Even though no stock analyst is perfect, what they say can have a huge impact on the market’s perception regarding publicly traded companies. One of the latest examples I could point to regarding this involves innovative health company Peloton Interactive (NASDAQ:PTON). After seeing its stock downgraded by Wolfe Research, shares of the company plunged 8.2% on June 21st. This represents just the latest example of what has been a rather painful downward trend in recent months. Personally, I never take for granted what other analysts say. However, I do investigate their claims critically. And based on what data has been provided by Zach Morrissey at Wolfe Research, I must say that I am in general agreement with his assessment.

Concerns regarding Peloton Interactive

In August of last year, I ended up writing an article wherein I downgraded Peloton Interactive from a ‘hold’ to a ‘sell’. At that time, I talked about how revenue and profits were worsening. Management was taking drastic steps at that time in order to reduce costs and to boost sales. However, I felt as though some of those initiatives could ultimately hurt the business more than help it. All of this uncertainty, combined with the financial performance of the company in the quarters leading up to that point, led me to become rather bearish and to caution investors to ‘tread carefully’. Since then, my ‘sell’ rating has played out quite well. Even though the S&P 500 is up 4.1% over this time, shares of Peloton Interactive have you seen downside of 33.4%.

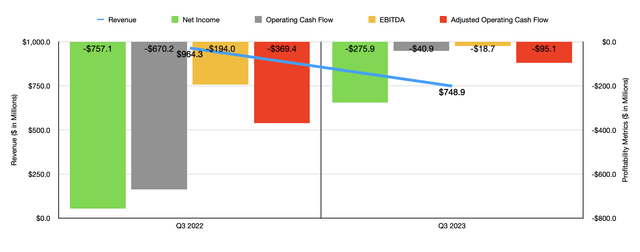

Author – SEC EDGAR Data

Fundamentally speaking, the picture for the company has remained problematic. To see what I mean, we need only look at data covering the third quarter of the company’s 2023 fiscal year. During that time, revenue came in at $748.9 million. 22.3% over the $964.3 million the company generated one year earlier. Normally when you see revenue decline this significantly, you would expect to see sales drop across the board. However, there was one bright spot for the company.

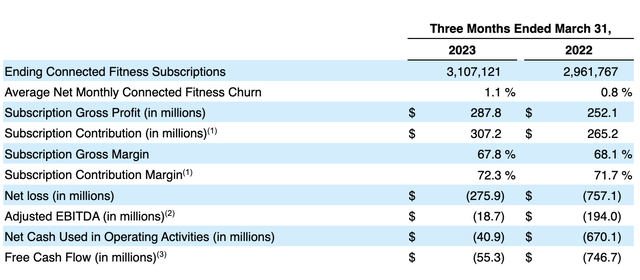

Subscription revenue actually spiked from $369.9 million in the third quarter of 2022 to $424.7 million the same time this year. That’s a year over year increase of 14.8%. This move higher was driven by an increase in the number of connected fitness subscriptions that the company had active. This number came in at nearly 3.11 million at the end of the most recent quarter. That’s up from 2.96 million reported one year earlier. The weakness for the company, then, came from its sale of connected fitness products. Revenue here dropped from $594.4 million to $324.1 million. This decrease was primarily attributable to fewer exercise machines and accessories that the company sold. Management chalked this decline up to a return to more normal home fitness patterns following strong demand for its offerings during the COVID-19 pandemic.

On the bottom line, the picture has improved. But that doesn’t mean that it’s great. The firm went from generating a net loss of $757.1 million in the third quarter of 2022 to generating a net loss of $275.9 million the same time of the 2023 fiscal year. One of the big drivers behind this improvement was a narrowing of the negative gross profit margin that the company achieved when it came to its connected fitness products. This number went from negative 11.4% to negative 5.4% in the course of a single year. Lower inventory reserves and write downs and reduce payroll expenses associated with the company’s restructuring efforts aided on this front. As a percentage of revenue, sales and marketing expenses also improved, dropping from 23.6% of revenue to 20.6% as a result of reduced advertising and marketing activities, as well as lower personnel related expenses caused by the firing of some employees.

