Main Thesis & Background

The purpose of this article is to evaluate the PIMCO Income Strategy Fund (NYSE:PFL) as an investment option at its current market price. PFL is a closed-end fund whose investment objective is to “seek high current income, consistent with the preservation of capital”.

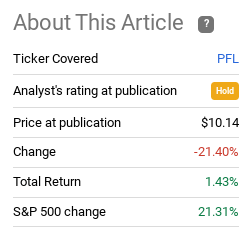

It has been a long time since I wrote about PFL CEF, but I think it is still useful to gauge how it has performed over time. When I last covered it a few years ago I was not keen on the prospect of buying this fund. I put a “hold” rating on it and, as you can see, I was spot-on in that assessment:

Fund Performance (Seeking Alpha)

With the amount of time that has passed since this review, I thought it was time to take another look at it. After consideration, there are a few reasons why I believe an upgrade in the rating is warranted here. I will discuss each of these in turn below.

High Yield Credit Poised To Deliver

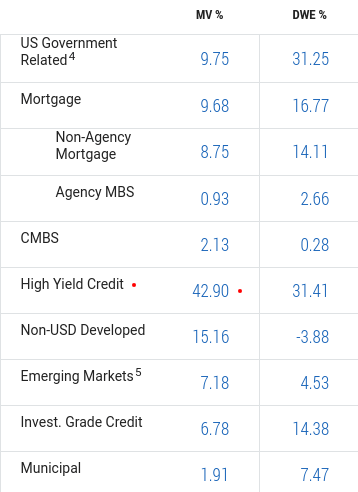

The right aspect I will consider for PFL is the fund’s sector exposure. This means a review of the high yield credit sector as it is overwhelmingly the most important holding of this CEF:

Sector Weightings (PIMCO)

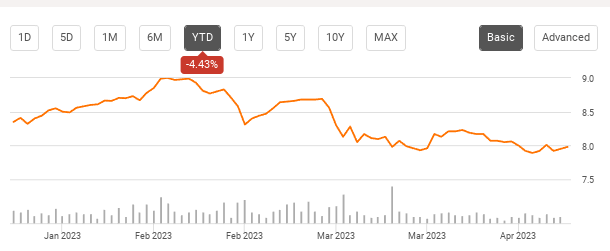

As you can see, PFL’s return is impacted considerably by this sector. So its fortunes truly rest with how high yield assets are doing. Importantly, this is a story that has become more important with time. In my review in few years back, PFL was still overweight high yield assets, but to a lower degree:

High Yield Exposure (on 9/20) (PIMCO)

So clearly this is a fund that needs the high yield sector to do well. That begs the question – is this the right move for 2023?

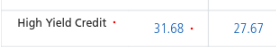

Year-to-date, it really hasn’t been. PFL has drifted lower since the year began, although that means its total return is essentially flat when we consider the monthly distributions its pays:

YTD Performance (PFL) (Seeking Alpha)

But a “flat” return isn’t really something to celebrate. This means we need to consider if the fund is positioned to perform better in the second half of the year than it has in the first.

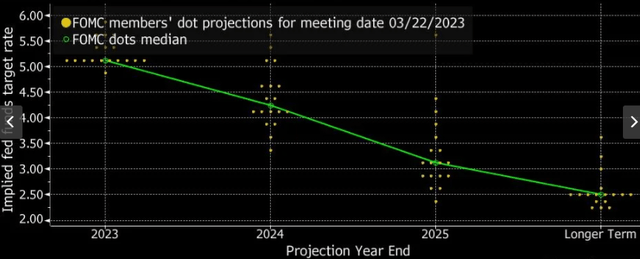

Fortunately, I do believe that is the case. This thesis rests predominately on the fact that I see the Fed nearing the end of its rate hiking cycle. I believe it will hike one more time and then pause, and the dot plot suggests this is a reasonable expectation to hold:

Fed Dot Plot (Bloomberg)

What this graphic is showing is that rates are near their peak levels now and will start to drop soon. I personally don’t see the Fed cutting rates until next year, but the market is clearly more dovish than I am. Regardless, if we are at “peak” levels now, that bodes especially well for high yield credit and PLF by extension since it owns a lot of that type of debt.

