Investment Summary

Now well into the year after its merger with SeaSpine, Orthofix Medical Inc. (NASDAQ:OFIX) continues to trade at compressed market multiples. The market has not revised its expectations on the company post-merger, which is telling. Since my last OFIX report in December, the equity line has remained flat as the horizon.

This report will update investors with all of the moving parts in the OFIX investment debate, critically analyzing the company’s latest numbers with SeaSpine’s contribution. Net-net, there is a lack of evidence to suggest OFIX is a buy right now in my view, based on the combination of fundamental, sentimental and valuation grounds. Without these factors to support the case, I cannot urge readers to buy the company at this stage. Reiterate hold.

Figure 1.

Data: Updata

OFIX recent developments

The company’s Q1 FY’23 numbers, posted in early May, provide invaluable data on the full-year expectations. From my analysis, there is a lack of evidence to suggest OFIX will attract investment down the line, based on fundamental, sentimental and valuation factors.

Q1 financial results

OFIX had a reasonable start to the year with top line revenue growth of 11% pulling to $175mm on adj. EBITDA of $3.2mm. On a pro forma basis (including the SeaSpine results revenues were up 65% YoY.

The bone growth therapies (“BGT”) division experienced a solid start to the year as well, up 14% YoY and clipping $48mm. The increase in BGT was driven by double-digit growth in the spine and fracture management channels and the early integration of the new salesforce.

Part of the revenue upside involves the cross-selling opportunities into SeaSpine’s markets following the merger. As a positive, the company’s most recent addition to the portfolio, AccelStim, adds a new fracture indication to the existing product line, albeit on the rehabilitation side, by promoting bone density. This was a gap OFIX had mentioned it wanted to fill in years gone by, so it looks to have achieved this in part since the merger. Hence, you’re looking at OFIX pushing into the spine and fracture management channels, also building out its orthopaedic implants segment in doing so. To this, the firm is driving volumes of its SpineStim and CervicalStim units– two offerings that I would encourage investors to keep a close eye on moving forward. Further, the launch of SeaSpine’s mariner deformity pedicle screw system is a potential tailwind for the firm to capture additional market share.

I talked on the global market opportunity OFIX had in front of itself, with the newly formed entity post-merger with SeaSpine, in the last publication. In particular, I said the pediatric opportunity is attractive, noting “[t]he pediatric orthopedic implants market is expected to reach $3.4Bn by 2027. This represents a CAGR of 10.2%…according to John Hopkins Medicine, approximately $3mm children in the United States are diagnosed scoliosis each year, requiring specialized treatment and surgery.”

OFIX grew global orthopedics sales 14% in Q1 to $26mm in revenue. Hence, it appears to be making some headroom in this capacity as well.

Moving down the P&L, the following takeouts are relevant:

- Gross margin analysis reveals a decrease in margin from 73% in Q1 FY’22 to 63% last quarter.

- The reduction is all merger-related– things like non-cash charges, excess/obsolete inventory, and the dilutive impact of the acquired intangibles from SeaSpine.

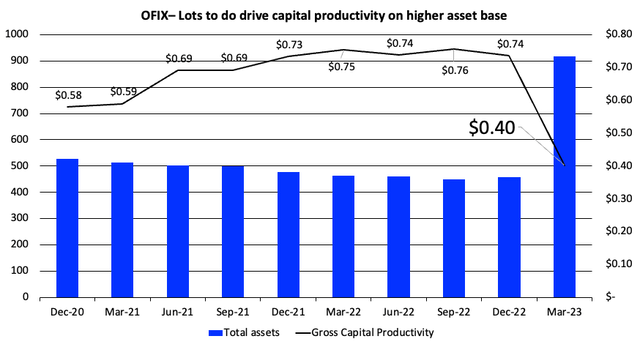

- Excluding these merger-related impacts, gross came to 71%. Still, it is important to consider the impact of the higher asset base going forward. You can see below, the company holding a c.$0.74 gross capital return on its operating assets from 2021–2022 (TTM values). However, since the merger, total assets have doubled, meaning the required gross profit to maintain the gross capital productivity has also doubled. Figure 2 shows the company’s numbers in Q1 (TTM figures). Hence, I will be monitoring this closely going forward, once all the merger charges have settled.

