Written by Nick Ackerman. A version of this article was originally published to members of Cash Builder Opportunities.

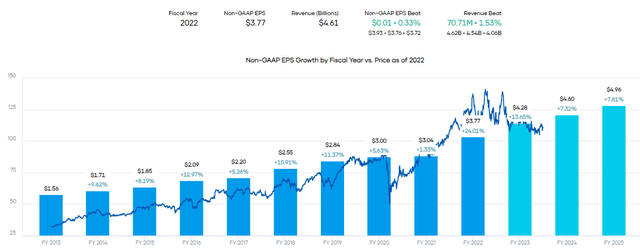

Paychex (NASDAQ:PAYX) delivered their latest Q4 quarterly earnings and, with that, wrapped up their fiscal 2023 year. PAYX has been able to deliver solid growth in earnings and revenue. That even included the COVID pandemic, where growth slowed but remained positive.

I believe this company plays an important role as a barometer for the overall market, and its outlook is always something that should be considered. They have tons of insight into small and medium businesses through their operations that drive the economy. They operate through two segments that they classify as “Management Solutions” and “Professional Employer Organization (“PEO”) and Insurance Solutions.”

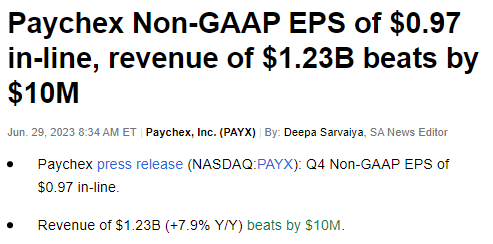

The latest results showed once again that they can continue to deliver. The EPS was in-line with expectations, and revenue slightly topped estimates.

PAYX Q4 Earnings Vs. Estimates (Seeking Alpha)

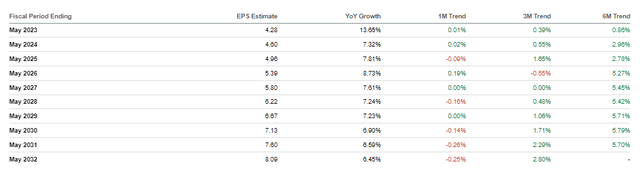

Perhaps more importantly, though, is that the hurdle for earnings has not been being revised down by analysts as we’ve seen with other companies. Instead, they’ve actually inched up. When we last looked at the company last quarter, analysts had expected $4.25 EPS for fiscal 2023. Going back to the fall of 2022, analysts were expecting $4.18 in 2023. So this isn’t a case of lowering guidance to make it easier for companies to beat expectations.

PAYX Earnings Revisions (Seeking Alpha)

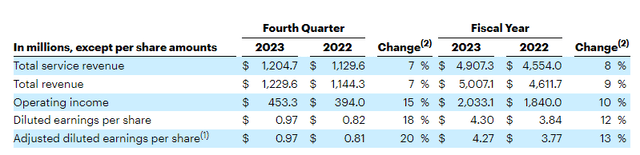

For the fiscal year, they delivered a solid 9% revenue growth year-over-year and 13% in adjusted EPS. Earnings for the year came in at $4.27 over the $3.77 posted in the prior year.

For Q4 itself, revenue grew 7% while adjusted EPS growth came in at a whopping 20% at $0.97 over $0.81 in the prior year. That helped drive strong growth overall and outpaced the EPS growth of the prior quarter.

PAYX Q4 And 2023 Fiscal Earnings Figures (Paychex)

With the outlook from PAYX in fiscal 2024, they’re anticipated revenue to grow in the 6% to 7% range. That would be a deceleration from the growth experienced for 2023. That range puts it within what analysts are expecting as well, with 2024 showing revenue could grow around 6.25%.

Perhaps more bullish for the stock is that EPS estimates are for adjusted EPS to grow in the 9 to 10% range. That’s above the 7.32% expectations of Wall Street analysts.

PAYX Earnings History and Estimates (Portfolio Insight)

That could suggest that instead of the $4.60 in earnings, the company anticipates adjusted EPS to come in around $4.65 to $4.70. In our previous update, 2024 EPS had been estimated at $4.54. So there, too, we’ve seen the hurdle move higher for PAYX instead of lower.

Operating margins came in at 40.6%, above fiscal 2022 at 39.9%. With expectations for fiscal 2024 to come in at 41 to 42%. So they’re expecting some contributions of earnings growth to come in the form of margin expansion.

