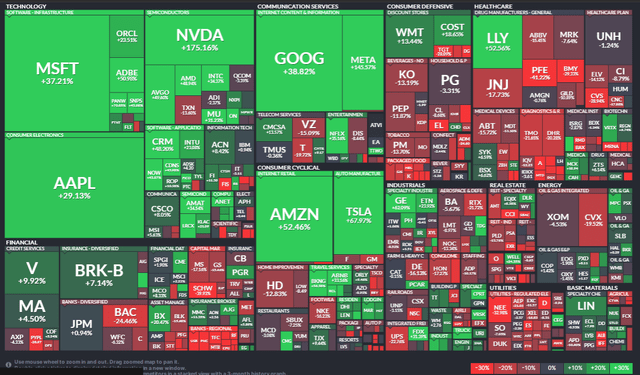

The Magnificent 7 tech-related stocks capture the spotlight, but there’s another mega-cap that is often left on its own as a remarkable 2023 winner: Eli Lilly (LLY). The Indianapolis-based $511 billion Health Care sector company boasts a premium 45x forward price-to-earnings ratio (using 2024 estimates) and is up better than 53% so far in 2023. It is also the biggest component in the VanEck Pharmaceutical ETF (NASDAQ:PPH). Fellow GLP-1 name, Novo Nordisk (NVO), is also a top holding in the otherwise large-cap value fund.

Still, I have a hold rating on the fund despite significant technical risks and a top-heavy nature. I like its somewhat defensive construct as the broad economy heads into a potential slowdown through mid-2024.

LLY Left Out of “Magnificent”?

Finviz

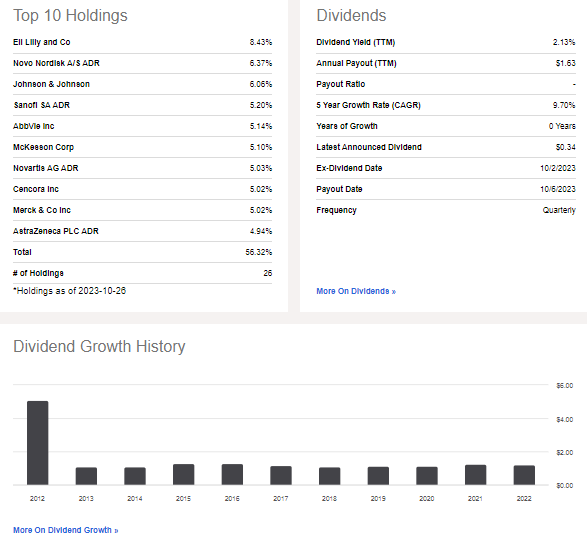

According to the issuer, PPH invests in companies involved in the pharmaceutical industry, covering aspects like research and development, production, marketing, and sales of pharmaceuticals. This ETF focuses on highly liquid and industry-leading companies, with a global scope that includes both domestic and U.S.-listed foreign companies to provide a comprehensive representation of the pharmaceutical industry.

PPH is a small fund with just $400 million in assets under management, but its annual expense ratio is on the low side for an industry-centered ETF at just 0.36%. With a dividend yield of 2.1% as of October 26, 2023, you get a bit more income versus owning an S&P 500 index fund. The fund’s high allocation to LLY has perhaps resulted in PPH leading its ETF sub class (ranked 1 out of 34).

The 4-star rated fund (Morningstar) features solid liquidity given average daily volume of 285k shares and a 30-day median bid/ask spread of only four basis points. While it is a risky fund based on its composition, share-price momentum is listed with a good B- rating, though I assert later in this article that there has been significant technical damage done.

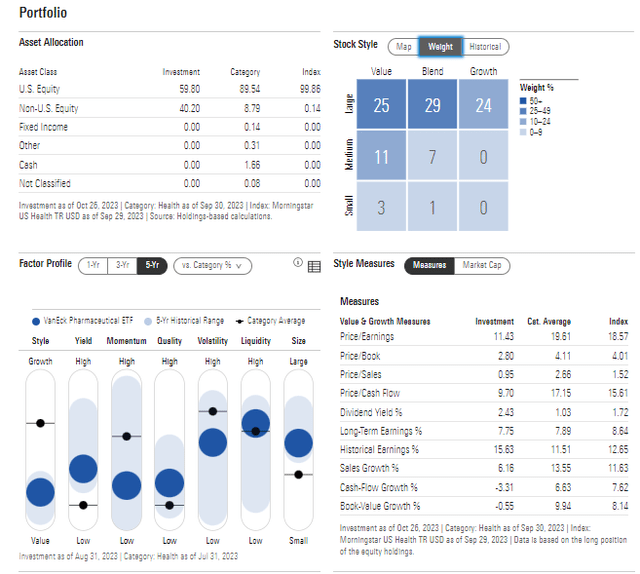

Digging into the portfolio, there is an aura of defensiveness with PPH given that it’s allocated exclusively to pharma equities, and the highest exposure is to large caps given its market-cap weighting construction. There is also a decent mix of value, growth, and blend across styles. The fund’s weighted average market cap is very large at more than $165 billion, and the latest trailing price-to-earnings ratio is to the high side at 17.0 (driven higher by LLY).

