Investment Thesis

I consider Paycor HCM, Inc. (NASDAQ:PYCR) to be a promising investment opportunity in the long term. The company has a comprehensive platform for payroll, workforce management, talent management and other HCM applications, along with strong referral business from Paycor’s benefits brokers, and an open-system approach sets up the company for secular share gains from legacy providers and in-house CPAs. Paycor’s key differentiator in human capital-management software for small businesses is its vertical expertise, specializing in health care, food and beverage, professional services and manufacturing. Paycor has a competitive product that can capture market share in a TAM that is still dominated by legacy vendors. The current valuation appears attractive, with a reasonable price-to-sales multiple in line with its SaaS peers.

Strong Q3 Results & Favorable Outlook

Paycor delivered better-than-expected results, driven by strong pricing growth and an increase in revenue per employee per month by 15%. The company also experienced a 6% growth in employee count among its clients. Paycor’s outlook is optimistic, with a stable demand environment and labor market and flat customer-employee growth expected. Key verticals such as food and beverage, manufacturing, healthcare, and professional services show no significant changes. The talent module within their Workforce segment stands out, with management noting its trajectory as being as significant as payroll and human resources.

Paycor continues to invest in its go-to-market capabilities and direct sales teams to improve win rates and expand average deal size. In the medium term, the company appears to be prioritizing the upmarket opportunity over expanding down-market, which is expected to improve retention rates and PEPM through better attachment rates. The company remains on track with its expansion into Tier 1 markets, targeting a 20% growth in sales headcount to drive sustainable top-line growth. However, there are questions about when more substantial leverage in the business model will be observed beyond the impact of float.

Full HCM Solution Coverage for SMB

Paycor’s health-care program is configured to meet payroll-based journal (PBJ) requirements and monitors nurse engagement, scheduling challenges and recruitment. The manufacturing program provides integration into ERP, certified payroll requirements and labor-cost tracking. The food and beverage program ties into points of sale and application-tracking systems where there’s high industry turnover. Professional services has analytics for retention, gender and diversity tracking and compensation capture. Industry solutions are high-touch implementations with specialist support for industry vertical legal requirements and other analytics.

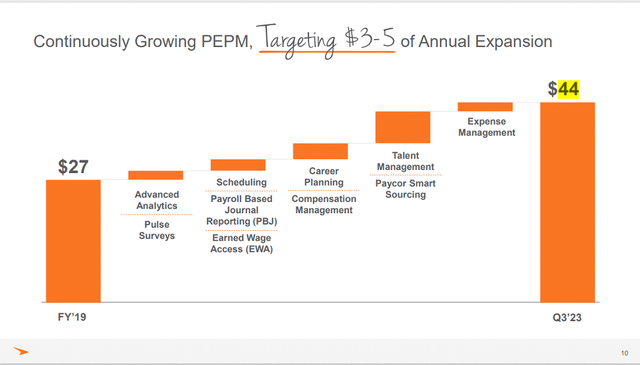

Portfolio reaches $44 per employee per month (PEPM) on analytics, surveys, scheduling, payroll-based journal reporting and smart sourcing. That’s on top of employee-experience apps like onboarding, HR, wallet and compensation expenses that offer elevated cross-selling potential and likely upward momentum in average revenue per customer (currently more than $21,000). Paycor’s human capital-management product fully covers HR and payroll software, talent and workforce management, employee experience and benefits administration. According to management, the talent management module (recruiting, talent development, learning and career management) could overtake core HR and payroll opportunities in several years.

