As Palantir Technologies (NYSE:PLTR) soared to $20, investors were warned to pump the brakes on the AI hype. The market for generative AI chips might be hot, but enterprise AI software is still in the development process and sales cycles take time. My investment thesis is much more Neutral on the stock near support around $14, but Palantir doesn’t become a true value until lower prices near $10.

Source: Finviz

Takes Time To Transform Business

The hype surrounding AI is the potential to transform businesses. Palantir will use enterprise AI software to harness the power of large language models and algorithms.

On the Q2’23 earnings call, CTO Shyam Sankar describes how LLMs have limiting factors as follows:

Large language models occupy a middle ground between algorithmic reasoning and human thought. They are fluent in natural language, yet they don’t really understand what they say. They are not good at executing algorithms yet, they can be instructed in ordinary prose.

They are something else, non-algorithm compute. LLMs are statistics, not calculus. And the introduction of even one stochastic variable into a deterministic system makes the entire system now stochastic.

The key here is that this opens up Palantir to offer customers enterprise AI solutions to harness the powers of LLM. The company uses algorithmic and software tools to power the statistics summarized in LLMs, such as with AIP, to deliver outcomes and accelerate workflows.

The problem for Palantir is that sales process and software implementation take time. The company only reported Q2 sales of $533 million for just 13% growth, a new low quarterly growth rate since going public.

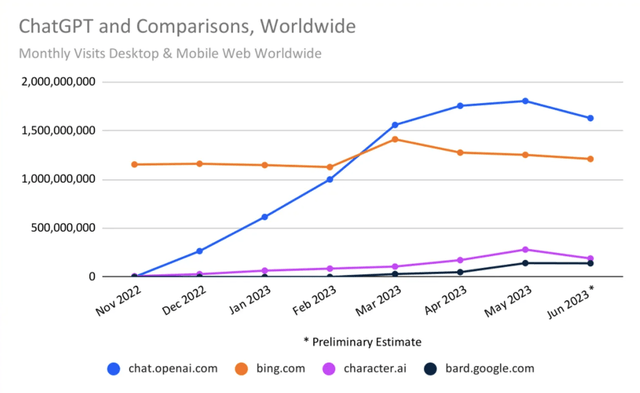

The excitement surrounding LLMs and ChatGPT started back last November. Sure the excitement has grown in the last few quarters with Nvidia reporting massive demand growth for AI chips, but Palantir has seen virtually none of the boosted demand for LLMs actually flow through to higher revenues.

As highlighted on the earnings call, AIP is shortening the sales cycle, but it’s not preventing a sales cycle. Not to mention, the AIP product hasn’t been on the market for 3 months now.

C3.ai (AI) provided investors with more details on the generative AI impact on the enterprise software sales cycle. On the FQ4’23 earnings call, CEO Tom Siebel discussed a sales cycle that decreased by 1.3 months for a company that also shortened sales cycles due to the move to a consumption pricing model:

The average sales cycle for new and expansion deals was 3.7 months down from five months in Q4 of the previous year.

The clear enterprise AI software industry indication is that generative AI chat has increased product interest, but large companies still take a long time to sign deals and implement new software. Palantir might not see a real benefit from generative AI chat demand until way into 2024.

Another concern is that actual ChatGPT usage has dipped in the last few months in another sign the usage of generative AI is being rationalized. Users are now looking for chatbots to prove their worth and working with Palantir is a potential path, but such a shift will take time.

Source: ZDNET

Minimal $1 Billion Buyback

A lot of technology companies are rushing out share buybacks, though stocks really don’t trade at levels offering a value. Palantir announced a $1 billion share buyback, but the current stock valuation sits at over $36 billion with a diluted share count of 2.28 billion.

The share buyback plan only amounts to repurchasing 2.7% of the outstanding shares providing limited benefit to shareholders. Palantir has a $3.1 billion cash balance, but the company shouldn’t necessarily spend the cash on share buybacks at any price.

If the stock fell back to $10, Palantir would more logically utilize the share buyback. The enterprise AI software company could repurchase over 4% of the outstanding shares at the lowered price.

After all, the diluted share count rose 61K in just the sequential quarter from 2.22 billion shares in Q1’23. The company heavily diluted shareholders via share-based compensation at a listed cost of $115 million in Q2’23. The additional share dilution during the quarter was actually worth nearly $1 billion in market cap based on the current stock price.

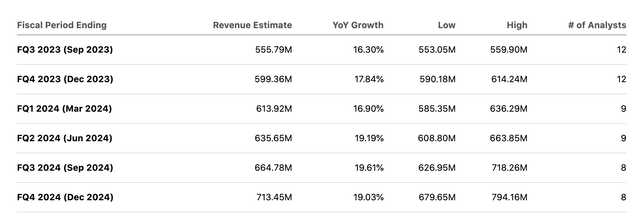

Palantir guided to FQ3 revenues of $553 to $557 million for ~16% growth. The analyst targets don’t get the enterprise AI software business back to 20% growth rates anytime soon.

Source: Seeking Alpha

All the AI hype isn’t exactly showing up in the financial projections. The stock is far more interesting at $14 due to the stock support and far better value than up at $20 when Palantir traded at nearly 20x forward sales.

The stock still trades at 13x 2024 sales targets of $2.63 billion. The AIP product offers a lot of promise for long-term AI software growth, but Palantir still can’t avoid the sales cycle.

The current revenue targets suggest no real sales momentum nearly a year after the start of the generative AI craze due to the launch of ChatGPT and a 2nd quarter of the AIP product on market. The consensus analyst estimates still aren’t showing the AI hype driving accelerating revenue growth for enterprise software.

Takeaway

The key investor takeaway is that Palantir is a much better deal down here around $14. The ideal entry point for the enterprise AI software stock is back closer to $10 when the stock dips below 10x forward sales targets. The share buyback program offers real impacts when the price falls closer to $10 and share repurchases can buy up to 5% of the outstanding shares to help offset share dilution.

Palantir might not fall that low, but investors have no reason to be aggressive here with enterprise AI software spending not accelerating like generative AI chat hype.

Read the full article here