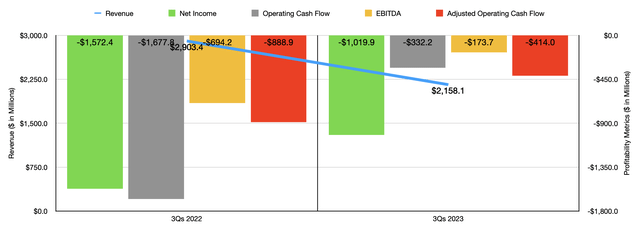

Author – SEC EDGAR Data

Other profitability metrics followed a similar trajectory. Operating cash flow went from negative $670.2 million to negative $40.9 million. If we adjust for changes in working capital, we would see this number decline from negative $369.4 million to negative $95.1 million. Meanwhile, EBITDA for the company turned from negative $194 million to negative $18.7 million. As you can see in the chart above, the third quarter was not the only time that results looked similar to this on a year over year basis. For the first nine months of 2023 as a whole, sales plummeted while profits and cash flows improved.

When I look at all of this data, I see a company that is still very much troubled. But I also see some bright spots. The cost cutting initiatives implemented by management are promising. On top of that, I like seeing the significant increase in subscription revenue. When it comes to companies like this, I have long maintained that the real opportunity is on the subscription side. This is because, even though the sales component might be lower than what the company can get from selling its equipment and accessories, the margins are higher. This is obvious when you look at the gross margin associated with subscription revenue. While this number was negative to the tune of 5.4% for connected fitness products in the most recent quarter, it was positive to the tune of 67.8% when it came to subscription offerings. Add on top of this the fact that the number of subscribers did increase year over year, and that churn, while certainly elevated, is only around 1.1%, and I can see some pathway whereby the company might survive.

Peloton Interactive

But when you look deeper into the picture, you understand just why a firm like Wolfe Research would be so bearish on the company. Morrissey’s belief, for instance, is that there is an unclear path for the company to reach the point of being profitable on an ongoing basis. This includes there being uncertainty about its ability to become free cash flow positive. Lower demand for the company’s offerings for a longer period of time can also prove to be problematic. These were the primary thoughts that led to Wolfe Research assigning a $6 price target to Peloton Interactive. Even now, that would represent a further decline of 20.8%.

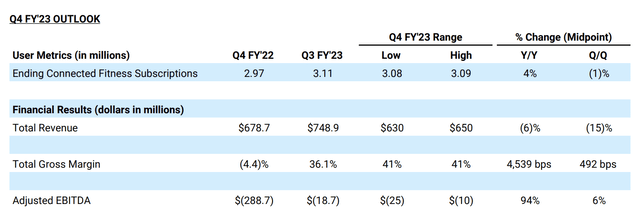

It may seem odd for me to agree with this assessment when I just previously stated that year over year subscription data was promising. This disparity has been caused by even management’s own opinion that the company lacks any real growth opportunities at this time. In its third quarter earnings release, the company revealed some guidance for the final quarter of the 2023 fiscal year. The expectation is that revenue will come in at between $630 million and $650 million. If this comes to fruition, it would definitely represent a decline compared to the $678.7 million the company reported the same time last year.

Peloton Interactive

This is not to say that everything is bad from a future outlook. In the final quarter of 2022, for instance, management reported EBITDA of negative $288.7 million. For the final quarter of this year, that number should be negative to the tune of between $10 million and $25 million. But in my mind, all of this is overshadowed by the fact that management is forecasting ending connected fitness subscriptions at between 3.08 million and 3.09 million. Even though this represents a modest amount of growth compared to the 2.97 million reported for last year, it is lower than the 3.11 million that the company reported in the third quarter of this year. In order for my bullish scenario to play off, the company needs to see growth on this front, not contraction. That blows away any real opportunity at success.

This does not mean that the company cannot ever become profitable. But even if it does, it’s likely that shares would look drastically overpriced at this time. If we assume that shares should not trade any higher than a price to operating cash flow multiple of 20 and an EV to EBITDA multiple of 20 (both of which are very high for a company achieving low growth), you would need to see the company generate operating cash flow of $134.3 million and EBITDA of $170.9 million on an annual basis. We may get to that point eventually. But I very much doubt it happening in the next few quarters.

Takeaway

Looking back to when I wrote my bearish thesis on Peloton Interactive, I do somewhat regret not assigning it a ‘strong sell’ rating instead of the ‘sell’ rating that I did. But at the end of the day, things turned out more or less along the lines that I anticipated. The picture on the bottom line is improving. But beyond that, the company has its issues. If management is correct about the number of fitness subscriptions shrinking during the final quarter of this year, then I don’t believe there is much hope for upside for the foreseeable future. Given all of these factors, I do still believe that a ‘sell’ rating is appropriate at this time.

Read the full article here