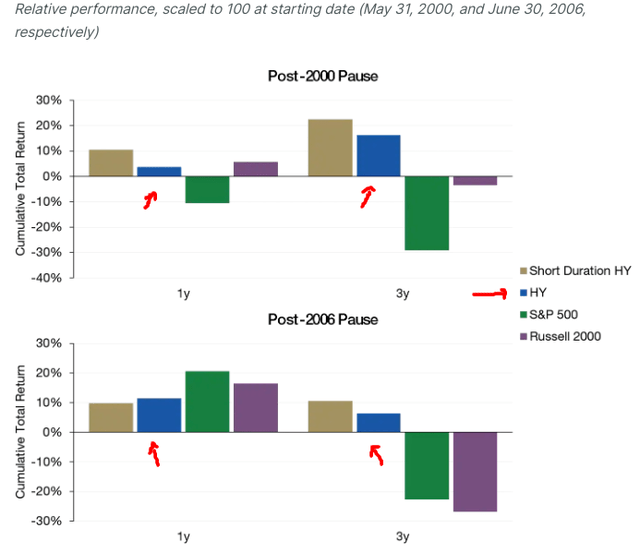

To understand why, let us look at historical returns for the sector. During the past few decades, this is an area that out-performed consistently after the central bank (the Fed) pauses its rate hiking initiative. While other sectors will also generate positive returns, the high yield sector appears to be one of the most reliable in that type of environment:

Historical Performance Post Fed Hiking Cycles (Lord Abbett)

The takeaway here is that high yield credit is expected to perform favorably once the Federal Reserve pauses its tightening cycle – which is anticipated in the next few months. That spells the potential for gains for PFL given its over-reliance on this area and is central to my “buy” rating for this fund.

Valuation Is Reasonable

The second thought for supporting positions in PFL is the fund’s valuation. When readers evaluate the high yield CEF space, there is a plethora of options. This makes paying too much for any particular fund very silly, in my opinion. Why pay an outrageous premium to own assets that own can own in a similar fund for a much better price? I can’t answer that myself (although many don’t seem to be bothered by it given how high premiums can get!).

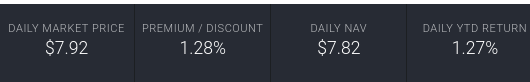

The fortunate case here is that PFL is not one such fund. While it has traded at what I consider frothy premiums in the past, that is not the case now. It sits just over NAV – so those who prefer a discount may not love it – but it is still very reasonable however you slice it:

PFL’s Metrics (PIMCO)

In my opinion this suggests buying here is a good option. The premium is minor and not really one to be concerned with. It is also much lower than the 5% level it sat at during my last review. Finally, it is noticeably lower than the two funds from PIMCO that are most similar to it: PIMCO Corporate & Income Opportunity Fund (PTY) and PIMCO Corporate & Income Strategy Fund (PCN), as shown below:

| Fund | Current Premium |

| PTY | 18.8% |

| PCN | 13.6% |

Source: PIMCO

All of these factors add up to tell me if one wants this type of exposure in their portfolio then PFL is the way to go. It is set up nicely for a Fed pause and it trades at a lower price than it has in the past and also at a much cheaper premium than its sister funds. This should help readers understand why I selected PFL as the buy candidate at this moment.

Equity Investors Getting Too Bullish?

My next point is a broad one and is indirectly related to PFL as it could be seen as a buy signal for any number of debt funds. But even still, I would use it to support a buy case as long as PFL (or another debt fund) had other attributes as well that made it a value option.

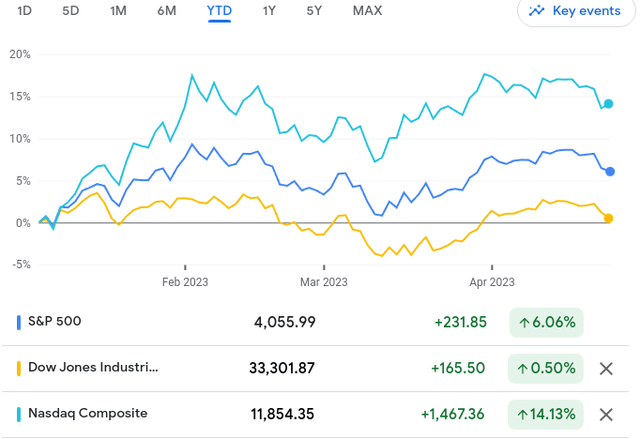

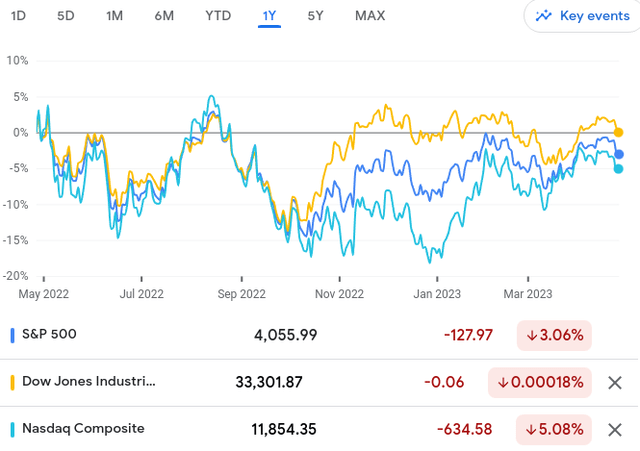

What I am referring to is how debt and credit markets compare to equity markets right now. It should be well known to readers that both 2022 and 2023 have been difficult investing environments. But 2023 has been kinder to equity investors than last year, despite the recent ups and downs! All three of the major indices are up year-to-date (albeit only slightly for the DOW), despite being down on a 1-year timeframe:

YTD Returns (Google Finance)

1-Year Returns (Google Finance)

What these graphs show is that after a difficult 2022, equities are now on the upswing. This begs the question – why consider PFL (or other debt funds) at all right now?

