We previously covered Palantir Technologies Inc. (NYSE:PLTR) in November 2023, discussing the management’s brilliant marketing approach for AIP, with it likely to accelerate its top-line and customer base expansions.

With the nascent generative AI SaaS market still ripe for immense growth, we continued to rate the stock as a Buy after a moderate pullback.

In this article, we shall discuss why we are choosing to downgrade the PLTR stock as a Hold here, attributed to the massive baked-in premium observed in its stock valuations and pulled forward upside potential in the stock prices.

While we remain convinced about its long-term prospects, we believe that it may be wiser to wait for a moderate pullback to its previous resistance level of $17s to dollar cost average.

The Generative AI Investment Thesis Has Gone Overboard With PLTR

For now, PLTR has a top-line beat in its FQ4’23 earnings call, with revenues of $608.35M (+8.9% QoQ/ +19.6% YoY) and adj EPS of $0.08 (+14.2% QoQ/ +100% YoY).

Much of its top-line tailwinds are attributed to the growing demand for its commercial offerings, particularly the AIP, naturally contributing to its robust commercial revenues of $284M (+13.3% QoQ/ +31.8% YoY).

While PLTR’s government revenues have shown signs of growth deceleration at $324M (+5.3% QoQ/ +10.5% YoY) by the latest quarter, it appears the return in commercial spending may be more than enough to balance the headwinds.

The same may be observed in the growing total Remaining Performance Obligations [RPO] of $1.24B (+25.8% QoQ/ +27.7% YoY) – mostly in the long-term RPO of $600M (+40.1% QoQ/ +31.5% YoY), expanding adj gross margins of 84% (+2 QoQ/ +2 YoY), and Net Retention Dollar of 108% (+1 QoQ/ -7 YoY).

Combined with the accelerating overall customer count to 497 (+44 QoQ/ +130 YoY), it is undeniable that there is robust demand for its SaaS offerings, marking the re-start of its high growth trend as more companies invest in their generative AI capabilities during a supposed global soft landing.

PLTR’s bottom line tailwinds are also attributed to deceleration observed in its operating expenses growth to $433.92M (+5.7% QoQ/ +2.7% YoY) in FQ4’23.

This is partly aided by the use of its balance sheet at a time of elevated interest rates, with $44.41M in net interest income (+22.9% QoQ/ +302.2% YoY) and slowing share count growth to 2.35B (+1.2% QoQ/ +6.8% YoY) by the latest quarter.

It appears that the PLTR management has delivered on its promise to manage the previously extravagant stock-based compensation, significantly aided by the yet-to-be-utilized $1B share repurchase program.

With a growing $3.67B of net cash in balance sheet (+11.8% QoQ/ +39.5% YoY) and practically zero debt, we can understand why the market has cheered as it has, further aided by the hype surrounding generative AI.

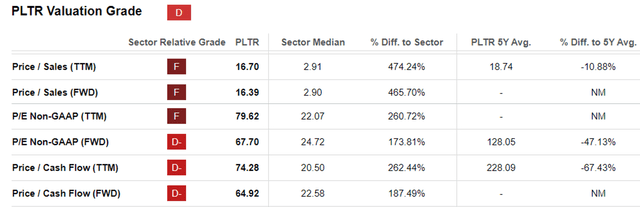

PLTR Valuations

Seeking Alpha

Nonetheless, while we may be PLTR’s shareholders ourselves, it is apparent that at FWD P/E valuations of 67.70x and FWD Price/ Cash Flow of 64.92x, the stock has been overly inflated. This is compared to its 1Y mean of 57.53x/ 68.97x and sector median of 24.72x/ 22.58x, respectively.

Even if we are to compare its valuations to other generative AI plays, such as Microsoft (MSFT) at 34.70x/ 27.42x, Nvidia (NVDA) at 56.38x/ 90.94x, and CrowdStrike (CRWD) at 102.28x/ 42.18x, it is apparent that the generative AI SaaS hype may have gone overboard at this point.

With the hype going into overdrive, we are reminded by the similar trend previously observed during the heights of hyper-pandemic euphoria in November 2021, with the subsequent correction being extremely painful.

