Fading inflation and sticky price increases helped building products companies expand their margins. Owens Corning (NYSE:OC) has grown its profitability in the face of lower volumes. I had rated the stock a hold in March 2023. Since then, the stock has returned an impressive 61% compared to the S&P 500 Index return of 13.6%. After this massive run, investors may consider taking profits or selling covered calls to generate income.

Price realization drives profit margins, aided by fading inflation

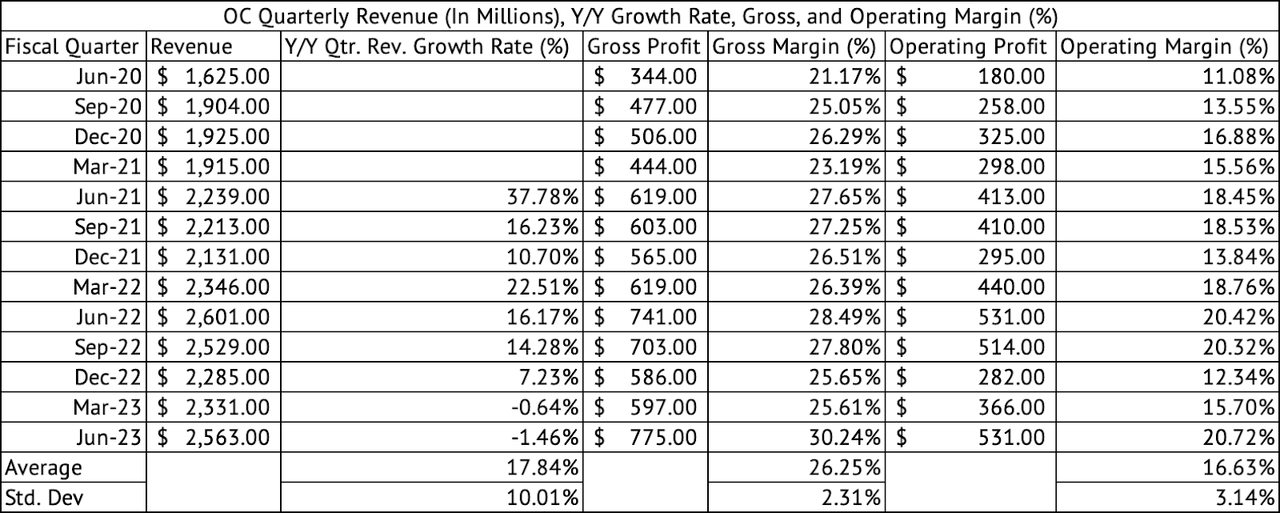

Although quarterly y/y sales declined, the company registered a substantial q/q increase in gross and operating margins (Exhibit 1). From a revenue perspective, its Roofing segment was solid. The company mentioned that storm activity drove higher demand for roofing while pricing remained strong. Its Insulation segment saw revenue impacted due to lower volumes while pricing remained strong. Its Composites segment is seeing demand stabilize, helping bring about good margins.

Exhibit 1:

Owens Corning Quarterly Revenue (Seeking Alpha, Author Compilation)

