Investment Thesis

We rate PowerSchool Holdings (NYSE:PWSC) a Buy driven by 1) visibility on the double-digit organic growth 2) strong USP compared to its competitors as a result of its unified offering across the breadth of the Edtech portfolio driving higher product penetration 3) sizeable TAM within the US as well as significant opportunity outside North America and 4) strategic acquisitions and the company’s track record in driving synergies

Company Background

PowerSchool Holdings is a leading vertical software provider for K-12 education enabling students, teachers and parents to stay connected. It serves about 50 million students across 15k+ schools and institutions across the US as well as in 90+ countries. It provides a unified platform that allows schools to leverage data analytics to efficiently manage instruction, learning, grading and assessment. In addition, it also helps schools in managing state reports and compliance, finance, HR, talent, attendance and registration.

Historical Track Record

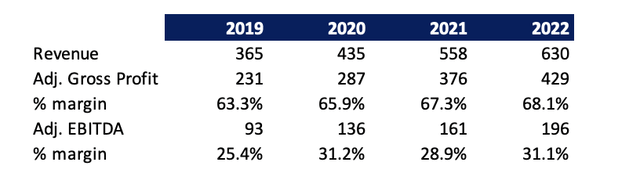

PWSC has a strong track record of growth with revenues growing at 20% CAGR in 2019-2022 driven by expansion within new geographies, a sharp focus on inorganic growth and continued growth in upselling services.

SEC Edgar

In addition, its gross margins have improved as a result of better utilization, upselling of products and higher net revenue retention rate from existing customers along with lower marketing spends which has led to a boost in its EBITDA margins.

Focus on Inorganic Growth

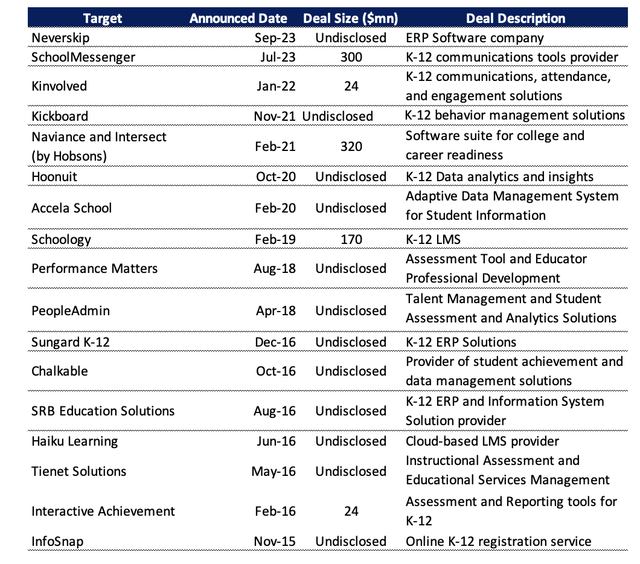

PowerSchool has been aggressive in driving consolidation within the Edtech space building out its portfolio, driving upselling/cross-selling of its products, and boosting its top line growth. It has announced about 17 deals since 2015 implying an average of 2 deals per year with the latest big ticket acquisition being the acquisition of SchoolMessenger, a leading provider of K-12 communications tools in North America, for $300 million. Other notable acquisitions include Schoology in 2019 which allowed them to enter into the LMS space just before COVID which generated massive demand for virtual classroom software and Naviance and Intersect in 2021 aiding the college research and applications for higher education.

Mergermarket, Company

While the company does not disclose the growth derived from acquisitions, we estimate that the company has been able to ramp up its growth while maintaining low-double digit growth organic growth through its historical filings.

In its prospectus, the company disclosed that about half of its 18% revenue growth was driven by the acquisition of Naviance and Intersect by Hobsons for Q1 2021. In addition, its revenues grew by 36% YoY in Q2 2021, a significant acceleration from Q1 with the full 3-month impact of the Hobsons acquisition compared to just 27 days in Q1 as the deal closed on March 4, 2021. We estimate that the acquisition likely contributed about 20 – 25 points with the organic growth continuing to be in the low-double digit range. This remains in line with its stated goal in its latest Investor Day to drive lower double-digit organic growth and reach a $1bn+ mark revenues by 2026, implying a 12% CAGR in 2023-2026.

