Introduction

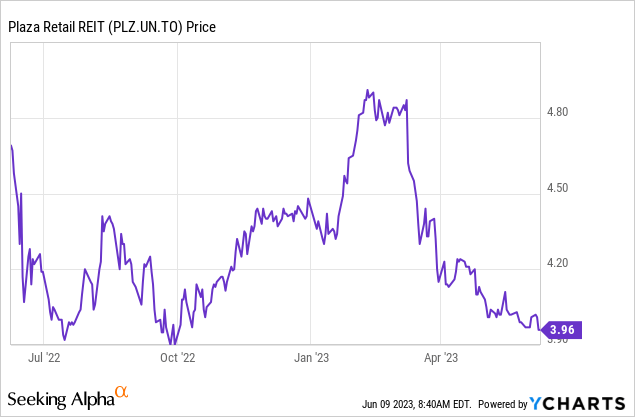

Over the past few years I have written numerous articles on Plaza Retail REIT (OTC:PAZRF) (TSX:PLZ.UN:CA), a Canadian REIT focusing on commercial real estate in the Eastern part of the country. I picked up the debentures at the height of the COVID crisis at a yield to maturity of in excess of 10% (which was pretty good given the low interest rates on the markets during those days). The debenture was fully repaid earlier this year so I wanted to have a look to see if I should perhaps dip my toe into the common units of Plaza Retail REIT to retain exposure to the company.

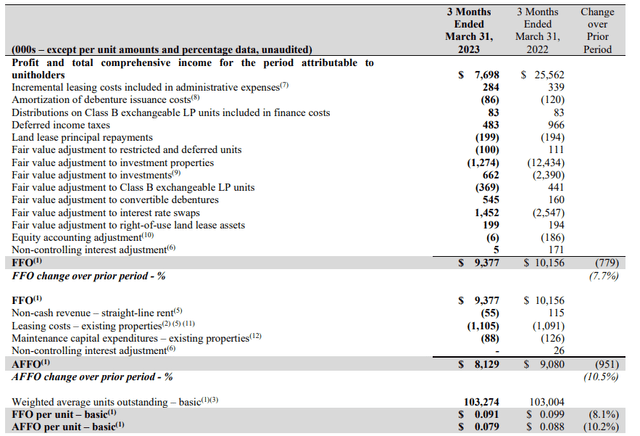

The FFO and AFFO were pretty strong in the first quarter

I won’t go into too much detail discussing the assets and the main tenants of Plaza Retail REIT and I’d like to refer you to this older article from February which reviewed all those elements. I’d rather focus on the REIT’s recent earnings report and how it plans to deal with the increasing interest rates on the financial markets which will ultimately hit its financing structure as well.

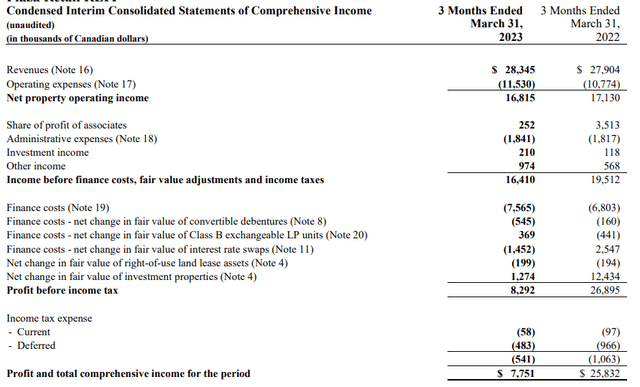

The REIT remained profitable and although profitability isn’t a good metric for any REIT to be judged on, I like to take a moment to have a look at the income statement as it allows an investor to identify sudden changes in, for instance, the G&A expenses and the interest expenses.

Plaza Retail Investor Relations

As you can see above, the net property income decreased compared to Q1 2022. Despite a 1.5% revenue increase, the sudden 7% increase in the operating expenses threw a wrench on the financial performance and the net property income decreased by approximately 2% to C$16.8M. Looking at the breakdown of those operating expenses, the increase appears to be mainly related to the non-recoverable expenses including a C$0.14M bad debt expense. Additionally, the REIT had to grant a tenant a C$235,000 allowance for the delayed delivery of premises. So there appear to be some non-recurring items there and adjusted for even just these two elements, the NOI would have shown a small increase. And on a same-asset NOI, there would have been a 0.8% increase.

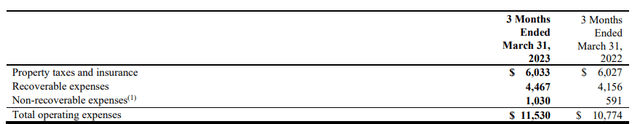

Plaza Retail Investor Relations

The income statement also shows a 10% increase in the interest expenses, which increased from C$6.8M to C$7.6M. I expect the interest expenses to continue to increase as existing fixed rate mortgages will roll off and will have to be refinanced.

The FFO and AFFO obviously are better metrics to judge a REIT on. As you can see below, Plaza Retail REIT generated a total FFO of C$9.4M and a net AFFO of C$8.1M. Both are down compared to the first quarter of last year and this could also be explained by the impact of the two non-recurring items on the NOI as well as the higher interest expenses.

Plaza Retail Investor Relations

With an AFFO of just under C$0.08 per share, the stock is currently trading at about 12 times the annualized AFFO.

What about debt maturities and the anticipated interest cost increase?