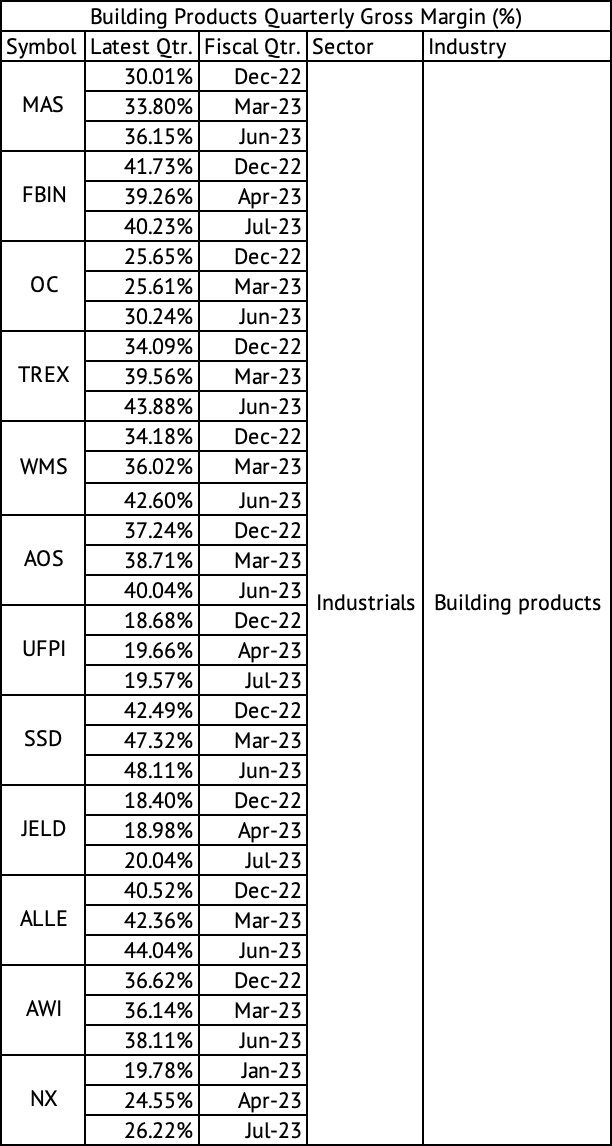

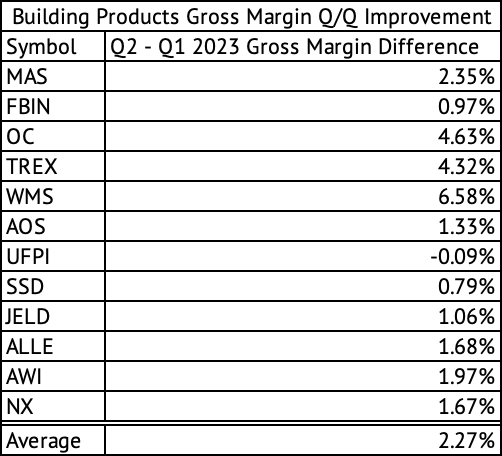

Gross margins increased from 25.6% in March 2023 to 30.2% in the June 2023 quarter. Operating margins improved from 15.7% in March to 20.7% in June. However, the building products sector has benefitted from fading inflation, leading to lower COGS and higher gross margins. Out of the twelve companies listed in the table, just one, UFP Industries (UFPI), saw its gross margins decline from the previous quarter (Exhibit 2 and 3). The average gain in gross margin was 227 basis points. But, the question remains whether this increased margin is sustainable long term.

This quarter’s gross margin may be an outlier and may soon revert to its historical average. The company has registered an average annual gross margin of 24.6% since 2017. The margin may be closer to this number in the future than the 30.2% it reported in June 2023. These margins helped the company generate significant EBITDA in the June quarter. The company generated $696 million in EBITDA, its highest since June 2020, with a margin of 27%.

Exhibit 2:

Building Products Companies Improvement in Gross Margins (Seeking Alpha, Author Compilation)

Exhibit 3:

Building Products Q/Q Gross Margin Improvement in FY 2023 (Seeking Alpha, Author Compilation)

Dividends, buybacks, and debt

The stock’s dividend yield has dropped appreciably over the past year due to price appreciation and valuation expansion. The stock now yields 1.4%, less than the Vanguard S&P 500 Index (VOO) yield of 1.5%. Vanguard Industrials Index Fund ETF (VIS) yields 1.37%, close to Owens Corning’s. The valuation expansion across building products companies has lowered their yields dramatically to the point where income investors may be better off waiting for a higher yield.

Over the past year, the company has grown its dividend by 45%, but do not expect that to continue. Although, the company has increased its dividend by an impressive 18% CAGR over the past five years. If Owens Corning can sustain its margins, it can continue its good dividend growth. But, these growth numbers are skewed by the massive increases in 2020 and 2021, which may not be sustainable. Investors should expect a much lower dividend growth rate than the 18% CAGR in the coming years.

