PYPL stock: what is treasury stock?

I last wrote about PayPal Holdings, Inc. (NASDAQ:PYPL) about a month ago. As illustrated by the screenshot below, the article was titled “PayPal May Have Turned A Corner” and was published by Seeking Alpha on July 16, 2024. In the article, I argued for a “buy” rating based on the following considerations:

PayPal Holdings, Inc. stock price has remained stagnant due to EPS uncertainties. Despite EPS headwinds, I see improvement in revenues, earnings, and operating margins. Further positives include its leading market share, loyal user base, strong balance sheet, and cheap valuation ratios.

Seeking Alpha

Since that writing, the company has released its 2024 Q2 earnings report (ER) and its price also diverged by about 10% from the broader market as seen in the chart above. Thus, I thought it would be helpful to write this follow-up article to incorporate these new developments. By this time, several other SA authors had already reviewed the Q2 ER (which was released on July 30) and dissected the numbers in various ways. Hence, here I will focus exclusively on one factor that has not been discussed at all thus far: its sizable treasury stock. In the remainder of this article, I will explain why this matters and how its valuation (already quite cheap) is even more attractive than on the surface once the treasury stock is considered.

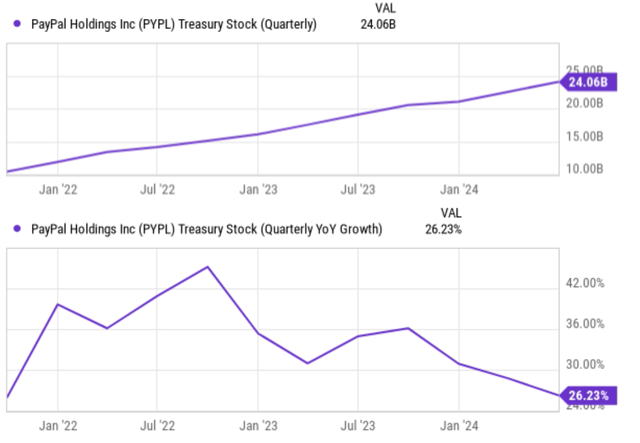

I assume many investors probably never paid attention to treasury stock (or treasury shares). So let me start with a brief introduction to better prime the more in-depth discussion. Treasury stock, also known as treasury shares, is stock that a company buys back from its shareholders. The company then holds the stock for future use (more on this later). For PYPL, its treasury stock has grown to a record $24.06B as of Q2 2024. More specifically, the chart below shows the treasury stock and its YOY growth for PYPL stock. As seen, PayPal’s treasury stock has been consistently increasing at a rapid pace recently. The year-over-year growth rate has been above 20% in the past 5 years, every year.

Next, I will explain where the treasury stock comes from and what it means for PYPL’s return potential.

Seeking Alpha

PYPL treasury shares: where do they come from?

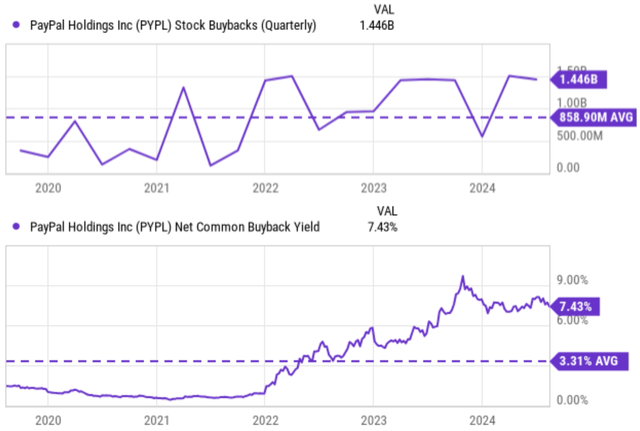

As aforementioned, treasury shares come from shares repurchased from shareholders. The company has been aggressively buying back its own shares recently – a strong sign of its healthy cash flow and an indication of the attractive valuation of its shares. More specifically, the next chart shows PayPal’s quarterly stock buybacks and net common buyback yield in the past 5 years from 2020 to 2024. As seen, buybacks peaked at approximately $1.5 billion per quarter for several quarters. The average buyback value is around $858.9 million during this period, translating into a net common buyback yield of 3.31% on average. The current buyback yield of 7.43% is far above the historical average.

After a company repurchases its own shares, the company can choose to remove the stock permanently from circulation (aka, retire the shares). Alternatively, the company can record it as a contra-equity account on its balance sheet, which then becomes the treasury stock we are talking about here.

Next, we will take a closer look at it and I will explain why the large treasury stock creates more value for shareholders than on the surface.