Drivers for Organic Growth

Sizeable TAM

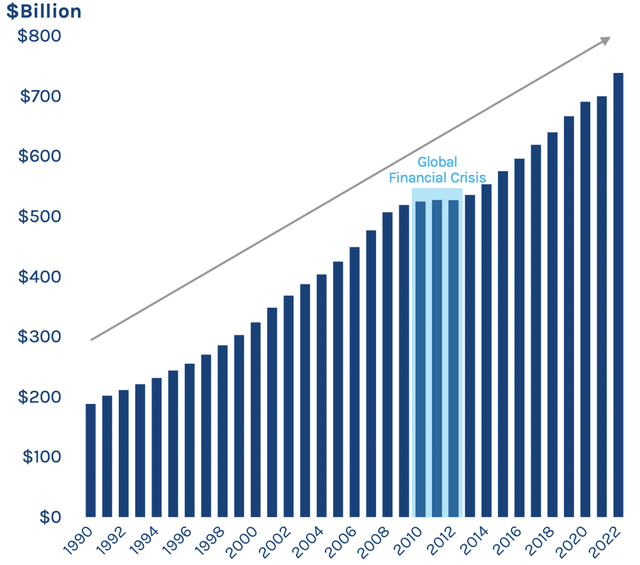

The US spends about $700+ bn annually on K-12 education, primarily derived from state funds and local taxes growing over 3% CAGR during the past decade with the bulk of the growth coming in recent years driven by the American Rescue Plan which outlined a massive stimulus to the tune of ~$300 bn during the COVID.

Company, US Department of Education, National Center for Education Statistics

Despite the continued growth in K-12 education spends, its technology spend remains significantly lower with just 1% spent on software and an additional 2% spent on other IT products could represent a massive opportunity to improve digital penetration.

Improving Product Penetration

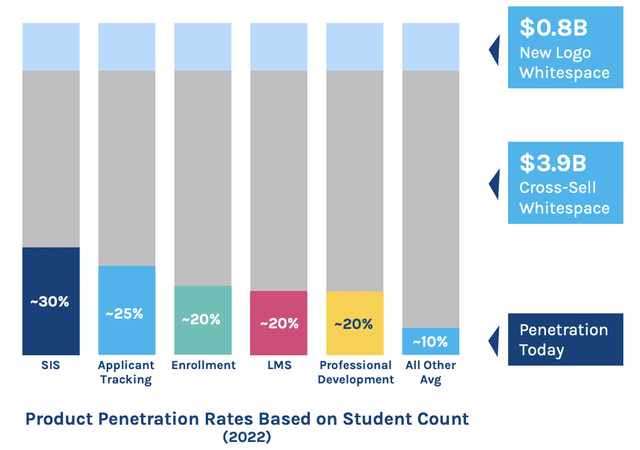

The company has strong potential to improve its product penetration through cross-selling and upselling as well as identifying new areas. As illustrated below, about 30% of PowerSchool users use SIS platform and may not be using other products or platforms of PowerSchool such as applicant tracking and enrollment which provides a significant $3.9 bn opportunity via cross-selling/ up-selling.

