Daenin Arnee/iStock via Getty Images

Overview

Blackstone Secured Lending (NYSE:BXSL) built a book of loans at the exact wrong time, in 2021, at the peak of the credit cycle. They put themselves in a weak position compared to their peers by using up too much of their 2x allowance for leverage at the wrong time in the cycle. They over-exposed their portfolio to a bubble sector at peak valuations, instead of saving their dry powder and lending to more diverse, quality borrowers on more favorable terms. Moreover, valuations on the private equity side remain frozen compared to public equity, and the combination of wider spreads in direct lending and realistic valuations present the opportunity to profit from a decline in Blackstone’s BDC.

Part 1. A Bad Vintage

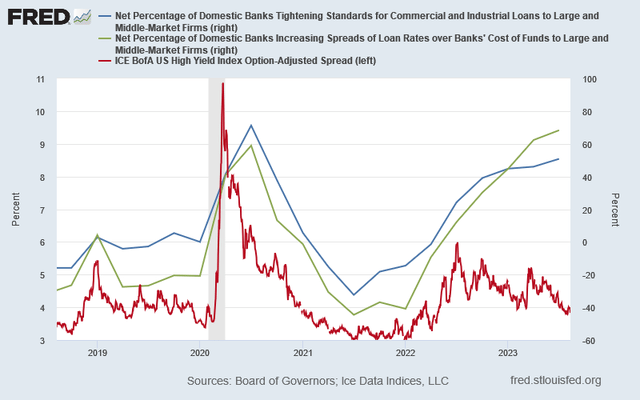

St. Louis Fed

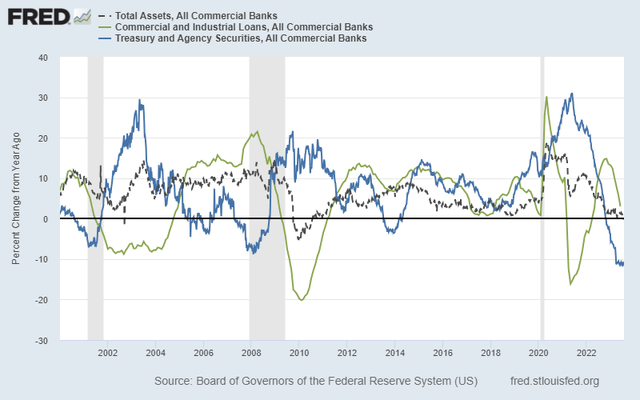

Yields fall when lenders chase borrowers. That’s what happened in the second half of 2020 and during 2021, as banks lowered standards for middle market borrowers, and the capital markets chased risk assets in general. That makes 2021 a bad vintage for middle market loans. When regional banks and the broader capital markets are on the same page about risk in the real economy, that is not the ideal time for BDCs to grow their loan portfolio. Instead, BDCs are best positioned to step in when banks have pulled back from the middle market. BDCs can use their credibility as underwriters to borrow from the big banks and the bond market, then engage in direct lending to good companies that are either shut out of bank lending or are too small to issue their own bonds.

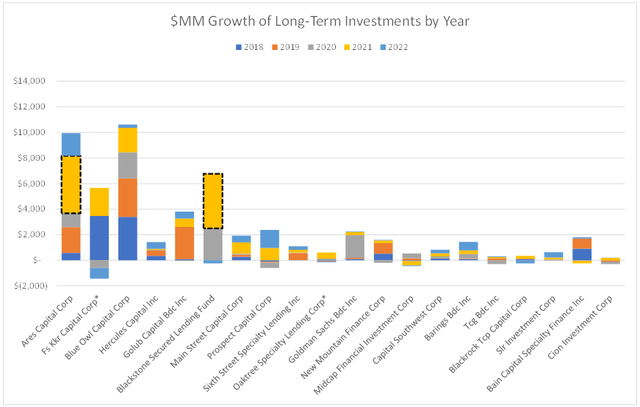

However, the top 20 BDCs grew their loans by $17 B in 2021, arguably the exact wrong time for their business model. That’s compared to $11 B in 2019, $7 B in 2020, and only $5 B in 2022. However, the 2021 growth was far from evenly distributed. Blackstone Secured Lending (BXSL) had over $4 B in loan growth in 2021, which came to 76% year-over-year growth in their portfolio, compared to an average of 15% year-over-year growth for the other top 20 BDCs. Blackstone bit off almost as much dollar volume of new loans in 2021 as Ares Capital Corp (ARCC) even though Ares is over twice Blackstone BDC’s size and has nearly 20 years’ experience. Blackstone’s BDC launched in 2018.

