A Quick Take On Patria Investments

Patria Investments Limited (NASDAQ:PAX) went public in January 2021, raising approximately $512 million in gross proceeds in an IPO that priced at $17.00 per share.

The firm provides investors with access to alternative investment opportunities throughout Latin America.

I previously wrote about Patria with a Hold outlook.

I’m cautiously optimistic about Patria Investments Limited due to its current strong capital-raising results, but I’m not so sure about its ability to harvest gains at favorable valuations in a slowing global macroeconomic environment.

I remain Neutral [Hold] for Patria in the near term.

Patria Investments Overview And Market

Grand Cayman, Cayman Islands-based Patria provides global investors with access to institutional equity investments in private companies in the greater Latin America region.

Management is headed by Chief Executive Officer Alex Saigh, who was previously CEO and CFO of Drogasil, a drugstore chain in Brazil.

PAX seeks investment from a wide range of limited partner types, which include sovereign wealth funds, pension funds, insurance companies, funds of funds, financial institutions, endowments, foundations and family offices worldwide.

The company seeks private firms to either invest in through minority interest purchases or through outright acquisition.

Management says more than 60% of its current limited partners have been investing in the firm for over a decade.

Major competitive or other industry participants include:

-

Advent International

-

Kinea Investimentos

-

Perfin

-

XP

-

KKR

-

Blackstone

-

Others.

Patria Investments’ Recent Financial Trends

-

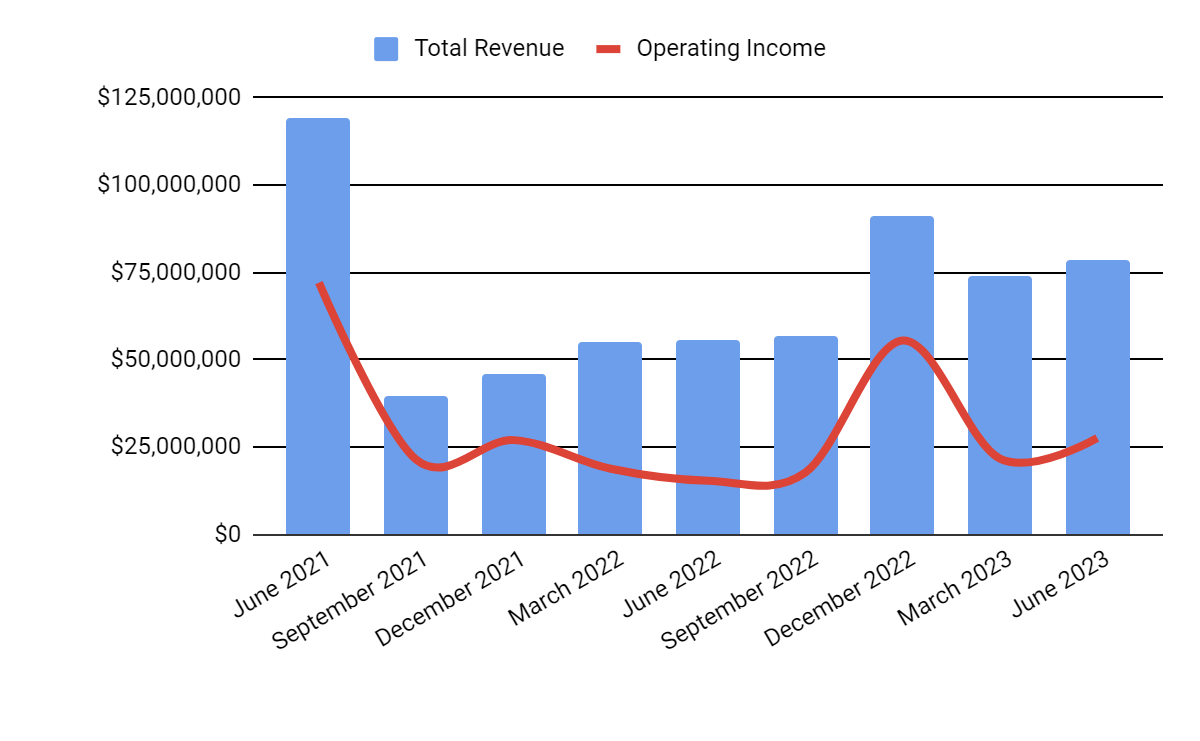

Total revenue by quarter has risen in recent quarters; Operating income by quarter has been volatile more recently.

Total Revenue and Operating Income (Seeking Alpha)

-

Gross profit margin by quarter has been fluctuating within a narrow range; Selling and G&A expenses as a percentage of total revenue by quarter have been trending higher recently.

Gross Profit Margin and Selling, G&A % Of Revenue (Seeking Alpha)

-

Earnings per share (Diluted) have been volatile in recent quarters.

Earnings Per Share (Seeking Alpha)

(All data in the above charts is GAAP.)

Valuation And Other Metrics For Patria Investments

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

6.2 |

|

Enterprise Value / EBITDA |

13.2 |

|

Price / Sales |

7.1 |

|

Revenue Growth Rate |

53.0% |

|

Net Income Margin |

37.2% |

|

EBITDA % |

47.4% |

|

Market Capitalization |

$2,120,000,000 |

|

Enterprise Value |

$1,870,000,000 |

|

Operating Cash Flow |

$81 |

|

Earnings Per Share (Fully Diluted) |

$0.77 |

(Source – Seeking Alpha.)

