Thesis

On 06/27/2023, Origin Materials, Inc. (NASDAQ:ORGN) announced the production startup of the Origin 1 plant, as expected, making a promising step towards the execution of its initial project. On 08/09/2023, the Q2 2023 earnings report was released. The press release also included information about an impactful change in Origin’s business strategy. The initial schedule falls at least 18 months behind while financing and operating uncertainties arise. The stock plunged ~72% in two days, and Origin Materials must now prove that this time will mean business while repelling criticism. Considering the above, a Hold rating is now fairer for Origin Materials; despite the attractive valuation at current or lower levels, there’s also the need for Origin to regain trust.

Q2 2023 ER – The new reality

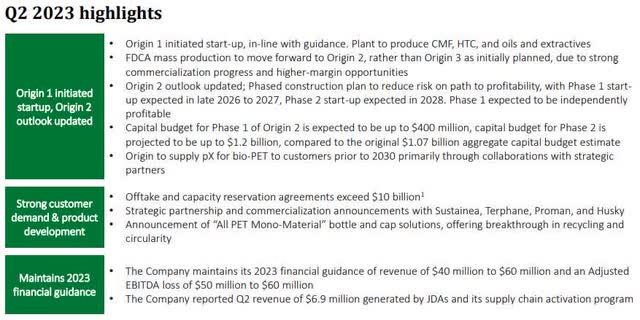

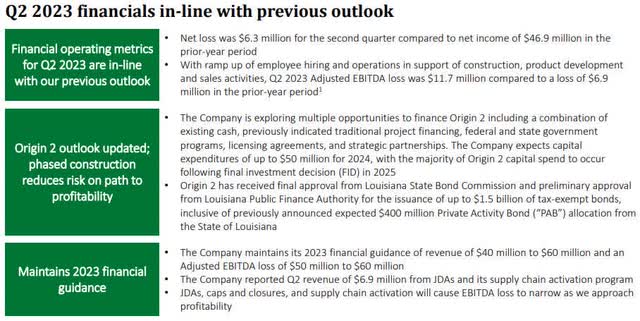

Unfortunately, some of the risks mentioned in my previous article and its last sentence proved sibylline. The Q2 2023 ER announcement brought speculation and uncertainty to those unaware of the new project. The company now plans a phased construction of the Origin 2 plant, announcing a considerable delay and a significant rise in the capital budget. Furthermore, the company will move FDCA mass production forward to Origin 2, rather than Origin 3 plant following the robust customer demand. Origin claims this is the way to derisk the project and prioritize higher-margin product production. The CEOs sounded optimistic during the earnings call.

Origin Materials Q2 2023 Earnings Presentation

The good

- The Origin 1 plant started production as expected and is now up and running.

- Strategic investors, partners, and customers didn’t flee after the announcement, showing that they are in touch with the management to sort things out regarding the restructuring of the initial project.

- New partnerships announced with Sustainea Bioglycols, Husky, Terphane, and Proman.

- The company intends to license Origin Technology and co-develop plants with strategic partners, introducing a different source of revenue.

- The capacity reservations increased yet for another quarter.

- The company launched the new, all-PET bottle caps enclosures, business.

The bad

- A stock sell-off occurred amid the announcement of the project revision showing that some investors didn’t like the fact and sold immediately on the event.

- The new project includes a significantly increased capital budget regarding Origin 2 completion, an 18-month delay in the production startup, and a 2-year delay in achieving profitability. Every forecast is worse compared to the initial plan.

- Despite statements about various alternative financing options, there is a higher possibility of more debt issuance and dilution.

The ugly

- The possible loss of trust in the management will take time to recover. Investors, partners, and customers will probably have second thoughts about everything until tangible evidence of a successful execution appears.

- The company is technically valued at 0 (market cap =< net cash), yet leadership didn’t come forward to emphatically purchase stock providing a vote of confidence in the company and the new strategy.

Origin Materials Q2 2023 Earnings Presentation

(Re)Valuation

At present, Origin’s value is below zero. Its market cap is ~$192M while its Q2 2023 net cash is ~$205M. The market prices the Origin 1 plant, a large TAM, patents and intellectual property, partners, customers, and future potential at $0. In theory, one can buy 100% of Origin’s stock, receive all the cash paid immediately back, plus its assets, and keep the change. The delay, the funding and the successful execution of the new project probably trouble the market. The valuation calculations of the previous article are not accurate now. Thus, a fresh attempt to estimate future valuation should be set at 2028. According to Origin’s 2028 forecast for Origin 2, a $600M revenue is expected. Adding an estimated Origin 1 $100M revenue totals $700M. Applying a P/S ratio of 1.13 based on its current sector median according to Seeking Alpha metrics would result in a $791M market cap. Slashing Origin’s forecasts to $400M revenue for Origin 2 would result in a $565M market cap. Applying a premium 1.50 P/S ratio would result in a $1.05B and $750M market cap respectively. Considering these assumptions, new-coming investors could multiply their invested capital by 2028. Possible licencing or co-production revenue is not included. Needless to say, these estimates are highly speculative.

Origin Materials Q2 2023 Earnings Presentation

Conclusion

In a nutshell, I do not usually panic-sell unless there is a strong bankruptcy possibility when one needs to save whatever they can. Such uncomfortable situations just happen, and the loss is inevitable. When it comes to binary bets, investors must study each case carefully and decide if they believe in the project or not to make the right call. In Origin’s case, the announced strategic changes are crucial, and investors need to carefully examine if they should hold onto their positions while searching for positive signs to average down (or initiate a position) or sell, take their losses and move on. The market values the company below 0$ (market cap<net cash) and places the new plan near a trash can. Leadership and top executives should come forward and buy Origin’s stock to reassure investors that the time is right and they are confident the company will succeed. On a final note, Origin’s story is still intriguing, despite the timeline expansion and capital budget increase. Hence, I will stick to my position and closely watch future developments to decide whether I increase it.

Read the full article here