Finviz, Column Research

* FS KKR and Oaktree acquired loans originated in prior years through mergers. Investments are shown net of mergers.

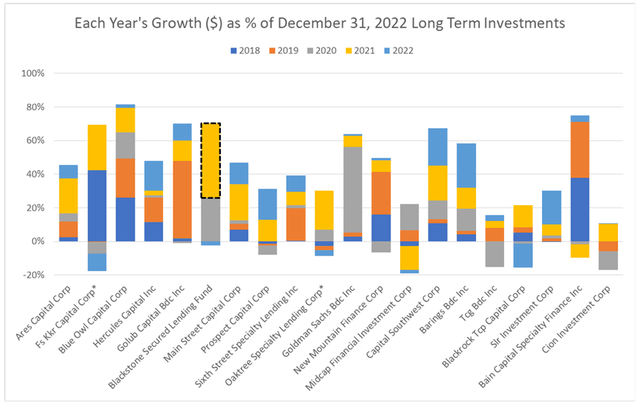

A year later, 2021’s vintage presented more of a hangover for Blackstone compared to Ares, with 2021 loans making up 44% of Blackstone’s books compared to only 27% for Ares.

Finviz, Column Research

Part 2. Opportunity Cost

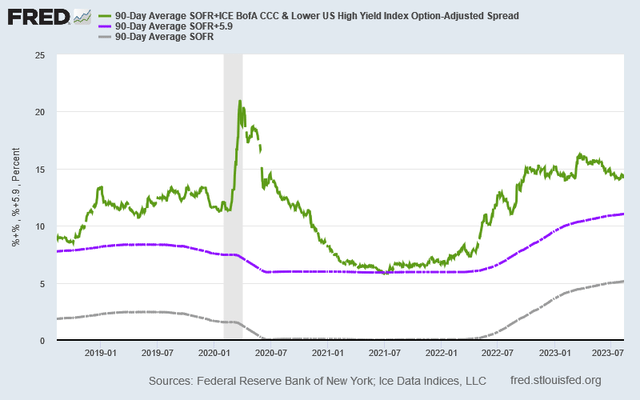

A 5-Year floating rate loan originated in June 2021, using 90-day SOFR plus the CCC high yield spread, paid 5.9% at origination. As the SOFR base rate rose from 0% to 5%, the floating rate loan rose to 11.9% by June 2023. This accounts for the 12% dividend yields of Blackstone and other BDCs. However, a book of loans originated in June 2023 would be paying 14.8%, as the spread rose from 5.9% to 9.8%. That increase in spreads represents the opportunity cost that Blackstone already missed out on, but there is more to miss out on going forward when you consider their allowance to expand leverage.

FRED, St. Louis Fed

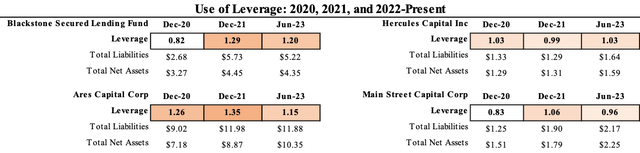

More importantly, by regulation the BDCs can only lever up to 2x their equity. Blackstone and Ares’ premature deployment of leverage in 2021 will continue to leave them in a weaker position to grow assets in the next several years. By contrast, Hercules Capital Inc. (HTGC) and Main Street Capital Corp (MAIN) continue to save their dry powder, with leverage at only 1x.

BXSL 10K Filings

Part 3. Credit Cycle

The ideal times for BDCs to growth their portfolios has been when banks’ C&I loan growth was declining while their Treasury & Agency growth was increasing. These periods indicated several conditions for banks: a flight to safety, increasing risk-capital requirements, and no requirement to take credit risk because deposits were cheap.

