We’re over halfway through the Q3 Earnings Season for the precious metals sector and while the results have been decent overall, Pan American Silver’s (NYSE:PAAS) results were on the disappointing side. This is because not only did we see another quarter of relatively weak margins despite the addition of the Yamana assets, but La Colorada and El Penon performed below plan, resulting in Pan American now guiding toward the lower end of its annual guidance. Meanwhile, although Escobal remaining offline is already priced into the stock, progress here has moved at a snail’s pace with the ILO 169 consultation continuing to drag on, which hasn’t allowed for any positive change in sentiment related to this asset. In this update we’ll dig into the Q3 results, the updated FY2023 outlook, and whether the stock is trading in a low-risk buy zone after its recent miss.

Jacobina Mine – Yamana Website

Q3 Production & Sales

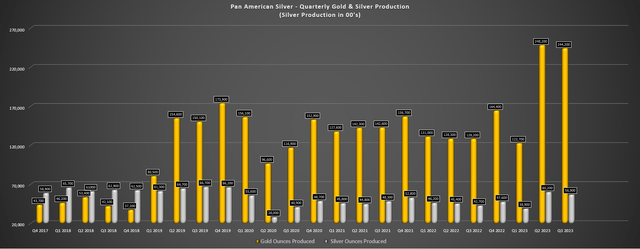

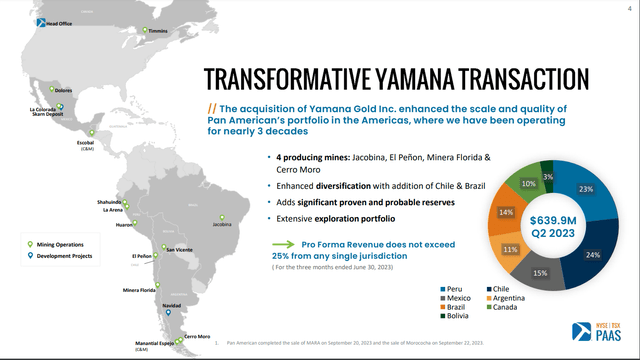

Pan American Silver released its Q3 results this week, reporting quarterly production of ~5.69 million ounces of silver and ~244,200 ounces of gold, translating to a 25% and 90% increase year-over-year, respectively. The increase in silver production was related to the new contribution from El Penon (~1.01 million ounces), Minera Florida (~89,000 ounces), and Cerro Moro (~1.27 million ounces) from the Yamana acquisition, offset by another weak quarter at La Colorada (lower throughput and grades) and Manantial Espejo moving into care and maintenance (~857,000 ounce headwind). As for the gold business, Jacobina (~48,300 ounces), Cerro Moro (~27,000 ounces), Minera Florida (~24,200 ounces), and El Penon (~29,100 ounces) provided a material boost to output, but this was unfortunately offset by lower output at Shahuindo and Dolores, with lower gold grades and throughput at the Mexican mine (0.57 grams per tonne of gold vs. 0.69 grams per tonne of gold) due to mine sequencing.

Pan American Silver – Quarterly Gold & Silver Production – Company Filings, Author’s Chart

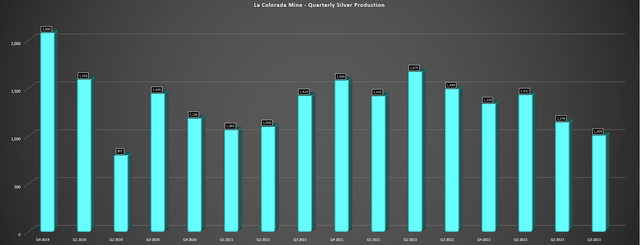

Looking at the results a little closer in the above chart, this was still a very solid quarter for gold production with Pan American seeing annualized production just shy of ~1.0 million ounces of gold, but silver production has continued to disappoint, with it actually down on a four-year basis (~5.69 million ounces vs. ~6.67 million ounces) despite the acquisition of two assets with meaningful silver production (Cerro Moro and El Penon), with the sale of Morococha, Manantial Espejo in care & maintenance, and much lower grades at La Colorada and Dolores (plus lower throughput at La Colorada). That said, the underwhelming production results from La Colorada (~1.01 million ounces) in Q3 were related to continued ventilation-related constraints that have impeded access to the high-grade and deeper portion Eastern Calendaria area of the mine. This wasn’t helped by an armed robbery at the mine in the quarter, which led to a brief shutdown with lower throughput year-over-year.