Figure 2. Large effort required to scale gross profitability along with asset growth post merger

Data: Author, OFIX SEC Filings

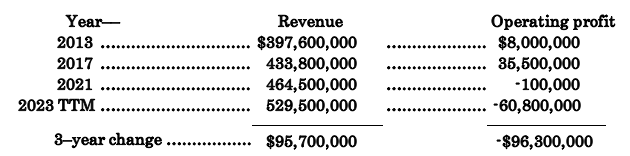

It pulled this to an operating loss of $38mm which might normalize back to long-term range once all restructuring charges are dealt with. I would say this is absolutely critical for OFIX, considering the following record:

Table 1.

Data: Author, OFIX SEC Filings

The above numbers call for a sharp turnaround, and would require a gargantuan effort to get there ($70mm in operating income to return to the black from Q1 FY’23 in the TTM).

Changes in sentiment

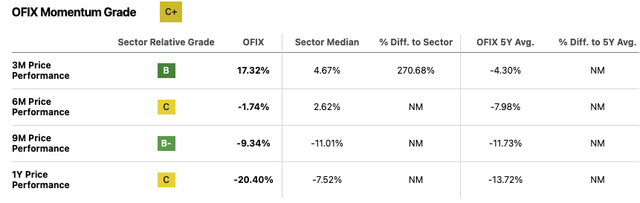

The merger between OFIX and SeaSpine has not had the desired impact on sentiment, despite 3 up revisions to revenue and 2 revisions downward to earnings in the last 3 months. Although consensus expects 65% YoY growth in FY’23 revenue, the lack of growth forecasts for FY’24. The potential breakeven with earnings in FY’25 is not a convincing prospect in my view.

With no options contracts written for July expiry (on both calls and puts), it is clear that investors have not taken a strong investment view on OFIX, indicating a lack of directional view. I would expect some “skin in the game” to suggest a change in view from the options market.

The stock is also currently trading flat with all moving averages, including 10, 50, 100, and 200-day lines. Furthermore, the price performance has been down across all time frames, from the past 5 years to the past month, indicating a lack of positive sentiment required for the stock to rate higher.

Figure 3.

Data: Seeking Alpha

Valuation factors

Investors are selling OFIX stock at ~1x forward sales and 1x book value as I write. Whilst these numbers may be appealing on face value, both ~70% discount to the sector respectively, there is good reason for this.

Consider that:

- OFIX has not created any additional market value over the last 1, 3, 5 and 10 years.

- Whatever investments it has made to grow, the market has punished– a sign of the challenges faced.

- Moreover, the market hasn’t been receptive to the SeaSpine merger.

- Further, the projected growth numbers aren’t conducive to seeing OFIX trading at higher multiples in 12 months’ time. The market is pessimistic on the company’s outlook in my view, placing it a discount to historical sales at a 0.89x multiple.

Hence, I believe the market has got OFIX priced correctly at the sum of its book value, correctly identifying the lack of value-add, and potential challenges moving forward. This is supportive of a neutral view.

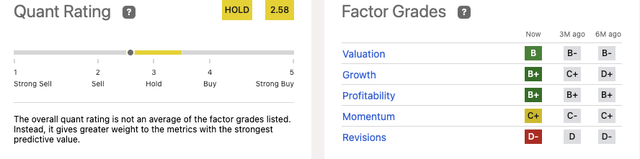

Furthermore, the quant system has got OFIX rated as a hold for similar reasons to my own. It also found similar findings around sentiment indicating there is low probability the company will attract substantial investment. This adds a layer of confidence to the estimates provided here today.

Figure 4.

Data: Seeking Alpha

In short

Investors may want to exercise caution if considering OFIX as a potential allocation to the long account. For those long of stocks, there are other selective opportunities available elsewhere, and the opportunities are plentiful. OFIX’s lack of forecasted revenue growth, in the year following the supposed game-changing merger with SeaSpine, is telling of why investor sentiment is currently low. The overall lack of value-creation and negative sentiment therefore make it difficult to recommend OFIX a buy at this time. I will be closely monitoring the company’s numbers going forward, observing how it integrates the bigger asset base. However, as for right now, prospects appear neutral in my view. Net-net, reiterate hold.

Read the full article here