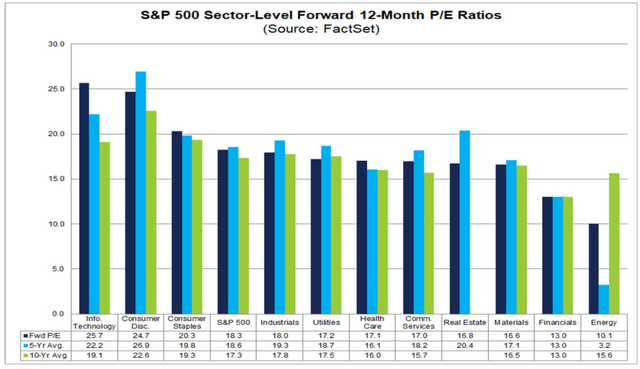

Earnings season is wrapping up. We will hear from a slew of retailers this week as well as chip-maker NVIDIA (NVDA) on Wednesday night. But with more than 90% of S&P 500 firms reporting, the corporate beat rate is strong at just shy of 80%. I noticed that the Utilities sector’s P/E has dropped back lately. At 17.2 times forward 12-month operating earnings, it is less expensive on a multiple basis compared to the SPX, according to John Butters at FactSet.

Following a ho-hum Q1 report, I reiterate my buy rating on PG&E Corporation (NYSE:PCG), but the stock is less of a bargain after a big run in the last several months.

Utilities Stocks Now Trade At A Discount To The S&P 500

FactSet

According to Bank of America Global Research, PG&E is a regulated utility servicing 13 million people in a 70,000 square mile service area in Northern and Central California. The utility has businesses in electric and natural gas distribution, electricity generation, procurement, and transmission, as well as natural gas procurement, transportation, and storage. It generates electricity using nuclear, hydroelectric, fossil fuel-fired, fuel cell, and photovoltaic (solar) sources.

The California-based $33.2 billion market cap Electric Utilities industry company within the utilities sector trades at a near-market 18.4 trailing 12-month GAAP price-to-earnings ratio and does not pay a dividend, according to The Wall Street Journal.

Earlier this month, PCG issued its first-quarter results. The EPS figure matched analysts’ estimates while the Utility beat modestly on the top line. Importantly, 2023 guidance was reaffirmed. Management expects $1.19 to $1.23 of operating EPS with 10% bottom-line growth, on average, through 2026. If that verifies, it would be among the best growth rates in the sector – part of the rationale for my buy rating.

A key risk, though, is what happens with regulatory issues in California. The CAISO RTO remains wary about wildfire risks. What’s more, uncertainty is seen with rate case decisions this year, but PCG earnings should benefit next year from higher base rates that would be effective as of January 2023.

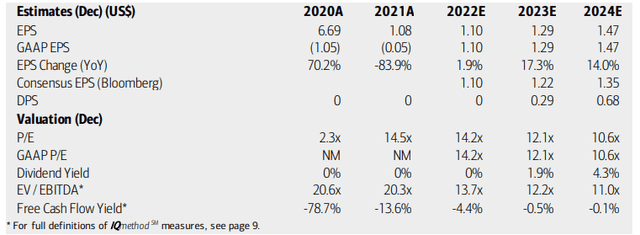

On valuation, analysts at BofA see earnings rising sharply this year with continued double-digit bottom-line growth in 2024. The Bloomberg consensus forecast is modestly less optimistic compared with BofA’s projection. While there is no dividend right now, the expectation is that a yield will resurface later this year – that has likely helped the stock price in 2023.

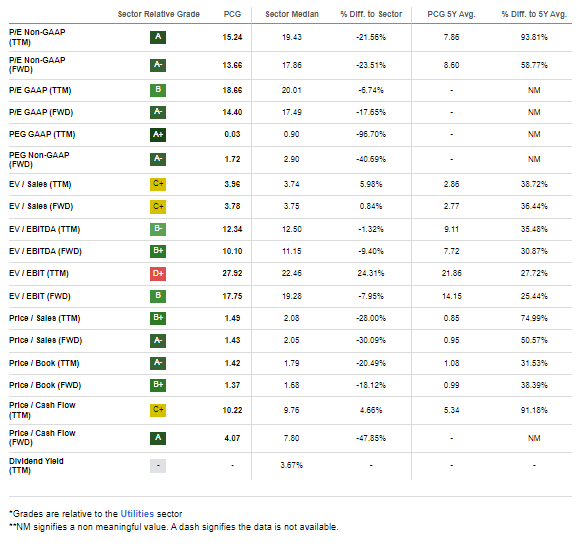

With earnings multiples now encroaching on the mid-teens, the value case is a bit less compelling, however I still assert that the stock is undervalued. Moreover, momentum is robust with PCG currently.