While that multiple sounds attractive, let’s not forget the worst is yet to come when it comes to interest expenses. The debt level has recently decreased thanks to a bought deal and the total debt to gross asset value decreased to 52%. The LTV ratio (defined as net debt versus real estate assets) is less than 50% and even 47.5% if you’d include the other investments on the balance sheet.

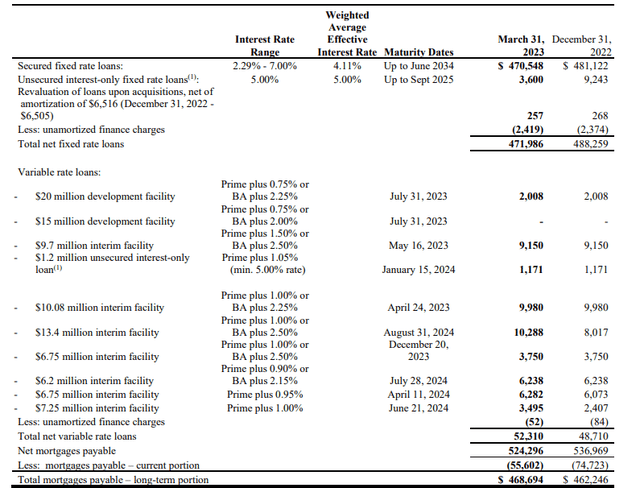

The most important portion of the debt consists of mortgage financings and of the C$525M in total amount of mortgages, about 90% has a fixed rate.

Plaza Retail Investor Relations

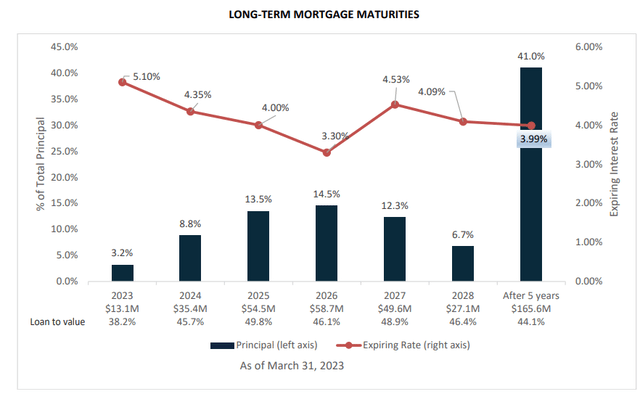

The next few years will be interesting but fortunately Plaza’s maturity dates are very well spread out in time. In 2024 only C$35M of debt will have to be refinanced followed by just C$54.5M in 2025. The average weighted interest rate for those maturities is approximately 4.13%. Assuming the average cost of debt increases to 6.25% for a mortgage loan, the REIT will see its interest expenses increase by just over C$1.8M per year. That’s C$0.45M per quarter and approximately 5% of the current AFFO result.

Plaza Retail Investor Relations

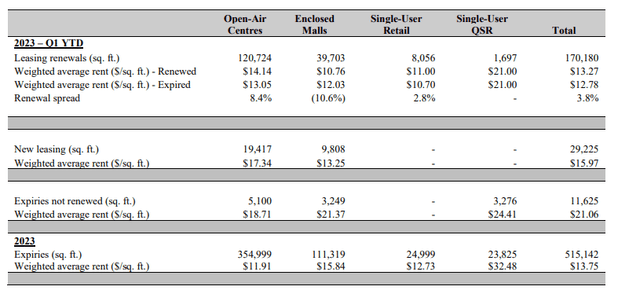

This does not mean we will see the AFFO decrease by 5% in the next few years as the leasing efforts are going well. The total renewal spread in Q1 was a bit weaker than I had expected (at 3.8%) and the image below shows this was caused by a negative renewal spread in the enclosed malls division. According to Plaza this was mainly related to one tenant which dragged the entire performance down and excluding that one renewal the total renewal spread would have been a positive 7.3%.

Plaza Retail Investor Relations

Interestingly, the new lease agreements are at a substantially higher rate. As you can see above, the average rent of the open air centres was C$14.14 per square foot for renewed contracts, but new leasing agreements were signed at a substantially higher rate of C$17.34 per square foot. And looking at the enclosed malls there also was a 25% uptick compared to the renewal rate. Of course these are just smaller agreements so for now I’ll consider them to be ‘anecdotal’, but the new lease spreads are very encouraging. So Plaza definitely has the potential to mitigate the impact of the higher interest expenses.

Investment thesis

Plaza Retail Rate doesn’t appear to be overly expensive at 12 times the expected AFFO for this year, but I think it’s safe to assume there won’t be much growth over the next few years as existing debt will have to be refinanced. The total refinancing requirement for 2024 and 2025 is just under C$150M and mainly consists of mortgages as well as some bank debt and the payment of principal on other mortgages (that aren’t maturing).

Keeping the AFFO stable at around C$0.32-0.34 per share per year would already be a strong achievement for Plaza. It would also mean the current distribution of C$0.28 per year is still fully covered, while the current share price represents a discount of approximately 20% to the NAV using a 6.75% capitalization rate is also pretty attractive. An increase of the capitalization rate to 7.5% (excluding the impact of future rent hikes) would result in an NAV of around C$4/share.

I also appreciate management’s decision to raise money in March when the stock price was higher. The REIT completed a C$40M bought deal offering in March at C$4.68 per share and used the proceeds to repay the convertible debentures. The impact of the dilution on the AFFO should be pretty neutral considering the capital raise was used to reduce the gross debt outstanding.

I currently have no position in Plaza but I’m still keeping track of the story.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here