Company Presentation

Trailing Behind Peers But is Steadily Expanding

Paycor lags behind other cloud-native human capital management and payroll companies in size, with revenue less than half that of Paycom Software, Inc. (PAYC) and Paylocity Holding Corporation (PCTY), yet is poised to catch up by fiscal 2025. Despite its limited size, smaller customers (an average of 79 employees at the client), direct-sales coverage ramp-up and portfolio build-out yield free cash flow and operating margin below competitive levels by 500-1,000 bps. Paycor’s upside to consensus average revenue growth for 2023 and 2024 is limited, I believe, with gains in customer employee counts flattening, removing one of the three pillars for higher per employee per month, though bundled pricing and cross-selling appear healthy. The human capital management software segment, and Paycor specifically, isn’t immune to longer sales cycles and tech-spending scrutiny across the application-software industry, with customer additions likely capped at mid-single-digit gains. The management continues to execute to 20% revenue growth, adjusted gross margin (excluding depreciation and amortization) of 80% and adjusted operating margin of 20%.

Valuation & Financial Outlook

Paycor’s near-term focus is on a US market. Its HCM suite expansion (increasing per employee per month to $50), plus a larger potential customer, yields a significant boost to its market. The global opportunity in the early stage of cloud payroll acceptance is a long-term driver.

Vertical sectors (manufacturing, health care, restaurants and professional services), tight US labor markets and human capital-management and cross-selling potential could sustain revenue expansion in the high teens. Paycor’s target customers are small businesses with an employee per client of about 79, below Paylocity and Paycom’s average customer size. The management continues to target up-market opportunities, with a portfolio equipped for a broader range of customer segments behind extensive third-party integration. The gross margin of 70% and operating margin of 12% in the most recent quarter are progressing toward management’s long-term targets of 80% and 20-25%, but I believe are about two years away. Paycor has a human capital-management portfolio built out to $44 per employee per month, with a goal of $50 by 2024. After this build-out, I believe there could be significant margin improvement as product-development costs trail off. Paycor is expanding direct-sales team and broker coverage in existing and new markets, focusing on the 15 most populated US metro areas.

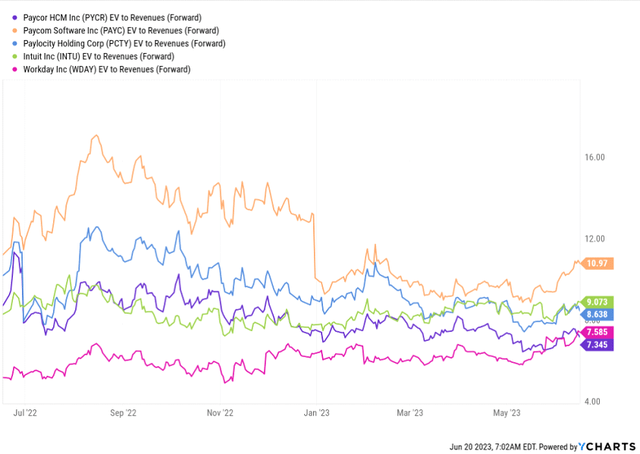

Paycor’s shares trade at 7.3x EV-to-2023 sales, a discount to peers. I keep an end of year price target of $29 on the stock based on a forward EV/Sales multiple of 8x applied to the 2024 revenue estimate.

Ycharts

Risks to Rating

The market for HCM solutions for SMBs is highly competitive and constantly changing. It consists of both established companies deeply integrated with customers and newer cloud-based firms offering advanced features. Notable competitors in this industry include Automatic Data Processing, Inc. (ADP), Paychex, Inc. (PAYX), Paycom, and Paylocity, among others. If competition intensifies or rivals successfully replicate Paycor’s functionality, it could negatively impact Paycor’s growth. Although software multiples have declined recently, they are still relatively high compared to historical levels. Additionally, the global economy is slowing down, and unemployment rates remain higher than before the pandemic. These factors increase the downside risk for companies like Paycor, as they are sensitive to macroeconomic developments such as high-interest rates.

Conclusion

Paycor specializes in providing payroll and HCM solutions to organizations. The company strives to provide users with a unified experience through a mobile-focused approach and an intuitive user interface. The company has developed a modern infrastructure that enables seamless integration with a wide range of other applications used by its customers. This modern cloud-based solution gives Paycor an edge over legacy payroll providers in terms of product offerings. I am optimistic on the company in the long term and currently have an end-of-year price target of $29 on the stock.

Read the full article here