PG&E: Earnings, Valuation, Dividend Yield Outlooks

BofA Global Research

If we assume $1.20 of earnings (slightly above PCG’s guidance, but near the Bloomberg consensus) and a 17 multiple (slightly under the sector average), then the stock should be near $20, leaving less than $4 of upside left.

PCG: Low Earnings Multiple Metrics, Dividend Yield Likely On The Way

Seeking Alpha

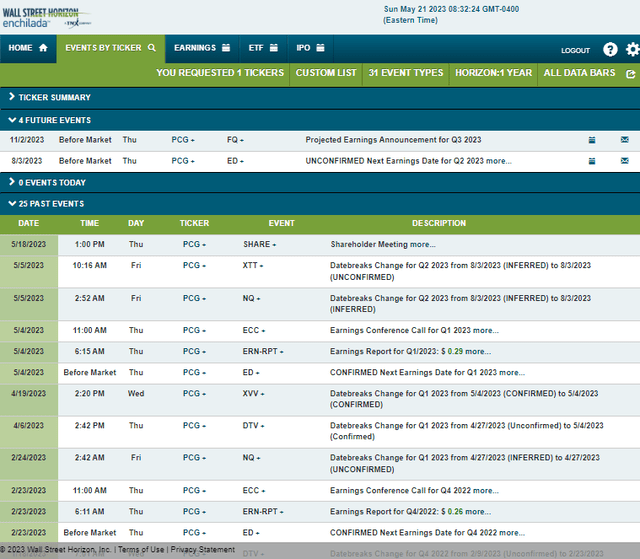

Looking ahead, corporate event data provided by Wall Street Horizon show a quiet risk calendar ahead. No noteworthy events take place until the Q2 2023 earnings report unconfirmed for Thursday, August 3 BMO.

Corporate Event Risk Calendar

Wall Street Horizon

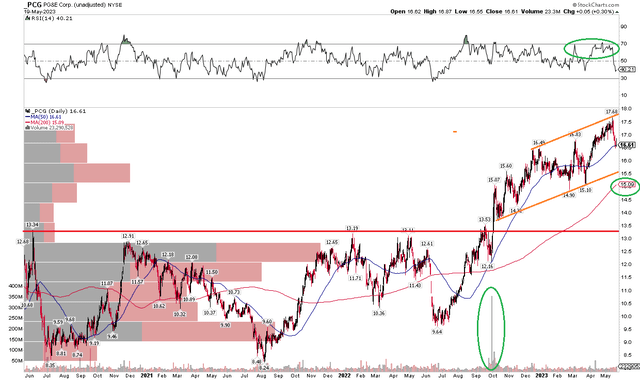

The Technical Take

PCG is doing all the right things from a technical standpoint. Notice in the chart below that shares are trending higher after breaking above prior resistance near the $13 level. The RSI momentum reading at the top of the graph confirmed the recent high in price just below $18. While the stock has declined back to the rising 50-day moving average in recent sessions, the 200-day moving average remains upward-sloped, indicating a bullish long-term trend.

We could see a further retreat to the 200-day, but there is some support around the $15 mark from prior lows in March and April. With little in the way of bearish overhead supply at current levels, PCG shouldn’t encounter a bevy of selling pressure soon. Overall, a continued long position is warranted, and even adding on a dip into the low $15s could work. $13 remains long-term support.

PCG: Gradual Uptrend, Long-Term Support Holds

Stockcharts.com

The Bottom Line

I reiterate my buy rating on PCG stock with a price target in the low $20s. With a dividend likely on the way later this year and EPS growth in the next few years, everything appears on track.

Read the full article here