going to be in the relatively near future of say “one year”.

Even the respectable economist John Galbraith once said that;

“the only function of economic forecasting is to make astrology look respectable”.

Our prediction is that the giant liner companies will have no choice but to fight for the business of filling up the growing fleet of vessels by offering lower prices.

At least for the next two years. What happens thereafter, is anybody’s guess.

The risk to the thesis is that we misjudge the supply/demand equation. A sharp improvement in demand could help OROVY to deal with the over-supply of new vessels.

However, we believe the chance of this is small.

We believe lower freight and volume will continue to drain liner companies, such as OROVY of much-needed cash and dividends will be a thing of the past.

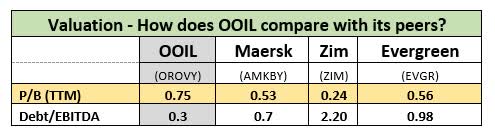

In terms of putting a valuation on OROVY, many fellow authors here on SA like to use the traditional method of Price/Book value. From that perspective, OROVY and most of its peers look very attractive, although OROVY is not as attractive as its peers.

OOIL – valuation against peers (Data from SA, Yahoo Finance & companies IR. Graph by author)

In a falling market, which all of them are experiencing, how much you theoretically could get for the assets is not that important.

Surviving – that is what matters now.

Fortunately, for most of them, they do have manageable debt loads. Now they need to batten down the hatches and sail through this storm, as they have done in the past.

We cannot put an exact price where we would judge OROVY to be a “fair price”. Lower, or no earnings, will resent any kind of valuation we may put on it.

We believe the share prices will come down, and that is the main reason why we are inclined to downgrade OROVY from a Hold to a Sell.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here