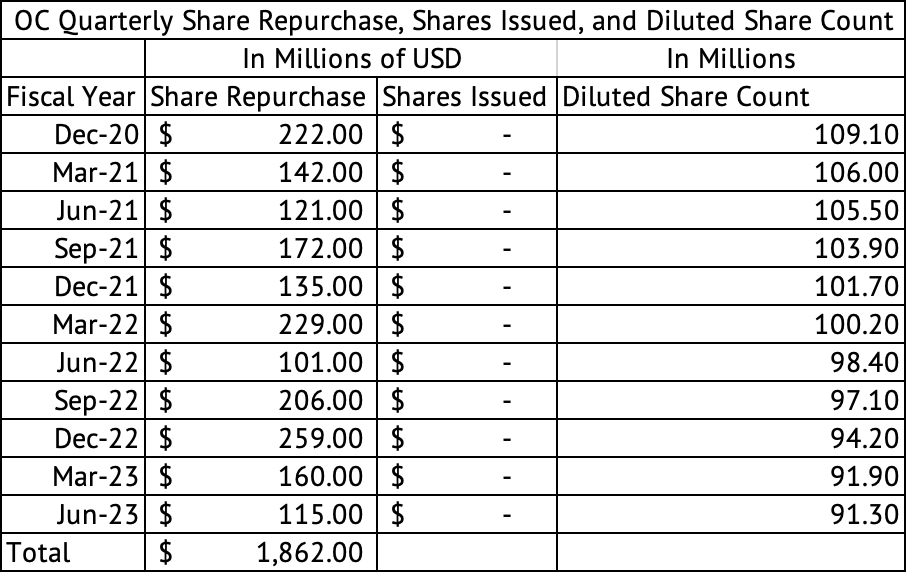

The company has spent $1.8 billion on share buybacks since December 2020, reducing its share count from 109.1 million in December 2020 to 91.3 million in June 2023 at an average buyback price of $104 (Exhibit 4). But the buybacks are slowing down across the building products sector as the massive cash flows the companies generated during 2020, 2021, and 2022 are reduced. The demand spike during the Pandemic was driven by a combination of ultra-low rates set by the Federal Reserve and the stimulus given by the U.S. Government. We have entered an era of relatively high interest rates compared to the past; this will crimp demand for all segments, including residential and commercial construction. Bank of America Securities says we are shifting from a “2% world” over the past two decades to a “5% world”, meaning inflation will be much higher in this era (Source: BofA Research Investment Committee Report, August 2023).

Exhibit 4:

Owens Corning Share Buybacks (Seeking Alpha, Author Compilation)

If Bank of America’s (BAC) research proves correct, income investors may be better off waiting for the stock to pull back in the stock before buying. My threshold for dividend investing is a minimum of 2.5% yield and a minimum dividend growth rate of 5%. I agree with Bank of America’s assessment that inflation may run higher due to supply disruptions, decoupling with China, and the resulting near-shoring efforts underway across the globe.

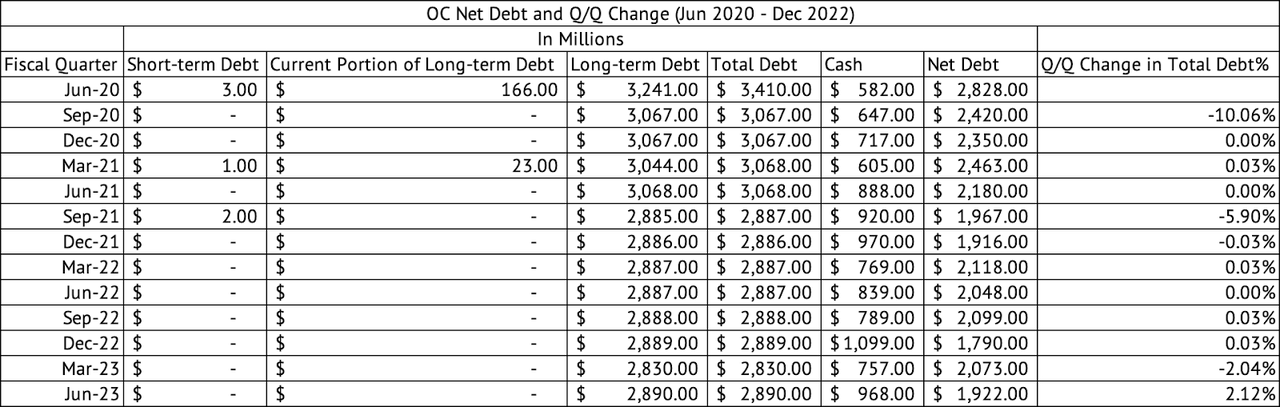

The company has seen little change in its debt. It carried a total debt of $2.89 billion in June 2023, an increase of 2.1% from its level in March 2023 (Exhibit 5). Its debt load is low, given its current EBITDA of nearly $2.2 billion. The dividend is safe, given the company’s strong balance sheet and low payout ratio of 15%.

Exhibit 5:

Owens Corning Debt (Seeking Alpha, Author Compilation)

Good news is priced into its valuation

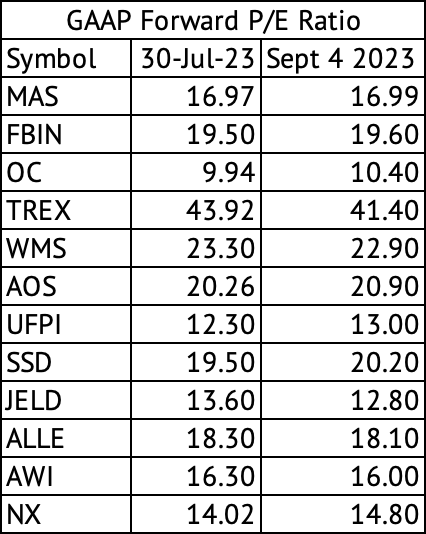

Markets are excellent at quickly pricing in any news into the current valuations of stocks. Most companies in the building products sector look fully-valued (Exhibit 6). Some, such as Trex (TREX), look overvalued. The markets have priced in all the good news regarding margin expansion.