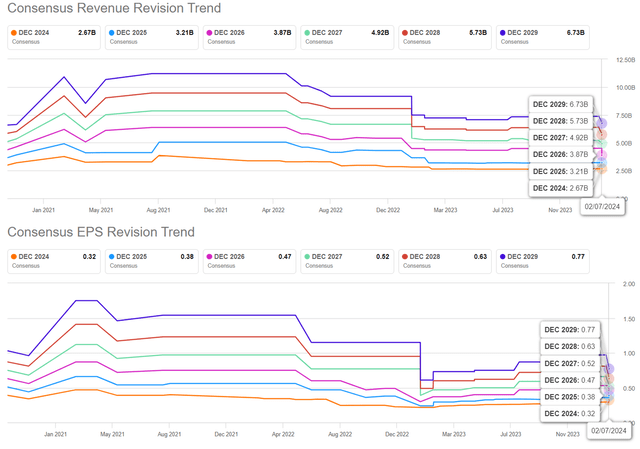

The Consensus Forward Estimates

Tikr Terminal

This is especially since the consensus forward estimates for PLTR has been consistently downgraded to a top/ bottom line CAGR of +20.3%/ +23.2% through FY2026.

These numbers are notably moderated, compared to the previous estimates of +26.4%/ +28.4% and historical top-line growth of +30.1% between FY2018 and FY2023, respectively.

While the management’s FY2024 midpoint revenue guidance of $2.656B (+19.3% YoY) seems to be accelerating compared to FY2023’s growth at $2.22B (+16.7% YoY), these numbers are still pale in comparison to the +47.2% YoY growth recorded in FY2020.

As a result of the overly inflated valuations and decelerating growth trend, it appears that investors must rein in their exuberance, with the market already pulling forward much of PLTR’s upside potential.

Based on the consensus FY2026 adj EPS estimates of $0.47 and its 1Y P/E mean of 57.42x, there appears to be a minimal upside potential of +13.9% to our long-term price target of $26.90 as well.

So, Is PLTR Stock A Buy, Sell, or Hold?

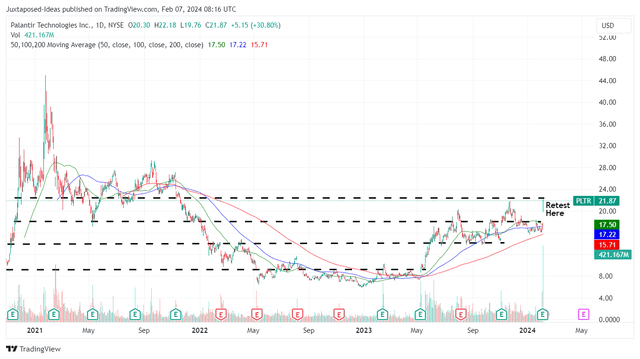

PLTR 3Y Stock Price

Trading View

On the one hand, PLTR has peaked again with it appearing to break out of its 50/ 100/ 200 day moving averages, while retesting its previous resistance level of $20s.

Despite the rise and fall trend observed after three of its previous earning calls, it is also apparent that the stock has been able to sustain its upward momentum since May 2023, with it charting newer highs/ newer lows and the $17/ $18s likely to be its next floor.

On the other hand, the combination of the lifting market sentiments, cooling inflation, Fed’s potential pivot by H1’24, and the increasingly greedy stock market index pose massive uncertainties to the sustainability of PLTR’s overly premium valuations and rising trajectory in the near-term.

Here is where the quote, “the trend is your friend until the end when it bends” may be highly applicable. With the uptrend seemingly gaining momentum, we may see the stock’s rise continue for a little longer, triggering short-term trading profits.

However, we believe that there may be near-term volatility ahead, with the stock market likely to pullback after much of the earnings season hype has been moderated.

As a result of the potential volatility, we prefer to prudently rate the stock as a Hold here, with interested investors better off observing for lower entry points according to their dollar cost averages and risk appetite.

Do not chase this rally here.

Read the full article here