Introduction

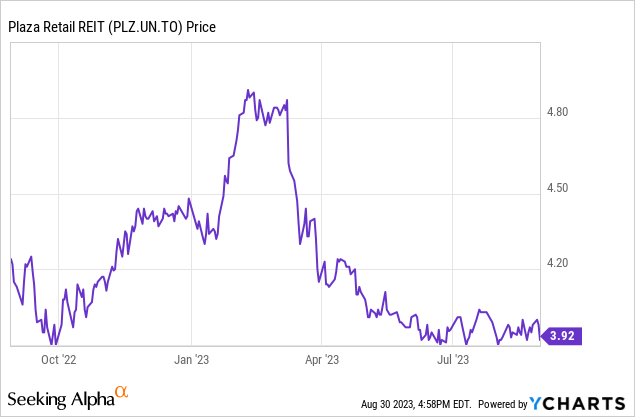

I have been keeping an eye on Plaza Retail REIT (TSX:PLZ.UN:CA) (OTC:PAZRF) for several years now and initially gained exposure during the COVID crisis by buying the REIT’s debentures at a discount to par but I currently have no long position in Plaza although I still think the stock is attractively valued. That’s why I continue to keep an eye on its performance waiting for a good entry point.

The Q2 FFO and AFFO: pretty flat

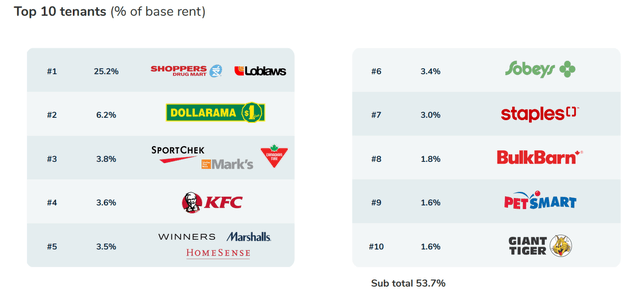

For an overview of the REIT’s exposure and main tenants, I’d like to refer you to my previous articles. But within excess of 25% of the base rent generated from the stores operating under the Loblaws and Shoppers Drug Mart banner, I’m not too worried about its tenant base.

Plaza Retail Investor Relations

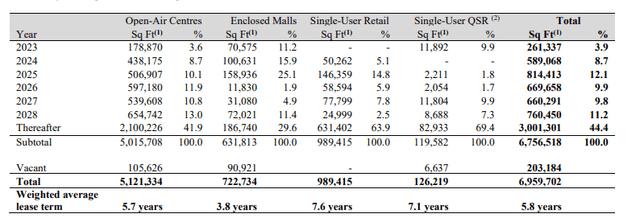

While the image above shows the breakdown as of the end of the first quarter, there are very few differences on a QoQ basis. And as you can see below, the weighted average lease term as of the end of June was just under six years. Only 12% of the assets will see their leases expire in the next six quarters.

Plaza Retail Investor Relations

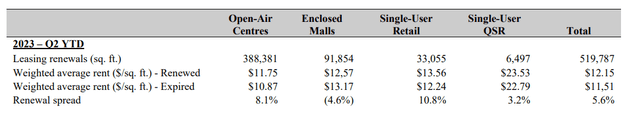

The lease renewal spread in the first six months of the year was quite positive at 5.6% and this was held back by a negative spread in the enclosed malls segment.

Plaza Retail Investor Relations

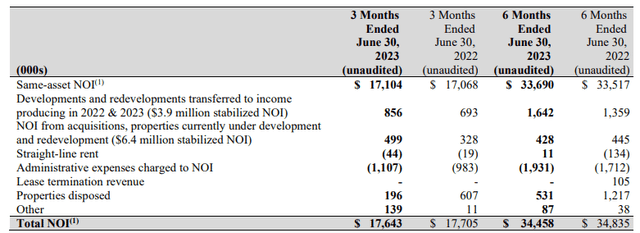

During the second quarter of the year, the total Net Operating Income decreased to C$17.64M, which is just marginally lower than in the second quarter of last year. On a same-asset level, there was a small increase but this was wiped out by higher administrative expenses.

Plaza Retail Investor Relations

With a total NOI of in excess of C$70M on an annualized basis, the current book value of C$1.03B for the income producing properties as quite reasonable as it indicates the capitalization rate is just under 7%.

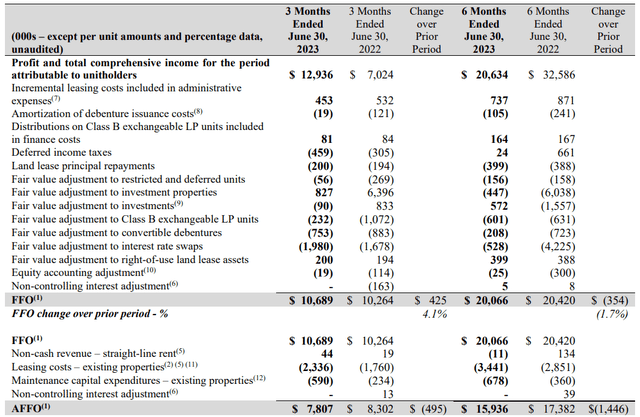

But even more important than the NOI, the FFO and AFFO need to be sufficiently strong as well. And looking at the image below, the total FFO increased by approximately 4% compared to the second quarter of last year. And while that’s good news, the AFFO actually came in lower at C$7.8M. That’s a decrease of about C$0.5M and while that does sound like a very negative development, it looks like there are two main reasons for this AFFO decrease.