Exhibit 6:

Forward GAAP PE Ratio of Building Products Companies (Seeking Alpha, Author Compilation)

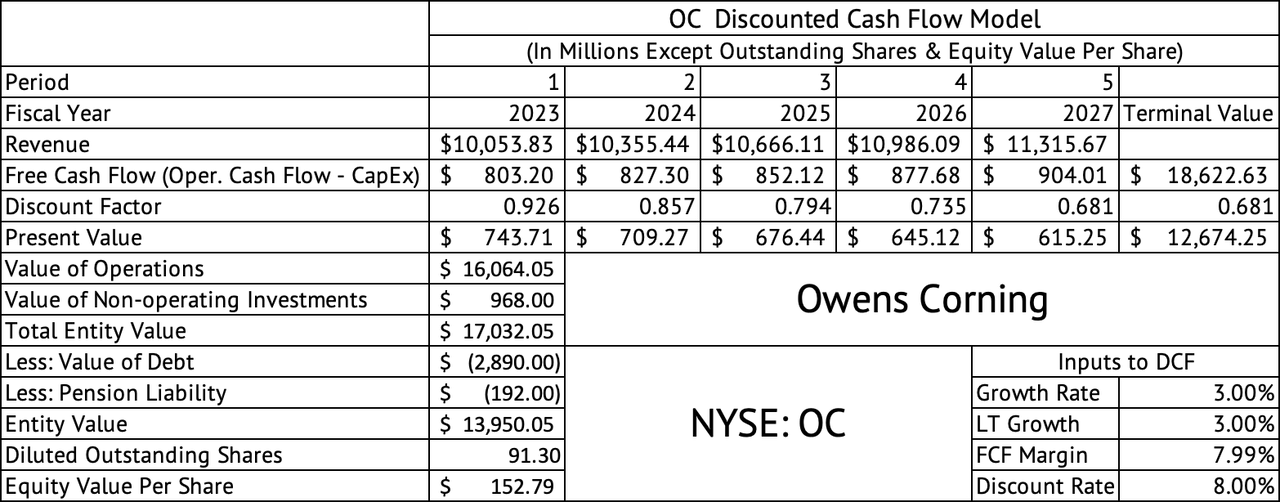

Owens Corning trades at a forward EV/EBITDA multiple of 6.8x, in line with its five-year average. The sector trades at 11.2x EV/EBITDA multiple. A discounted cash flow model puts the per-share equity value at $152 (Exhibit 7). This model assumes a growth rate of 3%, a free cash flow margin of 7.9%, its average over the past decade, and a discount rate of 8%. If a free cash flow margin of 12.1%, its average quarterly free cash flow margin since June 2020, is used in the model, the per-share equity value jumps to $243. Investors should remember that Owens Corning sees much variability in its free cash flow margins, with a standard deviation of 9.8%. At a minimum, its quarterly free cash flow margins could vary between 2.3% and 21.9%. Even the annual average free cash flow margins of 7.9% see a high variability of 4.5%. In short, the company sees wild swings in its business and profitability.

Exhibit 7:

Owens Corning Discounted Cash Flow Model (Seeking Alpha, Author Calculations)

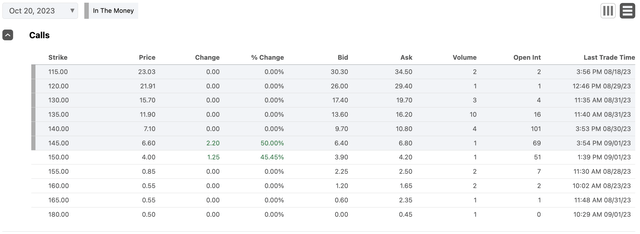

The building products sector has benefitted from strong price realization, which has helped improve margins in the face of lower volumes. The markets may have already priced in the good news in Owens Corning. The stock has done exceptionally well over the past year, returning 81%. On the back of expanding margins, Wall Street analysts have revised their EPS guidance higher for the September quarter, with 17 analysts revising EPS upwards with no downward revisions. Investors with good gains on the stock may consider taking some profits or selling covered calls to generate extra income. The October 20 expiry, $150 strike calls last sold for $4, amounting to a good premium of 2.66%, over 100 basis points over its annual dividend yield (Exhibit 8). The stock would have to rise above $154 or 5.4% above its current price before the owner of the call can see any profits. The stock is set to report earnings on October 25. Investors with significant gains on the stock can consider this call strategy even at the risk of the call being assigned.

Exhibit 8:

Owens Corning Call Options (Seeking Alpha)

Building products companies have benefitted from higher prices and lower-than-anticipated deterioration in volumes. Fading inflation helped these companies register good margins. Investors looking to buy may have to wait for a lower valuation. Most of the good news is already priced in the stock of Owens Corning.

Read the full article here