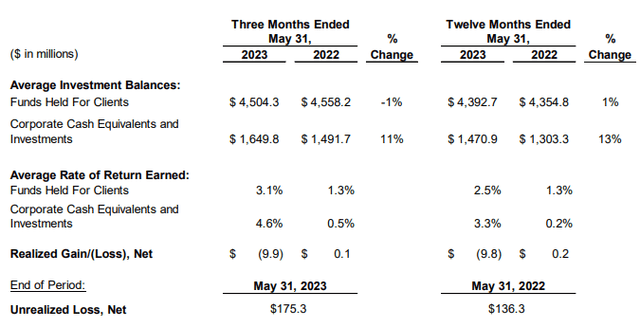

One area that’s really been helping drive the earnings for this company is higher interest rates too. Of course, their Management Solutions and PEO have delivered solid growth, but they also earn interest on funds held for clients. That resulted in $99.8 million in interest being generated for the fiscal year. That’s substantial and was a 73% increase from the prior year. The average interest rate for the last three months came to 3.1%, showing an improvement from the 1.3% in the prior year. This also was above the average 2.5% for fiscal 2023. With a few more rate hikes, we would see this going even higher. The average balance was flat year-over-year.

To look at it another way, they had an average of 360.5 million in shares outstanding at the end of the year. That was pretty consistent with the 360.8 million listed in the prior year. The point is that based on those shares outstanding, it would work out to roughly $0.28 per share in terms of earnings for the year. Not a bad earnings contributor as a “side” segment business.

With interest rates expected to potentially be cut next year, that could result in a headwind. However, the Fed still expected higher rates for longer, and we aren’t expecting rates to go back to 0% – barring a black swan event. For fiscal 2024, they’re anticipating this to contribute $135 to $145 million at the mid-point, which would suggest EPS contributions from interest at $0.39 alone. This is even with the expectation for the Fed to cut. Though worth noting, 2023 was just shy of the $100 to $150 million they had anticipated.

Another area that can hurt companies with higher interest rates is debt costs. For PAYX, debt has not been a big factor in their playbook. They have $800 million in private placement debt with a fixed rate of 4.07% for Series A and 4.25% for Series B. That was to acquire Oasis several years ago. With cash and cash equivalents of $1.649 billion, they are a negative net debt of nearly $800 million. That puts them in a situation where this interest contributes to income rather than showing an expense. Similar to the funds held for clients, they’ve seen a notable increase in the average rate of return on these funds.

PAYX Rates Earned on Cash (Paychex)

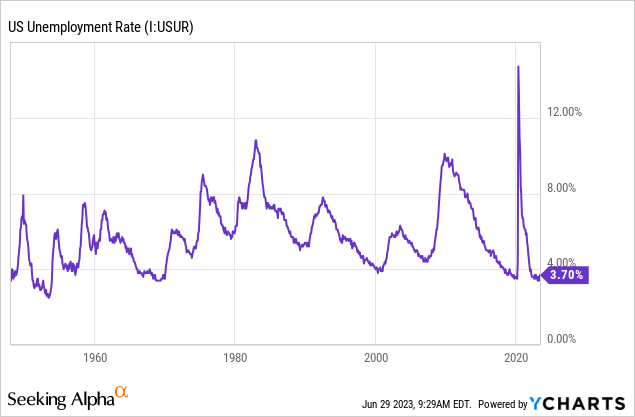

In a black swan event, that also would likely drive up unemployment which is historically low. Higher unemployment would be another significant headwind for PAYX.

Ycharts

Slowing down earnings growth was the company’s expenses climbing by 7% for the year. They continue to cite compensation costs due to both headcount and wage increases. They also list investments in their product development, technology, and marketing.” Which, of course, is a standard operating expense for any company to continue to grow going forward.

Consistent Trend of Dividend Growth

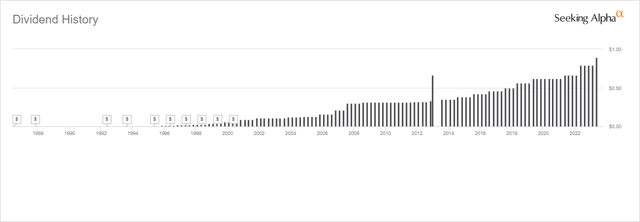

Since our prior update looking at the last quarter, the dividend was raised by a healthy amount. Taking the payout up 13% from $0.79 per quarter previously to $0.89. This is on the back of the strong earnings they continue to deliver. They have a strong history of raising their dividend over time, and this latest increase was a step up from the ~7% 10-year dividend CAGR they had been delivering.