Morningstar lists a more attractive forward earnings multiple in the low double-digits. Finally, over a 3-year period, PPH’s equity beta is low at just 0.58 – indicating less volatility compared to the SPX. It’s important to note that there is 40% non-US exposure, so monitoring currency moves and macroeconomic conditions overseas is wise for those going overweight the ETF. Overall, with a low forward P/E and international diversification, the fund appears as a quality way to play the pharma industry.

PPH: Portfolio & Factor Profiles

Morningstar

PPH: Holdings, Dividend Information, Dividend History

Seeking Alpha

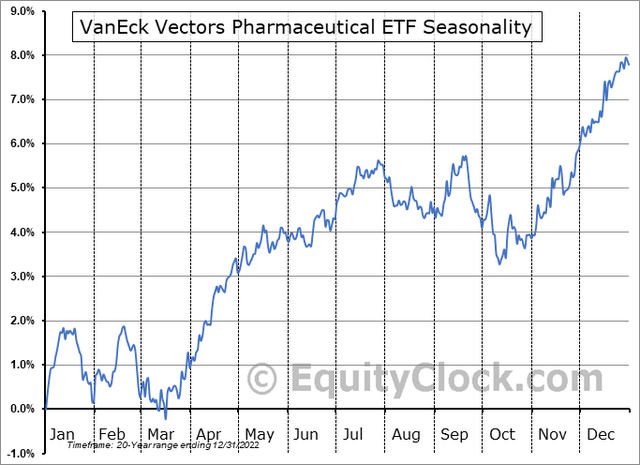

Seasonally, PPH tends to roar to the close of the year, according to data from Equity Clock. The November through mid-January stretch, along with late Q2 through July, is a particularly bullish stretch, so this is a key upside risk for Pharma bears.

PPH: Very Bullish November-December Seasonality On Tap

Equity Clock

The Technical Take

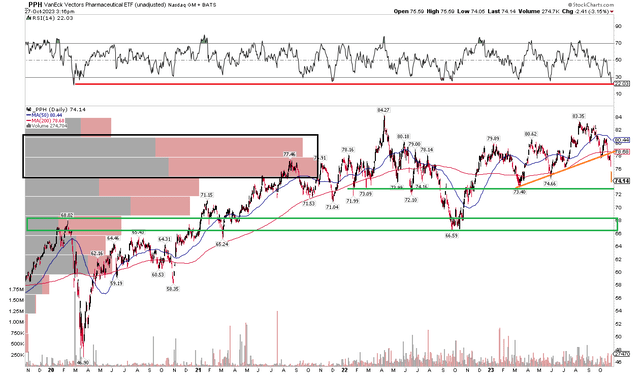

PPH had been one of the top-performing industry ETFs since early 2022 when the bear market began, though the ETF did plunge by more than 20% from its Q2 2022 peak to a low notched in October last year. Notice in the chart below that the 200-day moving average never really inflected lower, but a severe multi-day decline lately appears to mark a topping pattern.

I see possible support in the $72 to $75 zone – that’s where buyers stepped on a number of occasions, sans the Q3 2022 dip. On the bearish side, however, take a look at how the ETF broke below a key uptrend support line, leaving technical downside to its 2022 lows in the mid-$60s (that would be another 10-15% fall from current levels). PPH is also the most oversold it has been since the Covid Crash, as measured by the RSI momentum indicator at the top of the chart.

Overall, momentum has clearly deteriorated, and further negative price action is likely as bullish seasonal trends should take hold.

PPH: Low $70s Support, Technical Risks to its 2022 Low

Stockcharts.com

The Bottom Line

I have a buy rating on PPH. Relatively safe large-cap pharma stocks are usually a decent place to hide during macroeconomic weakness, but the makeup of the fund results in unusual risk given that its biggest holding is a high-growth glamour stock. With technical weakness having emerged, I am skeptical that bullish seasonality will save the day, but PPH’s style and geographic diversification aspects are appealing.

Read the full article here