Seeking Alpha

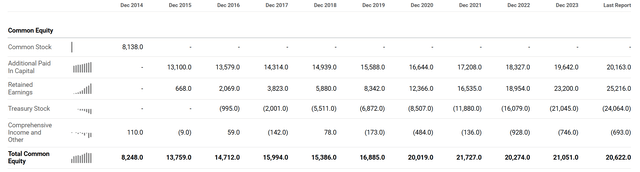

PYPL stock: treasury stock is hidden treasury

As just mentioned, treasury stock is recorded as a contra-equity account in the balance sheet. Specifically for PYPL, the chart below shows its treasury stock in the past 10 years. As seen, it started at a negligible amount of $995 million in 2014 and rapidly grew to the current record amount of $24.06 billion. Of course, many companies hold treasury stock. It is just in the case of PYPL, its holdings are too large to ignore either in comparison to its total common equity (as seen in the chart below) or its market cap (about $66B as of this writing). The sheer magnitude, combined with its current valuation, makes it a large upside catalyst for shareholder returns in more view.

Seeking Alpha

First, a large share buyback (to create treasury stock in the first place) can potentially create more value for PYPL shareholders than holding cash or paying cash dividends for many reasons. Cheap valuation (more on this later) and tax advantage are the top two on my list.

Second, compared to retiring the repurchased shares, there are also some key advantages for a company to hold treasury stock. The advantages can come in various forms and shapes, but the essence can be summarized in one word: flexibility. By holding treasury stock rather than retiring it, a company maintains the option to use these shares as it sees fit. For example, PYPL can re-issue these shares in the future to raise capital when it needs. PYPL could also use the treasury stock to fulfill stock options they’ve offered to executives as part of their compensation package. Such flexibility is more potent than on the surface (although a $20B+ position is already quite potent on the surface) as explained next.

Other risks and final thoughts

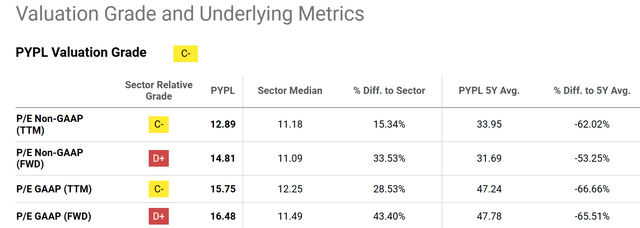

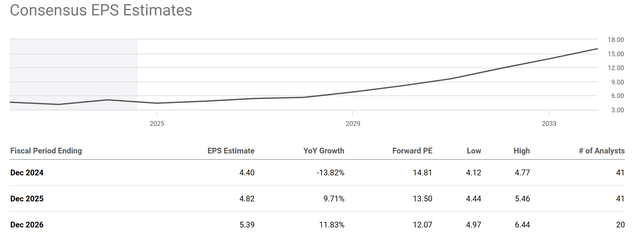

A factor many PYPL bulls quote is the cheap valuation. Indeed, the stock’s current P/E is very attractive both in absolute terms and relative terms. The chart below summarizes PYPL stock’s valuation grade. As seen, its shares are trading at only 12.89x P/E on a TTM and non-GAAP basis. This is more than 62% lower than its 5-year average of 33.95. The valuation discount is even deeper than on the surface when the above large treasury stock (and growing common equity) is considered. Even if the company’s earning power does not improve, the company should be worth more by simply hoarding cash. In PYPL’s case, the earnings power is projected to grow at robust rates (see the second chart) and thus I expect the potency of its treasury stock to rise in tandem.

Seeking Alpha Seeking Alpha

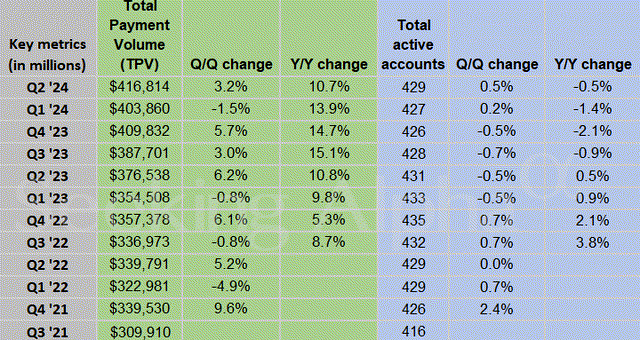

In terms of downside risks, the number of active accounts has been stagnating lately. The chart below shows the total active accounts of PYPL stock in recent quarters. As seen, the number peaked at 435 million accounts in Q4 2022. The growth rate then started fluctuating since then. On a year-over-year basis, the number has declined by 0.5% in Q2 2024 to 429 million. Judging by its Q2 numbers, it seems to me that some increased activity among the existing customer base helped to offset the impact to some degree. Looking further out, it’s unclear to me how/whether the number can resume its previous growth rates given the current utilization rate of the platform by merchants and also the overall macroeconomic environment.

All told, my verdict is that the stock offers a skewed return/risk profile under its current conditions. At its current P/E of around 15x with double-digit EPS growth projection, PayPal Holdings, Inc. stock offers an appealing GARP opportunity (Growth at a reasonable price). Its valuation is even more attractive than on the surface, considering the sizable treasury stock. As a thought experiment for illustrative purposes, retiring all its existing treasury shares today would instantly reduce its share counts by about one-third (at today’s share prices), thus boosting its EPS and lowering its P/E by the corresponding amount.

Seeking Alpha

Read the full article here