Investment Thesis

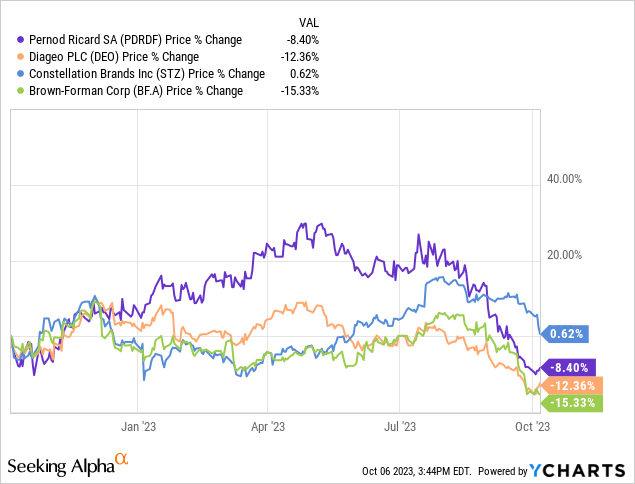

Pernod Ricard generated bulk of the sales growth in FY23 driven by pricing actions across its key markets, like most of its peers. The stock ceded most of its gains for the year and is now down 8% in last 52 weeks having lost about a fourth of its market value since August.

We believe the company is likely to face significant earnings pressure throughout FY24 and its organic sales growth is likely to be negative as a result of softer recovery in China and adverse product mix impact in the US with declining volumes and waning pricing benefits. We initiate with Neutral and await visibility on the growth in its key Asian markets, India and China.

Company Background

Pernod Ricard (OTCPK:PDRDF) is the second largest spirits company globally after Diageo with focus on premium spirits market. It has diversified operations globally with the US and China contributing about a fifth of the revenue each while India contributes about a tenth of its total revenue. It has exposure to emerging markets (Asia contributing about 40% of total revenues) and a portfolio of premium wine and spirits brands including Jameson, Absolut, Chivas Regal, and Ballantine.

Soft end to FY23

The company ended FY23 on a softer note with strong top line growth while the profitability remained a drag. Q4 organic sales growth of 19% YoY driven by growth in its European and Asian markets with US remaining a drag, primarily driven by pricing actions. Europe organic sales grew 14% in Q4 after 7% in Q3, yielding an 8% growth in FY23 while US organic sales grew 3% in Q4 after declining 10% in Q3 and reporting a 2% growth for the full year. Organic sales in India grew 13% for the year driven by price/mix with Duty-free sales growing about 40% as passenger traffic reached ~90% of pre-COVID levels.

Gross margins remained stable as pricing actions were largely offset by significant cost pressures. Advertising and Promotion as % of sales remained at 16% with the company’s focus on key brands and markets, while, discipline on structure costs helped in eking out a ~40 bps lift to the margins. Organic EBIT growth jumped 11% YoY ahead of management’s guidance of 10% growth, however, adverse FX dragged the EBIT growth by over 3%. In all, it reported diluted EPS of €9.11, up 11% YoY, missing Street estimates as a result of flattish core operating margins and adverse FX.

Challenging FY24

Pernod’s growth in FY23 was largely driven by pricing actions while volumes eked out marginal improvement, particularly in Europe and India. High single digit (HSD) pricing impact in the US implies a HSD volume decline for the year while a 6% organic growth in China and HSD pricing implies volumes were down low single digits. We believe as the pricing overlap wanes, the company could be headed to a rocky start throughout FY24. Management committed to a 4-7% organic sales growth in the medium term, however, refrained from committing to that range for FY24.