FRED; St. Louis Fed

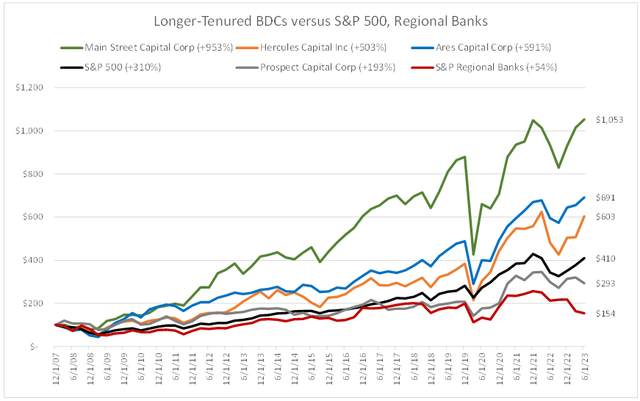

Since the banking crisis in 2008, the longer-tenured BDCs who successfully exploited this dynamic were able to return as much as 950% (Main Street Capital Corp), 590% (Ares Capital Corp), and 500% (Hercules Capital Inc.) to their investors. That’s compared to 310% for the S&P 500 and only 50% for the regional banks. The two pillars of an effective credit fund strategy, then, are both patience and quality underwriting. By waiting for risk aversion to take hold, BDCs can lend to strong borrowers at opportune times.

Column Research

*Total Returns calculated assuming dividends were reinvested on the day received.

Part 4. Peak Demand

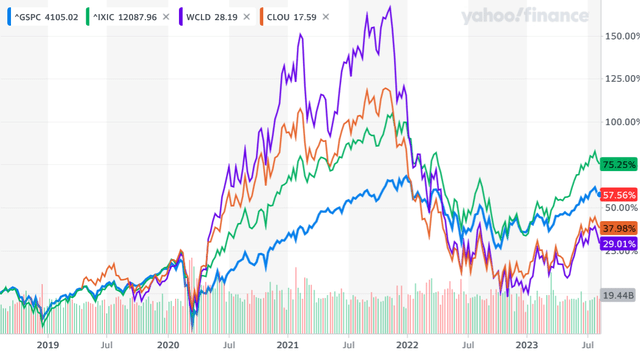

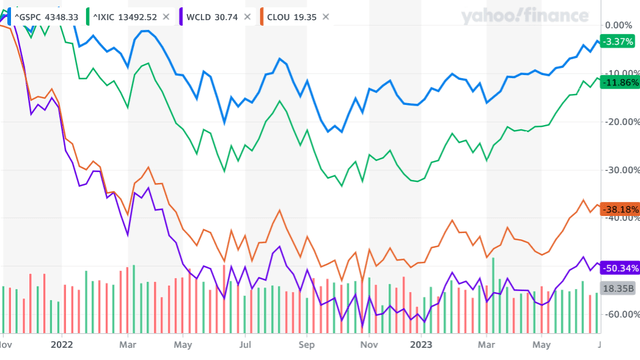

Not only did 2021 see peak demand in credit, and therefore lows in credit spreads. It was also a peak in valuations for equity, especially for Cloud/SaaS companies.

Yahoo Finance

From the peak in Q4 2021 to June 2023, while the S&P 500 and Nasdaq were down 3.4% and 11.9%, respectively (excluding dividends), the Cloud/SaaS companies, as represented by the Global-X Cloud Computing ETF (CLOU) and the WisdomTree Cloud Computing ETF (WCLD) were still down 38% and 50%, respectively.