Gartner, Company

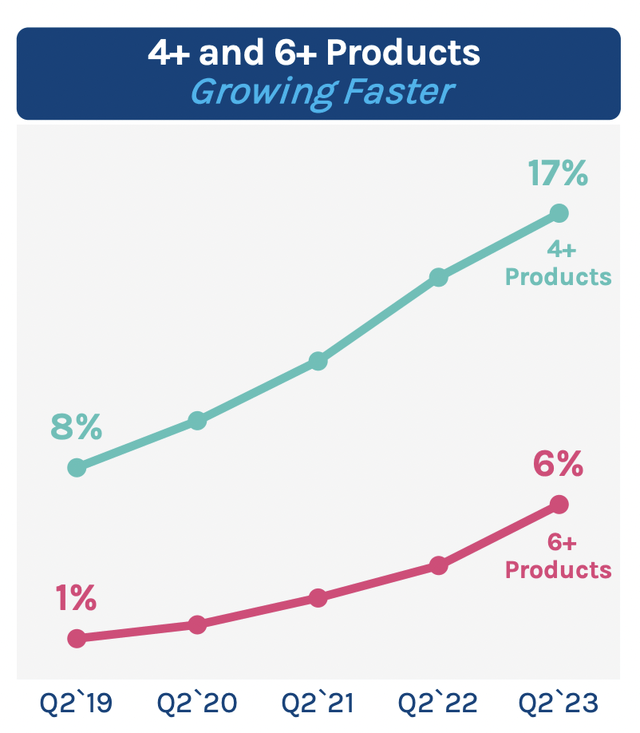

The company has been able to meaningfully improve its penetration within its existing customers who adopt more than 2 products with penetration of users subscribed to 4+ PWSC’s products improving from 8% to 17% and penetration of users subscribed to 6+ PWSC’s products improving from 1% to 6% over the past 3 years.

Company

International Expansion

The company has been focused on expanding internationally with a sizeable 1.3bn students outside North America. It recently acquired Neverskip, an ERP / SIS solutions provider in India, serving about 1.2 million students and further opportunities to consolidate and grow. It has also signed 8 international partners during the year serving about 800 international clients globally. It has a presence in over 90 countries outside of North America, however, the total contribution of its international business remains a minuscule sub-2% as of 2022 which provides an opportunity to expand and consolidate within the fast-growing untapped economies.

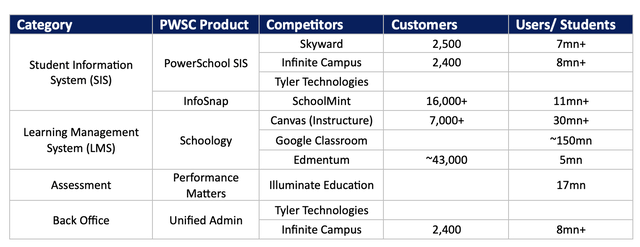

Competitive Landscape

PowerSchool competes with several niche players with SIS players including Infinite Campus and Skyward; Schoology LMS competitors including Canvas, Google Classroom and Edmentum while Assessment competes with Illuminate Education. However, the competitors remain primarily focused on operating within a niche space with PowerSchool’s differentiator being its breadth of portfolio offering products across a suite of Education technology verticals.

Company website

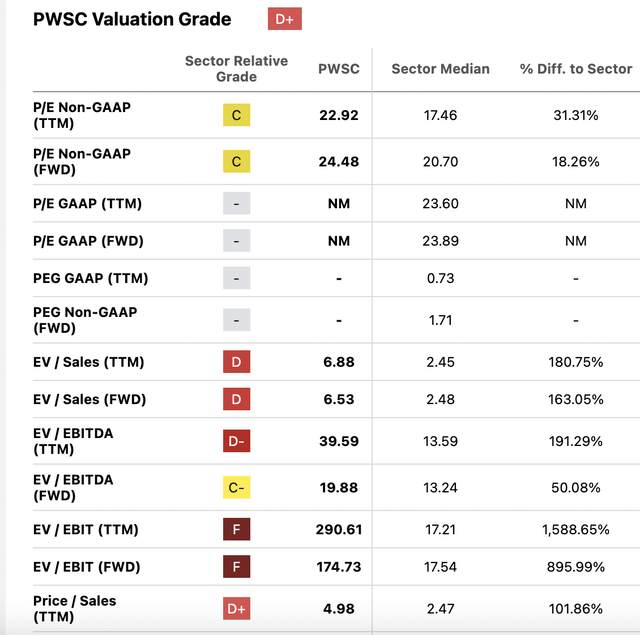

Valuation

Seeking Alpha’s valuation grade ascribes a ‘D+’ rating as it trades at a premium to the sector median. On a forward P/E basis, the company trades at 24.5x at a premium of about 20% compared to the sector median of ~21x.

