Although it feels like yesterday, a month passed since my last piece on PacWest Bancorp (NASDAQ:PACW) got published on the site. May was an eventful month for shareholders of this troubled lender. As I continue to hold a sizable position in PacWest preferred shares (NASDAQ:PACWP), I am monitoring the bank’s progress and am keen to provide a new update.

Before delving into the analysis, I want to say I am pleased with the progress in the pricing of PACWP shares since I reiterated my BUY recommendation on May 6th. Despite PACW experiencing extreme volatility and a huge share price drop at the beginning of May, I recommended investors and readers not fold their long positions and weather the storm. Since the close at $8.19 on May 5th, PACWP has gained back over 70% and now trades approximately at @93% of the value of my original recommendation of April 27th. Those who, like me, held positions since near the lows of March or followed my suggestion to average down during the “May madness” shouldn’t be underwater at this point, even considering that, in the meanwhile, PACWP also declared and paid a $0.4845 dividend.

So, the big question is now: should investors hold on further, waiting for a home run, or be satisfied to have dodged a bullet and move on?

Investment thesis and recent events recap

As we already know, PACWP holders have a potentially highly profitable investment on their hands. Further normalization of PACWP price towards the shares’ redemption value ($25), coupled with the current 13.8% yield, could return a massive 30% annualized over the next few years. The bull case I stated in my original article is undoubtedly clear, but is it worth the risks?

The short attack on PACW during May left the lender with a deposit base further weakened. PACW closed Q1 with $28.2 billion in deposits, recovering about $1.1 billion from the lows of March but still a $5.7 billion drop from 4Q22. With deposits dwindling another 9.5% between May 4th and 5th, it is logical to expect the current amount not to exceed $26 billion. A recovery towards the $30 billion mark is most likely the best-case scenario, compared to the management’s estimate of $35 billion during the 1Q23 earnings call. The deposit’s decline provides critical background context about PACW’s May moves. The situation required management to fix the imbalance between loans and deposits fast. The bank’s executives, in my opinion, delivered just fine. The fact that PACW achieved asset sales so quickly proves once again that, while the future remains uncertain, the bank was always a different animal from the likes of First Republic Bank (OTCPK:FRCB) or Silicon Valley Bank.

a) sale of real estate loan portfolio

On May 22nd, PACW filed with the SEC about selling a 74 real estate construction loans portfolio to Kennedy Wilson (KW). The price tag was $2.4 billion, a $200 million discount to the portfolio value of $2.6 billion. While the haircut is an obvious negative for PACW, set to erode the bank’s common equity further and cut its book value by about $2 per share, the sale will help strengthen its regulatory capital ratios. Given the circumstances, the transaction is a win for PACW, mainly because it frees the bank from assuming further funding obligations related to these construction loans, which added up to another $2.7 billion under the portfolio. Also, the bank is working with KW to sell another six construction loans with an aggregate principal balance of $363M. A lot of discussion on the site centered on whether or not PACW got a good bargain by getting rid of lucrative, floating-rate, high-yield loans with an average interest rate of approximately 8.4%, but I believe that is beside the point. PACW needed to cut lending and realign with deposits. The loans the bank took out to shore up liquidity aren’t cheap either, and the sooner they are gone, the better. I’ll take it as a bullish sign if the bear rhetoric has moved on from “PACW will be toast soon” to “PACW didn’t get a good deal in selling off assets.” And anyhow, with mortgage rates currently yielding 7.0% – 7.5%, the deal’s rates don’t strike me as notably different from what could be the probable going rate for new construction loans. KW’s win was getting these at a discount.

b) sale of the lending arm unit

Just a day after the deal with KW, PACW also announced an agreement to offload its property lending arm, Civic Financial Services (CIVIC), to Roc360. The sale was not financially material and was sealed at an undisclosed amount without any SEC filing by PACW. Also, the deal did not include previous originations by CIVIC. The main positive for PACW was the further addressing liquidity and LDR imbalance concerns. As the bank continues to work around its deposit base, it is apparent that new originations must slow down considerably, impacting CIVIC’s business.

Forecasting Q2

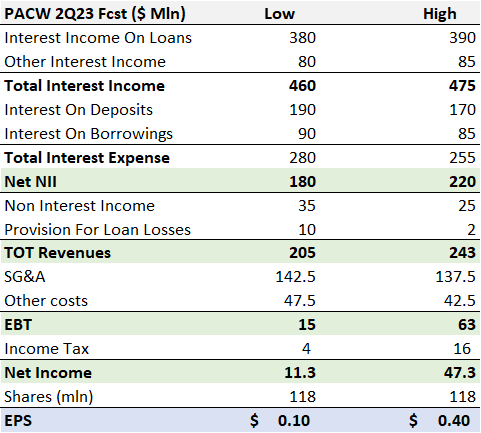

After the deals, my projections for PACW’s 2Q23 earnings are not too dissimilar from the current Street consensus estimate of $0.25 per share. Considering the significant uncertainty ahead, producing an accurate forecast is quite hard. The main problem is correctly factoring the magnitude of PACW’s hit on interest from deposits. After running a couple of best & worst scenarios, I believe the Street’s estimate provides an appropriate midpoint. In fact, I project the bank’s earnings for next quarter to fall pretty much anywhere between $0.10 and $0.40.

And Value For All

The forecast does have important implications. Number one: if we assume that the banks’ worst headwinds are now behind, PacWest will most likely survive. Yes, a prolonged, severe recession could pose an existential threat to the bank, but that is a far too general statement and a common risk for most equities. Number two: the sales have shored up the banks’ liquidity, and the aggressive de-risking adopted by PACW has left short sellers without ammo to throw against the company. I expect FDIC-insured deposits to cover about 80% of the total bank’s deposits for Q2, and depositors who sought to fly to safety have likely already left. PACW options volatility, while still very high at the moment, has been subsiding, another indication that the trading crowd is slowly moving on.

Takeaway

The positive recent developments and the high discount to book value (even after factoring in the hit from the deal with KW) make an investment in PACW common shares potentially attractive. The bank can still likely earn $1+ per share over the next four quarters, implying a 7x – 8x forward earnings valuation, with significant further upside if the bank manages to stabilize funding and loan origination.

I continue to see PACWP (preferred) shares as more attractive than the common considering their high yield and potential for a reversal to redemption value over the long term. As long as the bank earns at least $0.20-$0.25 per quarter, the risk of a temporary dividend suspension is minimal, considering a max 50% payout ratio. However, my most conservative estimates indicate that there is indeed some potential for earnings to drop below the danger zone. I am still bullish, but investors must acknowledge the risks and position themselves accordingly.

PACW bonds maturing in 2031 could be the safest bet for conservative investors. Trading below 39% par value as of this writing, the total YTM is above 15.5%, and the current yield is above 8.3% (based on 3.25% at face value).

Read the full article here