I now estimate that Permian Resources (PR) will generate around $767 million in free cash flow in 2023 at current strip prices while increasing its oil production by approximately 10% from Q4 2022 to Q4 2023. Permian’s operational performance has been good so far, but its realized prices for its non-oil production will likely be relatively weak for 2023.

I have bumped up my estimate of Permian’s value to $12 per share in a long-term $75 WTI oil and $3.75 NYMEX gas scenario. Permian’s estimated free cash flow for 2023 is a bit lower than my previous estimates, but it is also growing production faster than previously expected.

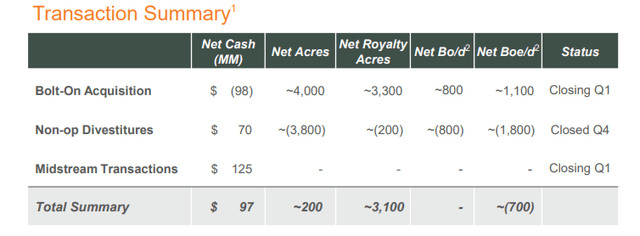

Transactions From Early 2023

Permian completed several transactions earlier in 2023. It made a $98 million Lea County bolt-on acquisition, adding 1,100 BOEPD (73% oil) in production. Permian is also gaining 4,000 net acres and 3,300 net royalty acres, along with 45 gross drilling locations.

Permian also sold non-operated producing assets in Reeves County for $60 million. These assets included 1,800 BOEPD (44% oil) in production, along with 3,500 net acres (with less than 10 gross drilling locations).

As well, Permian sold non-producing, non-operated assets in Eddy County for $10 million, which involved 300 net acres and less than 10 gross drilling locations.

Permian also executed an acreage trade in Eddy County that had little impact on its overall acreage but gave it higher working interest acreage and some nearer-term drilling opportunities.

Permian’s Transactions (permianres.com)

In addition to those land transactions, Permian divested some of its saltwater disposal wells and associated produced water infrastructure in Reeves County for $125 million at closing, with $60 million subject to repayment if Permian does not meet certain drilling requirements in the service area over the next several years.

I had assumed that the midstream divestiture would increase Permian’s costs a bit, but it provided improved guidance for its controllable cash costs (a 5% reduction per BOE). This appears to be helped by good operational performance as well as its divestiture of some higher operating cost Reeves County non-operated assets.

Updated 2023 Outlook

Permian Resources now expects to average approximately 161,500 BOEPD (53% oil) in production during 2023 at its guidance midpoint. It is targeting 10% oil production growth from Q4 2022 to Q4 2023.

At current strip prices (including $76 to $77 WTI oil), Permian is now projected to generate $2.8 billion in revenues before hedges, while its hedges add $100 million in value.

One thing to note is that NGL prices have fallen from Q1 2023 levels despite recent improvements in oil prices. I am thus modeling Permian’s NGL realizations at approximately 31% of WTI oil for 2023, after it realized 36% of WTI oil in Q1 2023.

| Type | Barrels/Mcf | $ Per Barrel/Mcf | $ Million |

| Oil | 31,025,000 | $75.00 | $2,327 |

| NGLs | 11,448,225 | $24.00 | $275 |

| Gas | 98,845,650 | $2.00 | $198 |

| Hedge Value | $100 | ||

| Total | $2,900 |

With its updated $1.35 billion capex budget, Permian is now projected to generate $767 million in free cash flow, while growing oil production by 10% from Q4 2022 to Q4 2023.

| $ Million | |

| Lease Operating, Cash G&A and GP&T | $448 |

| Production Taxes | $210 |

| Cash Interest | $125 |

| Capex | $1,350 |

| Total | $2,133 |

Permian’s $0.05 per share quarterly dividend adds up to approximately $111 million in dividends per year. This would give it $328 million to put towards variable dividends and/or share repurchases as per its return of capital framework. It could also put $328 million towards debt reduction.

Permian reported repurchasing 2.75 million shares for $29.4 million during Q1 2023, and it announced a $0.05 per share variable dividend related to Q1 2023 as well.

Estimated Valuation

In a long-term (after 2023) $75 WTI oil and $3.75 Henry Hub natural gas scenario, I now estimate Permian’s value at approximately $12 per share. I’ve tweaked my long-term commodity price estimates slightly compared to early 2023, resulting in higher expected oil prices and lower expected natural gas prices.

Permian offers a solid combination of production growth and free cash flow generation capabilities. However, it does have a lot of outstanding shares, at potentially around 587 million if its convertible notes are converted into shares. Thus, at $12 per share, Permian’s enterprise value would be close to $9 billion.

Conclusion

Permian Resources is now projected to generate around $767 million in free cash flow in 2023 at the current strip while also growing oil production by around 10% from Q4 2022 to Q4 2023. This is higher oil production growth than most of its peers, and thus, its ability to generate over $700 million in free cash flow along with that production growth is pretty solid.

I now believe that Permian is worth approximately $12 per share at my updated long-term commodity pricing estimates of $75 WTI oil and $3.75 NYMEX gas.

Read the full article here