However, I believe they are smart when they are raising, and while it’s been trending higher for decades, it hasn’t always meant a raise every single year consecutively. They have taken pauses during periods of extreme volatility, including the Dot.com crash, the global financial crisis and the COVID pandemic. So they’ve shown the ability of restraint when appropriate to not put undue added pressure on their balance sheet during recessions.

PAYX Dividend History (Seeking Alpha)

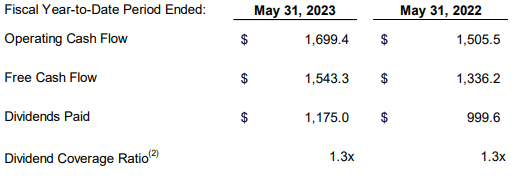

Based on the earnings estimates going forward of continued growth and strong free cash flow, the dividend is very likely to continue growing as well. FCF grew around 15.4% year-over-year.

PAYX Cash Flows Vs. Dividend (Paychex)

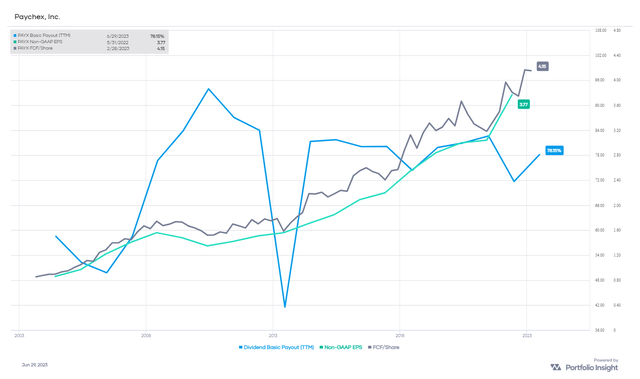

While the company pays out a higher payout ratio, this always has historically been the case for this company. In fact, if anything, the current payout ratio is a touch below usual, as it has frequently been above 80%.

PAYX FCF And Payout Ratio (Portfolio Insight)

Valuation Suggests Some Upside

When looking at the current price, the company is trading at a multiple above the market. Though perhaps deservedly so for the strong results, they’ve been able to regularly put up.

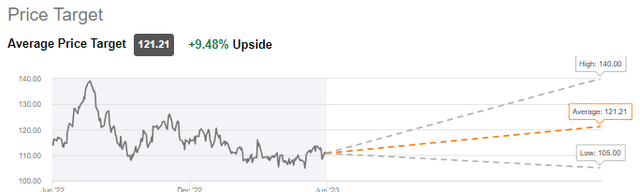

However, this also is another case where that isn’t all that unusual for PAYX. Instead, if we look at it historically over the last decade, the company is trading just below its fair value estimated P/E range of around 25x to nearly 30x. This translates to roughly $115 to $138 based on next year’s estimates, which we know are below what PAYX is expecting itself.

This also is close to the average consensus price target from Wall Street Analysts as well, which comes in at $121.21. Even the low price target is $105, suggesting that Wall Street currently doesn’t anticipate much in terms of downside. That said, the consensus is pretty neutral with a “Hold” rating.

PAYX Price Target (Seeking Alpha)

Conclusion

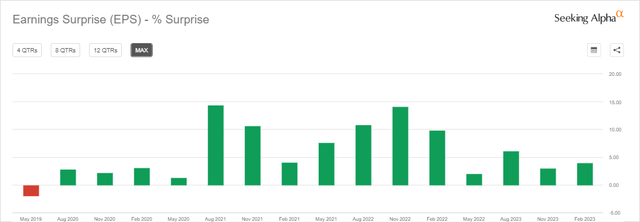

Ultimately, the latest earnings were strong, and the outlook remains strong. If you’re looking for a negative, I suppose the long string of sizable earnings surprises to the upside has ended simply by only coming in-line with expectations.

PAYX EPS Earnings Surprise History (Seeking Alpha)

The valuation might not put it at a level where it’s a steal, but it’s not necessarily overvalued either. Besides, most companies with decent growth trends don’t come cheap. For a long-term investor, one can look forward to being rewarded through its growing dividend and potential appreciation in the future.

Read the full article here