The answer is based on a contrarian viewpoint. I have been an equity bull until lately but now I am starting to see some optimism in the market that is making me cautious. I think the prudent position here is to take some profits, trim positions, and perhaps rotate into income-producing assets to lock-in historically high yields.

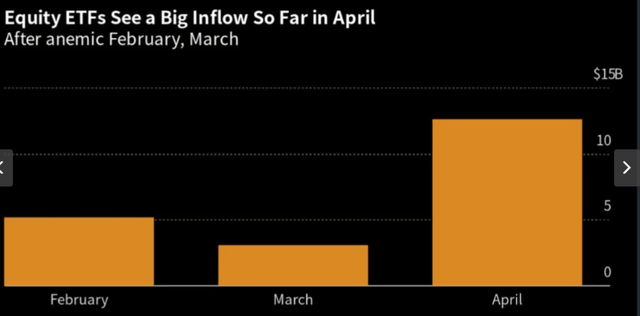

For support let us look at investor behavior. As markets have rebounded, so too has investor confidence. We can see this by gauging equity inflows. In April, so far investors have plowed money into Exchange Traded Funds (ETFs). This represents a sharp move from February and March and leaves me feeling a little uneasy that prices may be getting frothy:

ETF Inflows (Equities) (Yahoo Finance)

What this suggests to me is this is the perfect environment to get a bit cautious. There is nothing wrong with locking up some wins in a rising market – especially one like this with so many headwinds on the horizon. When I see retail investors pile in and get bullish that only reaffirms my desire for patient or caution. While PFL is by no means a risk-off play, it does give equity investors a way to diversify and rotate into an area that could perform well if the Fed does pump the brakes in the short term.

Income Metrics Should Be Monitored

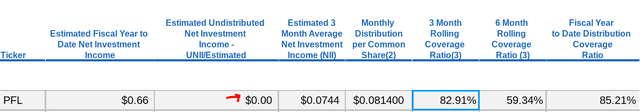

The next topic for discussion is the fund’s income stability. This is an area that isn’t the most rosy right now, so readers need to evaluate very carefully their own outlook and need for income going forward. The reason I say this is because it looks very much like PFL is not earning enough in income to cover its current stated distribution level. Its coverage metrics are weak and the inverted yield curve continues to punish highly leveraged funds like PFL and others. The most recent metrics do not give me very much confidence the current level is sustainable:

Recent UNII Metrics (PIMCO)

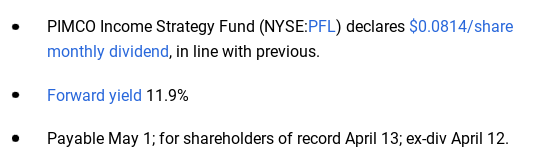

In may seem ill-advised to have a buy rating while at the same time anticipating an income cut. That is a fair criticism. But the rationale is that PFL’s yield is high enough right now that it can afford a cut and still be very attractive. At the beginning of April the fund maintained its prior distribution level which puts its current yield near the 12% mark:

Latest Distribution Announcement (Seeking Alpha)

Of course, if there is a cut, we don’t know the size of it. But if it is a dramatic 20% – 25% cut, for example, the yield will still be high enough for this climate to bring in buyers.

Let us say that does occur, for argument’s sake, and PFL dramatically reduces its payout to $.06/share. Assuming a share price of $8 (it is $7.98 at time of writing), that gives the fund a current yield of 9%. Not too bad when most savings accounts and corporate bonds are yielding in the 5% range. PFL will still offer a marked premium even after a cut. That supports why I am willing to recommend the fund even with this headwind in the way.

Bottom-line

PFL has been treading water in 2023, but I see better times ahead. For those who want high-yield CEF exposure from the PIMCO family, PFL offers a competitive income stream at a much lower premium than the average. This notably includes its two sister funds, PTY and PCN. Further, while the Fed has not suggested it will be cutting rates in 2023, there is a high likelihood of a pause after the next rate hike. I personally believe it will be the final one for the year and that bodes well for below IG credit. This is a sector that historically performs well after a Fed pause so front-running that development could be a smart move.

However, I would caution investors to not get carried away with risk at this time. PFL remains a risky, leveraged play, so even with a bullish outlook readers should stay within their own unique risk tolerance and weigh the potential that the Fed could keep rates elevated for longer. This could result in an income cut for PFL and prevent the expected rally for the underlying high yield credit sector. Therefore, while I believe a “buy” call is the correct one for PFL, I still recommend a selective approach at this time.

Read the full article here