The PBR Investment Thesis Remains Robust, Despite The Cut In Payout Ratio

We previously covered Petrobras (NYSE:PBR) in June 2023, discussing its highly attractive income investment thesis, due to the combination of stellar shareholder returns and geopolitically discounted stock prices.

Combined with the company’s low break-even cost and higher Brent oil spot prices, we believe shareholders with higher risk tolerance may still benefit from the rich Free Cash Flow generation, significantly aided by the ADR’s doubled dividend payout.

For now, the PBR management has already finalized its new shareholder returns policy at 45% of Free Cash Flow generated, “including the possibility of repurchasing shares,” compared to the previous 60%.

This is an interesting choice, since the change in policy is originally attributed to the expanded low carbon investment and the Strategic Plan 2024-2028. Therefore, technically speaking, there is no real need to reduce its variable shareholder returns policy, since its Free Cash Flow generation already takes into account of capital expenditure.

For example, PBR generated $10.6B in cash from operations (-17% QoQ/ -4.4% YoY) and recorded $2.48B in capital expenditure (-29.5% QoQ/ -4.2% YoY) in FQ1’23. This triggered $8.12B in Free Cash Flow generated (-12.3% QoQ/ -4.4% YoY), of which approximately $4.19B was paid out in dividends (+3.9% QoQ), implying a 52.8% payout ratio (+9.3 points QoQ).

Therefore, it appears that the Brazilian oil/gas company is looking to drastically deleverage its balance sheet, with $29.83B of finance debts reported in the latest quarter (inline QoQ/ -15.7% YoY), especially since $3.6B is due over the next twelve months.

That is not a bad strategy for now, due to PBR’s elevated annualized interest expenses of $2.16B (-6.2% QoQ/ +2% YoY), thanks to its growing weighted average interest rate of 6.5% (inline QoQ/ +0.3 points YoY), compared to FY2019 levels of 5.9% (-0.2 points YoY).

In addition, we may see its balance sheet improve from current levels of $12.28B (+81.1% QoQ/ +10.5% YoY), further improving its net debt situation moving forward.

Therefore, PBR investors may want to recalibrate their expectations, since we do not expect to see a return of its hyper-pandemic FY2022 payout ratios of 94.3%, ADR payout of $11.39, and an approximate ADR dividend yield of 87.6%.

Then again, we believe ADR holders are not overly concerned about the updated dividend policy yet, since the NYSE ADR comprises two Brazilian shares. As a result, based on its FQ1’23 Free Cash Flow generation of $8B, we are still looking at an approximate $3.6B in quarterly dividend cash flow and $0.58 in quarterly dividends, implying 16.6% in forward annualized yield.

While this projection may be underwhelming compared to its FY2022 numbers, we are still optimistic since PBR’s forward yield remains excellent compared to its US based oil/gas producers, Exxon Mobil Corporation (XOM) at 3.49%, Chevron (CVX) at 3.80%, and Occidental Petroleum Corporation (OXY) at 1.16%.

Either way, investors may still hope for special dividends by the end of the year, after its debt and social obligations are completed. All hope is not lost, since the management still maintained its reference debt level at $65B, significantly aided by its 13Y low debt levels.

In addition, PBR investors may want to note the recovering Brent Crude oil prices of $83.28 at the time of writing, drastically improved from May and June 2023 average of $73s. This optimistic cadence will naturally flow towards its improved profitability and Free Cash Flow generation, with dividend payouts remaining more than healthy.

Market analysts and the EIA also expect optimistic Brent oil prices of $84 through 2024, echoing the management’s projection of $80 in the recent Strategic Plan 2023 – 2027. As such, income investors may still enjoy handsome yields for a little longer, thanks to the geopolitical discount.

So, Is PBR Stock A Buy, Sell, or Hold?

PBR 5Y EV/Revenue and Market Cap/ FCF Valuations

S&P Capital IQ

For now, it appears that Mr. Market has previously priced in the bad news, especially aided by the PBR management’s constant warnings over the past few quarters.

As a result, the stock still managed to retain much of its recovering valuations of NTM EV/ Revenues of 1.24x and NTM Market Cap/ FCF of 3.86x, compared to its 1Y mean of 1.06x/ 3.15x, though naturally moderated from its 3Y pre-pandemic mean of 1.74x/ 8.59x.

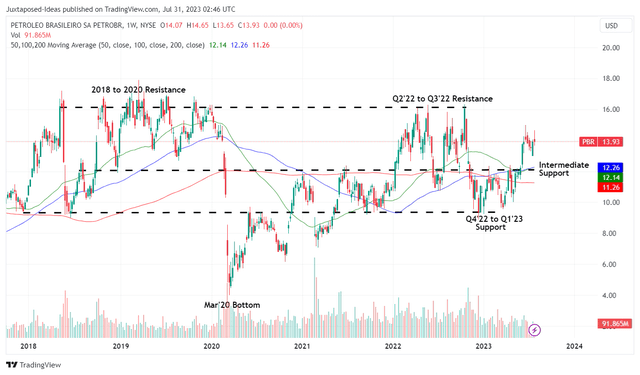

PBR 5Y Stock Price

Trading View

Depending on the potential volatility over the next few days and the FQ2’23 dividend announcement, we may see PBR retest its intermediate support level at $12s as well.

However, we maintain our buy rating on PBR, since volatility has been and will be a constant for the stock. Investors may want to take advantage of this dip and dollar cost average accordingly.

Based on its preliminary FQ2’23 production and sales report with 3,693 Mboed (-1.3% QoQ/ +3.9% YoY), it appears that we may see another decent quarter indeed.

While PBR’s sales volume of 2,824 Mbpd (-7.6% QoQ/ -9.3% YoY) appears to have been impacted by the shutdowns/ maintenance work and lower Q2’23 Brent spot prices at an average of $76s, we are not overly concerned. This is thanks to China’s growing H1’23 crude imports at +11.7% YoY, with things likely picking by H2’23.

Read the full article here