So far, the quarterly results for banks releasing Q3 2023 earnings have mostly been accompanied by a positive market reaction, with Pinnacle Financial (NASDAQ:PNFP) being the exception. Post-market, the stock lost just over 1%, while other regional banks such as Fulton Financial experienced a 4% jump.

In this article, I will show you what the market did not like and possible future scenarios.

Profitability and growth

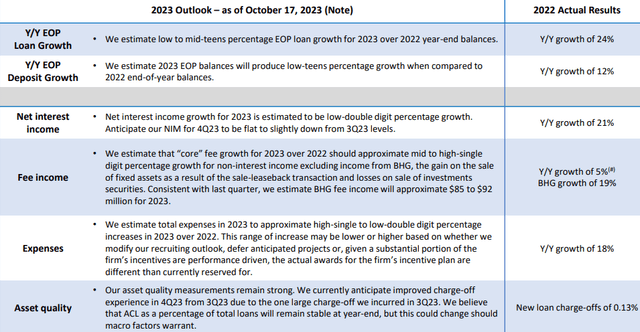

Overall, Pinnacle’s quarterly earnings report was not that bad, it simply did not meet all the expectations. EPS beat estimates by $0.08, but revenues were $11.13 million less than expected. Also, unlike some regional banks that have already released their results, Pinnacle did not improve FY 2023 guidance.

Pinnacle Financial Partners Q3 2023

Estimates remained about the same and the market did not appreciate this, probably because Pinnacle was one of the best-performing regional banks in recent months: +60% from post-crisis SVB lows. In any case, it remains a solid guidance, with growth rates above double digits in a macroeconomic environment that is not easy.

Pinnacle Financial Partners Q3 2023

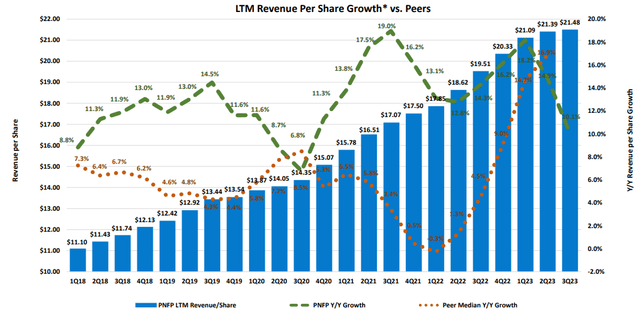

In recent years, Pinnacle grew more than its peers in terms of revenue per share, but in the last two quarters, there has been a reversal of the trend. Be that as it may, we are talking about a steady growth that only in the last few quarters has declined.

Pinnacle Financial Partners Q3 2023

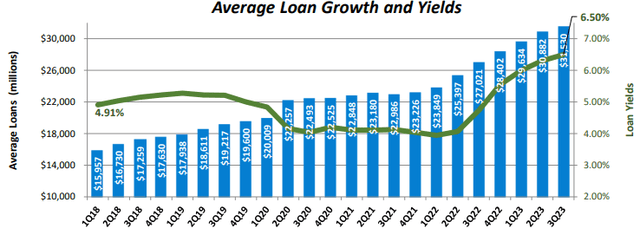

The average growth loan has accelerated since the Fed began its restrictive monetary policy, and with it, the average yield on loans has also increased, now at 6.50 percent.

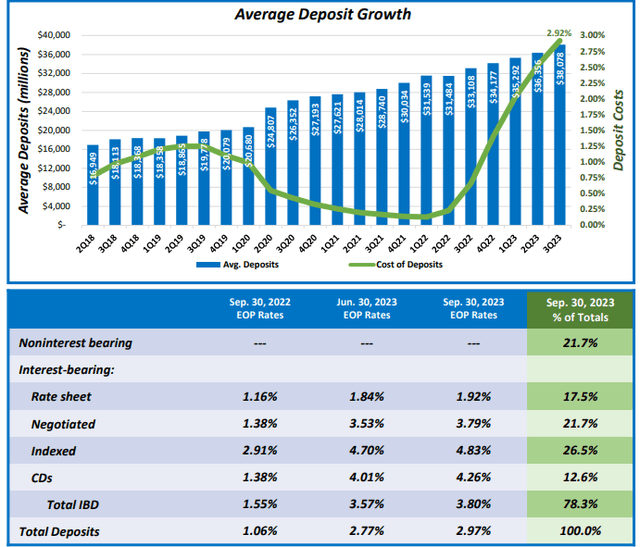

In contrast to loans, deposits have also increased, both in nominal and cost terms.

Pinnacle Financial Partners Q3 2023

To date, the cost of deposits is 2.92%, which is quite high and has increased more than the yield on loans. Current money market yields did not allow Pinnacle to keep non-interest bearing deposits high since clients were facing too high an opportunity cost. As of today, interest-bearing deposits are virtually the only way for banks to raise money from depositors, which is why their net interest margin is experiencing a gradual decline. All this reflects negatively on Pinnacle’s profitability.

Pinnacle Financial Partners Q3 2023

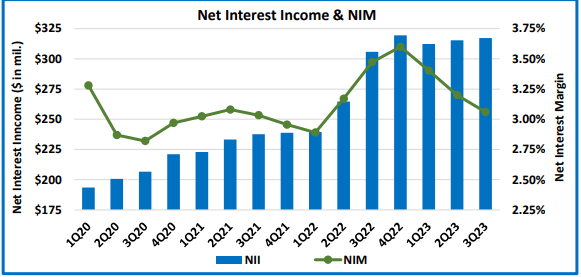

Net interest income remained stable, but net interest margin declined rapidly to 3.06%. Based on the guidance noted above, management does not expect an improvement for Q4 2023; rather, there will perhaps be a slight decline. For peers (banks with assets between $5-$49 billion) the average NIM is 3.26%, so 20 basis points higher than Pinnacle. In any case, in two weeks this could change since many banks still have to release their quarterly results.