As a reference, a relevant partial public comparable would be Vinci Partners Investments Ltd. (VINP); shown below is a comparison of certain valuation metrics:

Valuation Metrics Comparison (Seeking Alpha)

(Source – Seeking Alpha.)

Sentiment Analysis

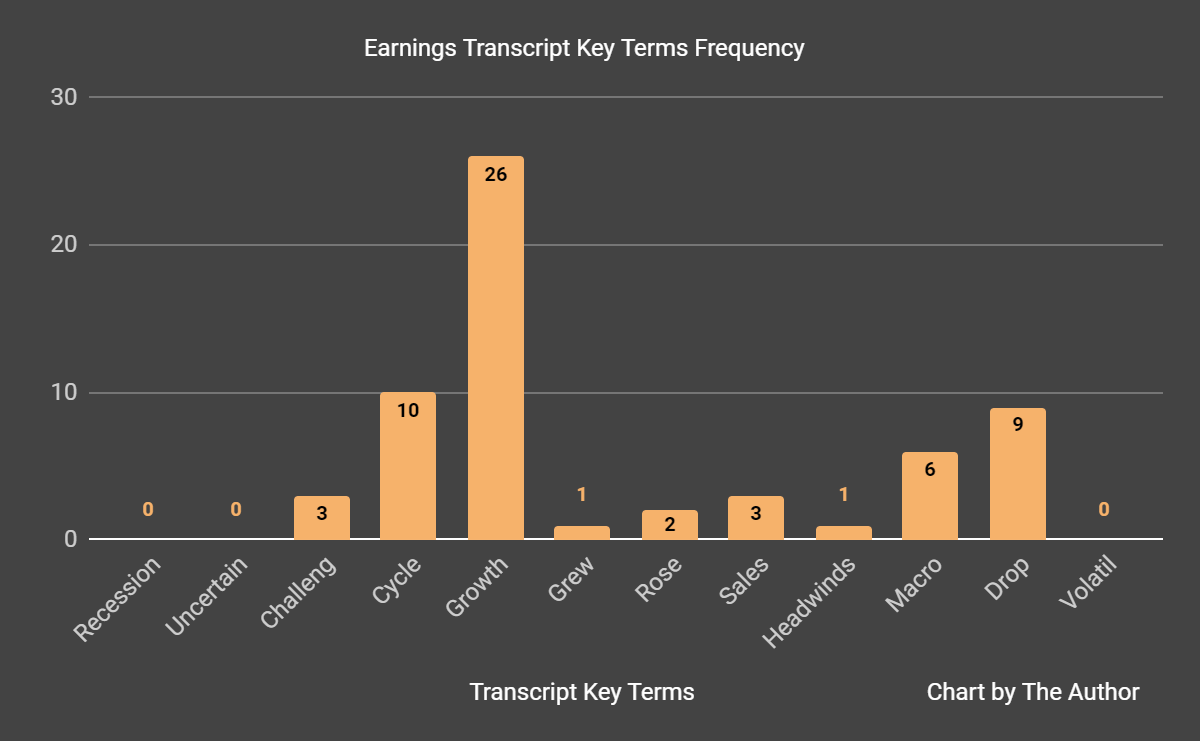

From management’s most recent earnings call, I prepared a chart showing the frequency of key terms mentioned (or not) in the call, as shown below:

Earnings Transcript Key Terms Frequency (Seeking Alpha)

I’m most interested in the frequency of potentially negative terms, so management or analyst questions cited “Challeng[es][ing]” three times, “Headwinds” once, “Macro” six times and “Drop” nine times.

This frequency of negative term mentions is a fairly significant indicator of challenging conditions for the company.

Commentary On Patria Investments

In its last earnings call (Source – Seeking Alpha), covering Q2 2023’s results, management highlighted the growth in performance fees which it views as still in the “early stages of a performance fee realization cycle.”

To that end, the firm also recorded $1.9 billion in “organic inflows through the end of the second quarter.”

Together with a Banco Colombia JV, which is expected to finalize in Q3 2023, the firm should record $3.4 billion in new capital YTD and approaching $8 billion since the start of 2022.

Management reiterated the firm is “tracking towards the four-year cycle target of $20 billion by the end of 2025.”

Total revenue for Q2 2023 rose 41.4% YoY and operating increased an impressive 79.2%.

The company’s financial position is quite strong, with $228 million in cash, equivalents and short-term investments and no debt.

Looking ahead, management sees the Latin American market as being subject to lower inflationary effects, with lower indebtedness initially allowing for tighter monetary policy followed by loosening of monetary policy in recent periods.

As a result, leadership believes there to be a political and macroeconomic backdrop that is favorable to the firm’s investing activities.

A potential upside catalyst to the stock could include an improving environment for harvesting gains through M&A or public listing.

While the U.S. public market continues to be challenging in light of higher cost of capital assumptions, if we are nearing the end of the current interest rate hiking cycle, investors may have greater predictability in their investment calculations, resulting in higher demand for IPOs and M&A.

Although I’m cautiously optimistic about Patria Investments Limited due to its current strong capital-raising results, I’m not so sure about its ability to harvest gains in a slowing global macroeconomic environment.

I’m Neutral [Hold] for Patria in the near term.

Read the full article here