Seeking Alpha

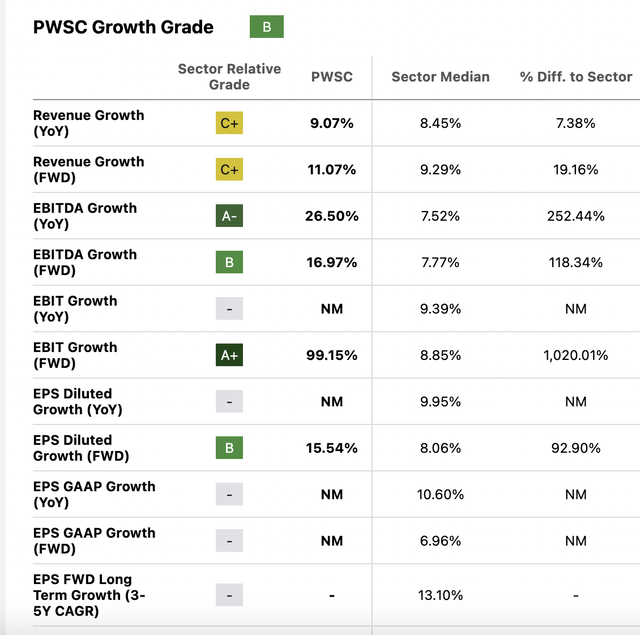

On a forward EV/ EBITDA basis, the company trades at ~20x compared to just 13x of the sector median. The premium could be attributed to higher top line and operating profit growth compared to its peers along with strong operating margins and cash-generating capacity.

Seeking Alpha

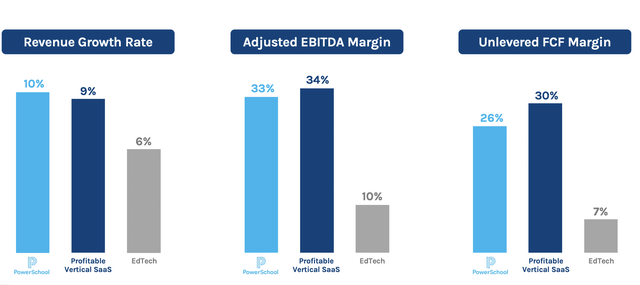

The company has consistently reported strong growth which is compared to a profitable Vertical SaaS player with robust EBITDA margins and FCF margins in line with vertical SaaS platforms and significantly above the Edtech players.

Company

We estimate given the growth characteristics, it is more prudent to value PWSC on a PEG basis. Assuming an 18% profit growth, the company is estimated to trade at 1.4x on a PEG basis, at a discount to its peers. We ascribe a Buy rating with a target price of $24.5 at 1.7x on a PEG basis.

Key Risks

1) PWSC operates in a K-12 sector which relies heavily on government funding and is subject to shifts in political ideologies. The company benefited from the ESSER fund and GEER funds as part of the COVID-19 stimulus with the availability of the ARP ESSER funding available till Sept. 2024, although several states have requested an extension. School administrators have spent less than half of the ARP ESSER funding so far with about $90 bn remaining available for spends till next year. However, according to a McKinsey study, the bulk of the spends are expected to be diverted towards teacher retention and the upgrading of infrastructure facilities which may not lead to a significant upside driver to PWSC’s business.

2) PowerSchool’s main driver for growth has been strong cross-selling opportunities and a unified platform offering a wide range of services. Its inability to increase adoption and utilization of the platform may lead to declining or stagnant gross margins

3) PWSC has been focused on inorganic growth having completed 2-3 deals on average historically. Its inability to pursue strategic acquisitions at a fair price or generate sufficient synergies may subject it to execution risks

4) Insiders have been selling the stock having sold about $8 million worth of shares over the past 3 months which can pose an overhang

Final Thoughts

PWSC witnessed a meteoric rise in its share price post its listing as a result of the strong adoption of its LMS-based system. However, post the pandemic reset and subsequent meltdown of growth stocks, the company’s stock declined by over 70% since its peak. We believe the company’s unified platform offering across a breadth of Edtech portfolio driving improving penetration could underscore the 10% organic growth in the foreseeable future. In addition, its leverage position has also continued to improve with net leverage of 3.3x (compared to 4.1x post-IPO) and the strong cash-generating ability (FCF margin of 16% in 2022 which is expected to improve to 20% as a result of moderating R&D and capex spends) would enable them to bring its net leverage position down to 2.5x-3.0x. We initiate with a Buy rating and ascribe a target price of $24.5.

Read the full article here