Yahoo Finance

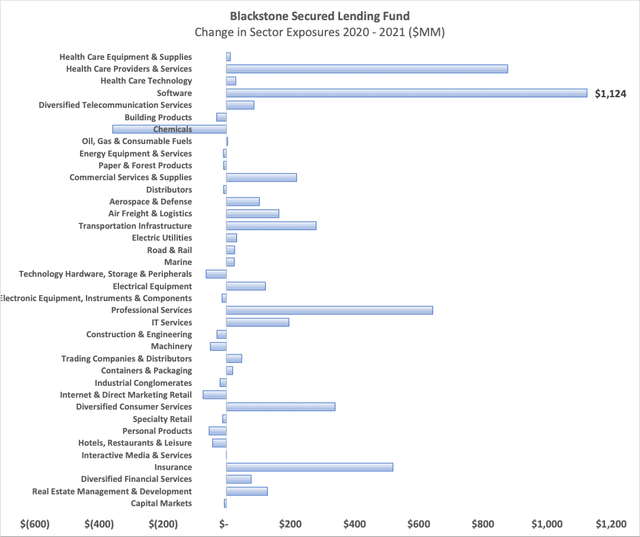

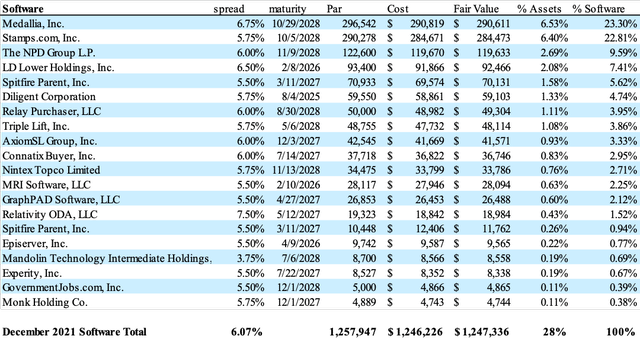

In our opinion, there is no reason for a credit fund’s industry exposures to resemble those of the public traded equity market, with 25-30% exposure to technology companies. However, that’s what Blackstone did, moving from a broadly diversified portfolio in 2020 with only 4 software companies making up 4% of assets, to 20 software companies making up 28% of assets in 2021.

BXSL 10-K Filings

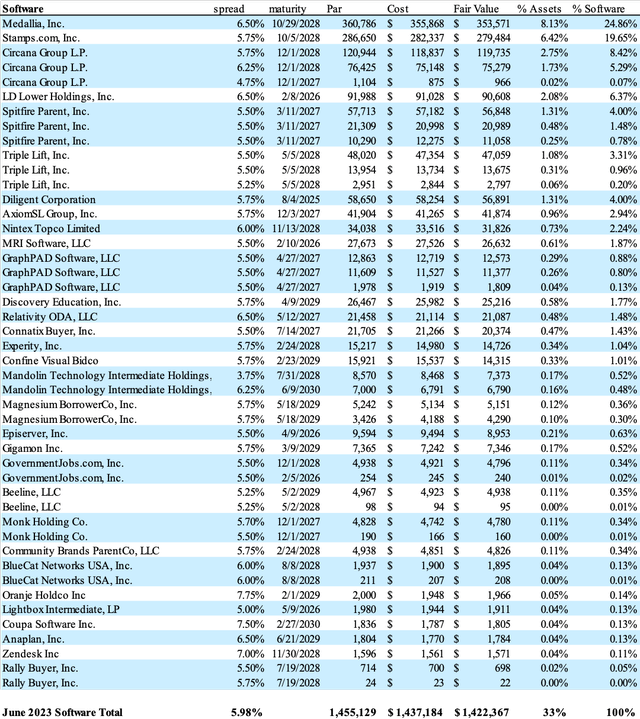

Software is historically considered to be a secular growth industry, resilient to the economic cycle, and is therefore pointed out as a defensive position by some fund managers. However, as 2022’s market selloff showed, the low-beta, high-quality, high-moat characteristics sought by investors in the big tech companies don’t apply equally smaller tech companies. Since the close of 2021, Blackstone has increased software exposure to 33%, and they have increased the number of those companies from 20 to 31.