La Colorada – Quarterly Production – Company Filings, Author’s Chart

In addition to the lower output across all metals at La Colorada that significantly affected its unit costs ($30.30/oz all-in sustaining costs vs. $18.50/oz in Q3 2022), we also got negative news out of the newly acquired El Penon Mine. Unfortunately, Q3 production fell sharply sequentially, with grades of 98 grams per tonne of silver and 2.70 grams per tonne of gold (Q2 2022: 110 grams per tonne of silver and 3.23 grams per tonne of gold) and were below plan according to the company. Pan American stated it has begun a review of the mining sequence to allow for more stable production based on recent reconciliation data, with negative grade variability in Q3. Pan American noted limited drilling (“drilled wider than it would have liked to see”) was completed in these high-grade areas that it had developed for mining and that it’s going to work on increasing drill density in the future in the higher-grade areas of the deposit. Overall, this isn’t a huge deal, as it’s the first mention of grade shortfalls, but it certainly didn’t help what were already mediocre Q3 results. Not surprisingly, this affected unit costs, with AISC at El Penon soaring to $1,372/oz.

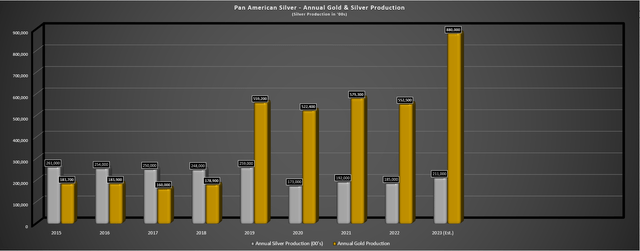

Pan American – Annual Silver & Gold Production + FY2023 Estimates – Company Filings & Author’s Chart

Given the weaker than planned production at these two mines, Pan American noted that it now expects to deliver into the lower end of its guidance of 21.0 to 23.0 million ounces of silver and 870,000 to 970,000 ounces of gold, with this shown in the chart above. And based on year-to-date production of ~15.6 million ounces of silver and ~615,100 ounces of gold, we’re likely to see annual production come in below 21.5 million ounces of silver and below 900,000 ounces of gold, a disappointing development. Plus, this lower output will affect its planned all-in sustaining costs, with silver segment all-in sustaining costs [AISC] now expected to come in above the top end of its guidance ($14.00 – $16.00/oz). The silver lining is that this is mostly La Colorada related, and with vent shaft at ~520 meters and the installation of two exhaust fans expected to be completed by mid-2024, we will see a meaningful recovery in production starting in Q3 at this key asset (access to higher grades at East Candelaria).

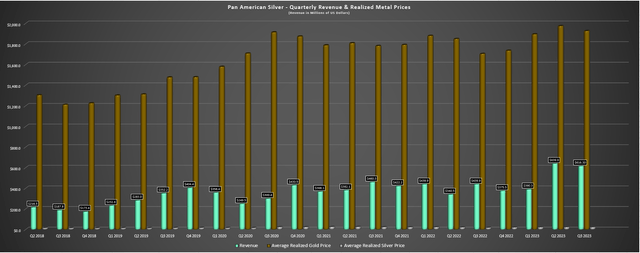

Pan American – Revenue & Realized Metals Prices – Company Filings, Author’s Chart

Finally, looking at PAAS’ financial results, revenue soared to $616.3 million on the back of new mines that were acquired earlier this year and higher realized metals prices ($1,927/oz gold and $23.11/oz silver). Meanwhile, operating cash flow was also up materially to $114.6 million (Q3 2022: $54.4 million), and the company paid down a net ~$295 million in debt in the quarter, with further proceeds (~$45 million) from the closing of its sale of Agua de la Felda in early November. The result of recent divestments and its reduced debt load is that Pan American can expect to see ~$90 million in annual savings from lower care & maintenance costs, with further gains expected from up to $60 million in annual synergies from the deal. Plus, Pan American could look at additional asset sales to further strengthen its balance sheet, which should ultimately help to support major capex for La Colorada Skarn if approved) and potentially opportunistic share buybacks if the share price remains at depressed levels.

