We updated investors in our previous article in January that it wasn’t the right time to buy into Paramount Global (NASDAQ:PARA) stock, as things “could get worse.” Even though Warren Buffett’s Berkshire Hathaway (BRK.A) (BRK.B) is PARA’s largest shareholder with a 15.3% ownership (up from 14.4% at the end of 2022), PARA has underperformed the S&P 500 significantly since our caution in June 2022.

With macro headwinds intensifying, the weakness in ad spending has “come home to roost,” coinciding with significant investments in Paramount’s direct-to-consumer or DTC segment.

As such, the company was likely compelled to slash its quarterly dividends from $0.24 per share to $0.05 per share, spooking income investors and driving a massive exodus.

Accordingly, PARA fell nearly 30% yesterday (May 4), almost wiping out the gains it accumulated since the end of 2022. However, management put on a brave front as it attempted to assure investors that the move was necessary to “enhance the long-term value for shareholders and help the company move toward profitability in the streaming space.”

However, investors did not buy it, as the company’s worse-than-expected free cash flow or FCF in FQ1 likely drove the company’s decision for the dividend fallout.

Accordingly, Paramount posted a negative free cash flow of $554M in FQ1. The previous consensus estimates indicated a full-year FCF of -$775M. Even though management assured investors that it expects FCF to “turn positive” in H2FY2023, the execution risks to that outcome have increased tremendously.

Paramount maintained its outlook that the company is on track to “returning to earnings growth and positive free cash flow in 2024.” However, we assessed that PARA’s buying sentiments could remain under pressure without the support of income investors willing to buy the dips in the near term (potentially including Warren Buffett).

Paramount is still burdened by a significant debt load, with analysts’ estimates projecting a net debt/adjusted EBITDA ratio of more than 6x for FY23.

It reported an interest expense of $226M in FQ1, putting further pressure on the company’s ability to navigate near-term headwinds while dealing with earnings growth challenges. While the dividend cut is expected to save about $500M annually, PARA threw its income investors under the bus.

With PARA’s topline growth expected to remain under pressure (given Linear TV’s secular decline and potentially declining ad revenue per user over time), the company increasingly relies on its DTC segment to turn profitable.

Paramount is likely caught in a rock and a hard place. We believe that the company wants to retain its income investors but needs to invest in bolstering its DTC segment.

Notably, Paramount’s DTC segment posted revenue growth of 39% YoY (Vs. total revenue growth of -0.9%). However, DTC’s adjusted OIBDA fell 12% YoY. As such, it’s clear that Paramount continues to bank on the success of its streaming investments to drive value creation for investors in the medium term.

However, with its high debt load and increasingly challenging macro headwinds, Paramount likely had no choice but to part ways with some dividend investors (probably an understatement) as its annualized dividend yield fell to just 1.2% (based on yesterday’s closing price).

Hence, those left holding the bag are faced with a difficult choice to make. Are they convinced that Paramount’s DTC strategy will work to mitigate the secular losses from its Linear TV segment? If they do, PARA’s valuation is not aggressive now, and they could choose to add more exposure.

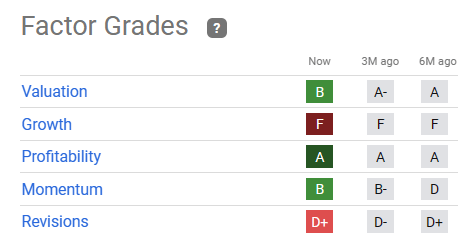

PARA quant factor ratings (Seeking Alpha)

As seen above, Seeking Alpha Quant gives PARA a “B” valuation grade, suggesting that the current levels aren’t aggressive.

However, its revisions grade of “D+” indicates that Paramount is likely facing significant challenges in lifting its earnings power. As such, we assessed that the massive dividend cut resulted from the company’s inability to navigate the multitudinous headwinds concurrently, which likely isn’t in its control.

Our price action analysis indicates that yesterday’s capitulation move likely sent income investors fleeing, de-risking the entry levels for high-conviction investors of a possible turnaround.

Usually, we would consider such opportunities as attractive to pick a buy level, as it could be reaching peak pessimism soon. However, we assessed that the structural headwinds could worsen due to macro challenges outside the company’s control. Moreover, ditching income investors to the sidelines could be a recipe for disaster, losing critical buying support from your most ardent followers.

Hence, we urge investors to remain patient until they observe constructive price action suggesting that investors are buying the current levels aggressively.

Rating: Hold (Reiterated).

Important note: Investors are reminded to do their own due diligence and not rely on the information provided as financial advice. The rating is also not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have additional commentary to improve our thesis? Spotted a critical gap in our thesis? Saw something important that we didn’t? Agree or disagree? Comment below and let us know why, and help everyone in the community to learn better!

Read the full article here