BXSL 10-K Filings

Source: Company 10-K filings

BXSL 10-K Filings

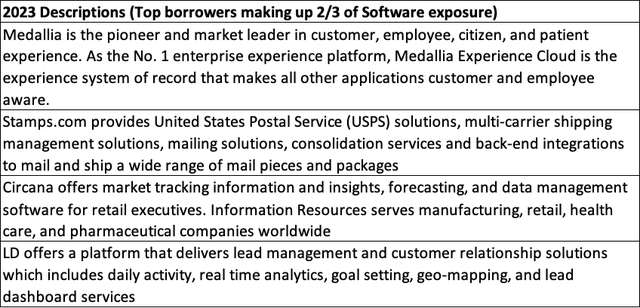

Like many middle market and small cap companies in the Cloud/SaaS industry, the companies making up Blackstone’s software exposure do not stand out for irreplaceable offerings. There are other vendors in the industry with similar offerings. The worry for lenders, from a broader economic perspective, should be that the industry is overpopulated with vendors laying claim to the same future market share. If a shakeout should occur in the next five years, that could expose Blackstone’s BDC to credit losses. Valuations of private companies have remained opaque in the last 18 months, as deal-making has been frozen in private equity, but eventually the wheat will have to be separated from the chaff, so to speak.

BXSL 10-K Filings

Part 5. Valuations vs. Charge-Offs

As of June 30th, 2023, Blackstone Secured Lending was trading at $27.36, a 4% premium to their NAV of $26.30, down from the fund’s 9% premium on December 31st, 2021, ($28.65 versus NAV of $26.27) amidst the highs in equity valuations and the lows in credit spreads. Our thesis for the downside in BXSL rests on a reduced market valuation (a discount to NAV) as a function of the market’s risk aversion, and less as a function of actual charge-offs. Blackstone’s loan book is made up almost entirely of Level 3 assets, meaning the stated NAV requires significant management judgement or estimation, and unobservable inputs are a significant factor in those estimates. The fund would trade at a discount if the market were to reassess management’s judgement.

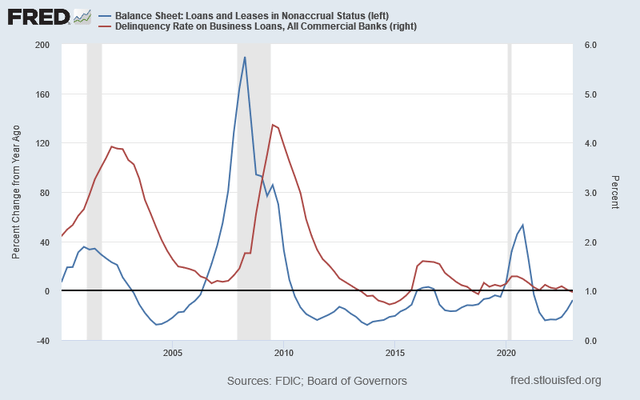

The primary risks to the downside thesis are #1: Blackstone could remain insulated from market skepticism by its composition of 98% 1st lien, senior secured debt and #2: the economy could recover quickly from the credit-cycle downturn. Over the past 15 years, including the 2008 crisis, senior secured loans had an average recovery rate close to 70%, according to analysis by Cliffwater, meaning that 70% of the 0.1% of Blackstone’s loan book currently on non-accrual status is expected to be recovered. As for the second risk to the downside thesis, cycles have been fast and furious since COVID-19, and it has to be acknowledged that markets could whipsaw so quickly that private equity and private credit may not have to visit the lows of the public markets. The Proskauer Private Credit Default index turned down from 2.15% in the 1st quarter to 1.64% in the 2nd quarter, and while there has been an uptick in non-accruing bank loans, the default rate on commercial bank loans has remained below 2% throughout the COVID crisis period.

St. Louis Fed

Final Remarks

The successful BDCs are able to do something much different for their investors than the regional banks or a high yield bond fund. They have the ability to lend at high yields but to do so very selectively, and with very selective timing. Because they don’t take deposits, they are not subject to the same risk controls that cause banks to retreat into government bonds at the trough of the credit cycle. At the same time, Congress has not granted the BDCs the ability to put on 10x leverage, as the banks can, so BDCs have limited capacity to expand their balance sheet. Blackstone Secured Lending, however, undertook balance sheet expansion at the peak of the credit cycle, underwriting loans at a 6% spread to Cloud/SaaS companies at the peak of a bubble in tech companies. For those reasons, we believe Blackstone’s BDC is likely to fall in price relative to its peers, or at least will not continue its price recovery trajectory.

Read the full article here