Costs & Margins

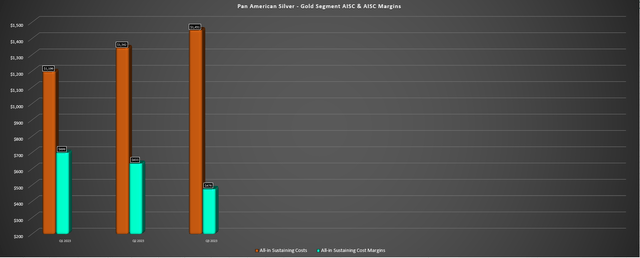

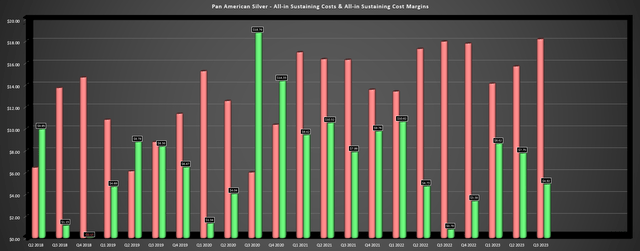

Moving over to costs and margins, it wasn’t a great quarter here either, with silver segment all-in sustaining costs coming in at $18.19/oz, translating to AISC margins of $4.92/oz or barely ~21%. That said, this was largely because of the disappointing performance at La Colorada and higher sustaining capital at Huaron/San Vicente, which had costs closer to ~$17.00/oz over the past two years. Fortunately, gold segment AISC was better but still came in a little below my expectations, with AISC improving to $1,451/oz (Q3 2022: $1,614/oz) largely because of being up against easy year-over-year comparisons related to NRV adjustments at Dolores last year. And while margins also improved materially to $476/oz (Q3 2022: $91/oz), they were still below the industry average. That said, we should see improved gold segment AISC next year with a full year from the previous Yamana operations, assuming El Penon can get back on track.

Pan American – Gold Segment AISC & AISC Margins – Company Filings, Author’s Chart Pan American Silver Segment AISC – Company Filings, Author’s Chart

Overall, the margin performance in Q3 was weaker than I expected, but Pan American was bailed out by higher metals prices and it was an unusually weak quarter for two of its most productive assets. On a positive note, the company is sitting on ~$390 million in cash and just over $300 million in net debt and is positioned to be able to invest in growth and asset optimization its assets after a very solid start to portfolio rationalization just six months after the Yamana deal closed. So, while the recent results weren’t anything to write home about, the company is making the right moves to position itself for the future and I would expect a much better Q3 next year with La Colorada mining higher grades and hopefully closer to 10,000 tonne per day processing rates at Jacobina.

Valuation

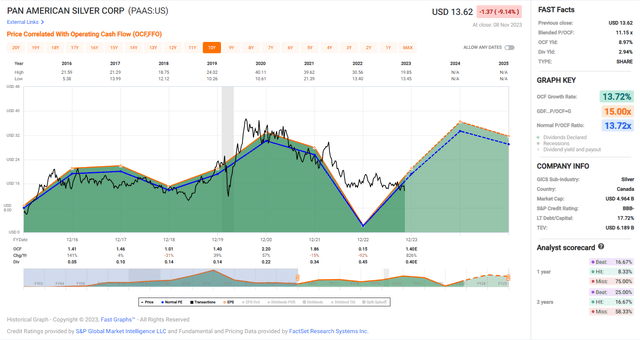

Based on ~365 million shares and a share price of US$13.80, Pan American trades at a market cap of ~$5.04 billion, down from a peak market cap of ~$8.4 billion at its 2021 highs. This is although Pan American has a much stronger portfolio today with several stronger assets, as well as a much better development pipeline with La Colorada Skarn, La Arena II (more likely to be sold), Escobal, the potential for Jacobina Phase 4 and possibly Jacobina Norte long-term, and other lower-capex opportunities like potential expansions at Minera Florida and Cerro Moro. And besides trading at a much lower market cap, PAAS also trades at a significant discount to its historical multiple with it currently sitting at just ~7.0x more conservative estimates for FY2024 operating cash flow ($1.95) vs. a 10-year average multiple of ~13.7. Meanwhile, the stock has gone from trading at a premium to net asset value to a discount (~$5.04 billion vs. estimated net asset value of ~$5.8 billion) which is quite rare among the silver producer space.