Nielsen data reported that US Spirits sales grew 6.9% YoY driven by for the last 4 weeks ending September 9, driven by double-digit growth in volumes with a 3% drag as a result of price/mix. For Pernod, pricing growth remained modest and with declining volume growth across its key brands in the US, overall sales growth remained negative for the last 12 weeks as well as the last 4 weeks ending September 9.

| Jameson | 0.2% | 6.1% | (5.5%) |

| Absolut | (2.0%) | 3.5% | (5.4%) |

| Malibu | (1.6%) | 7.5% | (8.4%) |

| Kahlua | 1.3% | 8.1% | (6.2%) |

| Seagram gin | 1.7% | 10.6% | (11.2%) |

| Glenlivet | (13.6%) | 10.2% | (21.5%) |

| Beefeater | 1.0% | 5.8% | (4.5%) |

| Chivas Regal | (8.6%) | 9.5% | (16.5%) |

| Martell | 9.0% | 7.9% | 1.0% |

| Total | (0.5%) | 1.2% | (2.2%) |

| Particulars | Sales Growth | Price Growth | Volume Growth |

Source: Nielsen. Data for the last 12 weeks ending September 9.

In addition, the contribution of premium and above value share has been gradually receding and it ceded share in the last few months which can lead to further downside risks as a result of consumers trading down.

We expect an organic sales decline in Q1 on the back of a broad base decline across all its key markets. China has shown a softer recovery, particularly in its on-trade premise and it is likely to face an HSD decline in organic sales as it laps outsized comp growth during mid-autumn last year. US continues to cede market share as a result of low margin RTD growth while the loss of its license in the key Delhi market in India would further be a drag on its overall growth. We expect a 3% decline in organic sales growth in Q1 followed by LSD growth in Q2. We believe the recovery will be dragged as a result of slower recovery in China along with the tepid outlook of US alcohol consumption with pricing benefits waning. We await the management commentary, particularly on its outlook in China, and remain on the sidelines till we have clarity. In addition, we believe operating margins to decline as a result of higher advertising and promotion costs due to volume declines and change in product mix to lower margin RTD categories.

Valuation

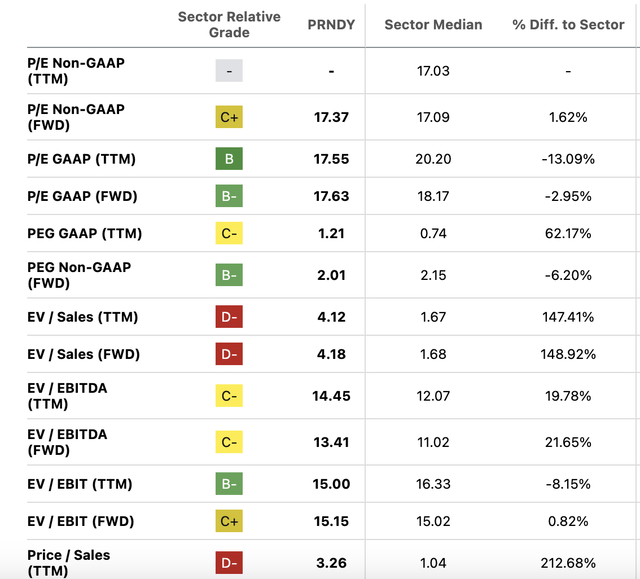

Seeking Alpha’s Valuation grade assigns a ‘C-‘ rating as it trades at an Fwd P/E ratio of 17.4x, in line with its peers and still remains slightly above its long-term average. Despite the 25% decline in its market value, the stock still does not provide a favorable risk-reward as a result of intensifying earnings pressure and a weaker demand environment, particularly in China. We initiate with a Hold rating until some visibility emerges on its recovery within Chinese on trade premise and stability in US volumes.

Seeking Alpha

Risks to Rating

Risks to rating include

1) Macroeconomic pressure leading to a decline in consumer spends which can impact volumes and product mix

2) Slowing recovery in China along with a declining sales growth in India could lead to an adverse impact on its organic growth

3) Upside risks include travel retail recovery in China could offset any decline in on-premise growth, continued market share gains in the US, increasing shareholder activity such as dividends and share repurchases

Final Thoughts

Pernod Ricard witnesses a volatile year having shed most of its gains for the year, declining by about a fourth since August. We believe despite the steep decline there are significant downside risks given the slower-than-anticipated recovery in China and headwinds within the US and India. We remain skeptical of the company’s ability to drive mid-single-digit organic growth for FY24 with management being non-committal. We believe despite the steep fall, the current valuation multiple provides a limited margin of safety and has more pronounced downside risks. Initiate at Neutral.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here