Jay Powell is due to speak on Thursday and could deliver a message that shifts the heavy lifting of bringing inflation down from the Fed to the market. This last step seems essential if the Fed is to achieve its goal of getting inflation down to 2%.

It seems likely that Powell will reiterate the same message he has now for months. The economy is strong, the labor market is tight, and inflation is too high. The Job, CPI, and Retail Sales report all suggest that the Fed’s job is far from finished and more work will need to be done.

Higher Rates

While the Fed may be closer to the end of the rate hiking cycle than the beginning, the Fed and Powell still have much they can say to move rates and tighten financial conditions. But instead of most of that work occurring on the front of the yield, Powell will likely push that job to the back of the yield curve.

To do this, he will have to acknowledge the possibility that the US economy is operating at a higher neutral rate and that it’s possible that rates aren’t restrictive enough to bring inflation all the way back to their 2% target. This will require rates to stay higher for longer, meaning there may be no rate cuts in 2024, and it will depend on the path of inflation.

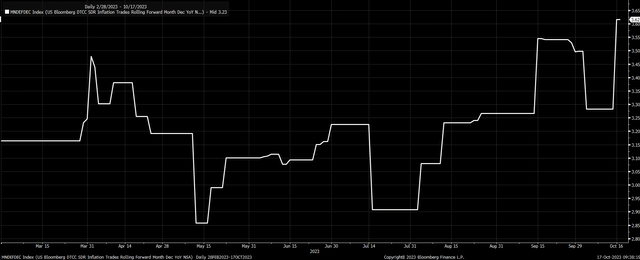

Certainly, the CPI swaps market doesn’t see inflation falling back to the 2% percent objective in 2023. The CPI swaps market now sees inflation finishing the year closer to 4% than 2%. CPI swaps are pricing December 2023 at 3.6%, a new cycle high. That’s a big change from where the market saw inflation finishing the year in the summer when December swaps were trading for about 2.9%.

Bloomberg

The Neutral Rate May Be Higher

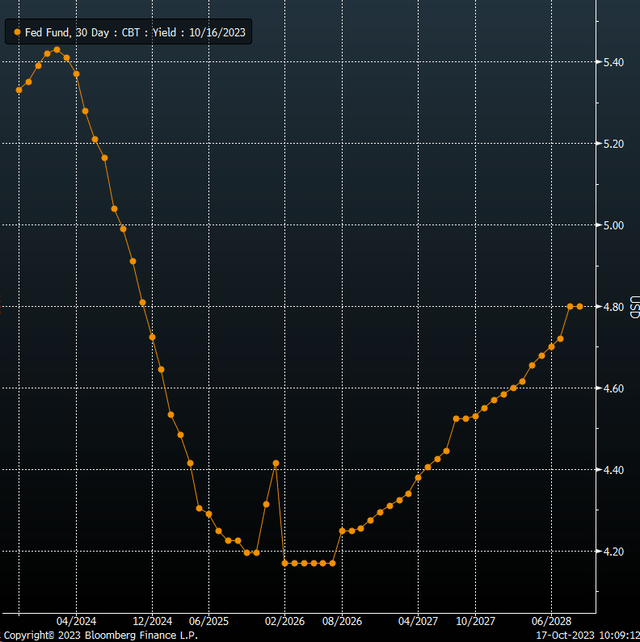

Acknowledging that the neutral rate may be higher leaves the door open for the Fed to potentially hike rates more in the future and not give the equity market the all-clear that the Fed is done while also acknowledging that rate cuts in 2024 aren’t a sure thing. The September Summary of Economic Projections saw the overnight rate fall to 5.1% in 2024. Meanwhile, Fed Fund Futures are currently pricing at a rate of 4.7%, so there’s room for the market to adjust Fed Future rates higher to align with the Fed’s view, which would mean removing rate cuts.

Bloomberg

Additionally, Powell could acknowledge that the longer-run rate of 2.5% may be too low and that it may actually be somewhat higher. Again, this would suggest that rate cutting has a higher floor, which would agree with what the Fed Fund futures are currently pricing, which is the overnight rate not going under 4% for the foreseeable future.

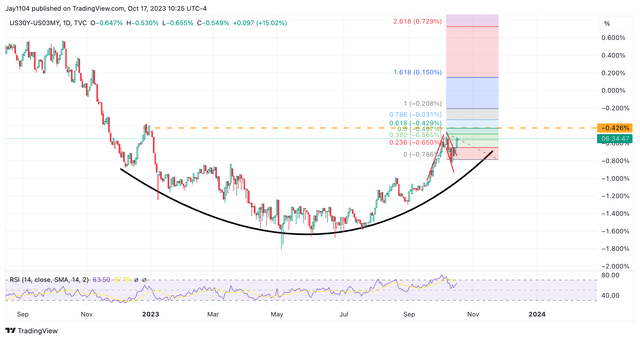

The current inflation rate is nearly double the Fed’s target, and the Fed is risking inflation getting stuck around this 4% region well into the future. Perhaps more importantly, inflation expectations are moving in the wrong direction. The 30-year inflation expectations have moved back up to the same region they were a year ago, and that is simply the wrong direction at this stage.

Bloomberg

If Powell can acknowledge that the neutral rate may be higher than previously thought, and that may require rates staying higher for a long time, along with the possibility that there will be no rate cuts in 2024, then it will likely push rates on the back of the Treasury curve higher, and cause financial conditions to tighten more, and work to slow the economy, something that given most of the economic data seems to suggest did not happen in the third quarter.

Tighter Financial Conditions Are Needed

The stronger data has helped to lift the back of the curve thus far, and there’s room for it to rise much further from current levels. The proof can be seen at the 30-year Treasury minus the 3-month Treasury at -55 bps. It appears technically the spread may be breaking out to the upside, which suggests that the spread moves up to -20 bps from its current level, and that would add an additional 35 bps to the 30-year Treasury rate, taking it to around 5.2%.

Trading View

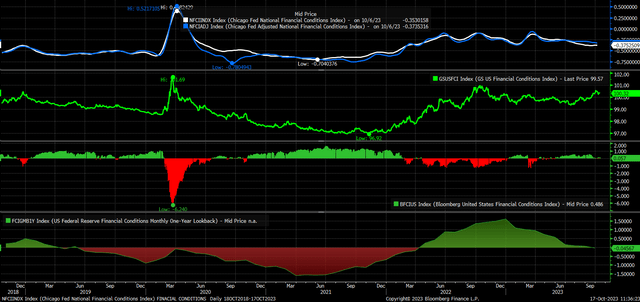

It would help Powell a lot if the back of the curve continued to rise to the front of the curve, as it would help financial conditions tighten more, and that’s what it needs to make sure monetary policy is restrictive enough to bring inflation back down.

As measured by the Bloomberg, Chicago Fed, and Federal Reserve financial conditions indexes, the policy is not restrictive and is, in fact, accommodative to the economy at current levels.

Bloomberg

Higher Treasury rates at the back of the curve should lift rates for corporate and high-yield bonds and, as a result, widen credit spreads, which should lead to tighter financial conditions, which poses a headwind for the equity market in the fourth quarter despite many investors’ clamor over favorable seasonal trends. In the end, tighter financial conditions, not higher equity prices, are needed to bring inflation down, and seasonal trends aren’t likely to override the force that comes with tighter financial conditions and wider credit spreads.

At this point, one should not become distracted by the fact the Fed is close to the end of the monetary tightening cycle at the front of the curve. It seems likely that the Fed will shift its focus to the back of the curve and jawbone long-end rates higher, which needs to happen if it hopes to get inflation back to its target.

Read the full article here