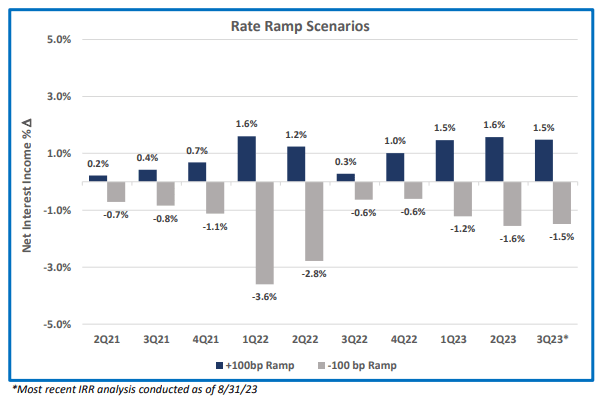

Finally, I would like to highlight the bank’s positioning relative to rate risk.

Pinnacle Financial Partners Q3 2023

If the Fed Funds Rate rises further, Pinnacle should experience an increase in net interest income; the opposite situation if it falls. Its exposure to floating-rate loans and securities makes it more agreeable to the bank that rates will not be reduced, or at least not quickly.

Unrealized losses and CRE concentration

Pinnacle is a solid bank with double-digit growth rates, but it has two main problems:

- The first is related to unrealized losses in the securities portfolio and affects not only Pinnacle but almost all banks.

- The second is related to a high exposure to CRE loans relative to regulatory capital. Typically, banks with such exposure exhibit excessive cyclicality.

Pinnacle Financial Partners Q3 2023

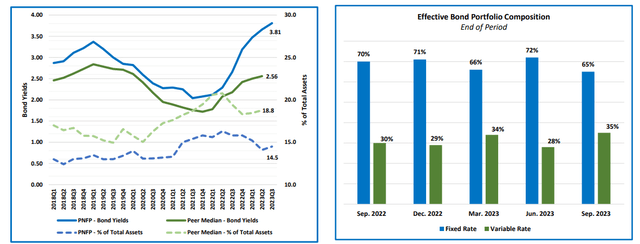

Starting with the first point, unrealized losses from both HTM and AFS securities amounted to $299 million, of which $127 million was recorded in the last quarter alone. Due to issues related to high U.S. debt and persistent inflation, T-bonds have experienced a significant increase in yield in recent months, exacerbating the difficulties of the securities portfolio. To date, the unrealized loss amounts to about 5% of equity, which is significant but less than many peers. Making the losses less severe was the composition of the bond portfolio, as more than 30% of the yields were floating rate. In fact, Pinnacle’s bond yield is 125 basis points higher than that of its peers.

In any case, these losses remain a problem to be solved since they are negatively burdening the tangible book value per share.

Pinnacle Financial Partners Q3 2023

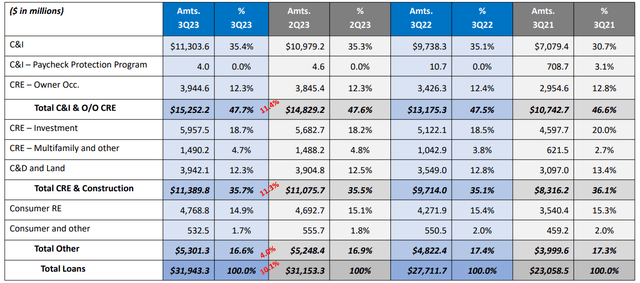

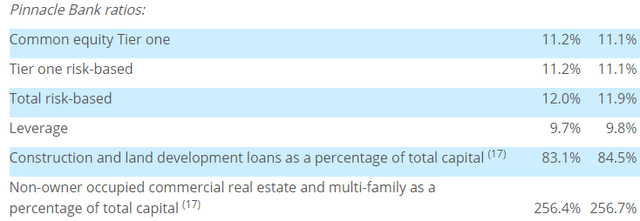

On the second point, Pinnacle’s loan portfolio has significant exposure to CRE loans. This approach can ensure better results than peers in the expansionary phases of the business cycle, but worse results in the downturn phases. In the current macroeconomic environment with high rates, companies may no longer be able to sustain such a high refinancing rate.

Pinnacle Financial Partners Q3 2023

The ratio of CRE loans to regulatory capital is dangerously high and may soon exceed the 300% threshold imposed by supervisors. For those who are pessimistic about future economic performance, they should keep in mind that Pinnacle may be more cyclical than other banks.

Conclusion

Pinnacle is a bank that has shown high growth rates in recent years, often outpacing peers. In the last quarterly report, the market had expectations that were too high, which is why there was a slight decline at the market close. Also weighing heavily is the outstanding performance achieved in the past few months, +60% from the May lows. In short, I think there is more room for a descent rather than a further ascent. There are banks that have suffered more during the crisis and still have ample room for recovery. In any case, an improvement in general sentiment toward regional banks could still have a positive impact on Pinnacle.

Finally, the high concentration of CRE loans makes this bank more cyclical and potentially weak in a recession. On the securities portfolio side, exposure to floating rates has mitigated unrealized losses better than peers have, but they still weigh on tangible book value per share.

Read the full article here