If the market is still counting on the easing of monetary policy, this week’s speech from Jay Powell is likely to put that to an end.

This Friday, the Jackson Hole economic symposium will take on a different tone this year than last. This year’s message is less likely to be about how far rates may have to rise but ultimately how long they will have to stay high. More importantly, Powell may need to point out a potential structural shift in the global economy, which means higher rates aren’t going away, and that rate cuts aren’t the same as loosening policy.

Rate Cuts Aren’t The Same As Policy Easing

At least as of the June FOMC meeting, expectations were that the Fed would be reducing the nominal Fed Funds rates in 2023 to 4.6%, which was higher than expectations in March when they stood at 4.3%. Where the Fed will be cutting rates back to in 2024 will be based on the path of inflation and where the Fed feels it will need the real rate to be to keep the monetary policy and financial conditions restrictive enough for inflation not to bubble back.

That means focusing less on the nominal Fed Funds rate but instead focusing on the difference between the Fed Funds rate less the PCE inflation or the real rate. For example, a 5.6% Fed Funds rate with a 3.6% PCE inflation rate means a real rate of 2%. Meanwhile, a Fed Funds rate of 4.6%, with a PCE rate of 2.6%, still is a real rate of 2%. So despite the nominal rate falling, there was no change in the real rate.

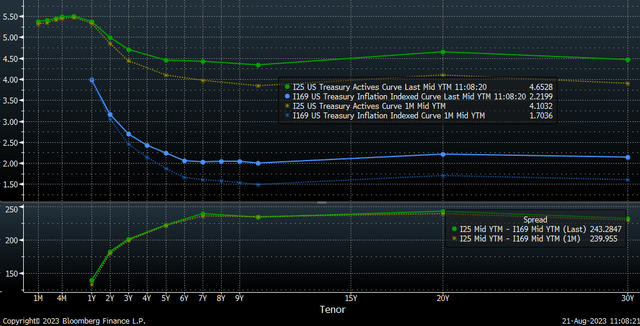

Bonds See Higher Real Yields

The bond market appears to be already thinking about and pricing in a more restrictive monetary policy path. It seems to point to a policy rate that may require rates to stay restrictive for many years. This seems especially true, given how resilient the economy, inflation, and the job market have been given the roughly 550 bps of rate hikes the Fed has implemented over the past 18 months.

As of August 21, the entire TIPS curve was trading over 2%, and that says a lot about the path of monetary policy over the long term and where nominal rates will have to stay to keep inflation from moving higher. It also seems to potentially be an acknowledgment that the economy is functioning at a higher natural rate of interest than it did before the pandemic began. The problem is figuring out where those rates need to settle ultimately.

Bloomberg

What is more impressive about the move higher in real yields is that breakeven inflation expectations have hardly changed during this rise in real rates. Over the last month, nominal and real rates have increased sharply, yet the 10-yr breakeven rate has only changed hardly changed and remains around 2.35%.

Bloomberg

This may suggest that rates may need to go even higher from here, but not at the front of the curve but at the back of the curve because if rates on the long-end were too high, we would see those inflation expectations falling. But instead, they aren’t falling; they are flat, which suggests that the market is trying to find a point where the balances in the long-term rates start to exert downward pressure on inflation expectations. That just hasn’t happened.

One of the reasons why breakeven inflation expectations haven’t changed despite nominal rates climbing is because CPI inflation swaps keep telling us that inflation will take longer to reach the Fed’s target of 2%. Inflation swaps for the next few months are rising and suggesting that CPI getting below 3% in 2023 may not be easy. October and November are expected to see the lowest inflation rates for the year, around 2.9%, but even those months have seen CPI expectations rise over the past few weeks.

Bloomberg

Data Suggests Higher For Longer

It is clear that the bond market, which at one point thought the Fed would cut rates in 2024 aggressively, is now repricing to higher yields based on the economic data that continually is reported. This appears to agree with what Powell has consistently returned to, a data-dependent approach to monetary policy he has been preaching since the May rate hike. Based on the data and the bond market’s reaction, it seems unlikely that, at this point, he is likely to veer from that stance. However, one new wrinkle he could work into the conversation, at least based on what the bond market seems to be saying, is that the natural rate of interest, or the neutral rate, could be higher than previously thought.

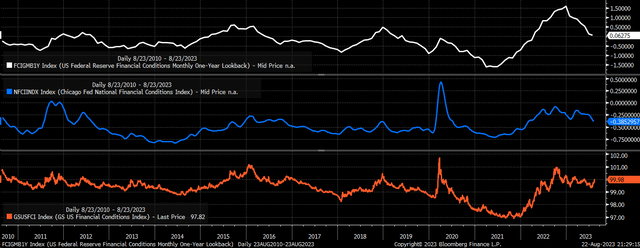

Easing Financial Conditions

If Powell suggests that the neutral rate may be higher than previously thought, it would agree with the bond market’s current move higher in interest rates. But more importantly, is it entirely possible that the neutral rate is higher than previously thought and that monetary policy doesn’t work with the same lags as it may have. Powell has repeatedly said that financial conditions began to tighten before the first rate hike in 2022. So if financial conditions can tighten before the actual shift in monetary policy, it seems silly not to think that financial conditions can’t loosen in anticipation of policy easing. That would suggest that perhaps lags in monetary policy do not persist today as they used to.

Bloomberg

Following SVB, by any number of measures, financial conditions eased and eased considerably. That easing of financial conditions was clearly because the market thought that rate cuts were coming, creating a more accommodative monetary policy. This easing of financial conditions has led to what appears to be a reacceleration in the economy and higher inflation pricing in the swaps market.

If it is the case that easing of financial conditions has been primarily responsible for the recent resurgence in GDP growth and a higher inflation rate, it would be wise for Powell to support the recent rise in rates and further encourage financial conditions to tighten further, by acknowledging that the rates may still need to go somewhat higher and that the economy may have structurally shift to a higher neutral rate from pre-pandemic levels.

If Powell’s 2022 speech was about rising rates and the sacrifices needed to restore price stability, Powell’s 2023 speech needs to lay the framework of a higher for longer monetary policy, and probably even higher and longer than previously thought.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here