Pan American Silver Historical Multiple – FASTGraphs.com

So, what gives the current disconnect?

For starters, while Pan American has undoubtedly added some exceptional assets after scooping up all of Yamana’s producing and advanced development-stage assets (ex-Malartic and Wasamac), margins have declined materially for its legacy assets because of inflationary pressures. In fact, year-to-date costs are materially higher than they were in FY2020 when the stock peaked (~$16.00/oz vs. ~$11.40/oz for silver / ~$1,350/oz vs. ~$1,010/oz for gold) despite the addition of lower-cost Yamana assets. And while we should see costs improve next year with a full year of contribution from the Yamana portfolio and a better year out of La Colorada, the reality is that margins have made little progress despite higher metals prices. Second, while the added diversification is a positive (more mines and less concentration jurisdictionally), Pan American has turned into more of a gold producer vs. a silver producer and this can have a negative impact sometimes as a premium is often assigned to silver producers.

Pan American Portfolio – Company Presentation

Finally, while there’s no question that Pan American is a stronger company today following the Yamana deal and got a very reasonable price for the Yamana assets in its tag-team deal with Agnico Eagle (AEM), we have seen severe multiple compression sector-wide. This is evidenced by some of the largest gold producers trading at multi-year lows on a P/CF basis despite the gold price within 10% of all-time highs. Hence, I would argue that a more conservative multiple for PAAS is 11.0x cash flow vs. its historical multiple of ~13.7. And while it previously looked like we could see PAAS enjoy a meaningful increase in FY2024 cash flow, La Colorada continues to suffer from ventilation constraints (expected to affect H1-24 production as well) and inflation has remained stickier than I previously expected, suggesting that a more conservative FY2024 cash flow estimate is ~$720 million or ~$1.98 per share. If we multiply this figure by a fair multiple of 11.0, this translates to a fair value for the stock of US$21.80.

Although this represents a 60% upside from current levels, I am looking for a minimum 40% discount to fair value to ensure a margin of safety for mid-cap stocks, and especially those that are volatile like PAAS. Hence, while there’s no question that PAAS is one of the more undervalued names in the sector today, I remain on the sidelines after taking profits at an average price of US$16.65 year-to-date given that the stock has been struggling to hold on to gains despite its undervaluation. That said, if the stock were to decline below US$13.10 where it would move back into a low-risk buy zone, I would strongly consider re-buying my position. For now, I continue to see more attractive bets elsewhere, and it’s tough to be overly bullish about Q4 with higher metals prices partially being offset by what will be another underwhelming quarter at La Colorada and a similar quarter for gold-equivalent ounce [GEO] production implied by the revision to the low end of guidance vs. year-to-date output.

Summary

Pan American Silver has done a solid job optimizing its portfolio and de-leveraging since the closing of the Yamana acquisition, and while the Q3 results were disappointing with the disappointing grades at El Penon and the continued ventilation-related constraints plus a brief suspension at La Colorada (armed robbery of two trailers of concentrate). The silver lining is that these appear to be short-term issues and we should see much better grades in H2-2024 at La Colorada and a return to more normalized grades at El Penon. On a negative note, FY2024 production will be softer than I expected and we’re still waiting for the completion of the ILO 69 consultation at Escobal in Guatemala with things moving slowly in regards to potentially reinstating the mining license. To summarize, while PAAS is cheap, there’s no immediate catalyst for a re-rating outside of higher metals prices. So, while I see PAAS as a top-5 way to get silver exposure sector-wide, I’m not in a rush to jump back in the stock just yet.

Read the full article here