Destiny is no matter of chance. It is a matter of choice. It is not a thing to be waited for, it is a thing to be achieved. – William Jennings Bryan

They wanted yield when there was none. Now they don’t want yield when there is some. And the challenge for investors today is knowing where to get the right kind of yield relative to risk. I’m not a fan of preferreds in general, but especially now given that high-quality bonds are comparatively less risky and offer just as compelling an income stream. To that end, this writing on PGX is less about the fund itself, and more about the challenges of being in preferred proxies to begin with.

Understanding the Invesco Preferred ETF

Launched on January 31, 2008, by Invesco Capital Management LLC, the Invesco Preferred ETF (NYSEARCA:PGX) is an exchange-traded fund that has carved a niche for itself in the fixed-income investment landscape. The fund’s investment strategy is centered around fixed-rate US dollar-denominated preferred securities. These are a class of equities that blend features of both bonds and common stock, thereby offering investors a steady stream of income coupled with the potential for capital appreciation.

PGX tracks the performance of the ICE BofAML Core Plus Fixed Rate Preferred Securities Index, a market capitalization-weighted index designed to measure the total return performance of the fixed-rate US dollar-denominated preferred securities market. However, the fund does not purchase all the securities in the index. Instead, it adopts a “sampling” approach, where it invests in a representative sample of securities that collectively have an investment profile similar to the index.

What Makes Preferred Stocks Attractive?

Preferred stocks are a unique type of equity offering a blend of features associated with both bonds and common stock. They’re particularly appealing to income-oriented investors seeking a steady, predictable stream of cash. Unlike common stocks, which have variable dividends and unlimited potential for price appreciation, preferred stocks pay a fixed dividend and have a par value that generally limits their price movement within a narrow range.

These securities offer substantial yields, often exceeding 5%. Additionally, preferred stockholders enjoy preferential treatment in the event of a company’s financial distress. They’re entitled to receive their dividends before common stockholders and have a higher claim on the company’s assets in case of liquidation. Furthermore, the dividends from preferred stocks are often classified as qualified dividends, which are taxed at a lower rate than ordinary income.

A Closer Look at PGX’s Holdings

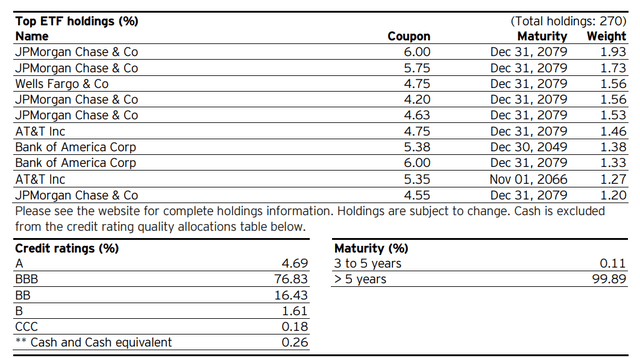

PGX’s portfolio is largely concentrated in the financial and utilities sectors. The fund holds a total of 270 different preferred stock issues, forming a diversified portfolio that mitigates the risk associated with individual securities. The top holdings of the fund include preferred stocks from reputed financial institutions such as JPMorgan Chase & Co, Wells Fargo & Co, and Bank of America Corp.

Moreover, the fund invests primarily in securities rated BBB, based on an average of three leading ratings agencies: Moody’s, S&P, and Fitch, indicating a moderate level of credit risk. It’s important to note that the fund’s credit quality may vary over time as companies issue and redeem preferred stocks.

Inveso.com

PGX’s Performance Over the Years

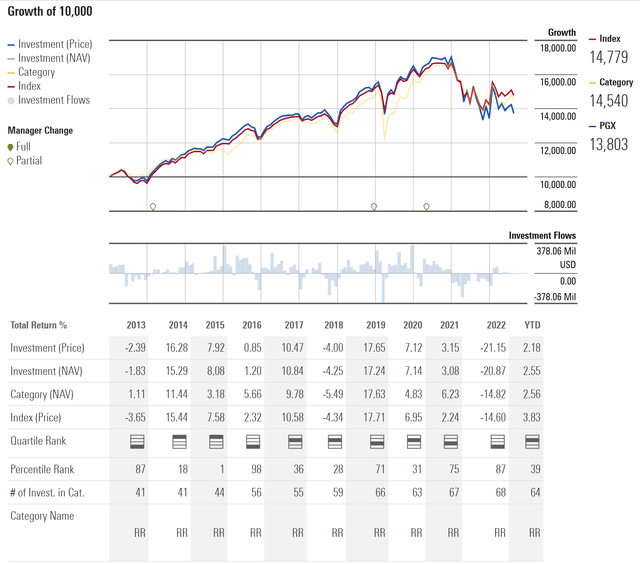

Over the past decade, PGX has been underwhelming. Yes it has consistently delivered monthly dividends to its investors, but anything heavily tilted towards Financials has broadly been disappointing.

Morningstar.com

Comparing PGX with its Peers

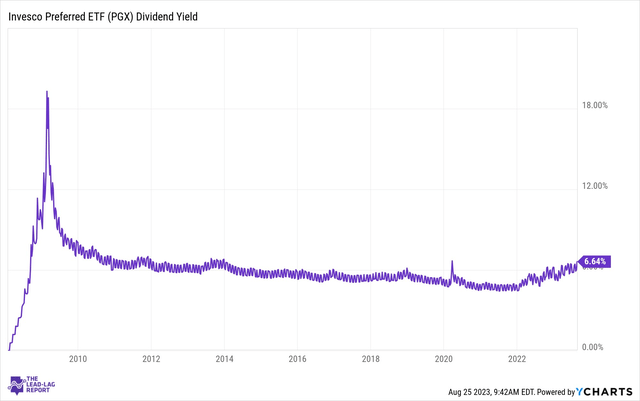

When compared with its peers, PGX stands out for its high yield and diversified holdings. For instance, the iShares Preferred and Income Securities ETF (PFF) and the SPDR Wells Fargo Preferred Stock ETF (PSK) offer yields in the range of 5-6%, which is comparable to PGX’s yield. However, PGX’s portfolio is more diversified, with a higher number of holdings. This reduces the impact of any single holding’s performance on the overall fund’s returns, thereby lowering the risk for investors.

YCharts.com

Risks Associated with Investing in PGX

Investing in PGX, like any other financial instrument, comes with its set of risks. These include interest rate risk, credit risk, and concentration risk. Rising interest rates can lead to a drop in the prices of preferred shares, thereby affecting the fund’s overall performance. Similarly, the fund’s substantial exposure to the financial sector can make it vulnerable to disruptions in this sector.

Wrapping Up

The Invesco Preferred ETF offers a unique investment opportunity for income-seeking investors. Its diversified portfolio, attractive yield, and steady performance make it a worthwhile consideration for those looking to generate a stable income stream. Having said that, I’m not a fan of this right here right now given the risk of a credit event and high-quality bonds offering attractive yields.

Anticipate Crashes, Corrections, and Bear Markets

Anticipate Crashes, Corrections, and Bear Markets

Are you tired of being a passive investor and ready to take control of your financial future? Introducing The Lead-Lag Report, an award-winning research tool designed to give you a competitive edge.

The Lead-Lag Report is your daily source for identifying risk triggers, uncovering high yield ideas, and gaining valuable macro observations. Stay ahead of the game with crucial insights into leaders, laggards, and everything in between.

Go from risk-on to risk-off with ease and confidence. Subscribe to The Lead-Lag Report today.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.

Read the full article here