Plaza Retail Investor Relations

First of all, the maintenance capex has increased and even almost doubled compared to the second quarter of last year. This already explains about 70% of the lower AFFO result. Secondly, we see the leasing costs increased by C$0.6M. This should “die down” in the second half of the year as the REIT does not have a lot of vacancy.

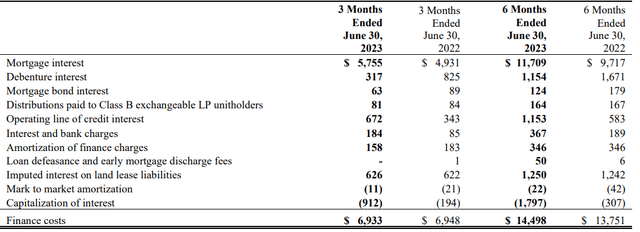

While the Q2 results definitely were not brilliant, the result actually could have been worse. Plaza Retail completed a capital raise earlier this year which helped to keep the interest expenses to an acceptable level. In fact, the Q2 finance expenses were slightly lower than a year ago.

Plaza Retail Investor Relations

The total AFFO per share came in at just C$0.07 in the second quarter which means the distribution is barely covered. Fortunately the AFFO per share in the first semester was C$0.148 per share resulting in a distribution coverage ratio of around 106%. Based on the management comments on the Q2 conference call, it sounds like the leasing costs should be lower going forward, which will push the AFFO and AFFO per share higher again.

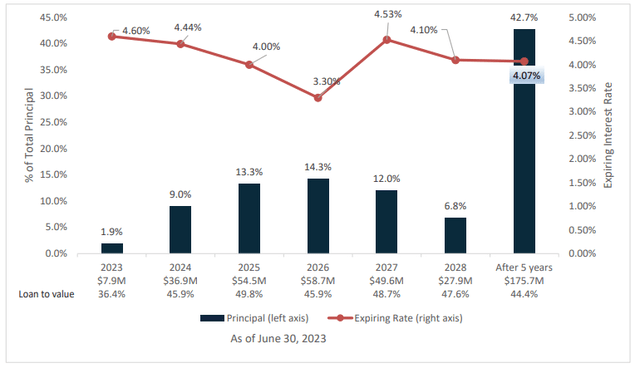

The REIT is quite fortunate it only has to refinance about C$45M in mortgages between now and the end of 2024. Those mortgages have an average cost of debt of 4.5% so even if there would be a 200 bp increase, the total interest expenses will increase by just C$0.9M. This means that a 1.5% NOI increase by the end of next year should fully cover the interest expense increase on the mortgages.

Plaza Retail Investor Relations

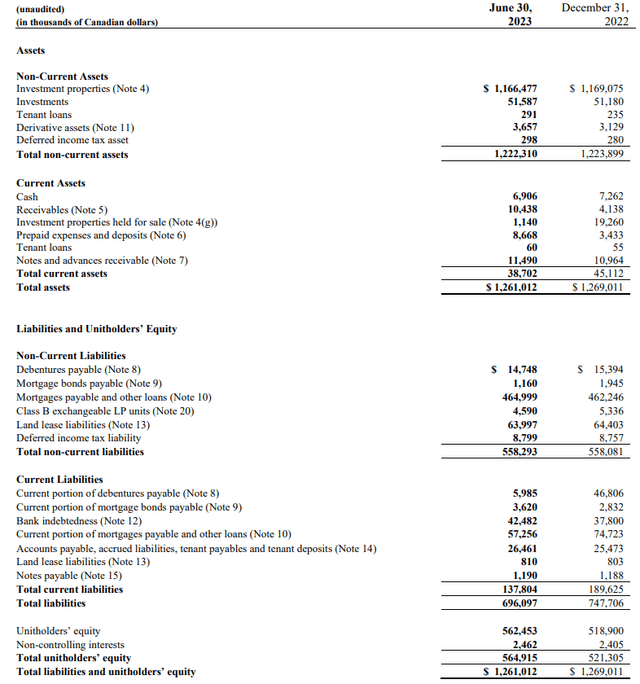

That being said, the LTV ratio remains high at about 48% (calculated as net debt divided by the book value of the investment properties and other investments).

Plaza Retail Investor Relations

The book value per share at the end of June was approximately C$5.09 per share based on the current share count of 111.5M shares including the impact of the Class B LP Units.

Investment thesis

The sole reason why I don’t have a long position in Plaza Retail REIT yet is because other commercial REITs jumped the queue. As explained in other articles, CT REIT (CRT.UN:CA) (OTC:CTRRF) was one of the stocks that suddenly got more interesting than Plaza as CT’s share price dipped while Plaza’s share price remained stable.

On the Q2 conference call, the Plaza management appeared quite confident in the future and in the ability of its tenants to pay rent.

Very, very few tenant concerns at this time. So in our portfolio, it’s very much dominated by large national retailers, then you have the franchised QSRs, which are obviously important to us, and that seems to be holding up quite nicely perhaps.

While I will have to keep an eye on the AFFO evolution in the next few quarters (and more specifically, keeping an eye on the leasing costs while the normalized AFFO should increase as a new development property will now start to generate rental income), the distribution still appears to be fully valued and the 7% yield is attractive.

I currently still have no position in Plaza Retail REIT but I’m keeping the REIT relatively high on my shortlist.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here